alberto clemares expósito

Introduction

I’ve written several articles on SA about DR Congo-focused tin mining company Alphamin Resources (OTCPK:AFMJF). The latest one was in September, and I said in it that the company was starting to look cheap, but that opening a position seemed dangerous as tin prices were recording their strongest decrease in history.

Well, global tin prices hit a two-year low of around $17,630 per tonne in late October but they’ve rebounded above $22,000 per tonne since then. Looking at Alphamin, there have been no updates about the company’s sale but Q3 2022 production results were solid as production surpassed 3,000 tonnes once again and all-in sustaining costs (AISC) per tonne of tin sold declined to $13,200. Let’s review.

Overview of the Q3 2022 results

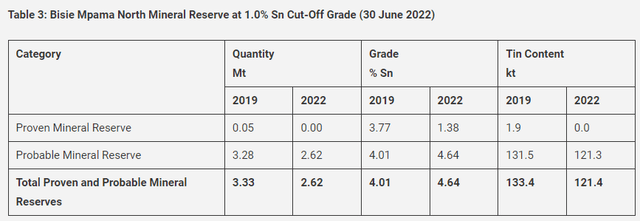

In case you haven’t read any of my previous articles about Alphamin, here’s a short description of the business. The company indirectly owns 84.14% of Bisie, which houses the Mpama North and is the highest-grade tin complex in the world. The remaining shares are held by South African state-owned development finance institution Industrial Development Corporation [IDC] (10.86%) and the DRC government (5%). In August 2022, Alphamin released an updated reserve and resource estimate for the Mpama North deposit which showed that proven and probable reserves stood at 121,400 tonnes of tin at an average grade of 4.01%.

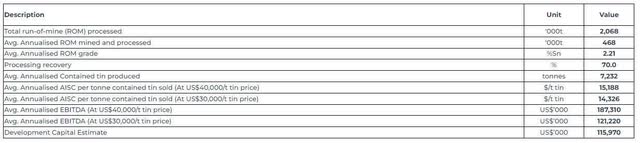

Bisie also includes the Mpama South deposit, which is adjacent Mpama North and it seems it contains a similar ore body to the latter. As of May 2022, Mpama South had indicated resources of 21,400 tonnes of tin at an average grade of 2.53% and Alphamin aims to bring it into production by December 2023. The company has already started the development phase and it spent $12 million in Q3 2022. The total capital development costs for Mpama South are not expected to exceed the $116 million from the preliminary economic assessment (PEA) released in March 2022. As of early October, completion stood at 18.6% and 84.3% of the procurement requirements were finalized and ordered so it seems that the company has good visibility in regard to the initial CAPEX.

Looking at the key financial figures for Mpama South, I think it’s a mixed bag. On one hand, the expected processing recovery is just 70%, but the AISC are forecast to be close to the levels of Mpama North despite the much lower grade. At 30,000 per tonne of tin, AISC are expected to come in at $14,326 per tonne.

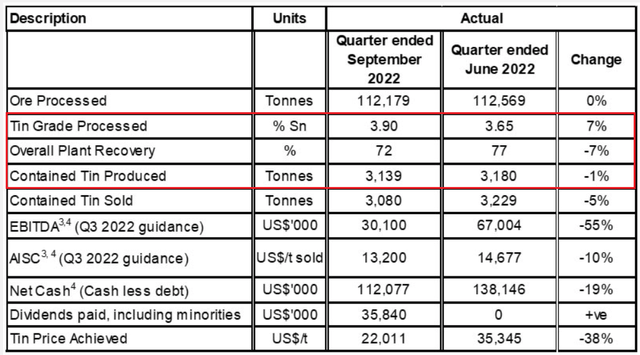

Turning our attention to Alphamin’s Q3 2022 results, I was surprised that the company exceeded its quarterly production guidance of 3,000 tonnes once again considering it had to mine and process a structurally complex area that wasn’t even included in the mineral resource or the mine plan. Well, this led to a decline in plant recovery to 72% but the higher grade made up for it as contained tin produced inched down by just 1% quarter on quarter.

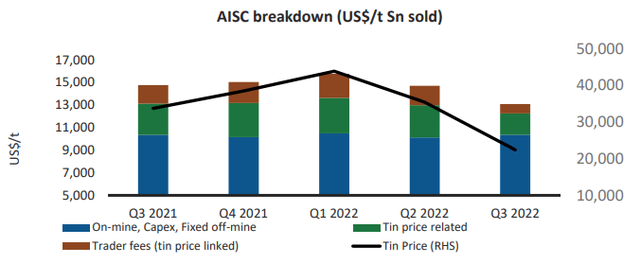

As you can see, AISC declined by 10% but the reason behind this was lower tin prices as a significant part of Alphamin’s costs are tied to the price of the metal. Looking forward, there isn’t much room for improvement if tin prices continue to fall.

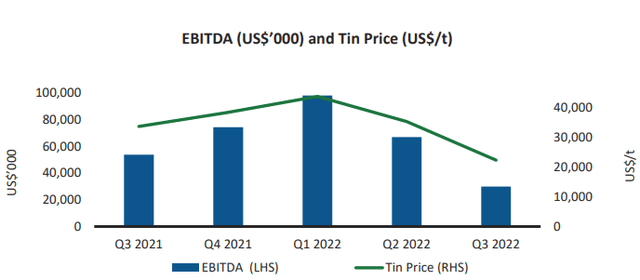

Revenue declined by 26% year on year to $67.8 million while EBITDA slumped by 55% to $30.1 million. However, I think that the financial results of Alphamin are likely to improve in Q4 2022 as tin prices started rebounding in early November and briefly passed the $23,000 per tonne mark recently.

In my view, tin prices soared in early 2022 due to rapidly rising demand following the end of lockdowns and restrictions related with COVID-19 and then they crashed on the heels of rising interest rates and the deterioration of macroeconomic conditions across several major economies around the world. It seems that the market has finally found a bottom as prices are near the historical averages and I don’t expect the situation to change drastically in the near future. In fact, we could see a slight increase in prices over the next few months if China decides to relax some its restrictions related with COVID-19. Looking at the long term picture, global tin supply is likely to change by little over the coming years while demand should be boosted by rising sales of electric vehicles (they consume about 8 times more tin compared to a standard vehicle).

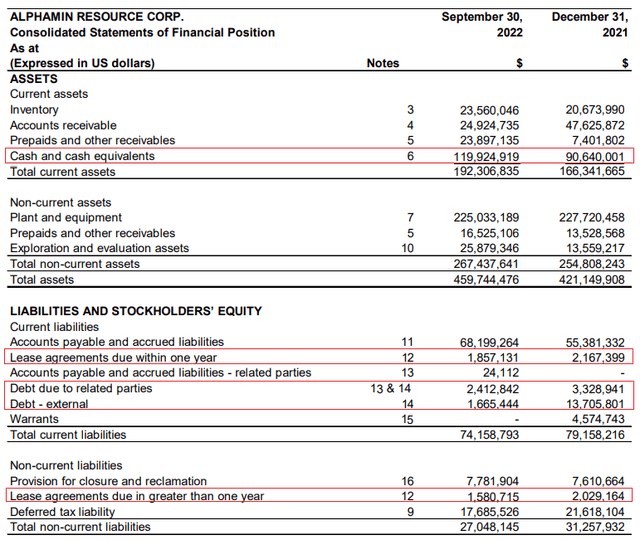

Turning our attention to the balance sheet, Alphamin closed September 2022 with a net cash position of $112.4 million following a $36 million dividend payment. Overall, the balance sheet looks strong, and the company should have enough funds to put Mpama South into production without an equity offering even if tin prices decline over the next year.

Overall, I think that Alphamin’s production and financial results look good in light of low tin prices. Considering the tin market seems to have bottomed out, I’m cautiously optimistic about the performance of the company’s share price over the coming months. Back in April, the media reported that Alphamin was seeking a buyer for its business in a bid to capitalize on high tin prices. However, there have been no updates on this story, and I doubt the company is for sale at the moment.

Looking at the risks for the bull case, I think the major one is that I could be wrong that tin prices have stabilized. Recession fears around the world are growing and a prolonged global recession could significantly push down tin demand. Other risks for the bull case include Alphamin underestimating the capital expenses for Mpama South or the complexity of the orebody at Mpama North.

Investor takeaway

Falling tin prices have pushed Alphamin’s enterprise value below $600 million and I think the company is starting to look undervalued considering the price of the metal has rebounded since early November. Quarterly EBITDA is still above $30 million and Mpama South should boost annual output to about 20,000 tonnes of tin per year.

I rate this one as a speculative buy considering the direction of tin prices is difficult to predict in the short term. In my view, it could be best for risk-averse investors to avoid this stock.

Be the first to comment