Just_Super

Overview

In this series of articles, I am focusing on single Dividend Challenger stocks and determining whether they are solid long term buy options for investors based on a number of criteria related to performance, financial strength, valuation, dividend strength, etc. In the first article of this series, I reviewed the Dividend Challenger stock ACCO Brands (ACCO) and determined it to be a hold for current shareholders and should be avoided for other long-term investors. That article can be found here.

Dividend Challengers are stocks that have increased their dividends every year for at least five consecutive years. This list is maintained with the Dividend Champions (25+ years) and Dividend Contenders (10+ years). More information on these lists can be found here.

For this first article, I will be reviewing the stock performance, financials, recent news, valuation, and dividend strength of AudioCodes Ltd. (NASDAQ:AUDC).

AudioCodes provides communication software, products, and productivity solutions for workplaces. The company operates throughout the Americas, Europe, Asia, and Israel.

Dividend

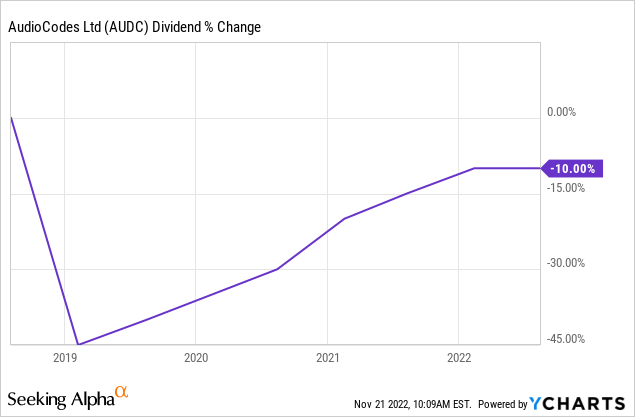

AudioCodes is a fairly new addition to the dividend challenger list. Looking at the chart below, it might seem that AudioCodes does not belong on this list as the chart shows a 10% decline in dividend growth over the past five years.

However, this chart is misleading as the starting point is the $0.20 dividend on 8/3/2018, which was an annual dividend. AudioCodes then updated their dividend to a semi-annual dividend which has increased from $0.11 to $0.18 per share. Taking this into account, the yearly amount of AudioCodes’ dividend has increased from $0.20 to $0.36 per share during this time. One thing to note is that in 2019, 2020, and 2021, the semi-annual dividend increased each year (from $0.11 to $0.12 in 2019, $0.13 to $0.14 in 2020, and $0.16 to $0.17 in 2021). In 2022, both semi-annual dividends were $0.18.

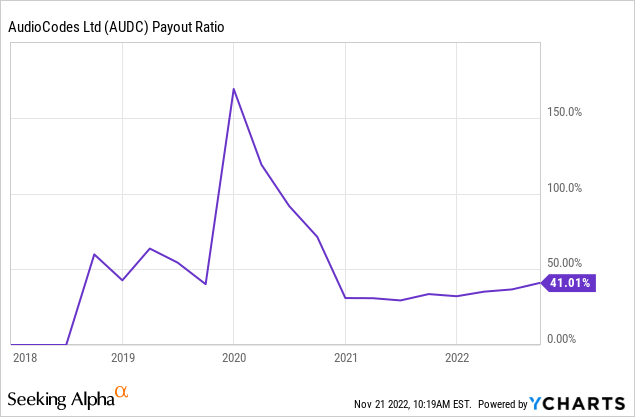

Looking at the chart below, you can see that AudioCodes payout ratio is significant, and has been on the rise since the start of 2021.

This, along with AudioCodes poor price performance during this time could explain why the 2nd dividend this year didn’t follow the same pattern of increase as seen in prior years.

AudioCodes currently maintains a dividend yield of 1.76%

Financials

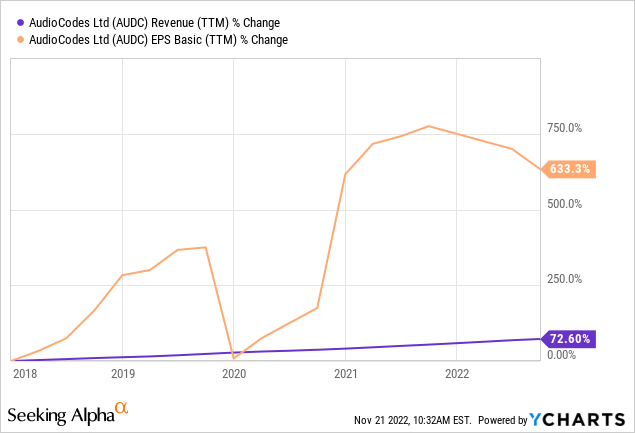

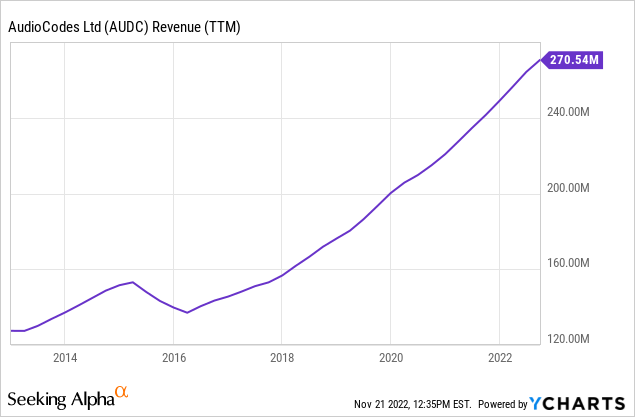

AudioCodes has seen significant growth in both revenue and earnings over the past five years. Looking at the chart below you can see that its revenue growth has been very consistent, while earnings have had more of an up and down ride with overall positive growth.

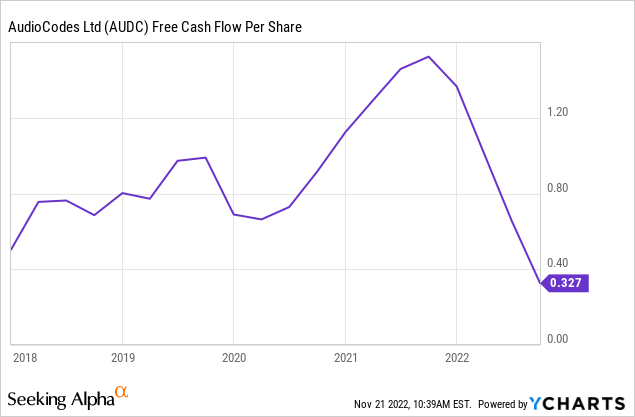

When looking at cash, you can see that AudioCodes’ free cash flow per share has been a bit of a roller coaster over the past few years, with a significant drop recently.

The lower free cash flow per share amount could explain the reason behind not increasing that 2nd dividend this year as had been the case for the prior three years.

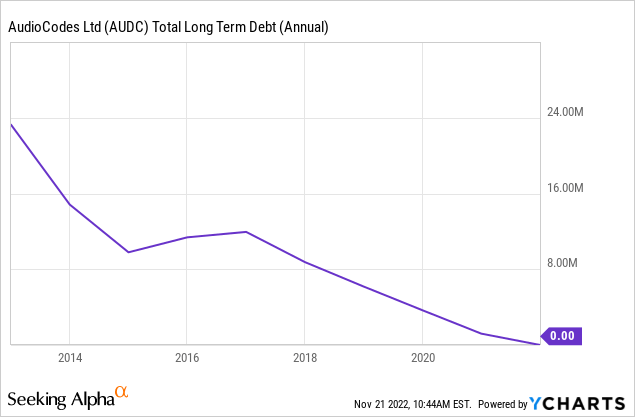

On a more positive note, AudioCodes has done a great job with its balance sheet, eliminating its long-term debt (as seen in the chart below) and keeping its overall liabilities at a respectable level.

Valuation and Performance

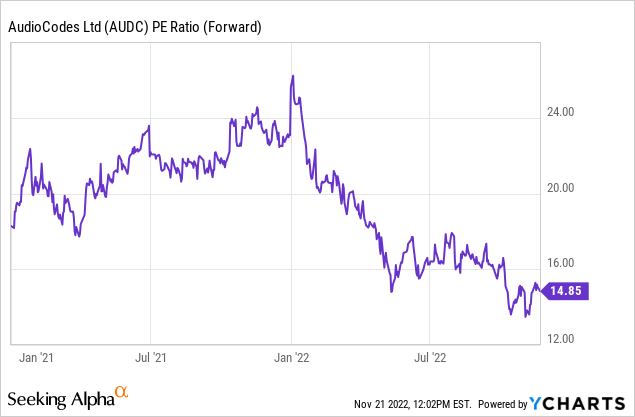

ACCO currently has a forward PE ratio of 14.85. Looking at the chart below, you can see that this is low compared to its recent historical average.

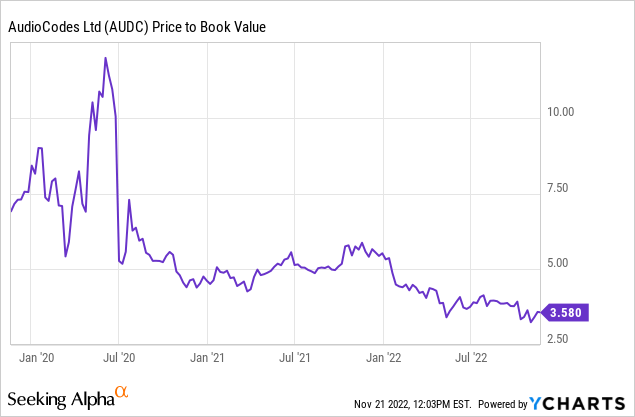

The same trend can be seen when looking at AudioCodes’ price-to-book value.

At first glance, this seems like a positive and appears to make AudioCodes an attractively valued stock; however, this does not take into consideration price performance during this time period.

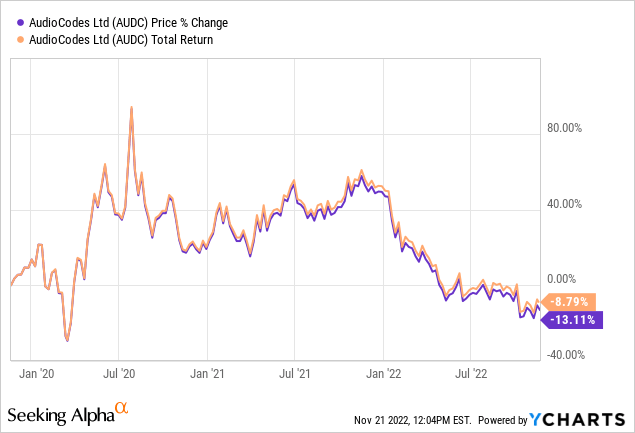

Looking at the chart below, you can see that AudioCodes has performed poorly over the past three years. Even adding in dividends to get to total return price, the performance is not much better.

You can see that since the beginning of this year, AudioCodes has seen a fairly steady drop in price, losing just over 42% of its value year to date.

Peer Comparison

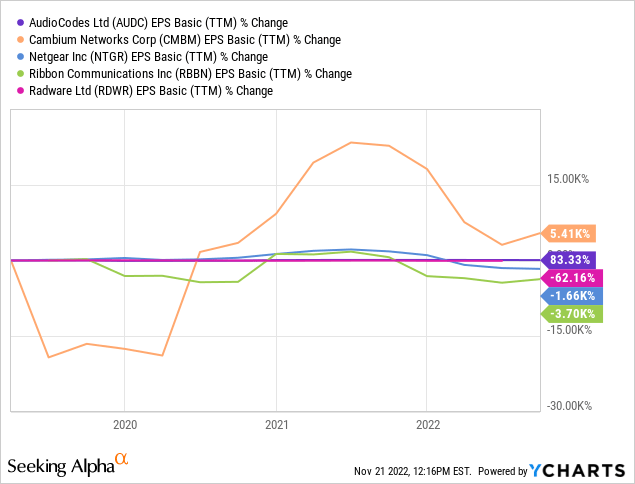

A few stocks within the same industry as ACCO include Cambium Networks (CMBM), NETGEAR (NTGR), Ribbon Communications (RBBN), and Radware (RDWR).

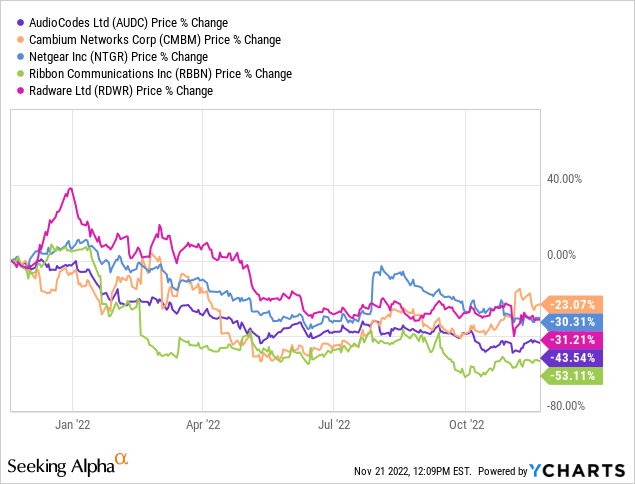

In terms of stock price, you can see in the chart below that only Ribbon Communications has performed worse over the past year, with all five stocks seeing significant drops in price during this time period.

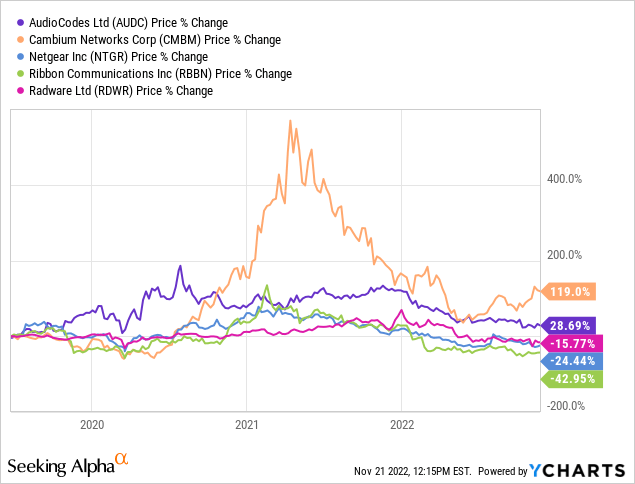

If looking back further, AudioCodes looks a little more respectable, ranking 2nd in terms of price appreciation over the past five years, coming in behind only Cambium Networks. The other three stocks have seen negative price appreciation during this time frame.

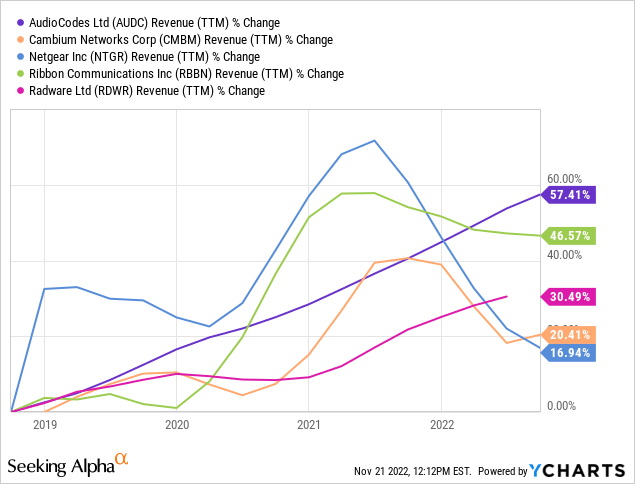

A similar trend emerges when looking at revenue growth over the past five years except that instead of ranking 2nd, AudioCodes has the top revenue growth during this time period.

AudioCodes has also performed well in terms of earnings growth during this time ranking 2nd out of the 5 stocks.

Recent News

Earlier this month, AudioCodes missed its quarterly revenue and earnings estimates with EPS of $0.32 and revenue of $69.7M.

While AudioCodes may have missed its targets, I feel that overall it was a good quarter for the company. Some highlights include:

- 10% increase in quarterly revenue

- 8.2% increase in quarterly service revenue

- AudioCodes repurchased 273,224 shares of stock at a cost of $6.1 million

- This share buyback helps explain the lower free cash flow

- Considering the low debt of the company combined with the steep drop in stock price that occurred in 2022, this was a smart time for a buyback in my opinion.

Conclusion

AudioCodes has not performed well in terms recently, down nearly 44% YTD and just over 44% over the past year. However, the overall fundamentals of the company I believe remain relatively strong. I believe that the drop in stock price from its highs of $35/$36 to its current value of just under $20 makes it an attractive option for long-term buyers.

Looking back at the last 10 years, AudioCodes has seen a very consistent increase in revenue that doesn’t appear to be ending any time soon.

Based on several positive factors outlined in the company’s latest quarterly call such as:

We see good continued momentum in both of the key markets that we serve: the UCaaS and the CX markets. Key driver of our growth came from UCaaS where Microsoft Teams related business grew nearly 20% year-over-year. AudioCodes Live for Microsoft Teams managed services continued to grow and reached a level of $28 million ARR, nearly 100% growth over the year ago period, putting us well on track to achieve our 2022 target of over $30 million.

Additionally, we had record conversational IVR, and VoiceAI Connect platform-as-a-service bookings, which grew by over 30% year-over-year in the quarter.

We expect that over the next several quarters we will benefit from better FX hedging, easing of supply chain pressures, and the tightening of discretionary spending, while we allocate investments prudently to strategic areas of our business. These factors should put us on track to drive improved operating leverage in 2023 and beyond.

I believe that AudioCodes will provide long-term investors with solid returns moving forward and consider it and Cambium Networks as the two stocks to consider as buys for long-term investors. Cambium Networks may provide better price appreciation moving forward and is also a good stock to consider; however, for dividend growth investors I believe AudioCodes is the stock to take a look at. As always, I suggest individual investors perform their own research before making any investment decisions.

Be the first to comment