bymuratdeniz

Article Thesis

Exxon Mobil Corporation (NYSE:XOM) reported its third-quarter earnings results on Friday morning. The company beat estimates easily and reported, overall, highly impressive results. With ramped-up shareholder returns, production growth, and new discoveries offshore Guyana, the company looks well-positioned fundamentally. Shares are not ultra-cheap following their strong performance this year, but with a beneficial oil price environment, XOM could rise even higher in the future.

What Happened?

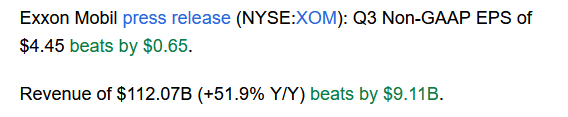

On Friday morning, Exxon Mobil released its third-quarter earnings results. The headline numbers looked like this:

Seeking Alpha

Not only did Exxon Mobil beat estimates, the company basically destroyed them. Revenues came in around 10% higher than expected, while earnings per share beat the $3.80 consensus estimate by 17%. The sales beat was also outstanding in absolute numbers — I don’t remember seeing a company beat/outperform quarterly revenue estimates by $9 billion. But apart from these headline numbers, there were many important items in the report, so let’s delve into the details.

Exxon Mobil Is A Winner In This Environment

The world is experiencing an energy crisis right now. Growing demand following the pandemic, supply disruptions caused by the Russia-Ukraine war, underinvestment due to ESG mandates and due to companies becoming more focused on free cash generation, and recent OPEC moves have led to a very tight market. Oil prices are off their highs that were hit earlier this year, but they remain well above the average seen over the last couple of years. Natural gas markets are tight as well, due to the fact that Europe is seeking to diversify its natural gas imports away from Russia, which means that more supply will come from the U.S., among others. Last but not least, the closing of many refineries in the U.S. and some other markets over the last couple of years has resulted in tight refining capacity, which is why refiners can generate above-average margins (crack spreads) in the current environment.

For a company like Exxon Mobil, which is active in oil production, natural gas production, LNG, and refining, this is a great environment. And since not a lot of additional oil supply will come to the market in the near term — in fact, with SPR releases likely ending in the foreseeable future, the contrary might happen — this beneficial macro environment could be maintained for quite some time, which would allow Exxon Mobil to generate massive profits and cash flows not only this year but beyond.

During the third quarter, Exxon Mobil was able to grow its production by 50,000 barrels per day, relative to one year earlier. Exxon Mobil is one of just a few oil companies delivering any meaningful production growth at all, as many oil players had been underinvesting during the pandemic, and some even prior to that. Exxon Mobil’s heavy investments in new production in the Permian Basin and offshore Guyana are paying off now, however, as the company is experiencing production growth at the perfect time — when it’s most profitable to do so, as markets are tight.

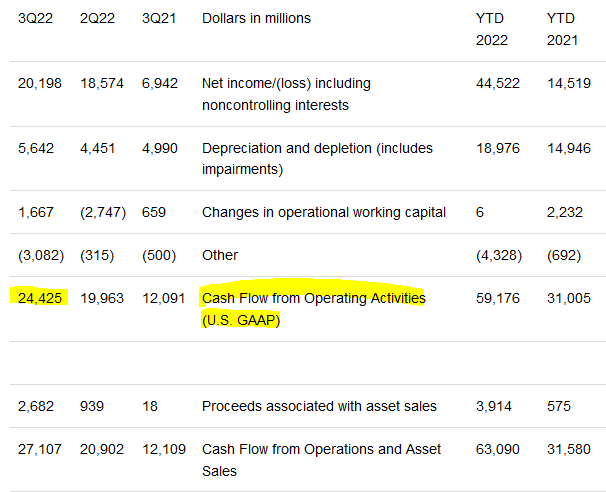

Thanks to high sales at attractive margins, Exxon Mobil was able to generate outstanding cash flows during the period:

Seeking Alpha

$24 billion in cash from operations is one of the highest quarterly cash flows reported by any company, ever. For reference, mighty Apple (AAPL) has generated $118 billion of cash over the last year, or $29.5 billion per quarter — Exxon Mobil is not too far behind. For those that want to include the proceeds from divestments, the number is even better, at $27 billion, although the one-time nature of asset sales makes me believe that it’s better to not include those in the cash flow picture.

Exxon Mobil has spent $4.9 billion on capital expenditures, which is marginally below the ~$5.5 billion per quarter guidance for the current year. This resulted in free cash generation of $19.5 billion — that’s $78 billion annualized. For a company that is currently valued at $450 billion, that’s a strong level of cash generation. Annualized, the Q3 pace results in a free cash flow (“FCF”) yield of 17%. It should be noted that Q1 and Q2 free cash flows were lower, but even when we annualize the year-to-date average, we get to free cash flows of $62 billion (FCF totaled $46.6 billion in Q1-Q3), which would result in a free cash flow yield of 14% at current prices. That’s pretty compelling, although it should be noted that there are energy stocks that trade with even higher free cash flow yields today, thus XOM is not the cheapest among oil and gas equities. Among others, Shell plc (SHEL) and BP p.l.c. (BP) offer even higher free cash flow yields right now.

Companies have several ways to spend free cash flows, where organic capital investments are already accounted for. They can go for acquisitions, they can return cash to their owners via dividends and/or share repurchases, and they can go for net debt reduction, either by paying off debt or by accumulating cash on the balance sheet. Many companies choose to go for a combination of these, and that holds true for Exxon Mobil as well. The company has declared a fourth-quarter dividend of $0.91 per share, which makes for a $0.03 increase versus the previous level, and which will result in annual dividend expenditures of around $15 billion. With shares trading at $108 at the time of writing, Exxon Mobil’s new dividend results in a dividend yield of 3.4% — quite solid and around twice as high as the broad market’s yield, but by far not the highest dividend yield in the energy space.

With the dividend costing XOM $15 billion a year, and XOM likely generating more than $60 billion in free cash this year, there is a lot of surplus cash on top of the dividend, of course. Exxon Mobil is returning some of that to its owners via share repurchases, as the company is currently working on a $30 billion share repurchase program that was announced earlier this year. So far, the company has spent $10.5 billion of that this year, including $4.5 billion during the third quarter. At an annualized pace of $18 billion, XOM will repurchase around 4% of its shares per year, which will have a very meaningful impact on cash flow per share growth and earnings per share growth in the long run. Apple’s famed buybacks, for perspective, have usually been in the 3%-4% per year range as well.

But even with $15 billion being spent on the dividend and $18 billion being used for buybacks, the company has an additional ~$30 billion for other purposes, calculated with the year-to-date free cash flow pace. Exxon Mobil has, so far, decided to use these additional cash resources to improve its balance sheet, which makes sense. The company has, historically, been operating with a very strong balance sheet — for a very long period of time (67 years), it had an AAA credit rating, but it lost that in 2016. Following the oil price crash around that time, XOM’s balance sheet worsened, as debt levels rose due to the company’s investments, e.g., in its Guyana asset base.

With those investments now paying off handsomely, it makes sense for the company to work on its balance sheet. And Exxon Mobil has made a lot of progress so far this year: with cash of $30 billion, short-term debt of $6 billion, and long-term debt of $39 billion, XOM now has a net debt position of $15 billion — equal to less than the FCF the company generated in Q3 alone. At the beginning of the year, Exxon Mobil’s net debt stood at $40 billion, thus in three quarters, the net debt position has improved by $25 billion. At that pace, Exxon Mobil will have a net cash position at the end of the second quarter. At that point, a credit rating upgrade could be possible, but even if that were not to happen, XOM would likely start to shift its cash flow usage, either going for M&A or ramping up its shareholder returns, e.g., by making special dividend payments or by increasing its buyback pace.

Is XOM A Good Investment?

Shares of Exxon Mobil have risen by 70% so far this year, while the broad market is down 20% year to date — so much for the “old economy” being uninvestable, as some thought during the midst of the pandemic.

Exxon Mobil’s operational performance is excellent — production is growing, margins are high, cash flow generation is massive, and the company is ramping up its shareholder returns even while improving its balance sheet at the same time.

The only issue I see here is that XOM is trading at a higher valuation than many other energy names. It is not expensive in absolute terms, but many other energy names are even cheaper. TotalEnergies SE (TTE), for example, trades at less than half Exxon Mobil’s EV/EBITDA (2.2 versus 4.7, respectively). XOM is the king in the energy industry, and its underlying performance is excellent — but others might still be better investments due to even lower valuations.

Be the first to comment