Justin Sullivan

F3Q23 Summary

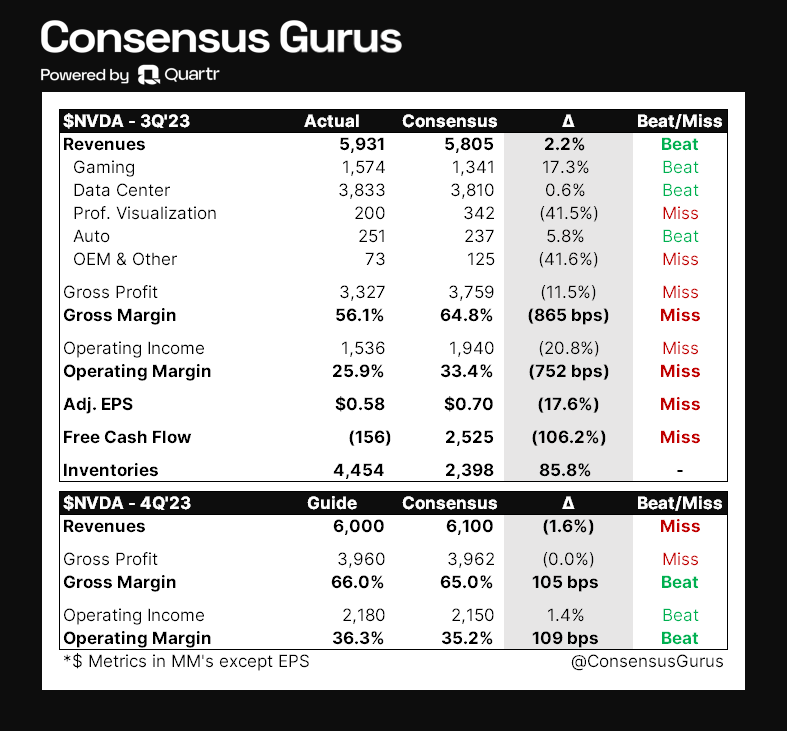

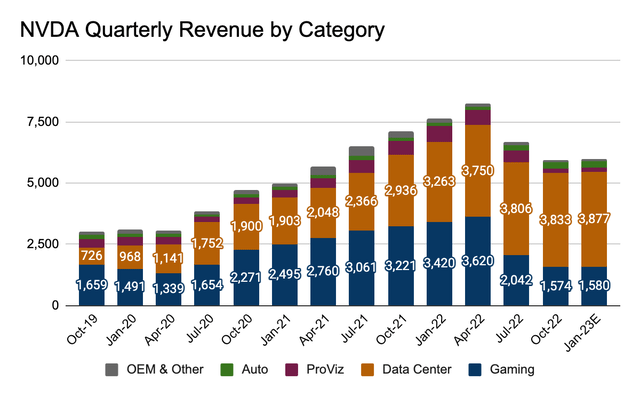

NVIDIA Corporation (NASDAQ:NVDA) delivered F3Q23 (C3Q22) revenue of $5.93 billion (-17% YoY) that beat consensus by 2% while adjusted EPS of $0.58 was 18% below $0.70 consensus. As expected, Gaming continued to face post-Covid headwinds with revenue down 51% YoY to $1.6 billion as the company works through channel inventories. Data Center was again the bright spot, with revenue of $3.8 billion (+31%) which was inline with consensus. While both ProVis and OEM & Other were both materially below Street expectations, Auto revenue reached a record $251 million (+86%). Inventories were significantly above consensus and up 99% YoY, driven by lower sell-in to AIB partners in the current demand environment.

Overall, the report wasn’t anything out of the ordinary, as Gaming weakness was well understood while DC seemed to have held up well so far. This explains why Nvidia shares didn’t make any major move in either direction post-earnings.

ConsensusGuru

Nvidia’s F4Q23 Outlook

Nvidia guided F4Q23 (C4Q22) revenue of $6 billion (+/- 2%), down 21% YoY and a touch light of consensus. On a QoQ basis, Gaming, Data Center and Auto are expected to see modest growth. Guidance for gross margin of 66% and EBIT margin of 36% both beat expectations. On a GAAP basis, management expects GM of 63.2%, OPEX of $2.56 billion, other income of $40 million, and a tax rate of 9% in the current quarter. Doing some quick math, we can arrive at a GAAP EPS of $0.46 for calendar Q4 (-60% YoY).

Gaming bites, but no longer a surprise

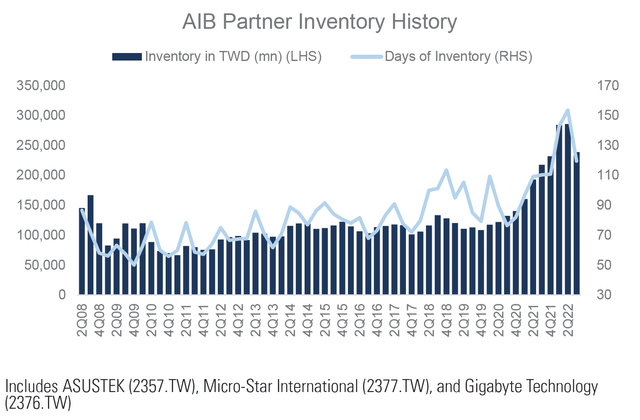

Gaming revenue was cut in half in Q3, and weakness is expected to continue through the next several quarters as Nvidia addresses excess inventories with channel partners. According to Tech Spot, prices of the 30 series GPUs actually increased by 4% on average from September to October, and inventory levels for the RTX 3090 series “appear to be falling.” AIB partner inventory also seems to be correction mode after reaching its peak in 2Q22.

FactSet, Company data, Goldman Sachs

The new RTX 4090 GPU on the Ada Lovelace architecture (using TSMC’s N4) had a strong launch in mid-October, with the RTX 4080 launching just recently. While demand for the $1600 GPU card appears to be strong, Nvidia is reported to have shifted its RTX 4090 capacity at Taiwan Semiconductor (TSM) over to the H100. The move is quite understandable considering the H100 products cost $10,000 a piece.

For C4Q22, management expects a small sequential growth in Gaming driven by demand for the RTX 40’s series while inventory normalizes. Assuming just a slight QoQ growth for Gaming in C4Q22, revenue is expected to decline by 54% YoY, where the segment will account for 26% of total revenue vs. 44%/30%/27% in C1Q/2Q/3Q. Aside from fading pandemic tailwinds, the structural downfall of GPU mining is also a major reason why Gaming is unlikely to return to its glory days of $3 billion+ in quarterly revenue.

“We don’t expect to see blockchain being an important part of our business down the road.” – Nvidia C3Q22 earnings call.

Evidently, Nvidia is now a data center story given demand for its gaming GPUs will exclusively come from good old-fashioned gamers looking to enjoy Modern Warfare II (ATVI) vs. miners scooping up the latest cards in a heartbeat. While weakness in Gaming is very likely to continue into calendar 2023, markets have sufficiently de-risked the YoY decline in revenue.

Data Center remains a bright spot, but debate on 2023 growth continues

Data Center saw a robust 31% YoY growth to $3.8 billion, which represented 65% of Nvidia’s total revenue. The strength was driven by strong demand from U.S. CSPs (cloud service providers) and corporate compute workloads such as large language models and recommendation systems. While U.S. export restrictions on China began impacting A100 and H100 shipments in C3Q22, Nvidia was able to offset the impact by launching the A800 chip as an A100 alternative during the quarter. Nevertheless, management noted that demand in China “remains soft” and expects weakness in the current quarter. In C3Q22, Nvidia also recorded a $702 million in inventory write-down due to softness in the Chinese market, with a good portion of it being related to the A100.

In early 2023, the flagship H100 data center GPUs will be available across major cloud infrastructure providers including AWS (AMZN), GCP (GOOG, GOOGL), Azure (MSFT), and Oracle Cloud (ORCL). On the technical side of things, H100 delivers 3x lower cost, 5x fewer server nodes, and 3.5x less energy vs. the previous generation.

Another exciting announcement from Nvidia was the collaboration with Microsoft on cloud-based AI supercomputer. Microsoft Azure will adopt Nvidia’s AI stack to help companies train and deploy AI models, as management noted the partnership will add “tens and thousands of A100 and H100 GPUs.”

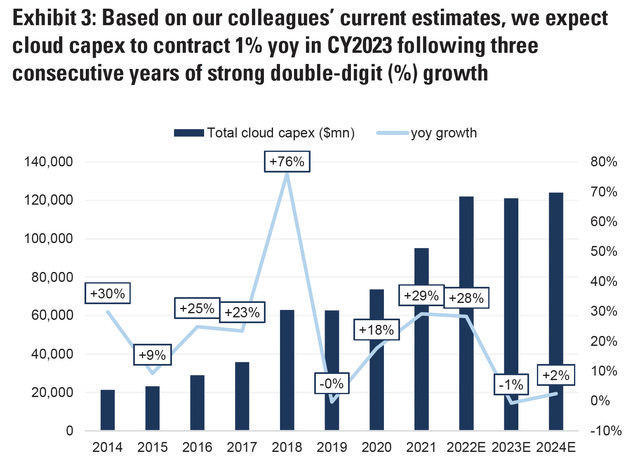

As solid as the data center story may be, the debate continues to be whether demand will see a material slowdown going forward. According to estimates by Goldman Sachs, cloud Capex is expected to decline 1% YoY in 2023 following 3 years of double-digit growth. This could be a strong possibility considering the massive layoffs seen across the tech sector including high-profile firms like Meta Platforms (META), Microsoft and Amazon. While Google is yet to announce any plans to cut staffing, CEO Sundar Pichai has publicly expressed his intention to make Google 20% more efficient.

Perhaps one could argue that corporate layoffs may not be directly tied to Capex reductions, but since cloud infrastructure providers charge customers based on usage volume, reduced business activities (the primary reason behind layoffs) in the tech space may trigger more thoughtful reviews of 2023 Capex plans for most major cloud providers. As a result, I believe the market may not have given enough scope for the possibility of below-expectation data center demand in 2023, especially following the recent rally in the stock.

Conclusion

Nvidia’s Gaming business has likely seen its best days, so Data Center will be the most important driver of growth going forward. While markets have de-risked the softness in Gaming, a normalizing data center demand environment suggests investor expectations may currently be too high given that Nvidia stock has rallied 50% from its October low and now trades at 36x forward 1-year earnings. Based on such a demanding multiple, I rate Nvidia shares a Hold and would remain on the sidelines until valuation improves again.

Be the first to comment