Jorge Villalba

It has been only six months since I warned of the risks associated with:

- Amazon’s (NASDAQ:AMZN) unsustainable valuation;

- Its heavy exposure to the fading momentum trade.

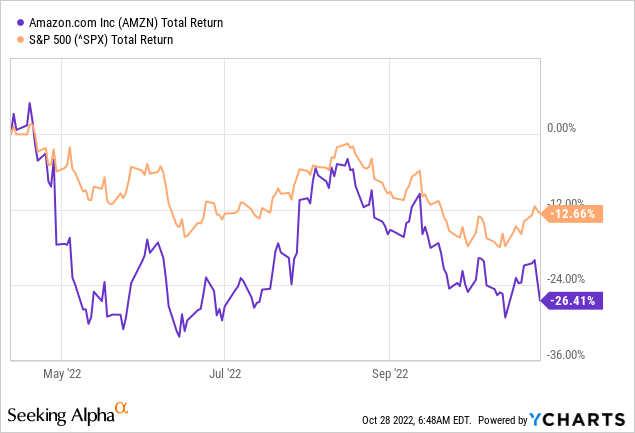

At the time all that sounded as science fiction and it was almost inconceivable to put ‘Amazon’ and ‘unsustainable valuation’ in once sentence. Unfortunately, it now becomes clear that my pessimistic take on the company has been too forgiving as Amazon’s share price lost more than 26% of its value in a matter of months and the after-market reaction to yesterday’s results points to even more pain ahead.

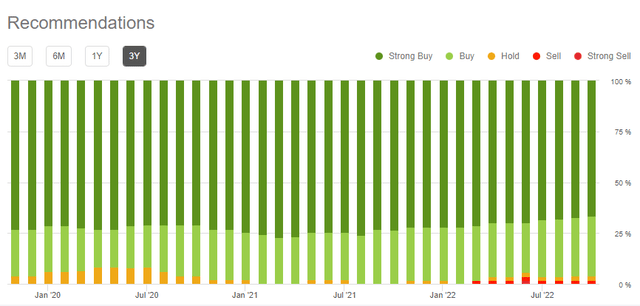

During this abysmal performance for AMZN at a time when the broader market fell by only 12.7%, the sentiment towards Amazon has remained almost completely one-sided. From retail to institutional investors and Wall Street Analysts, a bearish thesis was almost non-existent and this one-sided view was one of the factors for AMZN to be in the position it is today.

Following the yesterday’s results and the overall performance over the past months, Wall Street analysts will mostly likely follow the trend now and downgrade the stock. But if anything, this ‘follow the herd’ mentality is proving extremely dangerous for shareholders of growth companies in this highly uncertain environment.

The Obvious Reason

The most obvious reason for Amazon’s plummeting share price are the expectations of deaccelerating topline growth.

This is the area where most people get blind sighted by the eye-watering growth rates and high hopes for the future. After all, how can Amazon’s share price be falling sharply after a 19% year-on-year growth rate?

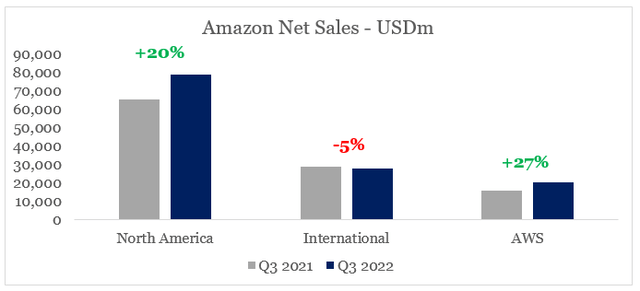

For the third quarter, worldwide net sales were $127.1 billion, representing an increase of 19% year-over-year, excluding approximately 460 basis points of unfavorable impact from changes in foreign exchange rates.

Source: Amazon Q3 2022 Earnings Transcript

After all, the Q4 2022 revenue guidance did fall short of expectations, however, it appears that unpredictable changes in exchange rates are largely to blame.

As I look ahead to guidance for Q4, I think the biggest individual factor is still going to be foreign exchange. This guidance includes 460 basis points of unfavorable impact year-over-year. FX is a bigger issue for us on our revenue growth in dollars than it is on our income. It actually has a slight favorability due to the investments we’re making internationally.

Source: Amazon Q3 2022 Earnings Transcript

At the same time the growth drivers of Amazon are firing on all cylinders. The advertising business grew at impressive 30% rate.

We also saw good growth in our advertising offerings where sales grew 30% year-over-year, excluding the impact of foreign exchange (…)

Source: Amazon Q3 2022 Earnings Transcript

AWS did not disappoint either, with its topline growing at 28% and demand for cloud services remaining robust as clients are looking for ways to reduce fixed costs while not compromising security.

In AWS, net sales increased to $20.5 billion in Q3, up 28% year-over-year, excluding the impact of foreign exchange, and now representing an annualized sales run rate of $82 billion.

Source: Amazon Q3 2022 Earnings Transcript

Overall, Amazon continued growing over the period with outside factors, such as foreign exchange rates being largely to blame.

prepared by the author, using data from SEC Filings

Although Q4 guidance fell short of expectations, it is not hard to use the latest reported results in conjunction with the extreme response in the share price to only support the bullish investment thesis behind the company.

Why This ‘Overreaction’?

To understand why Amazon’s share price is reacting so negatively to all these developments, we should get a grasp of how the equity market works under these times of unprecedented intervention and liquidity.

Without going into too much detail, high momentum stocks and especially those seen as the disruptors of our time have been the main beneficiaries of the monetary experiment that begun in 2009 and peaked around 2020-21 period.

You can read in detail about all that in my first analysis of Amazon, as well as in my recent analyses of the semiconductors and cloud sectors. The latter does a very good job at explaining how tiny changes to topline expected growth rates could have a disproportional impacts on valuation multiples for high growth names.

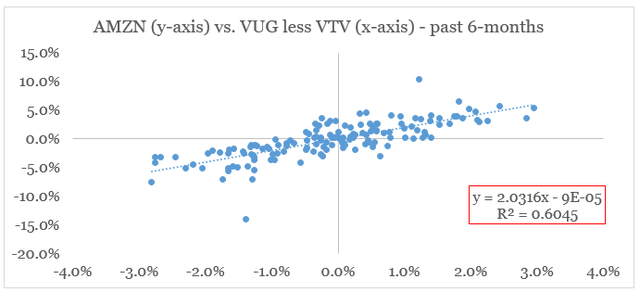

Back to Amazon, the company’s share price has been highly dependent on the market’s premium for growth that is slowly normalizing. In the graph below, I measure this by the relationship between AMZN’s daily returns of the past 6-months with an index that takes long position in the Vanguard Growth ETF (VUG) and a short position in the Vanguard Value ETF (VTV).

prepared by the author, using data from Seeking Alpha

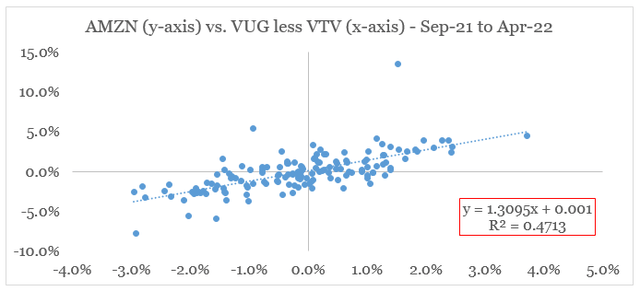

This is even more troubling, if we compare Amazon’s current exposure to the growth index with that from September 2021 to April 2022.

prepared by the author, using data from Seeking Alpha

As we see from the graphs above, not only is the relationship much stronger, but the steepness of the trendline has also increased dramatically over the recent months.

What that means is that Amazon’s share price has become even more dependent on its ability to deliver better than expected growth and the overall market premium paid for that growth. As I highlighted back in April, this dynamic is not uncommon for almost all mega cap tech names, but the case of Amazon is made even worse by its profitability and free cash flow profile.

Why Was Amazon Not Spared

The obvious pushback here would be that all high quality tech names that have been growing fast over the recent years are more or less exposed to the dynamic shown above.

However, in the case of Amazon, the company did not have a highly profitable business model to rely on the same way as Microsoft (MSFT) is. Therefore, as the already thin profitability wanes, Amazon’s share price is being hit with a disproportionally higher force.

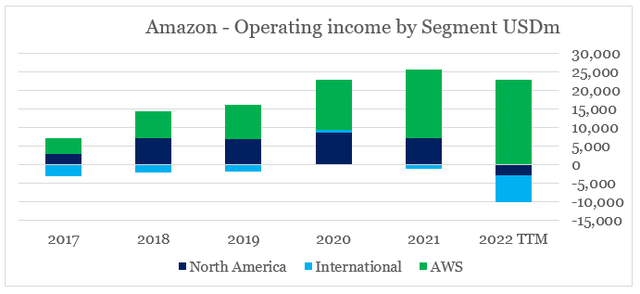

prepared by the author, using data from SEC Filings

Moreover, the recent quarter only confirmed fears that the slowdown of the global economy in conjunction with the inflationary environment puts Amazon’s e-commerce business at enormous risk.

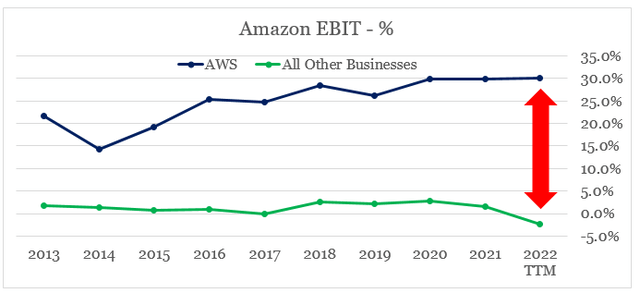

Although AWS is still doing the heavy lifting in terms of profitability, the gap with the rest of Amazon is growing at an alarming rates.

prepared by the author, using data from SEC Filings

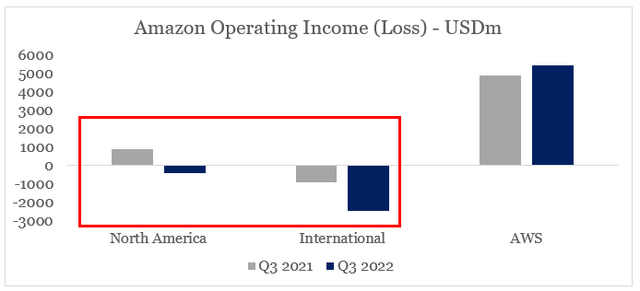

Even though a drop in profitability in the North America and International segments was to be expected, the last quarter was even worse than most people expected.

prepared by the author, using data from SEC Filings

Moreover, there are early signs that profitability of AWS is likely peaking and could become subject to more volatility over the coming years. Not to mention the need to ‘renegotiate pricing’ with customers which makes things even worse in the highly competitive cloud sector.

The broad disclaimer on AWS margins is that they will fluctuate over time as we balance investments versus renegotiating pricing with the long-term customer commitments, all as headwinds to the business, offset by increasing productivity and efficiencies in our data centers, which drive profitability.

Source: Amazon Q3 2022 Earnings Transcript

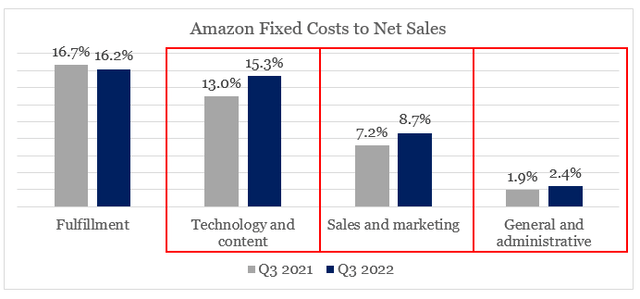

Having said all that, Amazon’s huge workforce puts the company at a significant disadvantage to its peers in the cloud space as the inflationary environment puts pressure on wages. As if all that is not enough, the company’s fixed costs have also become too stretched as a result of the ambitious plans to expand in areas such as Media, Health Services and Autonomous Driving.

prepared by the author, using data from SEC Filings

In a nutshell, Amazon has too much on its plate for a company that is all of a sudden having to deal with loss making e-commerce business and a highly competitive cloud unit.

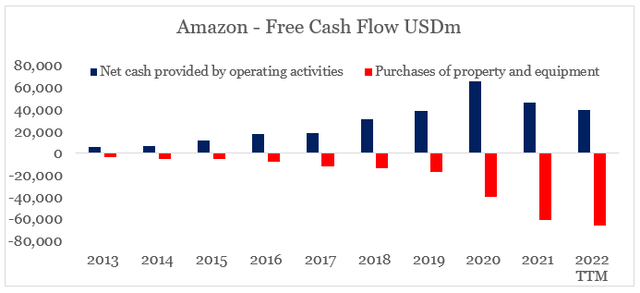

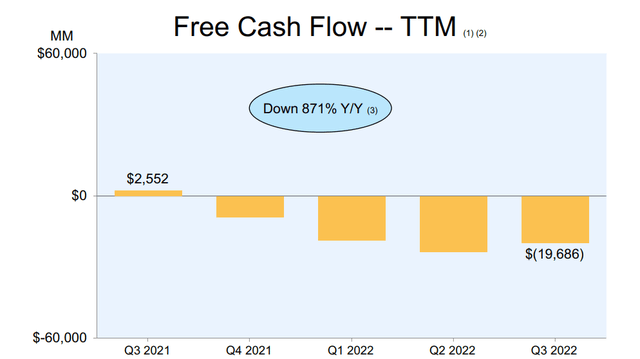

As a result, free cash flow is now deeply into negative territory which naturally makes investors extremely nervous even when considering the company’s strong footprint.

The double whammy effect of falling cash flow from operations and the need to massively increase capital expenditure to finance future growth that is even more uncertain is becoming a major issue for Amazon’s share price.

prepared by the author, using data from SEC Filings

During the last quarter, the issues with rising operating costs and inventory levels in Asia were pointed out as two major reasons for the falling free cash flow, however high Capital Expenditure remains the key driver.

While higher capital spend has been comforting investors as it supports future growth, it is troubling that the Capex budget has been cut by one-third over this year.

And then CapEx is a big driver. We had, again, a doubling of the network, had very high CapEx the last two years. You’ll see that we’ve lowered CapEx year-over-year. We probably cut about one-third of our budget from what we originally thought for 2022 while still focusing our capital dollars really on the AWS business and increasing customer demand or capacity for increasing customer demand in our stores business.

Source: Amazon Q3 2022 Earnings Transcript

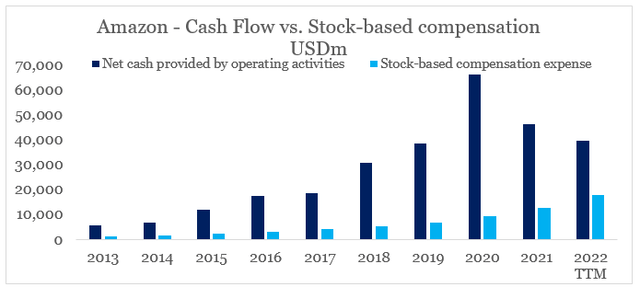

As if all that was not enough for Amazon, the company also needed to further expand its stock-based compensation, which now makes a sizable share of the cash flow from operations.

prepared by the author, using data from SEC Filings

Conclusion

Amazon’s disappointing quarterly results came as a surprise to many, however, the writing on the wall was plain to see for anyone not blind sighted by the exciting narrative. Moreover, issues with the share price exposure to momentum trade is an issue that investors need to take seriously in the future and should not overlook as something trivial. To make matters worse, all the problems with Amazon’s profitability and free cash flow have made the share price sensitivity to the growth rate premium mentioned above even more pronounced. While the 26% drop in share price over the past six months might seem as a good opportunity to buy, Amazon’s business is now in a very tough spot and its share price outperforming the market in the coming years seems highly unlikely.

Be the first to comment