Dzmitry Dzemidovich

With a sizable property base, inflation-protected cash flows, and a low pay-out ratio, W. P. Carey Inc. (NYSE:WPC) is a highly well-managed net-lease real estate investment trust. These characteristics suggest that the trust’s dividend will increase going forward.

I believe that W. P. Carey provides shareholders with a chance to profit from the trust’s increasing portfolio income while providing passive income investors with a long-term investment opportunity.

The valuation multiple for W. P. Carey based on funds from operations is likewise very fair, and the trust’s shares now yields a covered dividend of 5.3%.

Well-Managed Real Estate Portfolio

W. P. Carey is a sizeable net-lease real estate investment trust with a market value of roughly $17 billion. As of 30 September 2022, there were 1,428 net-leased buildings in the trust’s portfolio, which were leased to 391 tenants across a range of industries.

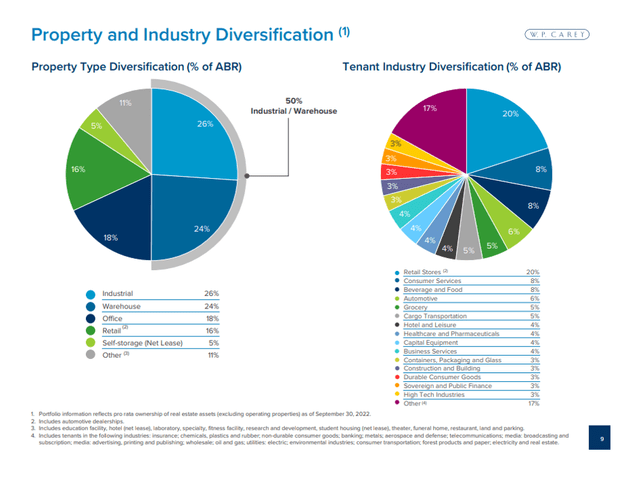

Industrial and warehouse real estate, which makes up 50% of the trust’s asset base, is the investing focus of W. P. Carey. Other real estate asset types that W. P. Carey invests in include offices (18%), retail (16%), and self-storage (5%).

The other category, which accounts for 11% of the trust’s real estate assets, consists of a variety of buildings such dining establishments, fitness centers, and educational institutions and cannot be combined with the other investment categories.

Property And Industry Diversification (W. P. Carey)

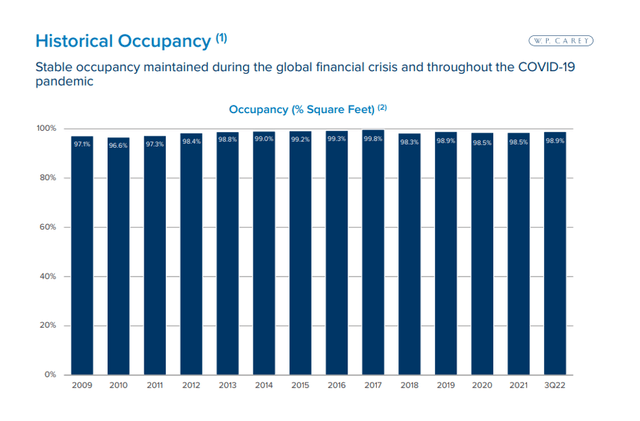

In the headline of this article, I referred to W. P. Carey as a sleep-well-at-night REIT and in my view, the main reason why is that the trust has a long history of excellent real estate portfolio management.

As of 30 September 2022, W. P. Carey had a 98.9% occupancy rate, and the portfolio as a whole has continuously fared well in terms of occupancy over time, particularly during the Covid-19 pandemic.

Historical Occupancy (W. P. Carey)

Inflation Protection

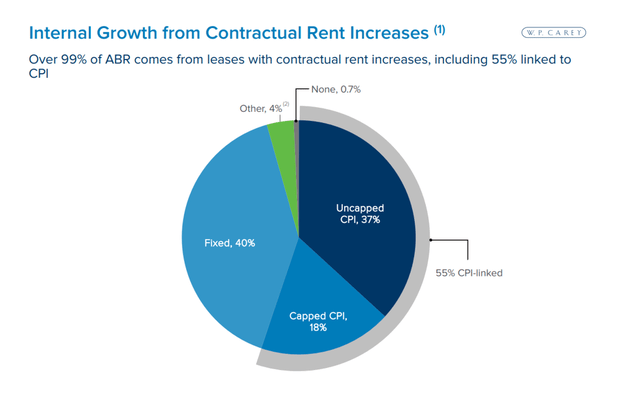

W. P. Carey provides passive income investors with a way to hedge against inflation, which is still a major market concern. A concern for both investors and consumers, consumer prices increased at an annualized rate of 7.7% in October, the highest level in 40 years.

Fortunately, a significant portion of W. P. Carey’s contract base consists of agreements that demand increased rental income from the trust’s borrowers in the event that the consumer price index rises.

Almost all of the trust’s leases (99%) contain clauses for rent increases, and 55% of all contracts are tied to the growth in the consumer price index, claims W. P. Carey. This means that the trust’s cash flow will increase as consumer prices rise, providing passive income investors with a built-in inflation hedge.

Internal Growth From Contractual Rent Increases (W. P. Carey)

The Dividend Is Covered And Sustainable

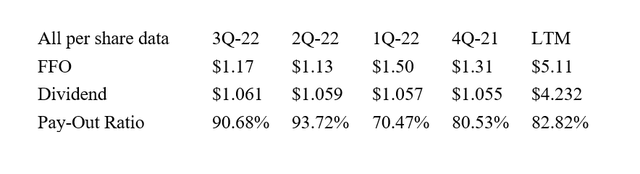

In the third quarter, W. P. Carey generated money from operations of $1.17 per share, more than enough to pay the dividend of $1.06 per share.

In comparison to the pay-out ratio for the previous 12 months, which was 83%, the pay-out ratio in the third quarter was 91%.

Having said that, I don’t anticipate any problems with W. P. Carey’s dividend coverage going forward and I have no doubts about the REIT’s ability to increase its dividend.

Dividend (Author Created Table Using Trust Information)

Based on an annualized dividend of $4.24, W. P. Carey’s stock presently yields 5.3%.

AFFO Guidance For 2022 And Valuation

W. P. Carey forecasts cash from operations for 2022 to range between $5.25 and $5.31 per share, or an AFFO multiple of 15.1x.

The real estate investment trust is expected to make between $1.5 billion and $2.0 billion in purchases this year, according to W. P. Carey’s estimates.

Realty Income Corporation (O) is currently trading at a P/AFFO-ratio of 16.6x, and the quality of the trust is comparable to W. P. Carey.

Why W. P. Carey Could See A Lower Valuation

Even though the U.S. economy is poised to enter a recession, the real estate investment trust is able to sustain its dividend through funds from operations.

Slower growth in funds from operations or a reduction in dividend coverage are the two things that could cause the trust’s valuation to drop, but I don’t really see either of those things happening.

A significant downturn in the U.S. real estate market may actually benefit W. P. Carey by allowing it to expand the scope of its portfolio and increase FFO thanks to larger acquisition volumes and better cap rates.

My Conclusion

W. P. Carey, having a sizeable property base, historically excellent occupancy rates, and a robust dividend that is covered by FFO, is a highly well-managed net-lease real estate investment trust.

Additionally, W. P. Carey’s leases provide investors who are concerned about the rise in consumer costs and the upkeep of their standard of living with inflation insurance.

I believe the pay-out ratio gives the dividend room to grow, and the current yield of 5.3% is alluring to investors seeking passive income.

Be the first to comment