Gladkikh/iStock via Getty Images

2022 has been a challenging year for the stock market as higher interest rates and inflation slow earnings growth and lower asset valuations. Unsurprisingly, the high-valuation technology sector and the cyclically exposed consumer discretionary industry have been hit hardest. Further, the utilities, consumer staples, and healthcare sectors have outperformed (though energy has performed best overall). Today, investor and consumer sentiment remain weak, causing many to consider lower-risk stocks as alternative choices. I believe utilities are not the best today due to their interest rate exposure and unique energy challenges. Considering the SPDR Healthcare Sector ETF (NYSEARCA:XLV) has been the second-best performer over the past three months, the fund deserves closer inspection to determine its risk-reward potential.

XLV has maintained its value throughout the year and ranks very high for momentum and asset flows, indicating investors are interested in the fund. Its yield is not very high at ~1.5%, but its dividend has risen steadily, indicating decent quality. Stocks in the fund are slightly cheaper than the S&P 500’s average, with a weighted-average forward “P/E” of 16.6X compared to the S&P 500 index at 20X. The ETF has strong momentum compared to most and, given its low valuation, would seem a robust quantitative choice. Of course, healthcare stocks are exposed to critical risks associated with regulation, and healthcare costs are rising at a problematically fast pace. With inflation rising, I believe the system may become overwhelmed to the extent many firms face significant earnings reductions. While XLV’s long-term downside risks appear formidable, its short-term potential and lack of direct, cyclical exposure are positive traits.

Healthcare To Be Crushed By Its Own Weight

The healthcare sector is historically distinctive and is not significantly impacted by cyclical risks. In good times and bad, people flock to healthcare corporations. US healthcare expenses make up a staggering ~19% of the US GDP, well above the following highest country, Canada, at ~13%. Even after accounting for differences in taxation and payee (public or private), Americans spend far more on healthcare than all other western countries (which generally pay more than non-western ones). The US also stands out for having a comparatively low (and falling) life expectancy compared to peers, particularly considering higher average income levels. While poorer health standards may cause higher healthcare spending, it is apparent that the US healthcare industry is in great need of relatively significant change.

The US healthcare industry has been weak since the 1990s when healthcare costs-to-GDP began to skyrocket above foreign peers. XLV is exposed to the entire sector, with around three-quarters of the fund in “healthcare goods” (pharmaceuticals, equipment & supplies, biotechnology, and life sciences tools) and the rest in healthcare providers & services. US healthcare spending costs are abnormally high for hospital care (76% above average) and are only 10-15% higher for drugs, administration, etc. Of course, the data changes depending on how measurements are taken, with other studies showing Americans pay over 2X for pharmaceuticals.

Healthcare regulation is a threat to XLV as it could result in a substantial decline in the fraction of GDP going toward healthcare corporations. In my view, higher profit margin companies, such as pharmaceuticals, equipment, and biotechnology, carry greater exposure to this risk since they have more to lose. There are some efforts from the US government to reduce pharmaceutical costs which may grow with public concern. Of course, the healthcare sector has made the most significant lobbying contributions in recent years, with little party discrimination, as two-thirds of congress members received money from pharmaceutical firms in 2020 (many of those firms are top holdings in XLV). On the one hand, this statistic shows large healthcare companies are somewhat protected from regulatory change. Conversely, it clearly illustrates their high perceived profit risk of regulatory change.

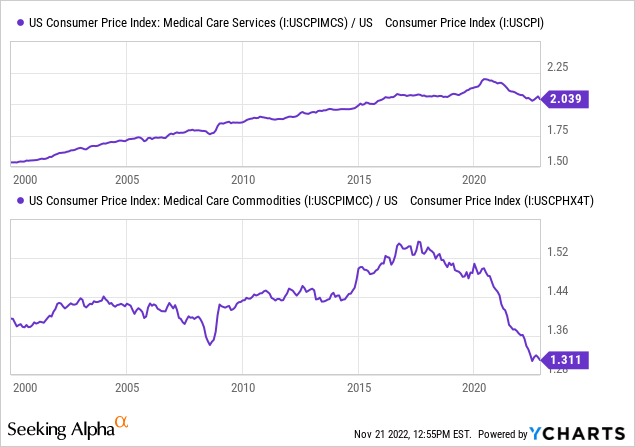

Interestingly, rising inflation has caused an apparent shift in the medical care market. Since 2018, medical care commodities (drugs, equipment – 18% of total medical care CPI weight) have fallen dramatically compared to the overall CPI. Since last year, real medical care service costs (physician’s bills, nursing, insurance, etc. – 82% of medical care CPI) have begun to wane. See below:

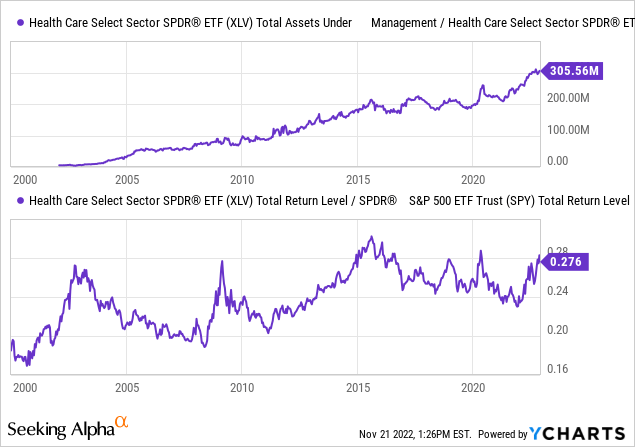

There are numerous issues with the “healthcare CPI” many of these costs are difficult to quantify as precisely as “a gallon of gas” or “an apple” as in other aspects of the CPI. In other words, the medical care CPI can decline due to a fall in “product quality.” Still, this data indicates a growing shift within the healthcare industry that accelerated last year. In fact, 2022 is the first year in decades that US health insurance premiums were nearly stable. The outperformance of XLV (511% total return) vs. the S&P 500 (310% total return) over the past 20 years is mainly attributable to the sharp rise in US healthcare costs. Medical care services costs have risen faster than the GDP for virtually all years since the late 1990s. If this trend reverses, most firms in XLV are unlikely to continue to grow their EPS at an above-GDP pace.

There are a few potential reasons for this sentiment that exclude regulatory changes (considering few large ones have occurred). With the cost of food, rent, and energy rising despite little wage or GDP growth, there is simply a lack of available income that can continue to go to healthcare. Secondly, after two and a half decades of tremendous growth (and few improvements in health conditions), there may be no more avenues for the healthcare industry to continue to expand. Indeed, considering most biotech, pharmaceutical, and equipment firms need constant new technology to maintain profits as patents expire. The “patent cliff” is one reason why many research-oriented firms in XLV carry lower valuations and may be another factor causing CPI-adjusted medical goods costs to fall.

XLV Has Strong Short-Term Momentum

Overall, I believe the long-term fundamental outlook for healthcare is generally bearish. The key secular trend that fueled immense healthcare spending growth over the past 25 years appears to be firmly reversed. Of course, it may take some time before investors note this change or it dramatically impacts firms. In the short run, XLV’s lack of cyclical exposure may continue contributing to its short-term momentum.

XLV has had strong flows and outperformed the S&P 500 since its inception. Critical periods of high momentum include the early 2000s, when the market began to overgrow, and the 2010-2015 period when the Affordable Care Act (Obamacare) fueled additional earnings growth for many healthcare corporations. There was a significant but short-lived momentum spike during 2020 when other stocks declined, and investors believed the pandemic would boost healthcare earnings. XLV has also had strong momentum since 2021 as other stocks struggle under cyclical exposures. Since 2015, XLV has suffered a general decline in long-term momentum. See below:

XLV is outperforming with decent relative momentum today, but weaker momentum from a long-term standpoint, with the fund not outperforming since 2015. CPI-adjusted medical care prices also stagnated around 2015 and have begun to trend lower and faster over the past two years. Thus, while XLV may be a potent target from a short-term standpoint, I doubt it will continue to outperform over the long run.

The Bottom Line

Overall, I have a bearish outlook on XLV and believe it is a generally poor investment choice from both a long-term and short-term standpoint. Over the next year, if the US economy enters a recession and cyclical stocks see EPS declines, XLV may continue to outperform by a vast degree. That said, as we’ve seen in 2022, its outperformance has not equated with positive performance, with the energy sector being the only segment to achieve positive performance. While I am bearish on XLV, I do not expect it to underperform markedly over the coming months and see no great short opportunity in the fund.

In the long run, over the next 3-7 years, I suspect XLV will underperform the S&P 500 as the US healthcare sector declines relative to the GDP. Evidence suggests there is little capacity for healthcare spending to rise higher, limiting the overall revenue potential of the industry as a whole. Further, many patented items will fall off the largest “patent cliff” in 30 years over the coming years. In 2023, the US pharmaceutical industry faces $44B in sales-at-risk due to patent expiry, the highest level ever – and one that will rise through 2029. New drugs are needed to reduce lost sales, but so far, it appears unlikely that will occur – implying likely EPS declines for many pharmaceutical and biotechnology firms. That said, with the healthcare sector as a whole facing secular decline, I believe all sub-industries will eventually be negatively impacted.

Be the first to comment