ArtemisDiana

Investment Thesis

C3.ai, Inc. (NYSE:AI) is an AI application platform. It reported fiscal Q2 2023 results that left a lot to be desired.

As a reminder, as we headed into this earnings call, I wrote,

[T]he bull case can be simply surmised as this, buy the dip.

[…] I understand that the stock is already down more than 65% in the past year, and therefore it should be undervalued. However, I simply don’t find value in this name.

I believe that investors would do well to avoid this name.

Given this earnings report, I stand by those statements.

Crossing The Chasm?

C3.ai’s business model is one designed to get its customers up and running in no time. The business model is one that allows developers to use its prebuilt low-code or no-code modules and adapt them for their own use.

Think of C3.ai as a productive platform that aids customers across a range of industries to gather predictive analytics to distill contextualized insights. C3.ai’s core product, C3 AI Application Platform, allows its customers to reduce the complexities of developing enterprise AI applications.

The problem with C3.ai is that there’s a chasm between a like-to-have platform and a non-discretionary platform. And I believe that C3.ai is the latter.

Revenue Growth Rates Fully Fizzle Out

Before going further, keep in mind that C3.ai just reported its fiscal Q2 2023.

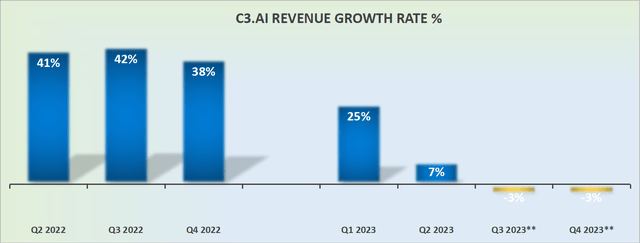

AI revenue growth rates, **guidance

What we see above is a graphic illustration of two companies. One that was growing at +38% in fiscal 2022, the year of its IPO. And then we see this year’s performance.

Even if C3.ai is lowballing estimates to allow for an easy beat further ahead, its revenue growth rates in the best case are going to around 0% y/y growth rates for the remainder of fiscal 2023. A performance that is not commensurate with its ”disruptive narrative.”

C3.ai Path To Profitability Still Some Time Out

For fiscal Q2 2023, C3.ai’s non-GAAP operating margins were 24%. However, as we look ahead to fiscal Q3 2023, its non-GAAP operating margins point to approximately negative 39%. The company’s profitability appears to be inching in the wrong direction.

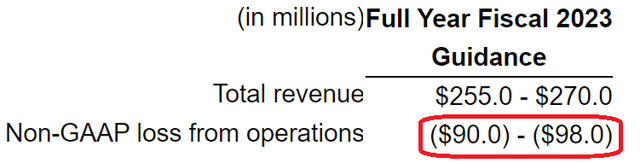

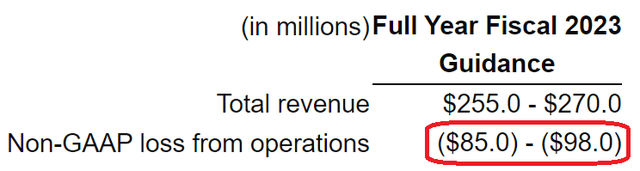

Next, consider C3.ai’s outlook for fiscal 2023 offered at the end of fiscal Q1 2023:

Now, let’s consider its newly upwards revised outlook offered together with its fiscal Q2 2023 results:

From where I stand, it appears to me, that after everything that’s happened with the stock down 90% from its highs, I don’t believe that this management team is operating fast enough to salvage investors’ capital.

Meanwhile, investors have reached out to me and told me that they understand that C3.ai is cheap, and given that C3.ai holds approximately $860 million of cash, this equates to approximately +65% of its market cap.

And mathematically, that’s true. And although having a large cash position is obviously compelling, we have to take a step back and think. Are we meant to invest in this unprofitable business for the cash on its balance sheet? Is that really what’s at stake here?

On the other hand, note that stock-based compensation in fiscal Q2 2023 was up 74% y/y. How is this level of compensation appropriate when the company’s revenue growth rates are only up 7% y/y?

For their part, I should highlight that C3.ai declares that it will be non-GAAP profitable by the end of fiscal 2024.

Bookings Are Moving in the Wrong Direction

As a reminder, bookings are an indication of work that has been invoiced but not yet delivered. It’s a leading indicator of where revenues will come in.

For Q2 2023, bookings were down 14% y/y. In my opinion, this doesn’t strike me as a growth company.

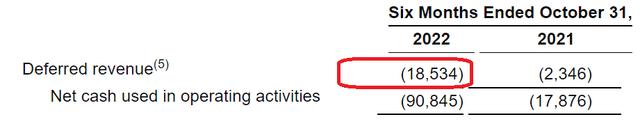

Moving on, below I’ve cut out a portion of C3.ai’s cash flow statement.

What we can see is that C3.ai’s bookings or deferred revenues have become a drag on cash flows in its trailing 6 months. When the company is growing and bookings are strong, the company gets cash upfront. And the free cash flow has the potential to be very strong. And everyone is happy.

But when bookings dry up and deferred revenues become a use of cash, that drags on the company’s free cash flow. Even if C3.ai, Inc. substantially improves its cash burn profile, I believe that its free cash flow burn for fiscal 2023 will reach a negative $200 million.

AI Stock Valuation — Difficult to Estimate Fair Value

In my previous article, I said,

[…] analysts following C3.ai are making what I believe to be too aggressive revenue growth assumptions as to how C3.ai’s next fiscal year will shape up to be. Analysts believe that C3.ai will grow its revenues next year by slightly over 20% CAGR.

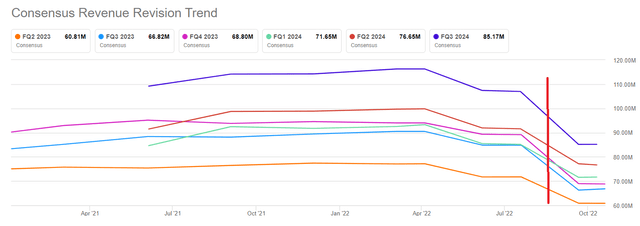

Since I wrote those comments, analysts have been actively downward-revising their expected revenue outlook for C3.ai.

AI analysts’ revenue expectations

However, I still don’t believe that analysts are looking at C3.ai, Inc. for what it actually is.

C3.ai, Inc. is a company that in the most favorable scenario will grow at somewhere around 10% to 15% CAGR in fiscal 2024. And no higher.

The Bottom Line

There are times in investing when you can be awed by the sound of esoteric, new concepts, and nascent industries. But in actuality, all that we are actually witnessing in C3.ai, Inc. is a company that was prescient enough to know exactly when to IPO.

It was a time when 0% rate companies could discount their potential many years into the future. But only when rates go up, do we see who is swimming naked. And you don’t need AI to know that.

However this turns out for you, all the best.

Be the first to comment