Natalya Bosyak

Thesis

As we approach year-end investors are left to ponder how their portfolios have fared in 2022: it has generally been a bloodbath, with the year exposing the weakness of the 60/40 portfolio in a rising interest rate environment. Both equities and bonds are down substantially on the year. While the market has recently recovered from a violent draw-down in September, we are of the opinion this is another bear market rally that just ended.

After looking in the rear view mirror and realizing it has been a tough year, a retail investor needs to ask themselves ‘What is next?’. Do not fall for the siren song of presuming that what has occurred in the past few weeks will continue. It has been a purely technical rally, driven by short-position closing and the squeeze placed on all investors who purchased a boatload of puts. Generally investors purchased year-end puts to hedge out their 2022 performance. With the time value of those options disappearing, many of those positions were closed in the past weeks, fueling the rally.

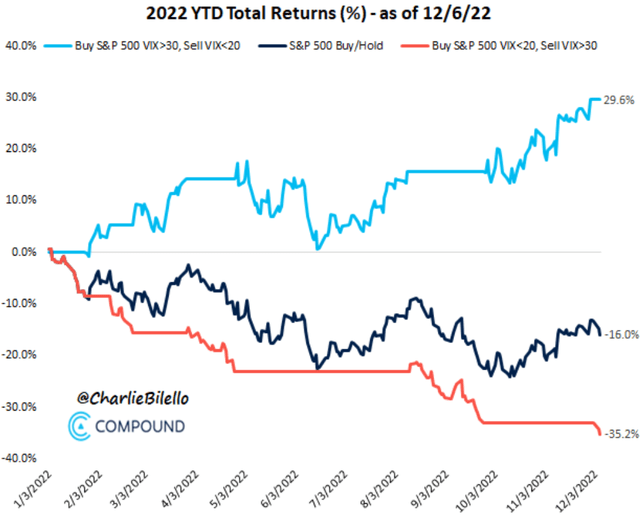

To this end please keep in mind that in 2022, a strategy where an investor would purchase equities when VIX was above 30 and those equities would be sold when VIX fell below 20, would have yielded total returns in excess of 29%:

Trading Strategy (Compound Capital)

We are now again in an environment when VIX has hit the 20 mark, hence it is time to lighten up on positioning. The stock market ultimately will have a mean reversion in terms of P/E ratios, and more importantly is not yet fully discounting the carnage in earnings (the E part of the above equation) that is coming:

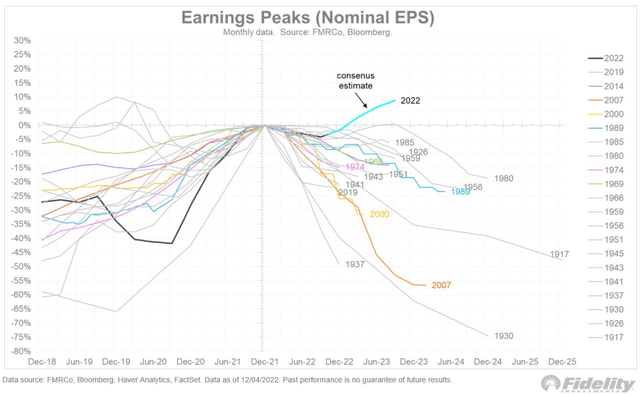

EPS Projections (Jurrien Timmer)

Ask yourself ‘What is wrong with the above graph?’. 2022 sticks out as an outlier in terms of EPS. There is now a consensus that a recession is coming, yet the Earnings projections have not come down to reflect that. The markets are not always immediately efficient, but they will adjust. Do expect earnings to come down to reflect the new recessionary reality in 2023.

When you expect a storm to come, what do you do? Do you buy puts and pray? Do you have unrealistic expectations that ‘Long term equities will go up’? We think not. With cash yielding above 4%, a rational investor should close the portholes and wait the storm out. Just think about it this way – if you do nothing next year and just hold cash you are getting a 4% portfolio return! This is a tremendously high cost of opportunity. Buying expensive puts costs money, and it is not guaranteed they will provide a full protection when the drawdown comes. A bear market is not a ‘straight down’ affair, but a slow grind lower. We have seen this in 2022, when purchased puts for shorter time-frames could have backfired royally.

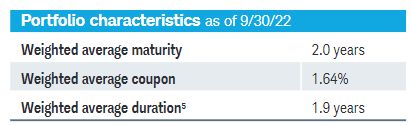

SCHO is a short duration treasuries ETF with an average holdings duration of 1.9 years:

Duration (Fund Fact Sheet)

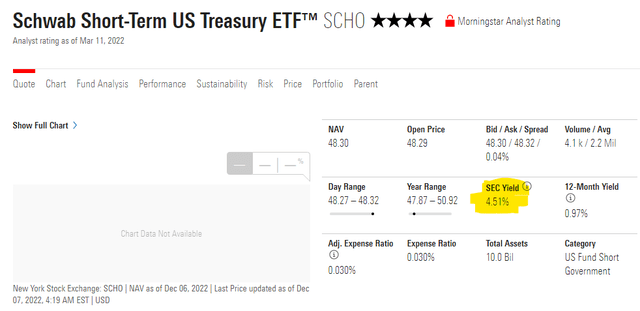

The fund is now yielding in excess of 4% when measured via a 30-day SEC yield:

30-day SEC Yield (Morningstar)

Please note that in today’s rising interest rate environment the 30-day SEC yield metric is the correct one to use, since the traditional trailing 12-months yield calculation takes into account the much lower interest rates observed in the past year.

Park your cash in treasuries, lighten up on risk and wait out the storm. Be fearful when others are talking about a ‘Santa Rally‘ and be greedy when others will scream that the world is coming to an end and equities crash.

Holdings

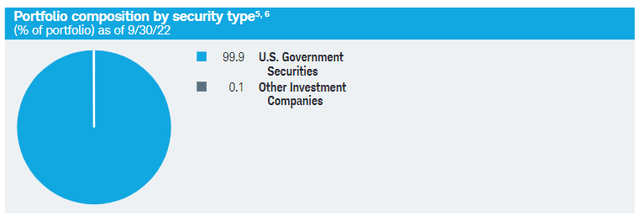

The fund holds only treasuries:

This composition gives the vehicle a risk free build, will all risks coming from interest rates. Given its short duration, the fund has a compact, secure build.

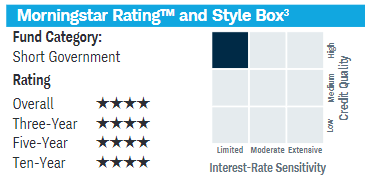

The fund falls in the short duration / high quality Morningstar category:

Duration Grid (Morningstar)

Ultimately you are buying a portfolio of short dated treasuries that are rolled over by the asset manager systematically.

Conclusion

Cash is no longer trash, and in effect it represents a very viable alternative to many other asset classes. It has been more than a decade since the last time an investor could park cash risk-free and get a rate in excess of 4% with no headaches. Not so long ago, investors were purchasing unleveraged high yield funds yielding around 5%. How times have changed! 2023 is likely going to be a difficult year, with consensus estimates calling for a recession, but with the stock market yet not fully discounting that in. We are down only -17% from the all-time highs from a year ago when rates were close to zero and inflation was not an issue. With the Fed set to keep raising rates in the face of a stagnating housing market, depleted savings rates and a rising unemployment rate something will break next year. And the Fed wants and needs that in order to bring inflation down in a consistent manner. The earnings part of the P/E ratio has not yet fully discounted the weakness to come, and the most rational move to come in equites now is down. Staying parked in cash is no longer an issue, with SCHO now yielding in excess of 4%. Lighten up on risk, close the portholes and prepare yourself for the storm to come.

Be the first to comment