piranka

Digital Realty Trust, Inc. (NYSE:DLR) is a well-managed, internationally positioned data center REIT that promises long-term-oriented passive income investors sustainable funds from operations and dividend growth.

Digital Realty is rapidly increasing its operational funds and strategically expanding its international portfolio.

The trust leases its data center to major technology companies, and while the REIT’s stock is not a steal based on FFO, I think Digital Realty has significant growth and valuation upside in the future.

International Growth Profile In A Fast-Growing Market

Digital Realty is a data center real estate investment trust focused on the United States, with 304 data centers totaling 36.7 million square feet in its portfolio. Digital Realty generates $2.6 billion in annualized cash net operating income from a $31 billion real estate portfolio as of September 30, 2022.

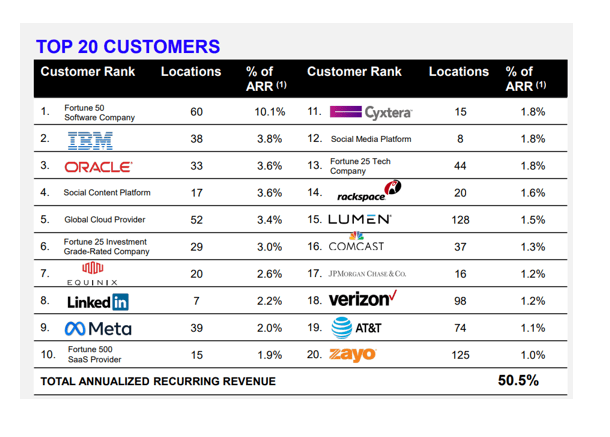

The trust leases out its data centers to the who’s who of the technology industry, with customers including IBM (IBM), Oracle (ORCL), Meta (META), and AT&T (T).

A list of the top twenty customers is provided below.

Top 20 Customers (Digital Realty Trust Inc)

At its core, Digital Realty leases data centers to businesses that are benefiting from the IT revolution, which requires businesses to deploy storage capabilities at scale.

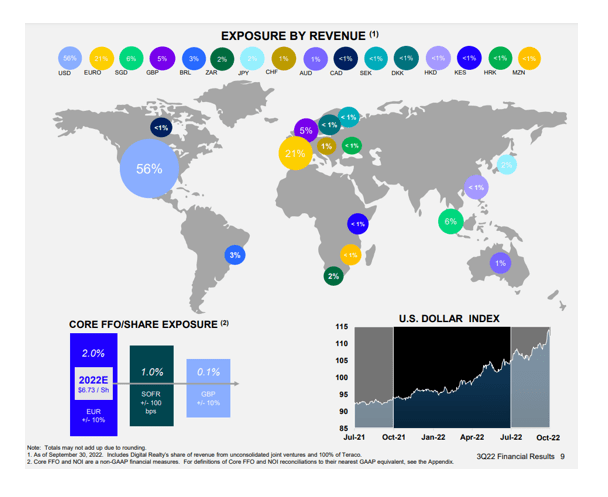

Digital Realty has a global real estate footprint, but it generated 56% of its sales in 3Q-22 in its home market, the United States. However, the real estate investment trust is aggressively expanding abroad, having acquired seven cutting-edge data center facilities in key South African metropolises by 2022.

The transaction cost Digital Realty $3.5 billion and reflects the company’s strategic priorities to increase its exposure to frontier markets.

Exposure By Revenue (Digital Realty Trust Inc)

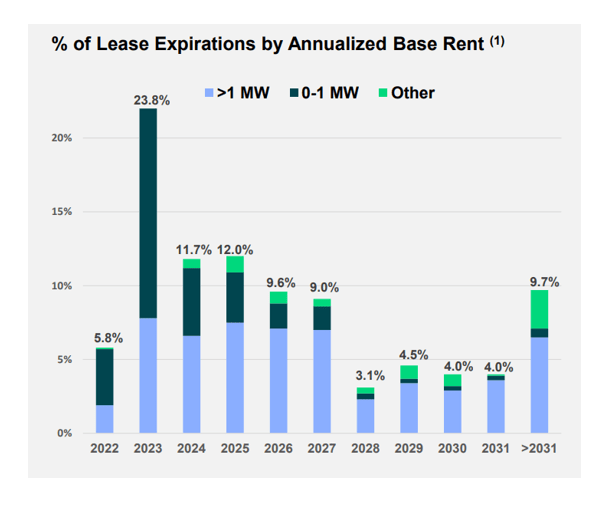

At the end of September, the average lease was 4.7 years long, with a significant portion of leases (23.8%) expiring the following year. However, given the consistency of demand for data centers, Digital Realty should have no trouble extending existing contracts.

Lease Expirations (Digital Realty Trust Inc)

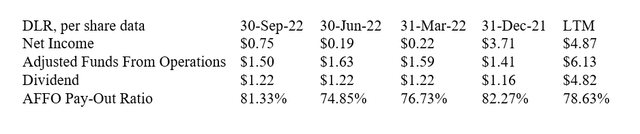

Moderately Low Pay-Out Ratio

Digital Realty has a low dividend payout ratio, which lends the trust a high degree of safety. In the September quarter, Digital Realty earned $1.50 per share in adjusted funds from operations, resulting in an 81% dividend pay-out ratio.

The pay-out ratio in the previous 12 months was 79%, indicating that the dividend can grow from a stable base level. Digital Realty is a dividend grower, increasing its dividend at an annual rate of 10% on average between 2005 and 2022.

Pay-Out Ratio (Author Created Table Using Company Supplements)

FFO Outlook And Valuation

The trust lowered its guidance for 2022 funds from operations due to currency headwinds caused by the strengthening of the U.S. Dollar. Digital Realty reduced its (core) FFO guidance to $6.70-$6.75 per share from $6.75-$6.75 previously. Based on this guidance, Digital Realty’s stock is valued at 16.2x FFO.

Digital Realty’s stock has never been particularly cheap, and it currently trades at an FFO multiple in excess of 20x in 2022. Given the trust’s massive dividend growth over the last decade, I believe the trust’s FFO valuation is very compelling.

Why Digital Realty Could See A Lower Valuation

The strong U.S. Dollar is weighing on Digital Realty’s performance (it resulted in a revision to the trust’s FFO guidance), and an increasing percentage of overseas sales is a potential headwind for the real estate investment trust in the future.

A weakening U.S. Dollar, on the other hand, could be beneficial to Digital Realty. I believe the data center REIT is well-positioned, and the global footprint will aid Digital Realty’s long-term growth.

Unless demand for storage space and computing power suddenly declines, Digital Realty has a long growth trajectory to exploit.

My Conclusion

Digital Realty is a well-managed data center REIT with a growing international focus. The trust generated more than half of its sales in the United States, but frontier markets offer the potential for above-average growth.

I believe the trust’s moderate dividend pay-out ratio based on adjusted funds from operations translates into consistent dividend income for passive income investors, and that the dividend will grow as Digital Realty expands its data center footprint.

The stock pays a 4.5% dividend, and while it isn’t a bargain based on FFO, the long-term valuation is very appealing.

Be the first to comment