frentusha

Investment Thesis

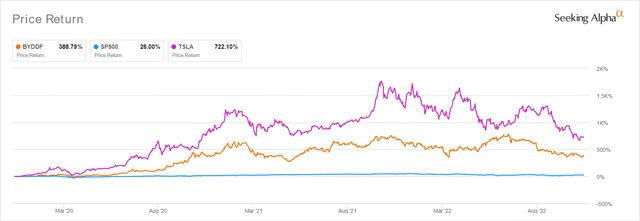

BYD 3Y Stock Price

The BYD Company Limited (OTCPK:BYDDF) (OTCPK:BYDDY) stock has performed tremendously well, with a total price return of 388.79% since the start of 2020, against the S&P 500 Index’s return of 26% and Tesla’s (TSLA) at 722.10%. Impressive indeed, despite the market-wide destruction thus far.

Depending on the individual investor’s risk tolerance and investing trajectory, the BYD stock definitely looks attractive at its current level, especially after the tragic -33.29% plunge YTD. Then again, if we were to compare against its 3Y pre-pandemic normalized valuations, the stock is still trading at a slight premium at 1.26x and 30.37x, compared to the EV/Revenue mean of 1.42x and P/E of 28.11x between 2017 and 2019.

Therefore, it is uncertain how much longer Mr. Market plans to punish the BYD stock, significantly worsened by the Chinese government’s sustained hard-line approach to the COVID Zero Policy thus far. Thereby, indicating more volatility ahead, due to the potential impact of the country’s stagnating GDP growth and economic slowdown. Investors, take note.

BYD Will Grow At Accelerated Pace, While Expanding Margins Moderately

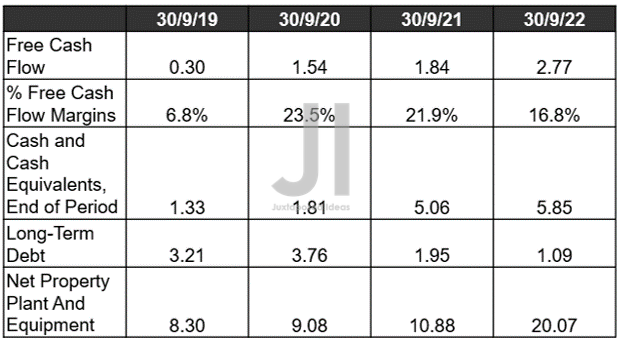

BYD Revenue, Net Income ( in billion $ ) %, and EBIT %

In its recent FQ3’22 earnings call, BYD reported excellent YoY top and bottom line growth by 95.48% and 400%, respectively. The sustained expansion in its margins is impressive as well, precisely attributed to the strength of its closed-looped system. Furthermore, market analysts expect the company to deliver another remarkable YoY revenue growth of 91.6% and net income of 828.57% in FQ4’22, respectively. Thereby, indicating minimal headwinds to its performance, against those reported by XPeng (XPEV) and NIO (NIO), since demand remains robust for its diversified line.

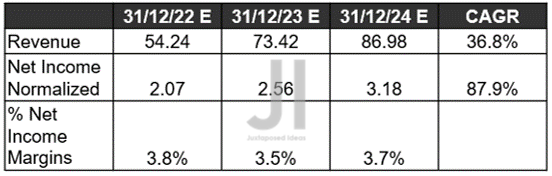

BYD Cash/ Equivalents, FCF (in billion $) %, Assets, and Debt

S&P Capital IQ

Thereby, further expanding BYD’s Free Cash Flow (FCF) generation to $2.77B in FQ3’22, representing an exemplary increase of 215.62% QoQ and 50% YoY. Those who are concerned about its declining FCF margins must also note the elevated capital expenditure at $12.06B over the last twelve months (LTM). The number indicated a rapid expansion by 336.87% sequentially or by 404.69% from FY2019 levels, since its cash from operations remained stellar, growing sequentially by 248.19% over the LTM.

This level of Capex is naturally expected, given BYD’s brisk geographical expansion to multiple manufacturing facilities within China and Thailand, on top of its existing plants in the country, the US, Canada, Brazil, the EU, and India. With declining long-term debts and robust cash flow, the company is indeed free to expand aggressively, with its net PPE assets already growing by 27.83% QoQ and 84.46% YoY.

It is apparent that BYD management proved highly competent in its vertical integration across EV battery manufacturing, semiconductor chips, software capabilities, renewable energy storage, solar panels, and electrical components thus far. Thereby, minimizing the impact of the supply chain issues from the country’s ongoing lockdowns across its electrified vehicle types. As a result, the company remains unhindered in its production output, with October delivering an impressive 217.8K vehicles (of which 103.1K are pure EVs) against TSLA’s 71.7K in China, NIO’s 10.05K, Li’s (LI) 10.05K, and XPeng’s 5.1K at the same time. Impressive indeed.

In the meantime, those keen on an RMB to RMB comparison for BYD’s FQ3’22 performance may refer here for more details, though we would also highlight that they are in Chinese. We chose to refer to its adj. numbers in USD through a paid service for ease of presentation and understanding.

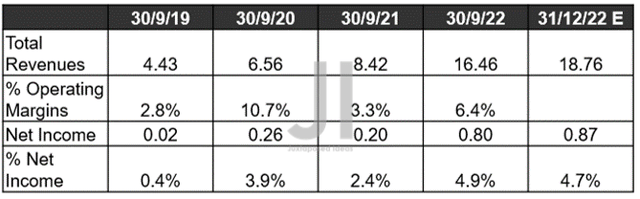

BYD Projected Revenue, Net Income (in billion $) %

S&P Capital IQ

Over the next three years, BYD is expected to report revenue and net income growth at an impressive CAGR of 36.8% and 87.9%, respectively, faster than pre-pandemic levels of 7.17%/-31.76% and hyper-pandemic levels of 36.18%/44%. The sustained expansion in its profitability is impressive as well, with net income margins of 3.7% by FY2024, against FY2019 levels of 1.3% and FY2021 of 1.4%.

It is also optimistically projected that BYD would report impressive revenue growth of 35.4% and net income growth of 23.7% in 2023, despite the tougher YoY comparison and supposed recession. Thereby, putting down any bears on its financial performance, though it is also apparent that there is a continued divorce with its stock valuations.

So, Is BYD Stock A Buy, Sell, or Hold?

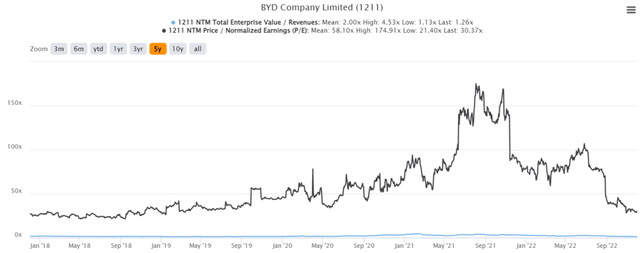

BYD 5Y EV/Revenue and P/E Valuations

BYD is trading at a dirt-cheap EV/NTM Revenue of 1.26x and NTM P/E of 30.37x, lower than its 3Y mean of 2.41x and 75.94x, respectively. In the meantime, TSLA has also been drastically moderated to 5.07x and 33.81x, from its previous 3Y mean of 9.92x and 115.38x, respectively. It is apparent that the time of hyper-pandemic valuations is over, especially given the former’s growing geopolitical risk and Elon Musk’s controversial takeover of Twitter (TWTR).

As a result, the BYD stock is only suitable for those comfortable with volatility and growing geopolitical risks, since it is unlikely that there will be much improvement in the short term. The Xinjiang solar block, Chip’s export ban, and the EUV technology ban have only demonstrated the growing tension between the two world leaders, despite the face-to-face meeting in early November. Then again, its production numbers do not lie, since the company is also set to expand its annual output to 4M vehicles by 2024. These numbers are definitely more impressive than TSLA’s, significantly aided by the former’s integrated supply chain thus far and sustained growth in profitability over the next two years.

Therefore, we cautiously rate the BYD stock as a Buy, due to its extremely attractive risk/reward ratio. There will come a time when geopolitical risks lift moderately and macroeconomics improves. By then, it is not overly ambitious to project a price target of $140, based on its FY2024 adj. EPS of $5.74 and moderated P/E valuations of 25x, indicating a speculative 600.34% upside from current prices. Only time will tell.

Be the first to comment