PeopleImages

It is unlikely to come as a surprise to anyone reading this that one of the biggest problems facing most Americans today is the pervasive inflation that has been driving up the cost of most of the things that we use in our daily lives. This inflation has been heavily centered on food and energy, which are both necessities, so it has had a fairly major impact on those of limited means. This has resulted in many people obtaining second jobs or looking for other means to obtain the money that is needed to support themselves and their families. Fortunately, as investors, we have other methods available to us to increase our incomes and counteract the effects of inflation. One of the best of these methods is to purchase shares of a closed-end fund that specializes in the generation of income. These funds are not the most well-known companies in the market but they are nice because they provide us with an easy way to obtain a diversified portfolio with one easy trade. In addition, these funds have the ability to use certain strategies that can result in a much higher yield than any of the individual assets possess. In this article, we will discuss the John Hancock Premium Dividend Fund (NYSE:PDT), which is one fund that we can use as a source of income. This fund yields a very impressive 8.32% at the current price, which is admittedly more than enough to turn the eye of most people. I have discussed this fund before but more than a year has passed since that time so obviously, a great many things have changed. This article will therefore focus specifically on these changes as well as provide investors with an updated analysis of the fund’s finances in an effort to determine if it could be a good investment today.

About The Fund

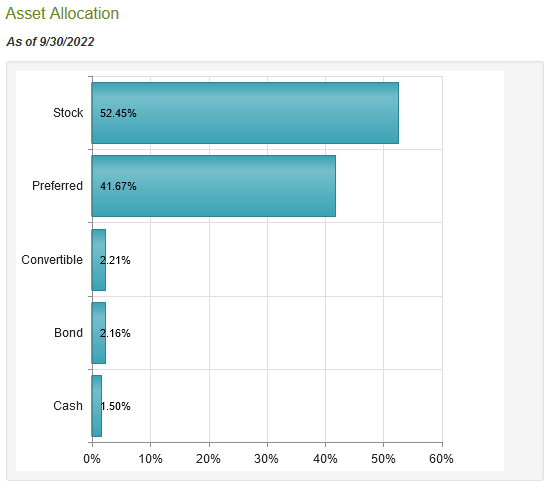

According to the fund’s webpage, the John Hancock Premium Dividend Fund has the stated objective of providing investors with a high level of current income. This seems somewhat unsurprising given that the fund’s name implies that it is very interested in the generation of dividend income. As common equities pay dividends, we can assume that the fund will also be interested in capital appreciation. This is certainly true, although it does specify that it is not actually attempting to maximize its capital gains. This desire for modest capital gains is reinforced by the fact that the fund invests in both common and preferred equities. As I have explained in various previous articles, preferred equities do not have nearly the same potential to produce capital gains as common equities do because they do not actively participate in the growth and prosperity of the issuing company. These securities instead pay a fixed dividend to their shareholders, just like any other fixed-income security. These securities, therefore, trade much like bonds, with prices increasing when interest rates decline and declining during periods of rising rates. As there is a limit to how low-interest rates can actually go, there is a limit to how high the price of these securities can go. That is not the case with common equities. The fund is relatively balanced between common and preferred stock:

CEF Connect

This is a very different portfolio structure than the fund had the last time we looked at it. Most notably, its common stock allocation has declined quite a bit and its fixed-income allocation has increased. This could be a good thing for income-focused investors since fixed-income securities, particularly preferred stock, typically have a higher yield than common equities issued by the same company. It could also be a safer portfolio than last time since fixed-income securities do not usually decline as much as common equities during a bear market like the one that we have been in for most of this year. Thus, at the moment the fund appears to be sacrificing some capital gains potential for security and income, which is a decent proposition right now.

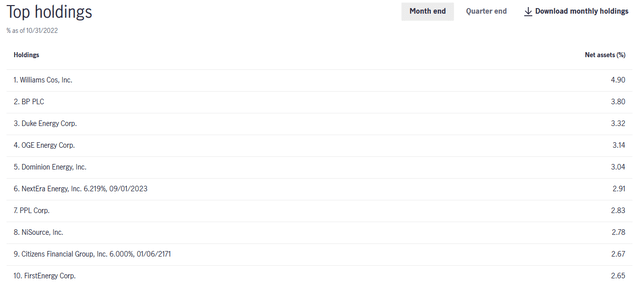

As my long-time readers are likely aware, I have devoted a considerable amount of time and effort over the years to discussing various dividend-paying companies such as utilities and midstream energy companies. In addition, many of the largest companies in the world pay dividends to their investors. As such, the majority of the largest positions in the portfolio will likely be familiar to most readers. Here they are:

John Hancock Investment Management

I have discussed most of these companies at one point or another over the past several years. In fact, the only ones that I haven’t discussed are Duke Energy (DUK), Dominion Energy (D), PPL Corp. (PPL), and Citizens Financial Group (CFG). The Citizens Financial securities are actually preferred stock and not common equity though so an understanding of the company is not as critical as it would otherwise be. The remainder of these companies are utilities, with the notable exceptions of Williams Companies (WMB) and BP (BP). One of the defining characteristics of utilities is that they have remarkably stable cash flows regardless of economic conditions. This is because they provide a product that is generally considered to be a necessity in today’s world. After all, who reading this doesn’t have electric service in their home and business? As such, most people will prioritize paying their utility bills ahead of making discretionary expenses during times when money gets tight. This could be important over the next year as a growing number of economists and analysts are predicting that the economy will soon enter a recession if it is not already in one. Williams Companies also shares this general element of stability as its cash flow is based on long-term volume-based contracts that generally result in the company’s cash flow being guaranteed. Thus, we can clearly see that the fund’s portfolio should be quite insulated from any coming economic weakness.

There have been a number of changes to the portfolio’s largest positions over the past year. Alliant Energy (LNT), Southern Company (SO) preferred stock, Wells Fargo (WFC), and Ocean Spray Cranberries (OTC:OCESP) have been replaced by OGE Energy (OGE), NiSource (NI), Citizens Financial preferreds, and FirstEnergy Corp. (FE). In addition, Dominion’s preferreds were replaced by its common equity. The sheer number of changes here would likely lead one to think that the fund has a high turnover rate, but this is not the case. In fact, the John Hancock Premium Dividend Fund only has a 17.00% annual turnover, which is lower than most equity funds. This is somewhat nice to see because trading stocks or other assets costs the fund money, which is billed to the shareholders. This results in a drag on the fund’s performance, requiring management to generate sufficient returns to both cover the added expenses and still deliver an acceptable return to the investors. This is a difficult task to accomplish and is one of the reasons why many actively-managed funds fail to beat their benchmark indices. This fund is no exception as it does frequently trail its benchmark, however during certain periods, it does outperform:

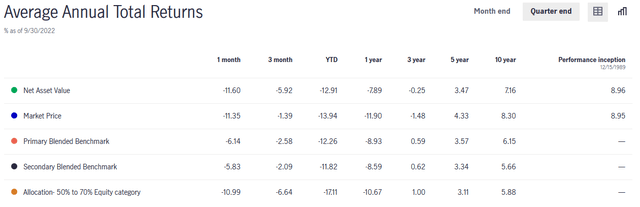

John Hancock Investment Management

The fact that the fund outperformed during the trailing ten-year period, in particular, is nice to see due to the power of compounding. As we all know, even a very small difference in return can make a huge difference over long time periods. Naturally, past performance is no guarantee of future results but it is still a nice place to start.

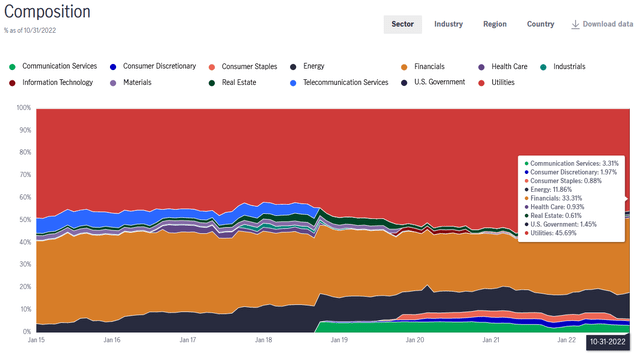

As mentioned earlier, the fund does tend to invest quite heavily in the utility sector, which is confirmed by looking at the largest positions in the list. However, its actual exposure to this sector is not as substantial as might be first assumed. In fact, only 45.69% of the portfolio is invested in the utility sector:

John Hancock Investment Management

The outsized exposure to financial services is something that might concern readers considering that the rising interest rates have put some pressure on the margins of the banking sector. However, it is important to keep in mind that this exposure to financials is mostly preferred stock. Almost any fund that heavily invests in preferred stock will have outsized exposure to the banking sector because banks are by far the largest issuers of these securities due to regulations. In short, banking regulators require that banks maintain a certain level of Tier one capital, which is that portion of the bank’s capital that is not a liability to someone else (such as a depositor). The two ways for a bank to increase its Tier one capital is by issuing common equity or preferred stock. As such, most banks will opt to issue preferred stock when they need to increase their Tier one capital in order to avoid unduly diluting the common stockholders. As issuing preferred stock is more expensive to the issuing company than debt financing, companies in most other industries will opt to use debt when additional capital is needed since they do not have the same regulations to contend with. Preferred stock tends to be reasonably safe even if the underlying company’s profit declines since the issuer cannot pay a dividend to the common stockholders unless it also pays the preferred stockholders and in many cases the issuer must pay any missed preferred dividends before paying anything to the common stockholders. As many banks pride themselves on the dividends that they pay out, they will thus typically do everything in their power to ensure that the preferred stockholders receive their dividends. As such, the fund’s portfolio is probably pretty safe from an income perspective.

Leverage

As mentioned in the introduction, closed-end funds have the ability to use certain strategies that can boost their yield beyond that possessed by the underlying assets. One of the strategies that is employed by the John Hancock Premium Dividend Fund is the use of leverage. In short, the fund borrows money and uses that borrowed money to purchase dividend-paying stocks. As long as the yield on the purchased stocks is higher than the interest rate that the fund has to pay on the borrowed money then this strategy works pretty well to boost the overall yield of the portfolio. As the fund can borrow at institutional rates, which are lower than retail rates, this will usually be the case.

However, the use of debt is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I do not generally like to see a fund’s leverage above a third as a percentage of its assets for this reason. Unfortunately, the John Hancock Premium Dividend Fund currently has a leverage ratio of 36.50% of its assets so it is above this level. Admittedly, it would be nice to see the fund reduce its leverage a bit in order to reduce our risk and we should keep an eye on this going forward to make sure that it does not get much worse.

Distribution Analysis

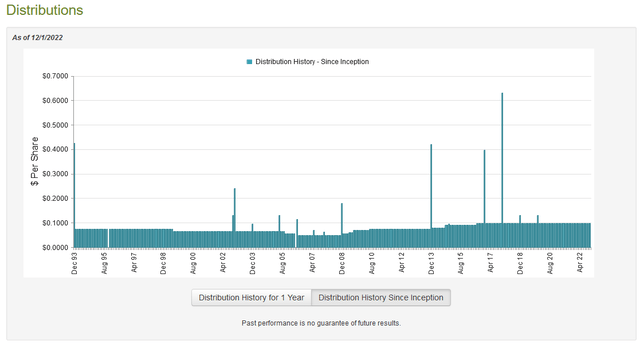

As already discussed, the John Hancock Premium Dividend Fund invests in dividend-paying stocks and uses leverage to boost the yield of the portfolio. The fund also has the provision of current income as its primary objective so we can expect that it would have a reasonably high yield. This is indeed the case as the fund currently pays a monthly distribution of $0.0975 per share ($1.17 per share annually), which gives it an 8.32% yield at the current price. The fund has not only been remarkably consistent about this distribution over time, but it has actually been increasing its payout over the past decade:

This makes the John Hancock Premium Dividend Fund one of the only closed-end funds to have a strong distribution growth track record over time. This is likely at least partly due to its investments in the utility sector, as utilities tend to grow their dividends over time. The fund’s track record will almost certainly attract investors that are looking for a consistent and stable source of income for paying their bills and other expenses. As is always the case though, we want to ensure that the fund can actually afford the distribution that it pays out since we do not want to be holding it if it is forced to cut its payout.

Unfortunately, we do not have a particularly recent report to use for our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period ending April 30, 2022. As such, it will give us limited insight into the fund’s performance during the somewhat volatile market we experienced during the year’s second half. The report should show us how the fund did during the early stages of the Fed’s current interest rate hiking cycle, however. During the six-month period, the John Hancock Premium Dividend Fund received a total of $21,581,326 in dividends and another $6,309,147 in interest from the assets in its portfolio. Once we net out foreign withholding taxes, the fund had a total income of $27,782,266 during the period. It paid its expenses out of this amount, leaving it with $21,213,132 available for investors. This was, unfortunately, not enough to cover the $28,560,785 that the fund actually paid out in distributions. At first glance, this is somewhat concerning.

However, a fund like this has other methods that it can use to obtain the money that it needs to pay for its distribution. The most important of these is capital gains. As might be expected by the disappointing performance of the market year-to-date, the fund was not particularly successful in this endeavor, although it did do better than we might expect. During the period, the fund reported net realized gains of $8,936,542 but this was offset by $27,189,116 net unrealized losses. Overall, the fund’s assets under management declined by $24,800,130 after accounting for all inflows and outflows. With that said though, the fund did have enough money through income and realized capital gains to cover the distribution. We want to make sure that it does not keep losing money though since the lower its assets, the harder it will be for it to generate sufficient capital gains to maintain its current payout.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the John Hancock Premium Dividend Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case with this fund today. As of December 1, 2022 (the most recent date for which data is currently available), the John Hancock Premium Dividend Fund had a net asset value of $13.31 per share but the shares traded for $13.90 per share. Thus, the fund’s shares are trading at a 4.43% premium to the net asset value. This is not nearly as bad as the 11.03% premium that the shares have had on average over the past month, but it is still higher than we really want to pay. It would make sense to wait until the shares trade down to a discount before buying in.

Conclusion

In conclusion, there are certainly a few things to like about the John Hancock Premium Dividend Fund today. The fund is invested in assets that should enjoy very stable cash flows over time and includes several companies that will likely be growing their dividends going forward. This is something that has allowed the fund to grow its distribution over time, which is also nice as the rising distribution helps to offset some of the loss of purchasing power that we have been suffering. However, the fund is suffering unrealized losses that may put pressure on its ability to maintain its distribution long-term, although it does appear fine right now. The biggest problem here though is the valuation as the fund is trading at a premium and we generally do not like to buy closed-end funds at a premium.

Be the first to comment