Yozayo/iStock via Getty Images

I am assigning Oracle (NYSE:ORCL) a positive risk/reward rating based on its accelerating growth rate, strategic healthcare expansion, discounted valuation, and asymmetric potential return spectrum. This report will be more condensed than usual, motivated by the following John Collison quote when interviewing Stanley Druckenmiller recently: “Invest then investigate.”

What Collison was referring to was Druckenmiller’s statement that (my paraphrase) sometimes you have to decide to buy before doing a full deep dive on an investment. My translation of this is that when there is heightened timing risk, considering competition with other investors, it is often advantageous to keep it simple to minimize opportunity costs, followed by a more thorough investigation.

Risk/Reward Rating: Positive

Opportunity costs are likely to be greatest when the preponderance of available information points toward an asymmetric risk/reward opportunity. I believe this to be the case with Oracle, especially considering its wide coverage in the analyst community and the associated information efficiency in the marketplace.

The Stanley Druckenmiller interview offers wisdom and experience for those interested in his 45-year perspective on current market conditions. To place his views into proper context, please keep in mind that his experience is that of a hedge fund manager.

I will refer to some of his ideas when building the Oracle case, especially in regard to current economic conditions. The following quotes, starting at 58:00 into the interview, resonate in light of last week’s market outlook report in which I concluded that we were likely at the beginning of a secular regime change in the markets.

In 45 years, I’ve never seen a constellation… where there’s no historical analogue. … Right now, I have more humility in terms of my views going forward than maybe ever.

The above quote, which I agree with from my 26-year portfolio manager perspective, points toward a current market environment that is more uncertain than has been the case during the careers of today’s most experienced investors. As a result, visibility in all its forms should receive a premium valuation for the foreseeable future.

Visibility

Oracle’s Q4 earnings report published Monday evening was unusual in its optimistic outlook given the current macroeconomic uncertainty and widespread earnings disappointments. I have found that visibility breeds optimism. The following quote by Oracle CEO, Safra Catz from the company’s earnings release speaks to Oracle’s visibility.

We believe that this revenue growth spike indicates that our infrastructure business has now entered a hyper-growth phase. Couple a high growth rate in our cloud infrastructure business with the newly acquired Cerner applications business—and Oracle finds itself in position to deliver stellar revenue growth over the next several quarters.

Given the uncertain economic backdrop, the company could have opted for a less optimistic tone in order to manage expectations lower. The confidence signals that Oracle is strategically well-positioned in the marketplace. Recent sales trends support this interpretation as can be seen in the following list of results from the Q4 2022 earnings report (emphasis added).

- Total Q4 Revenue $11.8 billion, up 5% in USD, up 10% in constant currency

- Total Q4 Cloud Revenue $2.9 billion, up 19% in USD, up 22% in constant currency

- Infrastructure Cloud Revenue up 36% in USD, up 39% in constant currency

- Fusion ERP Cloud Revenue up 20% in USD, up 23% in constant currency

- NetSuite ERP Cloud Revenue up 27% in USD, up 30% in constant currency

Healthcare: Strategic Expansion

On the strategic growth front, Oracle looks to be making exceptional capital allocation choices for the long term. The recent acquisition of Cerner provides Oracle with 25% market share in the US healthcare information system market which includes the electronic health record segment. The following quote from Cerner’s 2021 10-K filed with the SEC summarizes the healthcare foothold that Oracle acquired.

Cerner’s long history of growth has created an important strategic footprint in healthcare, with Cerner holding approximately 25 percent market share in the U.S. acute care electronic health record (“EHR”) market and a leading market share in several non-U.S. regions.

Larry Ellison, Oracle’s Chairman of the Board and Chief Technology Officer, shared his vision of the healthcare opportunity on the Q4 2022 earnings conference call, and stated: “It’s clearly going to be our largest business.”

The following Ellison quote from the Q4 2022 earnings release provides further color (emphasis added).

Cerner and Oracle together have all the technologies required to provide healthcare professionals with better information—and better information will fundamentally transform healthcare… There are so many opportunities to use information technology to improve healthcare and save lives. We made a good beginning during the pandemic—and we fully comprehend the importance of what remains to be done.

The Cerner acquisition was exceptionally well-timed given the aforementioned macroeconomic uncertainty. In addition to the healthcare industry being non-cyclical, Oracle and Cerner together offer cost reduction and broad-based efficiency opportunities to the healthcare industry. With profit margins facing inflationary cost pressures, Oracle’s full-spectrum capabilities alongside Cerner’s healthcare expertise should enable a competitive advantage in the marketplace.

Cerner’s competitors in the healthcare IT space are predominately niche technology providers. The following list of the competition is from Cerner’s 2021 10-K.

- Allscripts Healthcare Solutions, Inc.

- Epic Systems Corporation

- Arcadia Solutions, LLC

- Health Catalyst, Inc.

- athenahealth, Inc.

- InterSystems Corporation

- Capsule Technologies, Inc.

- Innovaccer, Inc.

- Computer Programs and Systems, Inc.

- Medical Information Technology, Inc. (MEDITECH)

- eClinicalWorks, LLC

- Optum, Inc.

The competitive advantage that Oracle provides is the ability to offer an entire suite of solutions with greater integration, scale, performance, and efficiency. Oracle’s long and successful history at the heart of the enterprise technology industry positions it as a trusted and dependable partner. Cerner and Oracle will enable healthcare customers to reduce their internal IT expenses, payroll, and the number of IT vendors required to execute their mission. The removal of complexity alone is a powerful value proposition.

There is 75% market share still available to Oracle in the US, while the global market opportunity is much larger and remains relatively untapped. As a result, there is a solid foundation from which to envision that the healthcare market will contribute to accelerated growth for quite some time.

The timing of the healthcare expansion is further enhanced by the pandemic, which amplified trends toward healthcare modernization and illuminated the information deficiencies in the global healthcare industry. The healthcare opportunity is indeed vast and top of mind for governments and institutions alike.

Cerner adds over $13 billion of contracted backlog to Oracle’s visibility, with roughly one-third expected to be recognized as sales over the coming year ($4.1 billion). Additionally, the backlog calculation is conservative in that it excludes cancellable contract provisions (which are rarely exercised). If included, these contract provisions add approximately $1.2 billion to the portion of backlog that is expected to be recognized as revenue over the coming year. Total backlog, if included, is likely over $17 billion. The above information is from Cerner’s 2021 10-K filed with the SEC.

The price paid for Cerner was generally fair, albeit on the pricey side. With $5.8 billion of sales in 2021, Oracle paid just under 5x sales or roughly $28 billion. Looking at cash flow, Cerner generated $1.8 billion in 2021 leading to a purchase price of 16x cash flow and 19x free cash flow after capital expenditures and excluding capitalized software development expenses.

Given the exceptional growth opportunity presented by healthcare IT modernization and the enhanced competitive positioning that Oracle provides, the acquisition appears to be an exceptional capital allocation decision for the long term. This is especially true against a backdrop of market averages trading between 22x and 49x trailing earnings (S&P 500 and Russell 2000).

Guidance

Oracle’s guidance for the current year (fiscal 2023) reflects its exceptional visibility. Total cloud revenue is projected to grow by 30%+, excluding currency change effects and Cerner. This would represent a material acceleration from the just reported 22% growth in Q4 2022. Including Cerner, cloud revenue is projected to be up 47% to 50% year-over-year in the current quarter, excluding currency change effects.

Oracle projects total sales to grow in the range of 20% to 22% in the current year (including Cerner). In a generally recessionary environment, the company will be reporting well-above-average growth over the near term. Above-average growth combined with exceptional visibility is an ideal combination given the current market environment, as highlighted by the Druckenmiller quote above.

Valuation

On the valuation front, under conditions of heightened uncertainty and low visibility, high valuations create an elevated level of risk. In other words, investors should gravitate toward opportunities that offer a greater margin for error to compensate for the elevated uncertainty.

As discussed above, Oracle has excellent visibility into above-average growth over the near term. This heightened visibility is likely to extend to the coming three-year period given Oracle’s track record of consistency and its secular growth opportunities. As a result, there is a strong case to be made for Oracle receiving a premium valuation.

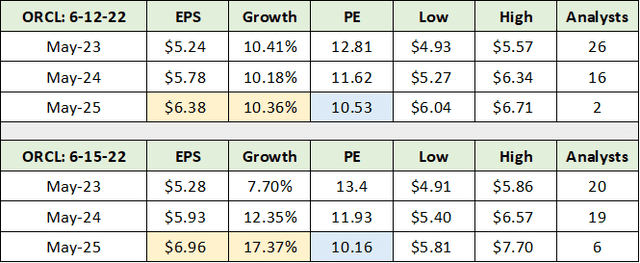

Interestingly, Oracle trades at a deeply discounted valuation to the market averages and select leading enterprise software companies. This strongly suggests the possibility of an asymmetric risk/reward opportunity. The following table was compiled from Seeking Alpha and displays consensus earnings estimates for Oracle through 2025. The estimates in the upper portion are prior to the recent earnings release (6-12-22) and the lower portion are following the earnings release (6-15-22). I have highlighted the key data points.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

Notice that estimates are beginning to increase. I have highlighted in yellow the consensus estimate for 2025 which has risen by 9% in three days, from $6.38 to $6.96 per share. The consensus estimate increase since the report looks to be entirely the result of the Cerner acquisition being incorporated into analyst estimates.

In other words, there is no increase in the consensus estimate yet pertaining to Oracle’s accelerating cloud growth, hypergrowth in its infrastructure segment, or the expanded healthcare opportunity set that is created by the enhanced competitive positioning of a combined Oracle and Cerner.

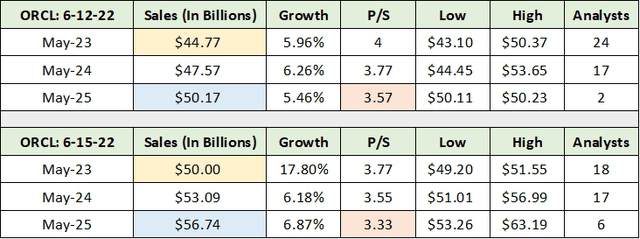

This interpretation of consensus estimates is confirmed by the change in consensus revenue estimates since the earnings report, which are displayed in the following table compiled from Seeking Alpha. I have color coded the key cells for ease of comparison.

Source: Seeking Alpha. Created by Brian Kapp, stoxdox

The consensus sales estimate for 2023 has increased by $5.3 billion (the yellow cells) and by $6.6 billion for 2025 (the blue cells). Given that Cerner produced $5.8 billion of sales in 2021, consensus sales estimates have increased by an amount that one would expect by including Cerner’s sales. Interestingly, Oracle’s valuation is now lower based on expected 2025 sales than it was prior to the positive earnings report (the orange cells).

Importantly, there likely remains material upside surprise potential to consensus earnings estimates through 2025. The upward revision since the earnings report is merely an incorporation of Cerner given that the acquisition just closed. There has been no adjustment for the positive trends that Oracle is manifesting. As mentioned above, these include Oracle’s accelerating cloud growth, hypergrowth in its infrastructure segment, and the expanded healthcare opportunity resulting from the enhanced competitive positioning of Cerner under the Oracle umbrella.

Overearning?

A final note on consensus earnings estimates, visibility, and Oracle’s valuation follows from one of the Druckenmiller ideas in the above interview. The idea centers on the concept of the unique sales and profit margin cyclicality that each industry experiences over a complete economic cycle. He refers to the concept as overearning.

Overearning has been a critical, and underappreciated risk factor during the post-COVID economic cycle. The current cycle has experienced abnormal cyclicality in corporate and sector results over an unusually condensed period of time. The cause was massive fiscal and monetary stimulus stoking demand at a time of economic dislocation that periodically shut down and disrupted global supply chains.

In essence, we experienced all phases of a typical economic cycle over a fraction of the normal time frame. Each industry experienced its own version of the normal sales and profit margin cycle in only one-sixth of the usual time. As a result, what appeared to be explosive growth in many sectors was in actuality the pulling forward of an entire economic upcycle.

Those that did not factor in cyclicality and the unusual nature of the current cycle extrapolated growth into the future that was not there, as it was pulled into the present. Most industries will continue to experience the ripple effects of the cycle resetting and a restoration of balance between supply and demand on the global stage. This process is likely to require further time to play out, hence the lack of visibility generally.

Oracle did not experience abnormal cyclicality during the current cycle and, therefore, it has not been overearning. As a result, growth estimates for Oracle carry much lower risk of disappointment than most as the underlying earnings offer a more reliable estimate of baseline earnings power. Eliminating the overearning risk in the current period reinforces the visibility premium thesis which is a central tenant of the Oracle investment case.

Technicals

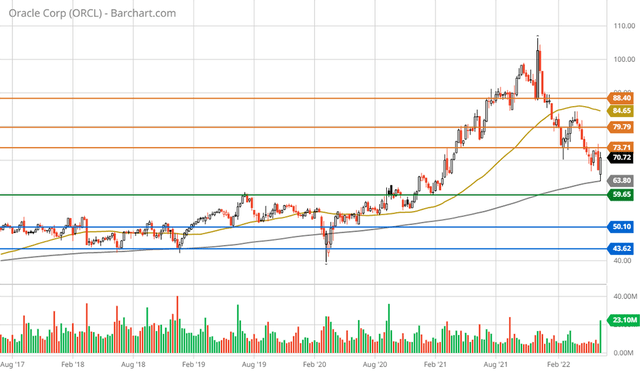

In addition to the fundamentals, the technical backdrop also offers excellent visibility. Oracle’s likely downside potential is well-defined by what looks to be an exceptionally strong long-term support base. The green line on the 5-year weekly chart below highlights the primary support level.

Oracle 5-year weekly chart (Created by Brian Kapp using a chart from Barchart.com)

The area near $60 served as upside resistance throughout 2019 and 2020. I consider this to be the most likely downside scenario as things stand. The lower support zone is defined by the two blue lines which denote the key resistance zone from 2014 to 2018. I view a test of this zone to be unlikely, however, a test near the upper end is possible if an adverse economic scenario plays out. The following 20-year monthly chart offers an excellent bird’s eye view of the underlying long-term trend.

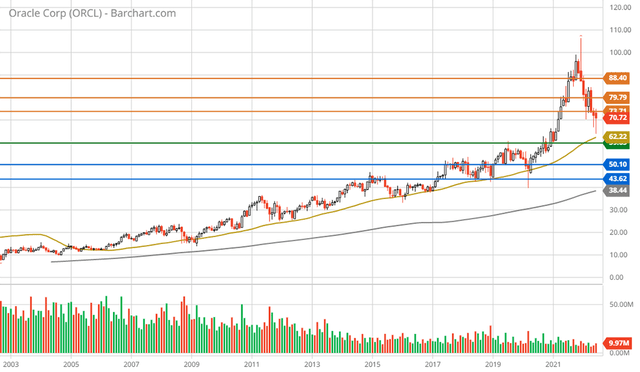

Oracle 20-year monthly chart (Created by Brian Kapp using a chart from Barchart.com)

The stable long-term uptrend is immediately evident from a cursory glance at the 20-year monthly chart above. A linear trend line from 2003 to the present would arrive roughly at the current Oracle share price. The stability of the trend speaks to Oracle’s historical consistency and to its structurally enhanced visibility. Please note that the orange lines represent resistance levels on the upside.

Potential Return Spectrum

The resistance levels represent technical upside return targets. From a fundamental perspective, with above-average growth, excellent visibility, and a discounted valuation, reasonable upside targets can be calculated using market valuations and comparables.

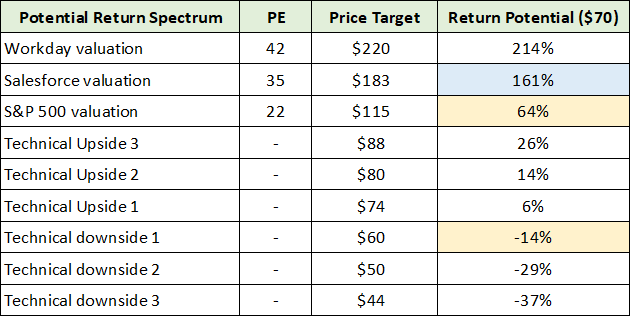

To estimate the fundamental upside, I apply the S&P 500 PE multiple of 22x to Oracle’s 2023 consensus earnings estimate. For industry comparables, I apply the current valuation of Salesforce (NYSE:CRM) and Workday (NASDAQ:WDAY) to Oracle’s 2023 earnings estimate. The table below summarizes the return potential to each technical and fundamental target.

Created by Brian Kapp, stoxdox

I have highlighted in yellow what I view to be the high probability, near-term potential return spectrum. In terms of further upside potential, keeping in mind that Salesforce is a large Oracle customer, I view the blue cell as being in the realm of possibility.

If the $183 target were achieved in 2025, the PE ratio would be 26x the current consensus earnings estimate for that year. While I view this as a high valuation for Oracle, the potential for upside earnings surprises is material, as discussed above. This suggests that if the upper price target were to be achieved in 2025, the valuation would be more in line with the current market averages.

Summary

I will wrap things up with another quote from the Druckenmiller interview. In the interview, he makes the case that successful investors do not invest in the present and that it is change that moves stock prices. It was general advice to younger investors lacking the wisdom of experience.

I want you to try to envision a different world in a year and a half from now.

Oracle’s visibility, accelerating growth rate, strategic healthcare expansion, discounted valuation, and asymmetric potential return spectrum beckons investors in the current climate of heightened uncertainty. The fact that consensus estimates have yet to adjust higher, outside of the Cerner acquisition, points toward material upside surprise potential through 2025. One can certainly envision a better world for Oracle a year and a half from now.

Finally, in light of the highly uncertain macroeconomic environment, as evidenced again by the Druckenmiller quote below, Oracle’s visibility and consistency through time render it a top choice.

In 45 years, I’ve never seen a constellation… where there’s no historical analogue. … Right now, I have more humility in terms of my views going forward than maybe ever.

Thank you for reading. We continually curate the most asymmetric and broadly relevant risk/reward opportunities and trends of our times. The stoxdox platform is designed to empower all investors in search of the highest quality, unbiased, professional analysis delivered in an actionable format. We will be launching a Seeking Alpha Marketplace in the near future, with more details to follow. Please follow us to keep abreast of the Oracle update and the coming Marketplace launch.

Be the first to comment