svetikd

Co-produced with Treading Softly

Growing up, I was taught the importance of being patient. Not every need, want, or desire had to be satisfied the moment it crossed my mind. The ability to understand this and to apply it appropriately is a key to unlocking the great rewards of delayed gratification.

The saying we can think of tied to this is: Good things come to those that wait.

A study was done on young children who were placed in a room with a single marshmallow. They were told if they did not eat it, they’d be given two instead of one. The child was then left alone. You can imagine the various reactions. Knowing how children often live in the present, without the fully-developed forethought of adults, many ate the single marshmallow with reckless abandon.

However, those who waited were rewarded with double the initial prize, they got two.

As adults, we often struggle not only with applying delayed gratification but also deal with a greater level of hesitancy. We see the improved reward and worry, if we act now, we may miss an even greater one.

This hesitancy can cause us to miss out on opportunities entirely, no action, and zero rewards.

That’s when the often unquoted second half of our above saying comes into play: But not to those who hesitate.

As an investor, you must learn to be patient but also to remain vigilant and aware of the situations around you. Your personal life, financial needs, and economic outlook all play important roles in whether it should be time to act now and on which opportunities.

So with recession risks looming, rising interest rates, and stubbornly persistent inflation, where are good opportunities to act on which, if we hesitate, will vanish as quickly as they appear?

Let’s look at two of them available to you right now.

Pick #1: BGR – Yield 5%

From 2014 through 2020, oil companies struggled to generate profits from oil that was frequently selling for $40-$60/barrel. It was a shock for many companies, which had gotten used to prices ranging from $70-$110+ from 2007-2014.

When companies build their models, investment decisions, and habits around high prices for their products, and the price collapses, it is very painful. Something that many investors in the energy space are keenly aware of.

Yet, as is often the case in investing, there is another side to that coin. When companies become accustomed to low prices and build their business models, investment decisions, and habits around being profitable despite low prices, they experience a windfall when prices skyrocket. This is the case with oil, which was very cheap for the better part of the decade, and the cycle has come around, bringing back high prices.

BlackRock Energy and Resources Trust (BGR) provides exposure to oil majors like Exxon (XOM), Chevron (CVX), and ConocoPhillips (COP). BGR is currently trading at a 13% discount to NAV, meaning it is significantly cheaper to buy BGR than to buy its holdings directly.

BGR has increased its dividend twice so far this year. We believe more dividend hikes will be on the way, with NAV at pre-COVID levels and climbing.

Historically, when oil prices get high, they stay high for an extended period. With production increasing slowly, we expect it could easily be another 5-7 years before oil prices decline significantly. Maybe even longer, considering that many governments continue actively discouraging new crude oil production, even as demand for oil and oil products like plastics expands.

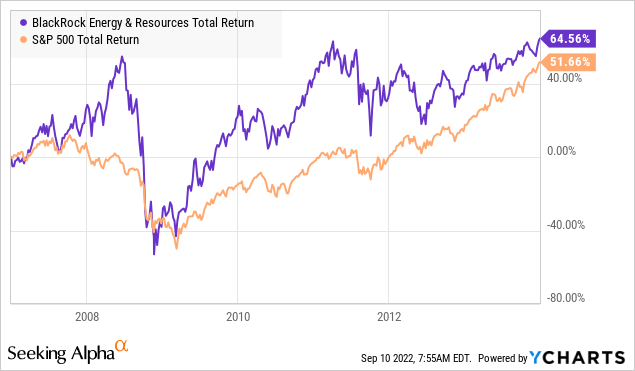

The oil sector is again having its time in the sun. What happened to BGR during the last bull market for oil?

BGR easily outperformed the S&P 500, despite the Great Financial Crisis.

Oil companies are positioned to thrive for the foreseeable future as oil prices remain high, and supply takes time to catch up to demand. Energy has had a strong 2022 but is still attractively valued. BGR provides us access to the oil majors, a good dividend, and at a discounted price.

Pick #2: BTO – Yield 7.2%

We haven’t talked about John Hancock Financial Opportunities Fund (BTO) for several months. The main reason is that the price got a bit rich.

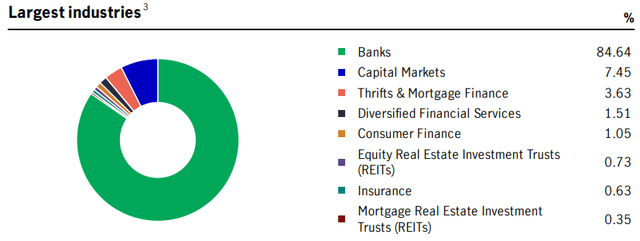

BTO primarily invests in bank stocks, with exposure to private equity funds and other financial services.

It isn’t a secret that these companies are in a fundamentally strong position. They were the direct beneficiaries of pumping from the Federal Reserve. On average, banks have healthy balance sheets, underwriting quality has been high, and default rates are low. Interest rates are rising, providing a good outlook for future profitability. It is a good time to be a bank.

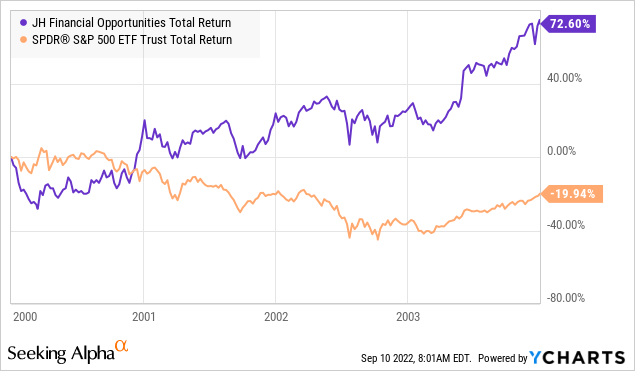

Many investors have a recession on their minds, bringing up memories of 2008, which was absolutely brutal to banks. Many became insolvent, and some big-name banks blew up spectacularly. This is not the case with all recessions. During the dot-com bust, BTO dramatically outperformed the market, going up even as the market fell.

This is the difference between a recession and a financial crisis. A financial crisis always causes a recession, but not every recession includes a financial crisis.

When banks are strong and capable of withstanding the economic storm, they become a source of safety and above-average dividends. This is where banks are today. So now that the prices have come down, we’re ready to add a bit more to our position to protect our portfolio from future storms.

Conclusion

BGR has hiked its distribution multiple times, and its underlying holdings continue to raise their payouts. This is thanks to a unique global situation regarding commodities and stubborn inflation.

BTO gives widespread exposure to the financial sector, which is first in line to benefit from rising rates and is extremely resistant to recessionary pressures.

Good things come to those that wait but not to those who hesitate.

When building a multi-decade income portfolio, you’re guaranteed to miss some great opportunities due to inaction, hesitancy, or a lack of funds to invest. You’re also guaranteed to jump in too soon or out too rapidly. After all, we are all human! Anyone who claims otherwise is lying.

Today, I wanted to give you opportunities to take action and lock in excellent income for the long haul. It’s up to you to decide what you do with these opportunities. Take some time to evaluate them and make a final judgment call, but don’t fall victim to hesitancy if you decide you like them, as they’ll soon be gone!

Retirement is an essential time in one’s life, a time you should get to enjoy and relax. It also requires brief moments of action to maintain its proper course. I wish you all the success possible as you navigate it.

Be the first to comment