BeyondImages/iStock Unreleased via Getty Images

Thesis

BHP Group Limited’s (NYSE:NYSE:BHP) FY22 earnings release in August demonstrated that the leading global commodities mining company is confident in investing through the commodities cycle, given its robust portfolio and highly profitable operating model.

As a result, we believe the current pullback in BHP, down nearly 20% from its 2021 highs, is an opportunity to add exposure. We noted that the market had de-rated BHP, given worsening macro headwinds, contributing to worries of a looming recession. However, we surmise that BHP’s valuation has been de-risked adequately for investors confident in BHP’s long-term secular drivers, given its well-diversified commodities portfolio.

Furthermore, while the malaise in China’s steel industry remains a formidable near-term headwind, BHP expects a progressive recovery from FY23. We also gleaned that the price action in BHP’s critical base metals portfolio indicates potential signs of a long-term bottoming process. Therefore, we are confident that it should provide a tailwind towards the recovery of BHP’s upward momentum moving ahead, supporting a potential medium-term re-rating.

Accordingly, we rate BHP as a Buy.

BHP’s Valuation Has Been De-risked

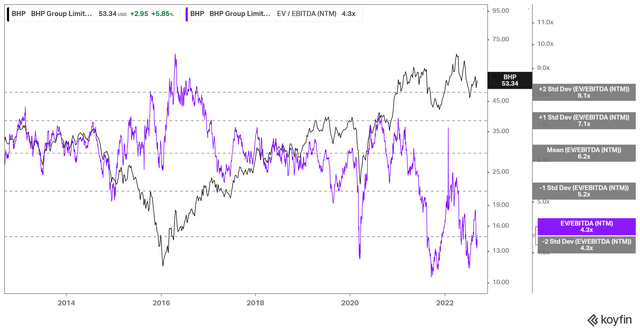

BHP NTM EBITDA multiples valuation trend (Koyfin)

As seen above, BHP’s NTM EBITDA multiples remain close to the two standard deviation zone below its 10Y mean. As a result, we deduce that the market has de-risked BHP materially to reflect its near-term headwinds.

Notwithstanding, BHP’s valuation has also found robust buying support at the current zone, suggesting that the market remains confident in BHP’s long-term drivers. Therefore, we urge investors to look ahead as BHP navigates the current cycle while continuing to invest for its long-term growth.

The Street Is Concerned About The Impact On BHP’s Profitability

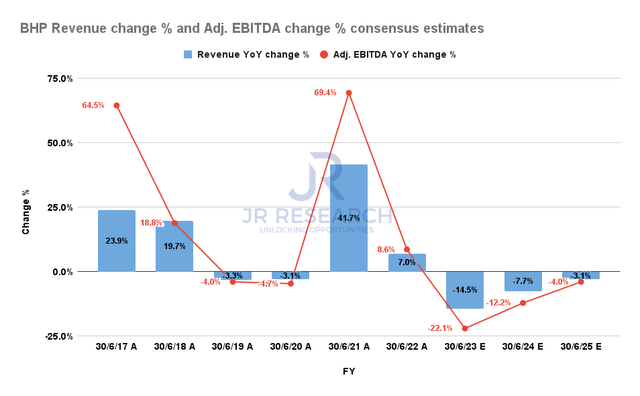

BHP revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

BHP capitalized on the solid commodity pricing cycle over the past year to register a record adjusted EBITDA of $40.6B in FY22, driven mainly by iron ore ($21.7B) and copper ($8.6B). Notably, BHP’s adjusted EBITDA surged by 69.4% YoY in FY22, demonstrating remarkable operating leverage on revenue growth of 41.7%.

BHP’s growth in coking coal and thermal coal was also stoked by geopolitical tailwinds, helping lift its profitability further. Despite the macro headwinds, BHP is also investing further into future-facing commodities, including nickel.

However, the Street is concerned with BHP’s near- and medium-term investment cadence, as it’s projected to drive up its CapEx amid higher inflation costs. Therefore, the Street is modeling BHP’s adjusted EBITDA growth to moderate significantly through FY24 before bottoming out in FY25, as seen above.

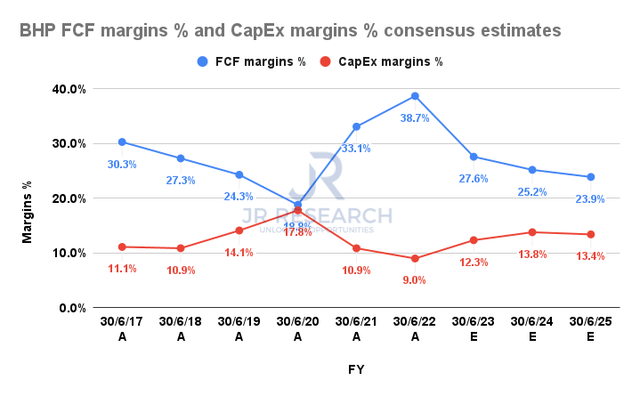

BHP FCF margins % and CapEx margins % consensus estimates (S&P Cap IQ)

As a result, BHP’s CapEx margins are expected to surge markedly through FY24, reaching 13.8% from FY22’s 9%. Moreover, its free cash flow (FCF) margins are also expected to take a further hit, coupled with rising cost headwinds and potential pricing correction in the underlying markets. As a result, BHP’s FCF margins are expected to fall from FY22’s 38.7% to 25.2% by FY24.

Therefore, we postulate that the market has been adjusting its expectations on BHP, de-risking its investment cadence to reflect execution risks amid macro headwinds. Despite that, BHP remains steadfast and confident in its execution, as management accentuated:

CapEx is expected to increase over the medium term as we said it would, and about 60% of that will go towards future-facing commodities, namely copper, nickel, and potash. One of the great strengths of BHP is our ability to invest through the cycle. We will also spend on our steelmaking commodities, which remain important for the energy transition. Combined, we expect annual capital expenditure and exploration expenditure of around $10 billion over the medium term. (BHP FY22 earnings call)

Notwithstanding, we urge investors to consider BHP’s proven record of execution over the years. Coupled with the de-rating by the market, we believe the market is proffering investors an opportunity to add exposure at levels that we think are attractive, as discussed in our valuation analysis. Hence, investors with a high conviction of BHP’s investment execution through the cycle should consider the current levels suitable to add more positions.

Is BHP Stock A Buy, Sell, Or Hold?

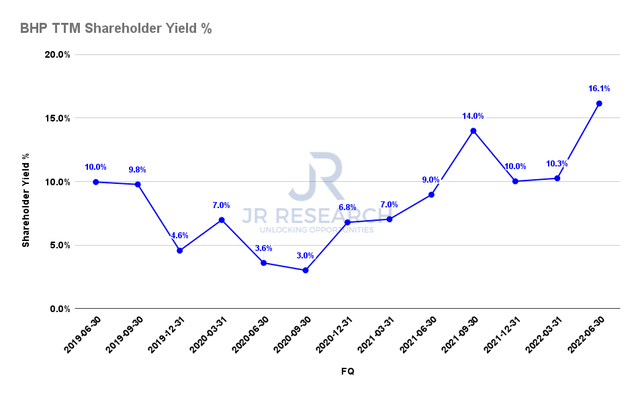

BHP TTM Shareholder yield % (S&P Cap IQ)

BHP has demonstrated its shareholder-friendly capital allocation priorities over the years. As a result, its TTM shareholder yield has risen to 16.1%, supported by its TTM dividend yield of 6.1%.

The company’s relatively low payout ratio of 57.8% corroborates our view that BHP’s robust profitability and balance sheet can support its future dividend payouts.

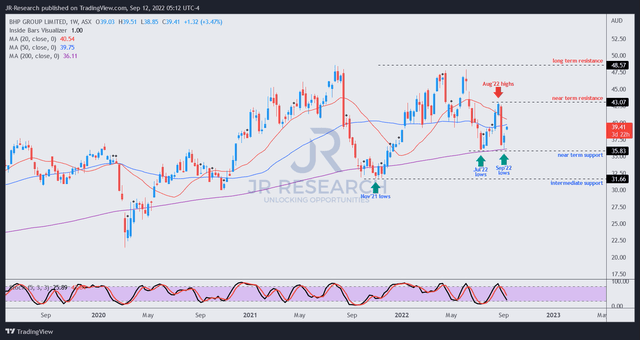

BHP price chart (weekly) (TradingView)

BHP’s constructive price action also indicates its near-term support ($36) should hold resiliently, despite the near-term headwinds. In addition, BHP has also “bounced” off its support zone, corroborated by positive price action in its underlying commodity markets.

Therefore, we are confident that the current levels are still possible for investors to add exposure, even though a return to 2021 highs is unlikely in the near term.

Accordingly, we rate BHP as a Buy.

Be the first to comment