designer491

By Robert Hughes

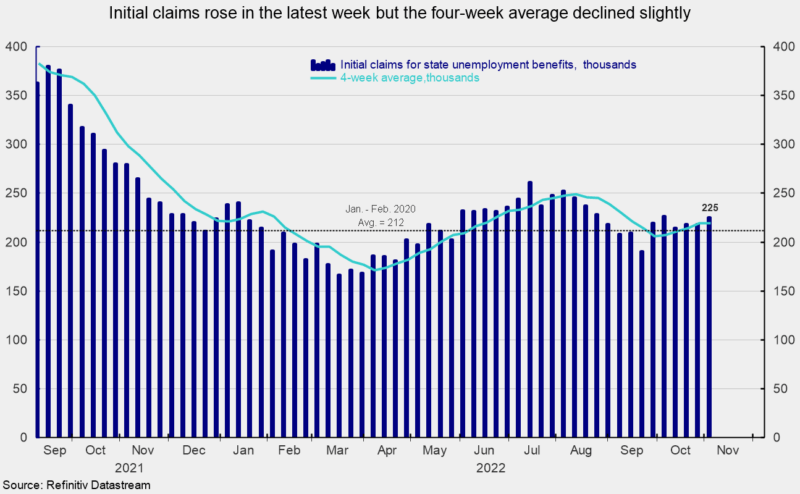

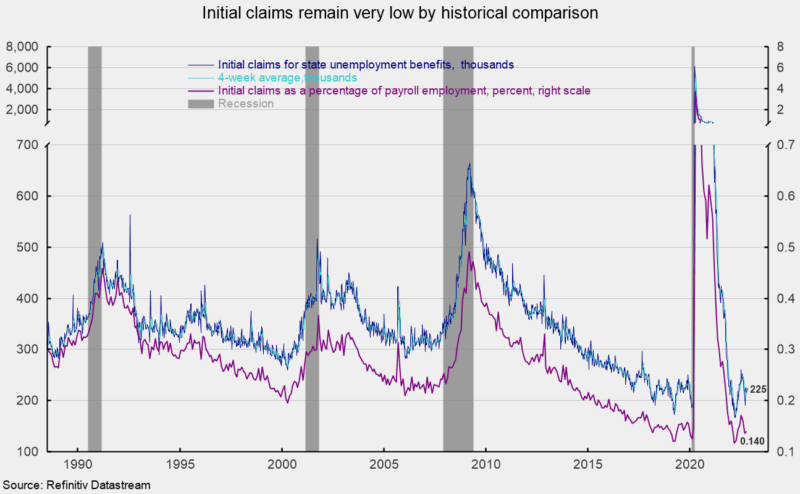

Initial claims for regular state unemployment insurance rose by 7,000 for the week ending November 5th, coming in at 225,000. The previous week’s 218,000 was revised up from the initial estimate of 217,000 (see first chart). Claims have risen in five of the last 13 weeks. When measured as a percentage of nonfarm payrolls, claims came in at 0.140 percent for October, up from 0.136 in September and above the record low of 0.117 in March. Overall, the level of weekly initial claims for unemployment insurance remains very low by historical comparison (see second chart).

The four-week average fell to 218,750, down 250 for the second week in a row. The four-week average peaked in early August and trended lower through the end of September. It drifted slightly higher until the back-to-back slight declines in the last two weeks. Overall, the data continue to suggest a tight labor market. However, continued elevated rates of price increases, an aggressive Fed tightening cycle, and fallout from the Russian invasion of Ukraine remain risks to the economic outlook.

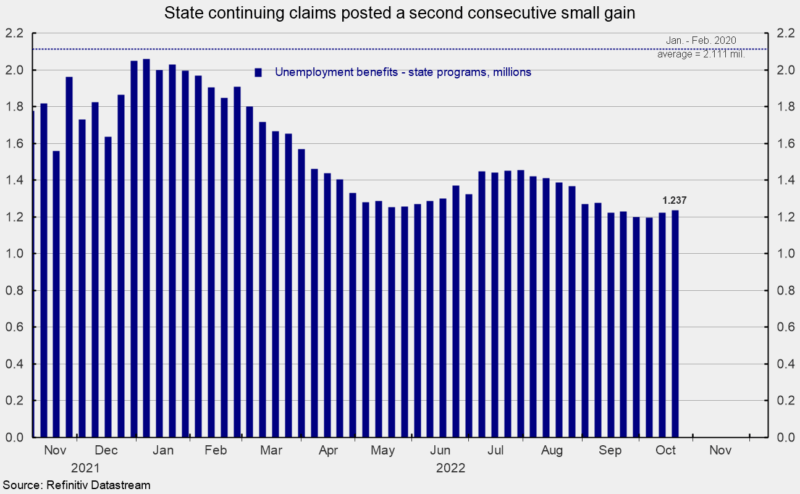

The number of ongoing claims for state unemployment programs totaled 1.237 million for the week ending October 22nd, an increase of 13,181 from the prior week (see third chart). State continuing claims have inched up in the last two weeks but have been range bound between 1.2 million and 1.5 million since April (see third chart).

The latest results for the combined Federal and state programs put the total number of people claiming benefits in all unemployment programs at 1.263 million for the week ended October 22nd, an increase of 12,522 from the prior week.

While the overall low level of initial claims suggests the labor market remains tight, uncertainty over the outlook remains a concern. The tight labor market is a crucial component of the economy, providing support for consumer spending. However, persistently elevated rates of price increases already weigh on consumer attitudes, and if consumers lose confidence in the labor market, they may significantly reduce spending. The outlook remains highly uncertain.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment