Deagreez

We’re now in a technical recession, with Q2 GDP coming in a -0.9% after a 1.6% contraction in Q1. The National Bureau of Economic Research isn’t likely to call this a recession since we’re creating jobs at a very healthy rate.

- 2.6 million in the first half of the year alone

- and personal consumption rose by 1% in Q2

But there is no question that growth and the economy are weakening.

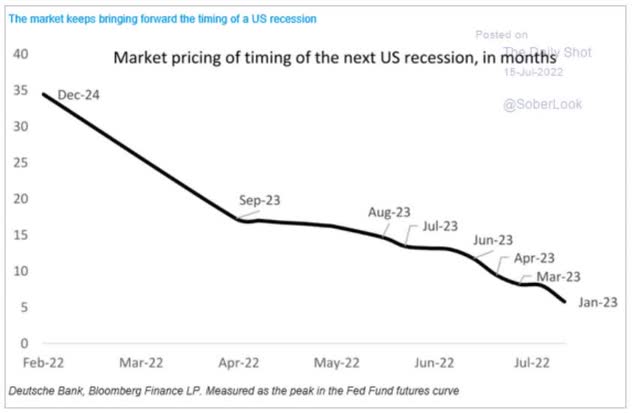

The bond market expects the actual recession to begin in January 2023, and that forecasted date keeps moving forward.

Stagflation is here, and in the coming months, we could see inflation peak at 10% to 11%.

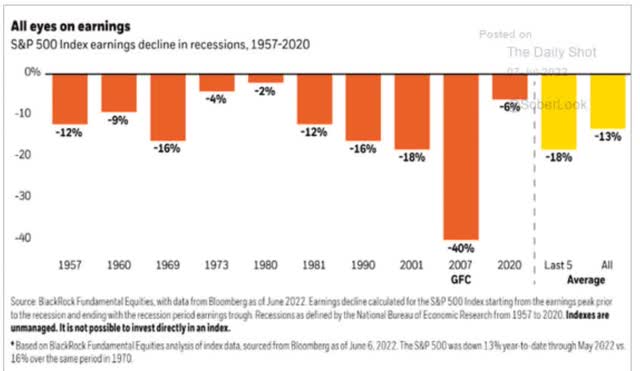

Some of the world’s most accurate economists, such as Morgan Stanley (MS), are warning that corporate earnings are likely to come in 10% below expectations.

Some are more pessimistic, with blue-chip economists Societe Generale (OTCPK:SCGLF) and UBS (UBS) warning that -20% to -30% EPS growth might be coming in a worst-case scenario.

What could that potentially mean for stocks?

- That the S&P 500 bottoms between -24% (already happened) to -52% before this bear market ends

With such a wide range of possible outcomes for the market in the coming months, who can any sensible person recommend, much less be buying stocks right now?

Here’s the method behind this apparent madness.

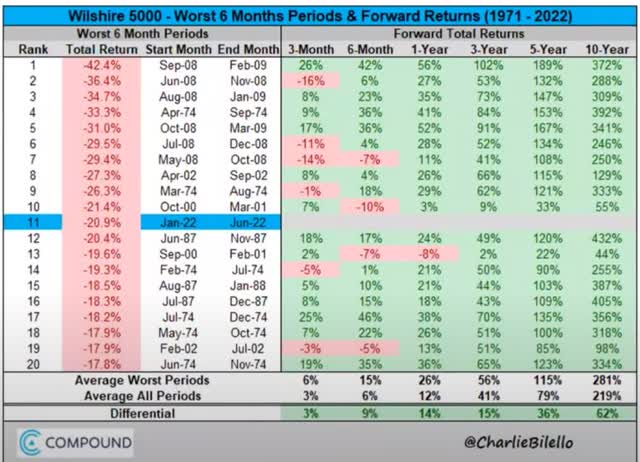

After severe market sell-offs like we just saw in the first half of 2022, the average historical 10-year forward return for the market is 281%.

- almost 4X returns over the following decade

Individual blue-chips can deliver 8X to 16X returns when market hell turns into investor heaven.

But wait a second? If stocks could fall as much as 52% in this stagflationary recession, doesn’t that mean the market might fall another 40%? That’s the WORST CASE scenario involving everything possible going wrong.

- inflation doesn’t peak until 11% later this year

- the Fed hikes to 6% by mid-2023

- we get a prolonged severe recession

- corporate earnings fall 30%

The most likely outcome is far less scary. Here’s what Bank of America (BAC) expects from this recession.

- -0.2% GDP growth in 2023

- the mildest recession in US history, half as severe as 2001’s -0.4%

Deutsche Bank (DB) expects -0.5% growth next year, the 2nd mildest recession in history, and both BAC and DB think the recession will last six months.

Moody’s (MCO), another blue-chip economist team (2nd most accurate during the Pandemic), thinks job growth could remain positive during this recession.

And consider this. During the double-dip stagflation recessions of 1980 and 1981, when the Fed took interest rates to 20%, earnings fell just 14%.

- The average corporate earnings decline during recessions since WWII

Now I’m not a market timer, and I’m not going to blow smoke and tell you that we’re likely not in for a lot of volatility and potentially market pain in the next few months.

But even if the market falls 52% in UBS’ worst-case stagflation hell scenario, guess what?

- the historical 10-year forward return rises to 5.9X

- individual blue-chip forward returns rise to 12X to 24X

The deeper the market pain, the more glorious the bull market that follows. Right now we’re likely in store for very nice returns over the coming decade.

If this bear market gets deeper? Then we could soon be enjoying one of the greatest bull markets in US history.

In other words, after this recession is over, we’re historically likely to see a face-ripping bull market that will handsomely reward anyone brave and smart enough to look beyond the scary headlines today to the bright tomorrow that’s almost certainly coming.

Over any 2 to 3-year period, your portfolio returns are a crap shoot.

| Time Frame (Years) |

Total Returns Explained By Fundamentals/Valuations |

| 1 Day | 0.01% |

| 1 month | 0.25% |

| 3 month | 0.75% |

| 6 months | 1.5% |

| 1 | 3% (Short-Term) |

| 2 | 6% |

| 3 | 23% |

| 4 | 31% |

| 5 | 39% |

| 6 | 47% |

| 7 | 55% (Medium-Term) |

| 8 | 62% |

| 9 | 70% |

| 10 | 78% |

| 11+ | 90% to 91% (Long-Term) |

| 30+ | 97% (Very Long-Term) |

(Sources: JPMorgan, Bank of America, Princeton, Fidelity, RIA)

But over the long-term? The returns of a diversified and prudently risk-managed blue-chip portfolio are destiny.

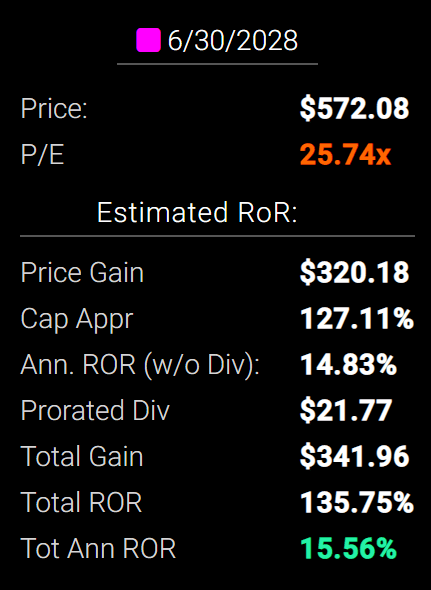

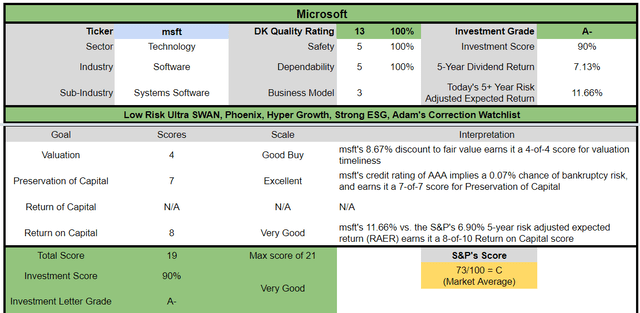

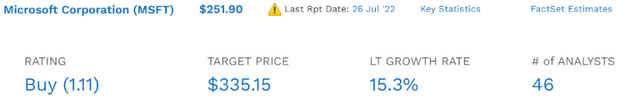

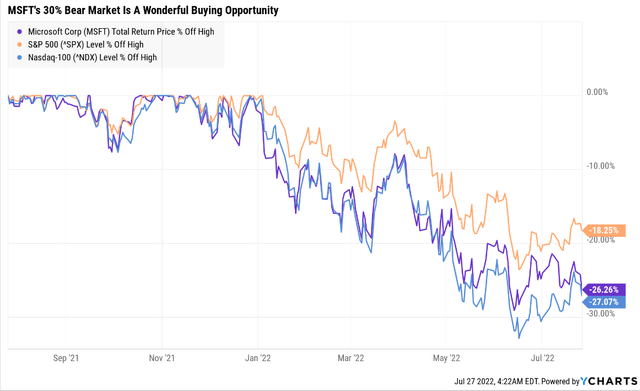

That’s why I’m here to tell you that Microsoft (NASDAQ:MSFT), arguably one of the best companies in the world, is a good buy today.

That doesn’t mean it can’t fall lower in a recession, but let me tell you four reasons why buying MSFT today could prove one of the smartest decisions of your life.

One that can help you sleep well at night in this or any future downturn and retire in safety and splendor.

Reason One: Microsoft Is The Ultimate Safe Dividend Growth Package

Here is the bottom line up front on MSFT.

Reasons To Potentially Buy MSFT Today

- 100% quality, very low-risk 13/13 Ultra SWAN tech utility

- the highest quality company on the Master List (100th percentile)

- 100% dividend safety score

- 18-year dividend growth streak (ever since they started paying one)

- 1.0% very safe yield (dividend expected to grow at 11% CAGR through 2027)

- 0.5% average recession dividend cut risk

- 1.0% severe recession dividend cut risk

- 9% historically undervalued (potential good buy, bordering on very strong buy)

- Fair Value: $275.81 (25.7 PE)

- 23.5X forward earnings vs. 22.5X to 26X historical (Nadella Era, New Business Model)

- 16.7X cash-adjusted earnings = hyper-growth at a reasonable price

- AAA stable outlook credit rating = 0.07% 30-year bankruptcy risk = strongest balance sheet in corporate America

- 85th industry percentile risk management consensus = very good, very low risk

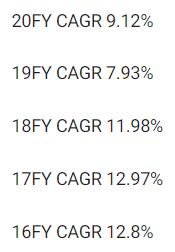

- 10% to 19% CAGR margin-of-error growth consensus range

- 15.3% CAGR median growth consensus

- 5-year consensus total return potential: 10% to 18% CAGR

- base-case 5-year consensus return potential: 16% CAGR (75% more than the S&P consensus)

- consensus 12-month total return forecast: 36%

- Fundamentally Justified 12-Month Returns: 11% CAGR

MSFT’s 30% bear market is a potentially wonderful buying opportunity for one of the greatest wealth compounders in history.

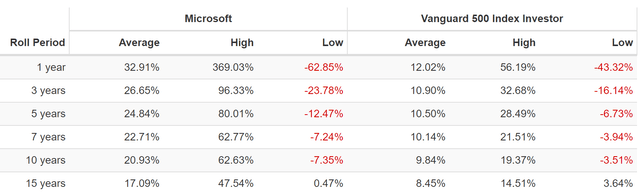

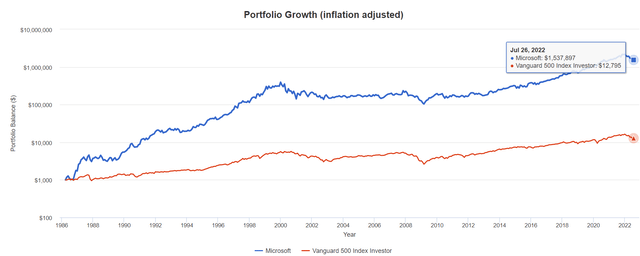

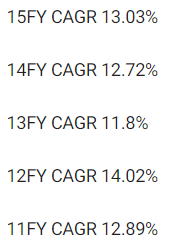

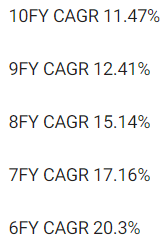

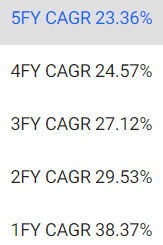

MSFT Rolling Returns Since April 1986

(Source: Portfolio Visualizer Premium)

MSFT’s average 15-year rolling return of 17% is similar to the anticipated 16.3% CAGR analysts expect.

MSFT Medium-Term Growth Consensus

| Metric | 2021 Growth | 2022 Growth Consensus | 2023 Growth Consensus | 2024 Growth Consensus | 2025 Growth Consensus | 2026 Growth Consensus |

2027 Growth Consensus |

| Sales | 19% | 20% | 13% | 14% | 16% | 11% | 11% |

| Dividend | 10% | 11% (Official) | 12% | 10% (20-Year Streak) | 8% | 49% | 10% |

| EPS | 38% | 16% | 14% | 17% | 17% | 10% | 12% |

| Operating Cash Flow | 28% | 19% | 15% | 14% | 4% | NA | NA |

| Free Cash Flow | 25% | 19% | 14% | 16% | 18% | NA | NA |

| EBITDA | 25% | 23% | 15% | 15% | 20% | NA | NA |

| EBIT (operating income) | 33% | 21% | 14% | 17% | 14% | NA | NA |

(Source: FAST Graphs, FactSet)

MSFT is one of the most profitable companies on earth and is still expected to deliver double-digit growth through at least 2027 and 10% annual dividend growth.

- it becomes a dividend aristocrat in 2029

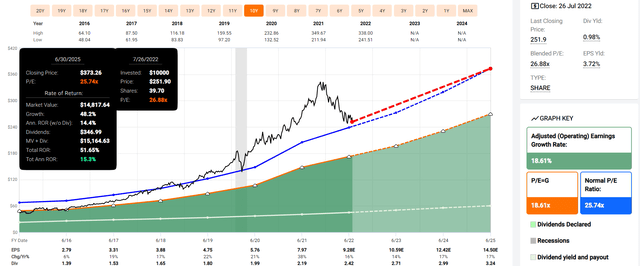

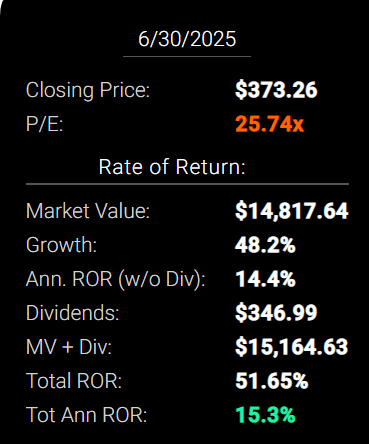

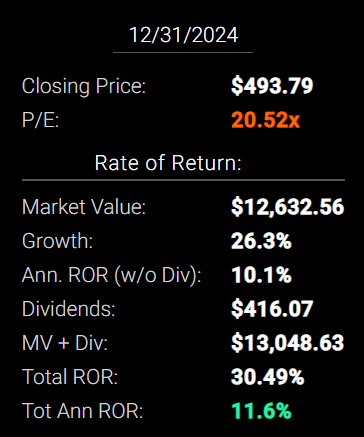

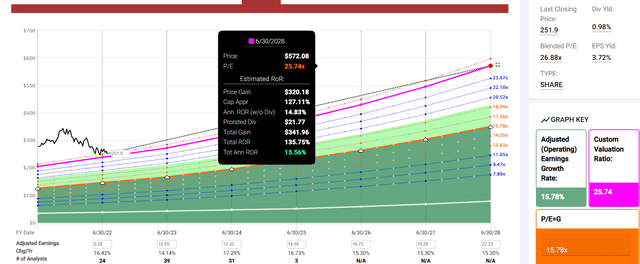

MSFT 2025 Consensus Total Return Potential

(Source: FAST Graphs, FactSet) (Source: FAST Graphs, FactSet)

If MSFT grows as analysts expect through mid-2025 and returns to historical fair value, it could deliver 52% total returns or 15% annually.

- returns on par with the greatest investors in history

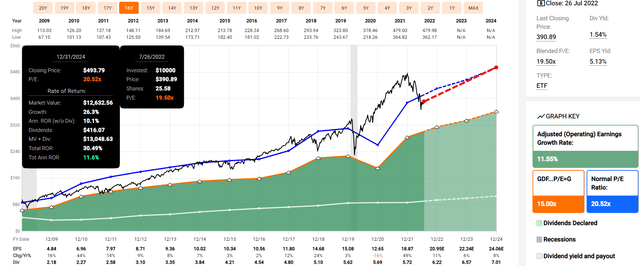

Now compare that to the S&P 500 consensus.

S&P 2024 Consensus Total Return Potential

(Source: FAST Graphs, FactSet) (Source: FAST Graphs, FactSet)

Analysts expect about 31% or 12% annual returns from the S&P 500 over the next 2.5 years.

MSFT 2028 Consensus Total Return Potential

(Source: FAST Graphs, FactSet) (Source: FAST Graphs, FactSet)

By mid-2028, if MSFT grows as expected and returns to historical mid-range historical fair value, it could deliver 234% total returns or 25% annually.

- about 2.5X more than the S&P 500 consensus

- returns on par with the greatest investors in history

S&P 500 2027 Consensus Return Potential

| Year | Upside Potential By End of That Year | Consensus CAGR Return Potential By End of That Year | Probability-Weighted Return (Annualized) | Inflation And Risk-Adjusted Expected Returns | Expected Market Return Vs. Historical Inflation-Adjusted Return |

Years To Double |

| 2027 | 53.76% | 8.96% | 6.72% | 4.61% | 67.79% | 15.62 |

(Source: DK S&P 500 Valuation And Total Return Tool)

MSFT Long-Term Consensus Total Return Potential (Ignoring Valuation Entirely, Which Cancels Out Over Time)

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return | Long-Term Inflation And Risk-Adjusted Expected Returns | Years To Double Your Inflation & Risk-Adjusted Wealth |

10-Year Inflation And Risk-Adjusted Expected Return |

| Microsoft | 1.0% | 15.30% | 16.3% | 11.4% | 8.9% | 8.1 | 2.35 |

| Nasdaq | 1.0% | 14.3% | 15.3% | 10.7% | 8.2% | 8.8 | 2.20 |

| Dividend Aristocrats | 2.6% | 8.6% | 11.1% | 7.8% | 5.3% | 13.5 | 1.68 |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% | 4.7% | 15.4 | 1.58 |

(Sources: Morningstar, FactSet, YCharts)

Analysts think MSFT could deliver 16.3% long-term returns, more than the Nasdaq, aristocrats, and S&P 500.

- roughly half the time to conservatively double your money as the S&P 500

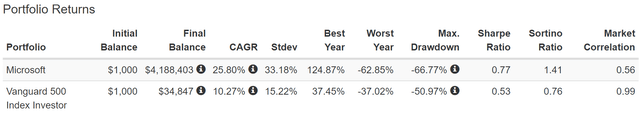

MSFT Total Returns Since April 1986

(Source: Portfolio Visualizer Premium) (Source: Portfolio Visualizer Premium)

MSFT is one of the greatest investments in history, delivering a remarkable 1,538X inflation-adjusted return since 1986.

- 120X more than the S&P 500

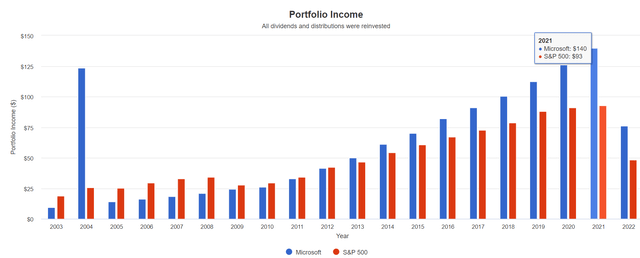

A Dividend Growth Blue-Chip You Can Trust

(Source: Portfolio Visualizer Premium) – includes reinvested dividends, 2004 = special dividend

| Portfolio | 2003 Income Per $1000 Investment | 2022 Income Per $1000 Investment | Annual Income Growth | Starting Yield |

2022 Yield On Cost |

| S&P 500 | $19 | $96 | 8.90% | 1.9% | 9.6% |

| Microsoft | $9 | $152 | 16.04% | 0.9% | 15.2% |

(Source: Portfolio Visualizer Premium)

MSFT has delivered 15% annual returns and 16% income growth since 2003 when it became a dividend growth stock.

- almost 2X the income growth of the S&P 500

- a yield on cost of 15.2% today

MSFT Consensus Future Income Growth Potential

| Analyst Consensus Income Growth Forecast | Risk-Adjusted Expected Income Growth | Risk And Tax-Adjusted Expected Income Growth |

Risk, Inflation, And Tax Adjusted Income Growth Consensus |

| 17.4% | 12.2% | 10.4% | 7.8% |

(Source: DK Research Terminal, FactSet)

Analysts think MSFT could deliver similar 17% annual income growth in the future, which, adjusted for the risk of the company not growing as expected, inflation, and taxes is 7.8% real expected income growth.

Now compare that to what they expect from the S&P 500.

| Time Frame | S&P Inflation-Adjusted Dividend Growth | S&P Inflation-Adjusted Earnings Growth |

| 1871-2021 | 1.6% | 2.1% |

| 1945-2021 | 2.4% | 3.5% |

| 1981-2021 (Modern Falling Rate Era) | 2.8% | 3.8% |

| 2008-2021 (Modern Low Rate Era) | 3.5% | 6.2% |

| FactSet Future Consensus | 2.0% | 5.2% |

(Sources: S&P, FactSet, Multipl.com)

- 1.7% post-tax inflation-adjusted income growth from the S&P 500

- S&P 500’s historical post-tax inflation-adjusted income growth rate (current tax code) is 5.8% CAGR

What about a 60/40 retirement portfolio?

- 0.5% consensus inflation, risk, and tax-adjusted income growth.

In other words, MSFT is expected to potentially generate about 4.5X faster real income growth than the S&P 500 and 16X faster income growth than a 60/40.

- Conservatively it should grow its dividends at least 33% faster than the S&P 500

What inflation-adjusted returns do analysts expect in the future?

Inflation-Adjusted Consensus Return Potential: $1,000 Initial Investment (Ignoring Valuation)

| Time Frame (Years) | 7.7% CAGR Inflation-Adjusted S&P Consensus | 8.6% Inflation-Adjusted Aristocrat Consensus | 13.8% CAGR Inflation-Adjusted MSFT Guidance | Difference Between Inflation-Adjusted FMS Consensus And S&P Consensus |

| 5 | $1,451.05 | $1,512.69 | $1,911.10 | $398.41 |

| 10 | $2,105.56 | $2,288.22 | $3,652.31 | $1,364.09 |

| 15 | $3,055.27 | $3,461.36 | $6,979.93 | $3,518.57 |

| 20 | $4,433.36 | $5,235.95 | $13,339.35 | $8,103.40 |

| 25 | $6,433.04 | $7,920.35 | $25,492.85 | $17,572.50 |

| 30 | $9,334.69 | $11,981.01 | $48,719.42 | $36,738.41 |

(Source: DK Research Terminal, FactSet)

Even if MSFT only grows as expected for a decade, that’s potentially almost 4X inflation-adjusted returns.

| Time Frame (Years) | Ratio Aristocrats/S&P Consensus | Ratio Inflation-Adjusted MSFT Consensus vs. S&P consensus |

| 5 | 1.04 | 1.32 |

| 10 | 1.09 | 1.73 |

| 15 | 1.13 | 2.28 |

| 20 | 1.18 | 3.01 |

| 25 | 1.23 | 3.96 |

| 30 | 1.28 | 5.22 |

(Source: DK Research Terminal, FactSet)

Almost 2X the market’s return potential and 60% more than the dividend aristocrats (which it will join in 2029).

MSFT Investment Decision Score

dk (Source: DK Automated Investment Decision Tool)

For anyone comfortable with its risk profile, MSFT is one of the most reasonable and prudent hyper-growth Ultra SWANs on Wall Street.

- 9% discount vs 2% market discount = 7% better valuation

- 1.0% yield vs. 1.7% yield (but a much safer and faster-growing one)

- 60% better consensus long-term return potential

- 2X better risk-adjusted expected return over the next five years

Reason Two: Microsoft Is Potentially The Highest Quality Company On Earth

There are many ways to measure safety and quality, and I factor in all of them.

The Dividend Kings’ overall quality scores are based on a 257-point model that includes:

-

Dividend safety

-

Balance sheet strength

-

Credit ratings

-

Credit default swap medium-term bankruptcy risk data

-

Short and long-term bankruptcy risk

-

Accounting and corporate fraud risk

-

Profitability and business model

-

Growth consensus estimates

-

Management growth guidance

-

Historical earnings growth rates

-

Historical cash flow growth rates

-

Historical dividend growth rates

-

Historical sales growth rates

-

Cost of capital

-

GF Scores

-

Morningstar business model uncertainty score

-

Long-term risk-management scores from MSCI, Morningstar, FactSet, S&P, Reuters’/Refinitiv, and Just Capital

-

Management quality

-

Dividend-friendly corporate culture/income dependability

-

Long-term total returns (a Ben Graham sign of quality)

-

Analyst consensus long-term return potential

It includes over 1,000 fundamental metrics, including the 12 rating agencies we use to assess fundamental risk.

-

credit and risk management ratings make up 41% of the DK safety, and quality model

-

dividend/balance sheet/risk ratings make up 82% of the DK safety and quality model

How do we know that our safety and quality model works well?

During the two worst recessions in 75 years, our safety model 87% of blue-chip dividend cuts, the ultimate baptism by fire for any dividend safety model.

How does MSFT score on our comprehensive safety and quality models?

Microsoft Is Arguably The World’s Best Company

- the #1 quality company on the Master List

- arguably the best company on earth

- as close to God’s own company as can exist on Wall Street

MSFT Dividend Safety

| Rating | Dividend Kings Safety Score (165 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| MSFT | 100% | 0.5% | 1.00% |

| Risk Rating | Very Low-Risk (57th industry percentile risk-management consensus) | AAA stable outlook credit rating 0.07% 30-year bankruptcy risk | 20% OR LESS Max Risk Cap Recommendation |

Long-Term Dependability

| Company | DK Long-Term Dependability Score | Interpretation | Points |

| Non-Dependable Companies | 21% or below | Poor Dependability | 1 |

| Low Dependability Companies | 22% to 60% | Below-Average Dependability | 2 |

| S&P 500/Industry Average | 61% (61% to 70% range) | Average Dependability | 3 |

| Above-Average | 71% to 80% | Very Dependable | 4 |

| Very Good | 81% or higher | Exceptional Dependability | 5 |

| MSFT | 100% | Exceptional Dependability | 5 |

Overall Quality

| MSFT | Final Score | Rating |

| Safety | 100% | 5/5 very safe |

| Business Model | 100% | 3/3 wide and stable moat |

| Dependability | 100% | 5/5 exceptional |

| Total | 100% | 13/13 Ultra SWAN |

| Risk Rating |

5/5 Very Low-Risk |

|

| 20% OR LESS Max Risk Cap Rec |

5% Margin of Safety For A Potentially Good Buy |

MSFT is the highest quality company on the DK 500 Masterlist.

How significant is this? The DK 500 Master List is one of the world’s best watchlists, including

- every dividend aristocrat (S&P companies with 25+ year dividend growth streaks)

- every dividend champion (every company, including foreign, with 25+ year dividend growth streaks)

- every dividend king (every company with 50+ year dividend growth streaks)

- every foreign aristocrat (every company with 20+ year dividend growth streaks)

- every Ultra SWAN (wide moat aristocrats, as close to perfect quality companies as exist)

- 40 of the world’s best growth stocks

In other words, even among the world’s best companies, MSFT is higher quality than all of them.

Why I Trust Microsoft And So Can You

Microsoft was founded in 1975 in Redmond, Washington, and has become potentially the best tech utility on earth.

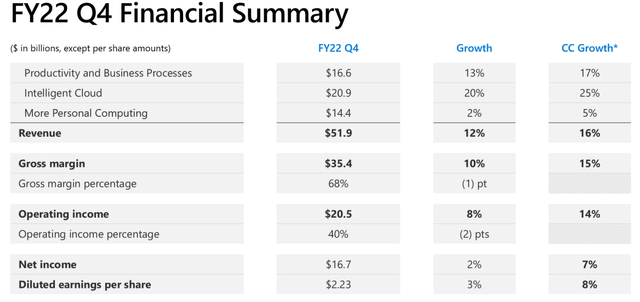

Earnings Update

MSFT warned a few weeks ago that the strong dollar and several other issues would cause it to miss its previous guidance

The results were impacted by:

- currency effects: -$595 million

- supply chain issues in China: -$300 million

- lower advertising revenue at Bing and Linked In: -$100 million

Yet were still objectively very good.

(Source: earnings presentation)

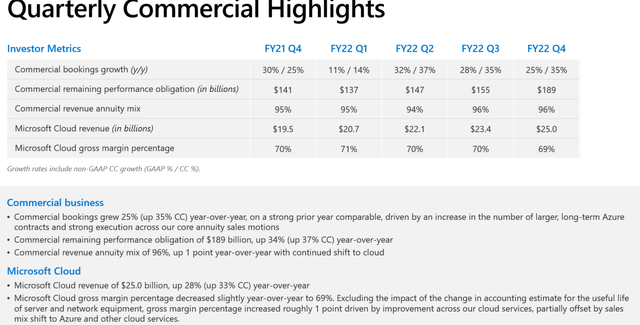

16% sales growth in constant currency, and EPS growth of 8%.

(Source: earnings presentation)

Cloud revenue was up 33% YOY in constant currency, with bookings up 35% and growth margins of 69% and 69% of sales from recurring revenue.

- LinkedIn revenue up 29% YOY

- Azure up 40% YOY

- other cloud revenue up 46% YOY

- Office 365 customers up 14%

- Office 365 revenue up 12%

In 2024 Azure is still expected to grow by 35%.

(Source: earnings presentation)

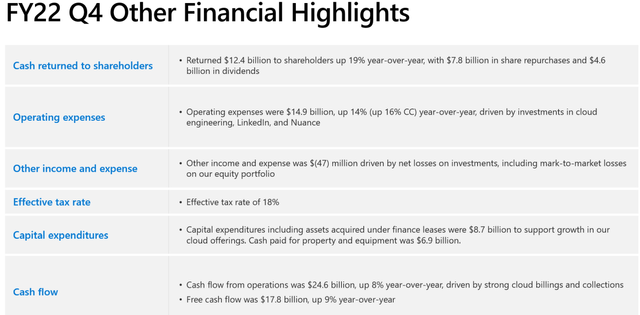

Capital returns to shareholders up 19% YOY to $12.4 billion and free cash up 9% to $17.8 billion.

- 70% FCF total payout ratio, including buybacks

- MSFT’s $105 billion cash pile is still growing

(Source: earnings presentation)

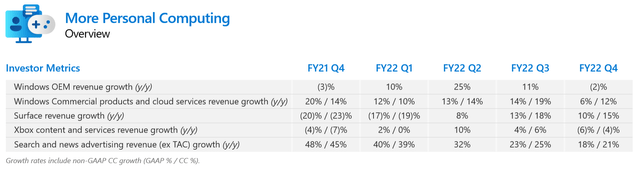

The weakest part of the business war hardware, including Windows OEM sales down 2% and Xbox down 4%.

But advertising, a major concern for that industry, posted 21% sales growth in constant currency.

Bottom Line: Microsoft is firing on all cylinders in a slowing economy.

Quantitative Analysis: The Math Backing Up The Investment Thesis

Ben Graham recommended combining qualitative (the story) analysis with quantitative analysis looking at the past, present, and likely future.

MSFT Credit Ratings

| Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

| S&P | AAA Stable Outlook | 0.07% | 1428.6 |

| Fitch | AAA Stable Outlook | 0.07% | 1428.6 |

| Moody’s | AAA Stable Outlook | 0.07% | 1428.6 |

| Consensus | AAA Stable Outlook | 0.07% | 1428.6 |

(Source: S&P, Fitch, Moody’s)

All three major rating agencies estimate a 0.07% fundamental risk of MSFT going bankrupt in the next 30 years.

- the lowest fundamental risk in corporate America

- 1 in 1,429 chance of going to zero

- as close to a risk-free single company investment as exists on Wall Street

- S&P rates MSFT a lower credit risk than the US treasury

MSFT Leverage Consensus Forecast

| Year | Debt/EBITDA | Net Debt/EBITDA (3.0 Or Less Safe According To Credit Rating Agencies) |

Interest Coverage (8+ Safe) |

| 2020 | 0.96 | -1.11 | 25.28 |

| 2021 | 0.71 | -0.88 | NA |

| 2022 | 0.51 | -0.60 | 79.33 |

| 2023 | 0.44 | -0.75 | 89.37 |

| 2024 | 0.37 | -0.91 | 106.25 |

| 2025 | 0.33 | -0.98 | NA |

| 2026 | NA | -0.33 | NA |

| 2027 | NA | -0.48 | NA |

| Annualized Change | -19.20% | -11.21% | 43.18% |

(Source: FactSet Research Terminal)

MSFT’s fortress balance sheet is expected to strengthen steadily over time, including a net leverage ratio of -0.9 by 2024 and 106X interest coverage.

MSFT Balance Sheet Consensus Forecast

| Year | Total Debt (Millions) | Cash | Net Debt (Millions) | Interest Cost (Millions) | EBITDA (Millions) | Operating Income (Millions) |

| 2020 | $63,327 | $13,576 | -$73,200 | $2,095 | $65,755 | $52,959 |

| 2021 | $58,146 | $14,224 | -$72,188 | NA | $81,602 | $69,916 |

| 2022 | $49,926 | $22,007 | -$59,055 | $1,053 | $98,463 | $83,533 |

| 2023 | $49,485 | $75,539 | -$83,818 | $1,055 | $111,790 | $94,286 |

| 2024 | $47,906 | $104,796 | -$118,220 | $1,027 | $129,988 | $109,115 |

| 2025 | $49,926 | $134,368 | -$147,791 | NA | $150,522 | $128,520 |

| 2026 | NA | $104,734 | -$54,899 | NA | $168,539 | $136,958 |

| 2027 | NA | $115,513 | -$90,831 | NA | $187,499 | $152,511 |

| Annualized Growth | -4.64% | 35.78% | 3.13% | -16.32% | 16.15% | 16.31% |

(Source: FactSet Research Terminal)

Debt is falling over time, cash is growing at 36% per year, and cash flows by 16%.

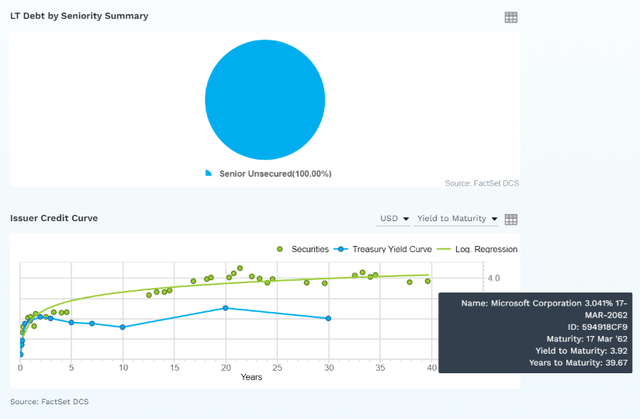

MSFT Bond Profile

(Source: FactSet Research Terminal) (Source: FactSet Research Terminal)

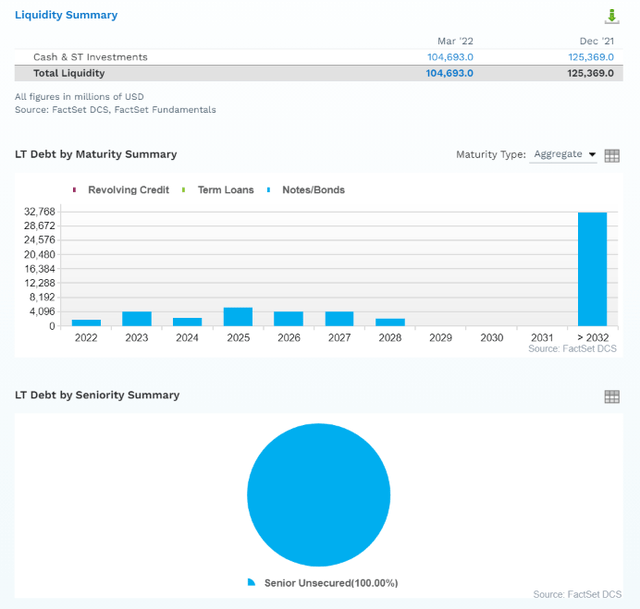

- $105 billion in liquidity

- well-staggered bond maturities (no problem refinancing maturing debt)

- 100% unsecured bonds for very good financial flexibility

- bond investors are confident enough in MSFT to lend to them at 3.9% for 40 years (3.0% originally)

- the average borrowing cost is 3.21%

- 0.7% after the bond market’s 30-year inflation expectations

- 0.7% real borrowing costs vs. 31.1% cash returns on invested capital

- MSFT’s ROIC is 44X higher than it’s real borrowing costs

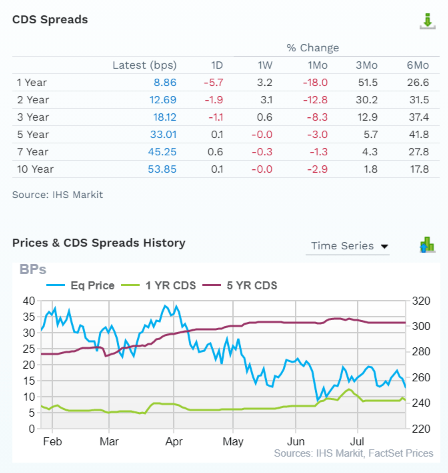

MSFT Credit Default SWAPs: Real-Time Fundamental Risk Analysis From The Bond Market

(Source: FactSet Research Terminal)

Credit default SWAPs are the insurance policies bond investors take out against default.

- they represent real-time fundamental risk assessment from the “smart money” on Wall Street

- MSFT’s fundamental risks are up modestly in the last six months

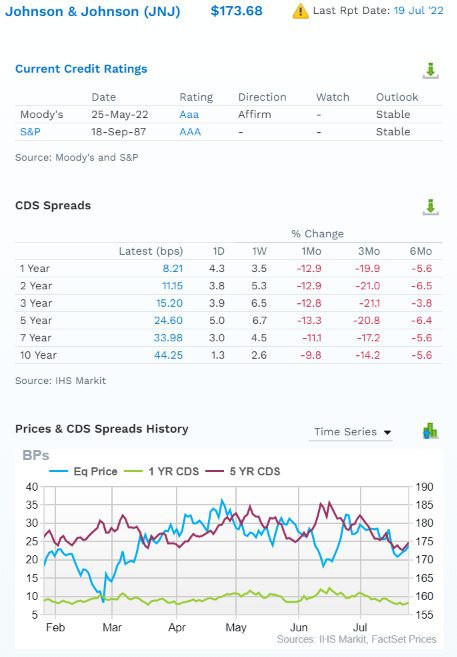

- the bond market is pricing in a 1.62% 30-year default risk, which is consistent with A credit ratings

(Source: FactSet Research Terminal)

CDS can only get so low, as you can see with JNJ’s AAA credit rating.

- no one will take out insurance on something that is virtually guaranteed not to happen

- analysts, rating agencies, and the bond market all agree

- MSFT’s thesis is intact

- 46 analysts, 8 rating agencies, and the bond market make up our FMS expert consensus

- 54 expert consensus + the bond market monitoring MSFT’s risk profile

- how we track fundamental risk in real-time

- to ensure high-probability/low-risk investment recommendations

MSFT GF Score: The Newest Addition To The DK Safety And Quality Model

The GF Score is a ranking system that has been found to be closely correlated to the long-term performances of stocks by backtesting from 2006 to 2021.” – GuruFocus

GF Score considers five key aspects. They are:

- Financial Strength

- Profitability

- Growth

- Valuation

- Momentum

MSFT’s excellent 96/100 GF score confirms its rock-solid fundamentals and exceptional investment thesis.

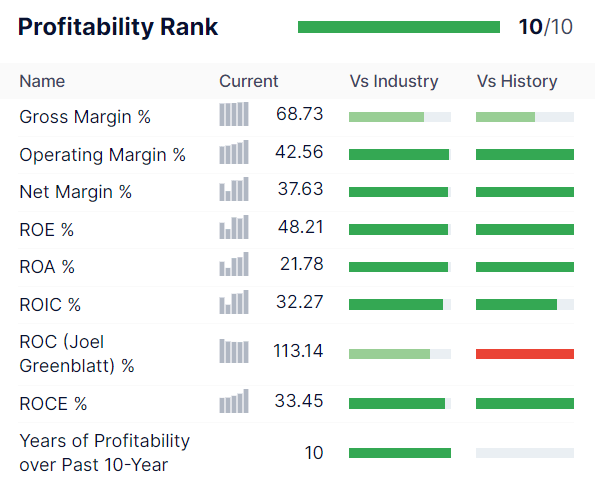

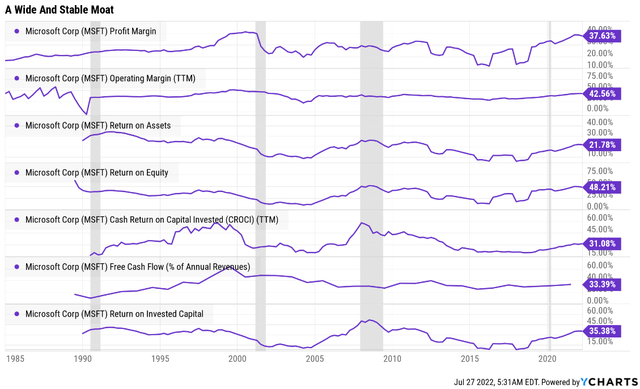

MSFT Profitability: Wall Street’s Favorite Quality Proxy

(Source: GuruFocus Premium)

MSFT’s profitability is the stuff of legend.

- even in a year with high inflation, currency effects, war in Ukraine and supply chain issues

- 38% net margins and 113% returns on capital

MSFT Trailing 12-Month Profitability Vs. Peers

| Metric | TTM | Industry Percentile | Major Software Companies providers More Profitable Than MSFT (Out Of 2,722) |

| Gross Margins | 68.73% | 73.21 | 729 |

| Operating Margin | 42.56% | 98.26 | 47 |

| Net Margin | 37.63% | 97.32 | 73 |

| Return On Equity | 48.21% | 97.35 | 72 |

| Return On Assets | 21.78% | 96.62 | 92 |

| Returns On Invested Capital | 32.27% | 92.09 | 215 |

| Return On Capital (Greenblatt) | 113.14% | 79.51 | 558 |

| Return On Capital Employed | 33.45% | 93.96 | 164 |

| Average | 49.72% | 91.04 | 244 |

(Source: GuruFocus Premium)

Only 244 major software companies worldwide were more profitable than MSFT last year.

MSFT has been steadily improving its profitability since shifting to a cloud-focused business model. Including a 33% free cash flow margin which remained rock steady during the Pandemic.

- FCF margin in the top 10% of all companies on earth

MSFT Profit Margin Consensus Forecast

| Year | FCF Margin | EBITDA Margin | EBIT (Operating) Margin | Net Margin | Return On Capital Expansion |

Return On Capital Forecast |

| 2020 | 31.6% | 46.0% | 37.0% | 31.0% | 1.01 | |

| 2021 | 33.4% | 48.5% | 41.6% | 36.1% | TTM ROC | 113.14% |

| 2022 | 32.9% | 49.7% | 42.1% | 35.0% | Latest ROC | 101.70% |

| 2023 | 33.1% | 50.1% | 42.2% | 34.8% | 2027 ROC | 114.13% |

| 2024 | 34.7% | 51.2% | 42.9% | 35.6% | 2027 ROC | 102.59% |

| 2025 | 34.6% | 52.0% | 44.4% | 36.4% | Average | 108.36% |

| 2026 | 31.1% | 52.3% | 42.5% | 35.3% | Industry Median | 13.78% |

| 2027 | 31.3% | 52.3% | 42.5% | 35.3% | MSFT/Industry Median | 7.86 |

| Annualized Growth | -0.16% | 1.84% | 1.99% | 1.90% | Vs. S&P | 7.42 |

| Annualized Growth (Post Pandemic/Insurance Business Sale) | -1.08% | 1.23% | 0.36% | -0.35% |

(Source: FactSet Research Terminal)

MSFT’s margins are expected to remain stable or slightly improve from their already industry-leading levels.

- 31% FCF margin in 2027

- 35% net margin in 2027

- returns on capital of 108% in 2027 = 8X the industry median and 7.4X more than the S&P 500

Joel Greenblatt considered return on capital his gold standard proxy for quality and moatiness.

- annual pre-tax profit/the cost of running the business

- MSFT’s incredible returns on capital of over 100% confirm its wide and stable moat and world-class quality

Reason Three: Incredible Growth Potential For Decades To Come

Microsoft has $105 billion in cash, but that’s not for lack of growth spending.

Microsoft Growth Spending Consensus Forecast

| Year | SG&A (Selling, General, Administrative) | R&D | Capex | Total Growth Spending | Sales | Growth Spending/Sales |

| 2020 | $24,709 | $19,269 | $15,441 | $59,419 | $143,015 | 41.55% |

| 2021 | $25,224 | $20,716 | $20,622 | $66,562 | $168,088 | 39.60% |

| 2022 | $27,745 | $24,374 | $23,886 | $76,005 | $198,270 | 38.33% |

| 2023 | $31,876 | $26,978 | $27,134 | $85,988 | $223,337 | 38.50% |

| 2024 | $35,764 | $30,050 | $30,854 | $96,668 | $254,085 | 38.05% |

| 2025 | $38,324 | $33,194 | $36,598 | $108,116 | $289,204 | 37.38% |

| 2026 | $45,116 | $38,993 | $44,576 | $128,685 | $322,254 | 39.93% |

| 2027 | $50,238 | $43,421 | $49,521 | $143,180 | $358,849.00 | 39.90% |

| Annualized Growth | 10.67% | 12.31% | 18.11% | 13.39% | 14.04% | -0.58% |

| Total Spending Next Five Years | $201,318 | $172,636 | $188,683 | $562,637 | $1,447,729 |

(Source: FactSet Research Terminal)

MSFT spent $67 billion on growth in the last year (fiscal 2021) and is expected to grow that spending by 13% annually to $143 billion in 2027.

- the US government’s infrastructure spending over the next decade is $125 billion per year

- MSFT will soon be spending more on growth than the US government

- $563 billion in growth spending over the next five years

- 40% of sales

What does all that growth spending get you?

MSFT Medium-Term Growth Consensus Forecast

| Year | Sales | Free Cash Flow | EBITDA | EBIT (Operating Income) | Net Income |

| 2020 | $143,015 | $45,234 | $65,755 | $52,959 | $44,281 |

| 2021 | $168,088 | $56,118 | $81,602 | $69,916 | $60,651 |

| 2022 | $198,270 | $65,149 | $98,463 | $83,533 | $69,447 |

| 2023 | $223,337 | $74,023 | $111,790 | $94,286 | $77,781 |

| 2024 | $254,085 | $88,229 | $129,988 | $109,115 | $90,342 |

| 2025 | $289,204 | $100,007 | $150,522 | $128,520 | $105,385 |

| 2026 | $322,254 | $100,311 | $168,539 | $136,958 | $113,846 |

| 2027 | $358,849 | $112,230 | $187,499 | $152,511 | $126,763 |

| Annualized Growth | 14.04% | 13.86% | 16.15% | 16.31% | 16.21% |

| Annualized Growth (Post Pandemic) | 13.47% | 12.25% | 14.87% | 13.88% | 13.07% |

| Cumulative Next Five Years | $1,447,729 | $474,800 | $748,338 | $621,390 | $514,117 |

(Source: FactSet Research Terminal)

Post pandemic analysts expect sales growth of around 14%, with earnings and cash flows growing at 12% to 15% CAGR.

$475 billion in cumulative consensus free cash flow over the next five years compared to $514 billion in net profit.

- 92% earnings to free cash flow conversion ratio are excellent for this industry and blue-chips in general

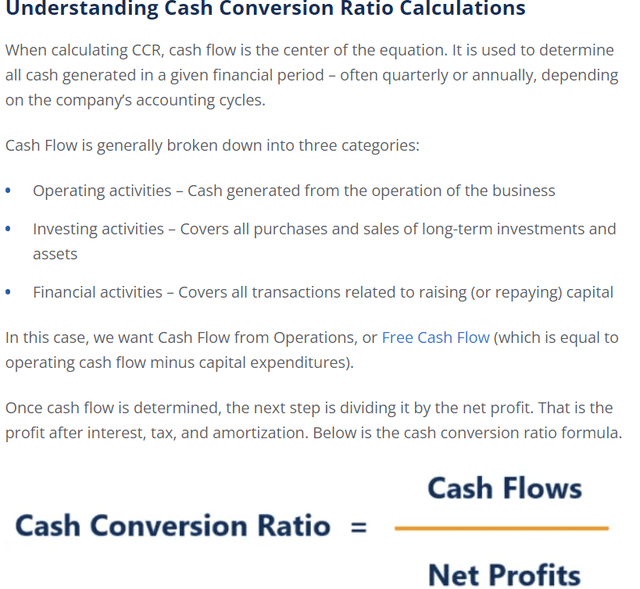

(Source: corporate finance institution)

A company’s cash conversion ratio is usually a good indicator of:

- efficient capital allocation

- low risk of fraud

Most blue-chips will have close to 100% cash conversion ratios over the long-term.

Companies with low ratios are potentially poorly run and or committing accounting fraud.

MSFT’s very good cash conversion further indicates good management, a solid business, and honest accounting.

- as well as a very safe dividend

MSFT Dividend Growth Consensus Forecast

| Year | Dividend Consensus | EPS/Share Consensus | EPS Payout Ratio | Retained (Post-Dividend) Earnings | Buyback Potential | Debt Repayment Potential |

| 2022 | $2.42 | $9.21 | 26.3% | $50,810 | 2.70% | 101.8% |

| 2023 | $2.71 | $10.39 | 26.1% | $57,469 | 3.05% | 116.1% |

| 2024 | $2.99 | $12.17 | 24.6% | $68,694 | 3.65% | 138.8% |

| 2025 | $3.24 | $14.30 | 22.7% | $82,762 | 4.39% | 172.8% |

| 2026 | $3.63 | $15.64 | 23.2% | $89,871 | 4.77% | 180.0% |

| 2027 | $3.99 | $17.56 | 22.7% | $101,544 | 5.39% | 203.4% |

| Total 2022 Through 2027 | $18.98 | $46.07 | 24.3% | $451,150.07 | 23.95% | 911.69% |

| Annualized Rate | 10.52% | 13.78% | -2.86% | 14.85% | 14.85% | 14.85% |

(Source: FactSet Research Terminal)

60% is the safe payout ratio for this industry, according to rating agencies.

- the payout ratio is a very safe 26% in 2022 and is expected to fall to 23% by 2027

- average 24% through 2027

- 11% annual dividend growth and 14% EPS growth

- $451 billion in consensus post-dividend retained earnings through 2027

- enough to pay 9X its debt

- or buyback up to 24% of shares at existing valuations

MSFT Buyback Consensus Forecast

| Year | Consensus Buybacks ($ Millions) | % Of Shares (At Current Valuations) | Market Cap |

| 2022 | $31,739 | 1.7% | $1,883,968 |

| 2023 | $32,125 | 2.0% | $1,883,968 |

| 2024 | $36,830 | 2.0% | $1,883,968 |

| 2025 | $38,994 | 2.1% | $1,883,968 |

| 2026 | $41,645 | 2.2% | $1,883,968 |

| 2027 | $44,477 | 2.4% | $1,883,968 |

| Total 2023-2027 | $194,071 | 10.3% | $1,883,968 |

| Annualized Rate | 2.09% | Average Annual Buybacks | $32,345 |

(Source: FactSet Research Terminal)

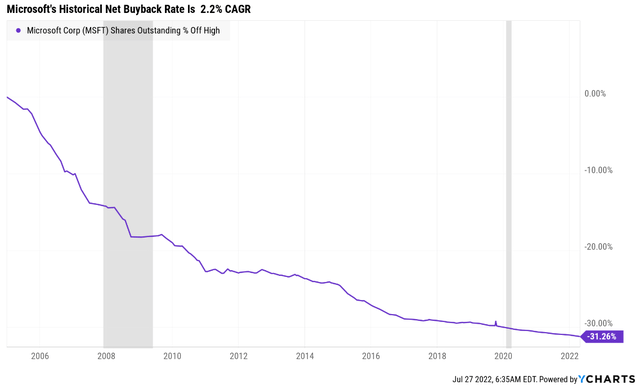

Analysts expect $194 billion in buybacks over the next five years, averaging over $32 billion per year.

- $8 billion per quarter

- $162 million per trading day

- $25 million per hour

- $415,000 per minute

- $13,800 per second

Over the last 17 years, MSFT has bought back 2.2% of net shares each year, and analysts expect that to continue.

| Time Frame (Years) | Net Buyback Rate | Shares Remaining | Net Shares Repurchased | Each Share You Own Is Worth X Times More (Not Including Future Growth And Dividends) |

| 5 | 2.1% | 89.98% | 10.02% | 1.11 |

| 10 | 2.1% | 80.96% | 19.04% | 1.24 |

| 15 | 2.1% | 72.85% | 27.15% | 1.37 |

| 20 | 2.1% | 65.55% | 34.45% | 1.53 |

| 25 | 2.1% | 58.98% | 41.02% | 1.70 |

| 30 | 2.1% | 53.07% | 46.93% | 1.88 |

(Source: FactSet Research Terminal)

MSFT is on track to buy back almost half its shares over the next 30 years, almost doubling the value of your shares not including sales, earnings, and dividend growth.

MSFT Long-Term Growth Outlook

(Source: FactSet Research Terminal)

- 13.7% to 15.7% growth consensus range (five sources)

- the median consensus from all 46 analysts is 15.3%

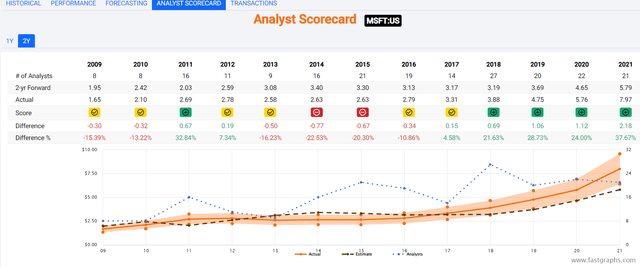

How accurate are analyst forecasts for MSFT (partially based on management guidance)?

FAST Graphs, FactSet FAST Graphs, FactSet

- Smoothing for outliers, historical analyst margins-of-error are 20% to the downside and 20% to the upside

- margin-of-error adjusted consensus growth range: 10% to 19% CAGR

- 70% statistical probability that MSFT grows 10% to 19% over time

FAST Graphs, FactSet FAST Graphs, FactSet FAST Graphs, FactSet FAST Graphs, FactSet

Thanks to the Nadella pivot to the cloud, MSFT has been accelerating its growth for the last decade.

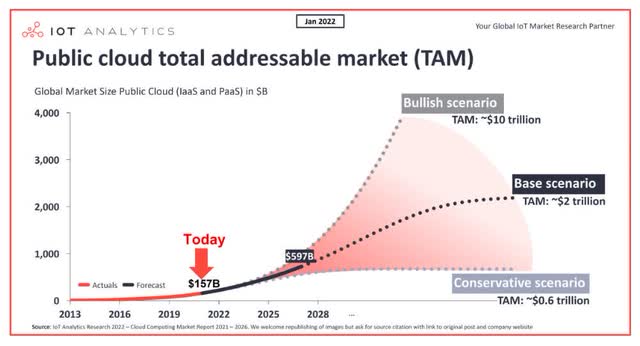

Cloud computing is a potential $2 to $10 trillion global market by 2030, according to IOT Analytics, meaning that MSFT still has plenty of room to grow.

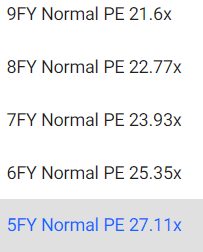

Reason Four: The Ultimate “Wonderful Company At A Fair Price.”

(Source: FAST Graphs, FactSet)

Since MSFT pivoted to a cloud-focused business model, billions of investors have consistently paid 22.5X to 26X earnings outside of bear markets and bubbles for FMS.

- high statistical probability that intrinsic value is 22.5X to 26X earnings

- likely towards the higher end of the range

- because early on, MSFT had yet to prove its dominance in cloud computing

| Metric | Historical Fair Value Multiples (10-Years, Nadella Era, New Business Model) | 2021 | 2022 | 2023 | 2024 | 2025 |

12-Month Forward Fair Value |

| Earnings | 25.74 | $221.36 | $253.54 | $292.15 | $292.15 | $345.95 | |

| Average | $221.36 | $253.54 | $292.15 | $292.15 | $345.95 | $275.81 | |

| Current Price | $251.90 | ||||||

|

Discount To Fair Value |

-13.79% | 0.65% | 13.78% | 13.78% | 27.19% | 8.67% | |

|

Upside To Fair Value (NOT Including Dividends) |

-12.12% | 0.65% | 15.98% | 15.98% | 37.33% | 9.49% (11% including dividend) | |

| 2022 EPS | 2023 EPS | 2021 Weighted EPS | 2022 Weighted EPS | 12-Month Forward EPS | 12-Month Average Fair Value Forward PE |

Current Forward PE |

|

| $9.85 | $11.35 | $4.17 | $6.55 | $10.72 | 25.7 | 23.5 |

I estimate MSFT is worth about 25.7X earnings and today trades at 23.5X.

- 16.8X cash-adjusted earnings = hyper-growth Ultra SWAN quality at a reasonable price

|

Analyst Median 12-Month Price Target |

Morningstar Fair Value Estimate |

| $338.74 (31.6 PE) | $352.00 (32.9 PE) |

|

Discount To Price Target (Not A Fair Value Estimate) |

Discount To Fair Value |

| 25.64% | 28.44% |

|

Upside To Price Target (Not Including Dividend) |

Upside To Fair Value (Not Including Dividend) |

| 34.47% | 39.74% |

|

12-Month Median Total Return Price (Including Dividend) |

Fair Value + 12-Month Dividend |

| $341.22 | $354.48 |

|

Discount To Total Price Target (Not A Fair Value Estimate) |

Discount To Fair Value + 12-Month Dividend |

| 26.18% | 28.94% |

|

Upside To Price Target ( Including Dividend) |

Upside To Fair Value + Dividend |

| 35.46% | 40.72% |

Morningstar’s discounted cash flow model estimates MSFT is worth about 33X earnings making it 28% undervalued, with a 41% upside to fair value.

Analysts think MSFT will trade at 31.6 PE within a year, delivering a 36% total return in 12 months.

I don’t recommend companies based on 12-month forecasts but on the margin of safety and whether or not it sufficiently compensates you for a company’s risk profile.

Margin Of Safety Not 12-Month Price Targets Are How I Make Investment Decisions

| Rating | Margin Of Safety For Very Low-Risk 100% Quality 13/13 Ultra SWANs | 2022 Fair Value Price | 2023 Fair Value Price |

12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $253.54 | $292.15 | $275.81 |

| Potentially Good Buy | 0% | $253.54 | $292.15 | $275.81 |

| Potentially Strong Buy | 10% | $228.19 | $262.93 | $248.23 |

| Potentially Very Strong Buy | 20% | $202.83 | $233.72 | $220.65 |

| Potentially Ultra-Value Buy | 30% | $177.48 | $204.50 | $193.07 |

| Currently | $251.90 | 0.65% | 13.78% | 8.67% |

| Upside To Fair Value (Not Including Dividends) | 0.65% | 15.98% | 9.49% |

For anyone comfortable with its risk profile, MSFT is a potentially good buy and just 1% above its strong buy price.

Risk Profile: Why Microsoft Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

What Could Cause MSFT’s Investment Thesis To Break

- safety falls to 40% or less

- balance sheet collapses (0.07% probability according to rating agencies)

- government breakup of the company (already attempted) – investors would get the spinoffs and not lose money

- growth outlook falls to less than 9% for eight years

- MSFT’s role in my portfolio is to deliver long-term 10+% returns with minimal fundamental risk

- 8+% total return requirement for defensive sectors (including healthcare)

- 10+% for non-defensive (cyclical) sectors

How long it takes for a company’s investment thesis to break depends on the quality of the company.

| Quality |

Years For The Thesis To Break Entirely |

| Below-Average | 1 |

| Average | 2 |

| Above-Average | 3 |

| Blue-Chip | 4 |

| SWAN | 5 |

| Super SWAN | 6 |

| Ultra SWAN | 7 |

| 100% Quality Companies (MSFT, LOW, and MA) | 8 |

These are my rule of thumb for when to sell a stock if the investment thesis has broken. MSFT is highly unlikely to suffer such catastrophic declines in fundamentals.

Risk Profile Summary

- Legacy high-margin business is being disrupted (by MSFT itself)

- disruption risk: AMZN and GOOG are the other two titans in cloud computing, but lots of smaller rivals (like CRM)

- M&A execution risk: $85 billion Activision purchase is the biggest in its history by far

- regulatory risk: mostly for future acquisitions as well as data tracking

- talent retention risk in the tightest job market in 50 years (tech is a high-wage sector)

- currency risk: modest headwind this year

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Analysis: How Large Institutions Measure Total Risk

- see the risk section of this video to get an in-depth view (and link to two reports) of how DK and big institutions measure long-term risk management by companies

MSFT Long-Term Risk-Management Consensus

| Rating Agency | Industry Percentile |

Rating Agency Classification |

| MSCI 37 Metric Model | 100.0% |

AAA Industry Leader, Stable Trend |

| Morningstar/Sustainalytics 20 Metric Model | 96.8% |

13.8/100 Low Risk |

| Reuters’/Refinitiv 500+ Metric Model | 99.8% | Excellent |

| S&P 1,000+ Metric Model | 58.0% |

Average, Stable Trend |

| Just Capital 19 Metric Model | 98.5% | Excellent |

| FactSet | 30.0% |

Below-Average, Stable Trend |

| Morningstar Global Percentile (All 15,000 Rated Companies) | 93.2% | Excellent, 1,009th best in the world |

| Just Capital Global Percentile (All 954 Rated US Companies) | 99.7% | Excellent, #3 best in America |

| Consensus | 85% |

Very Low-Risk, Very Good Risk-Management, Stable Trend |

(Sources: MSCI, Morningstar, FactSet, S&P, Reuters)

MSFT’s Long-Term Risk Management Is The 33rd Best In The Master List (93rd Percentile)

| Classification | Average Consensus LT Risk-Management Industry Percentile |

Risk-Management Rating |

| S&P Global (SPGI) #1 Risk Management In The Master List | 94 | Exceptional |

| Microsoft | 85 |

Very Good |

| Strong ESG Stocks | 78 |

Good – Bordering On Very Good |

| Foreign Dividend Stocks | 75 | Good |

| Ultra SWANs | 71 | Good |

| Low Volatility Stocks | 68 | Above-Average |

| Dividend Aristocrats | 67 | Above-Average |

| Dividend Kings | 63 | Above-Average |

| Master List average | 62 | Above-Average |

| Hyper-Growth stocks | 61 | Above-Average |

| Monthly Dividend Stocks | 60 | Above-Average |

| Dividend Champions | 57 | Average bordering on above-average |

(Source: DK Research Terminal)

MSFT’s risk-management consensus is in the top 7% of the world’s highest quality companies and similar to that of such other blue-chips as

- Colgate-Palmolive (CL) Ultra SWAN dividend king

- Ecolab (ECL) Super SWAN dividend aristocrat

- W. W. Grainger (GWW) Ultra SWAN dividend king

- Pepsi (PEP) – Ultra SWAN dividend king

- AbbVie (ABBV) – Ultra SWAN dividend king

- Lowe’s (LOW) – Ultra SWAN dividend king

- Lockheed Martin (LMT) – Ultra SWAN

- Amgen (AMGN) – Ultra SWAN

- BlackRock (BLK) – Ultra SWAN

- Adobe (ADBE) – Ultra SWAN

The bottom line is that all companies have risks, and MSFT is very good at managing theirs.

How We Monitor MSFT’s Risk Profile

- 46 analysts

- 3 credit rating agencies

- 8 total risk rating agencies

- 54 experts who collectively know this business better than anyone other than management

- and the bond market for real-time fundamental risk updates

When the facts change, I change my mind. What do you do, sir?” – John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Buy Microsoft Today, And Your Retirement Will Thank You

Don’t try to buy at the bottom and sell at the top. This can’t be done – except by liars.” – Barnard Baruch

Bernard Baruch was one of the greatest investors of his day before Buffett and Graham were even born. He understood that markets can be highly irrational in the short-term but in the long-term they always make sense.

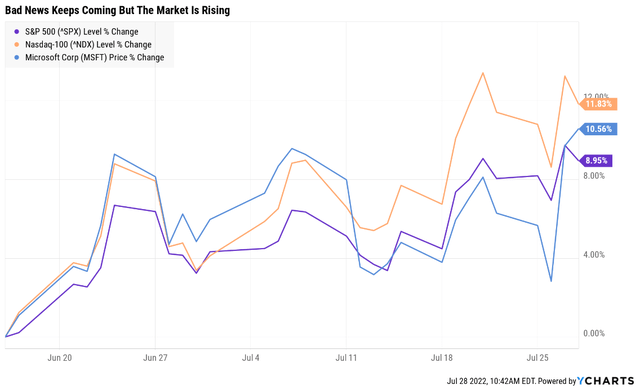

Today’s market is confusing to may. After all, since June 16th’s lows, we’ve seen a steady stream of bad news about the economy, and corporate earnings estimates are falling by the week.

Yet the stock market doesn’t seem to care. Why? It might be because this is a bear market rally or because the bad news is already priced in.

Only time will tell which is the correct answer, but here’s what I can say with 80% confidence about Microsoft today.

- MSFT is one of the world’s safest, most dependable, and highest quality companies on earth

- potentially the highest quality company on earth

- 1% very safe and steadily growing yield expected to grow 11% annually in the coming years

- 16.3% CAGR long-term total return potential, better than the Nasdaq, aristocrats, or S&P 500

- 9% historically undervalued, a potentially good buy, bordering on strong buy

- 16.7X cash-adjusted earnings, hyper-growth at a reasonable price

- 136% consensus return potential over the next five years, 16% CAGR, about 2.5X more than the S&P 500

- 2X better risk-adjusted expected returns of the S&P 500 over the next five years.

What do investors buying Microsoft have to fear from a potential recession? Very little. This is a tech utility with an AAA-rated balance sheet, 85th percentile risk management, and more money than God.

Might MSFT fall a bit more? A lot more even? Sure. But consider this.

Microsoft is one of the world’s safest companies, with the strongest balance sheet in corporate America, and offers around 16% long-term return potential.

- what Cathie Wood at ARKK and private equity strive for long-term

- with speculative and complex investments that can tie up your money for as long as 15 years

If MSFT falls 10% more, then you’ll earn an extra 11% over the long-term. Not per year, but over decades.

- An extra 0.35% CAGR over 30 years

How rational is it to miss out entirely on 16% annual return potential from a company with 0.07% fundamental risk? To try to earn an extra 0.4% per year in annual returns?

- The equivalent risk/reward ratio of potentially missing out on $1 in profit to try to earn an extra $0.02

I’m not saying it’s time to back up the truck on MSFT or put all your money into this stock. I am saying that if you buy today, at these attractive valuations, you’ll likely be very pleased in 5+ years.

And over 10+ years, MSFT represents not just a very safe investment but one that could potentially change your life and help you retire in safety and splendor.

Be the first to comment