-Oxford-

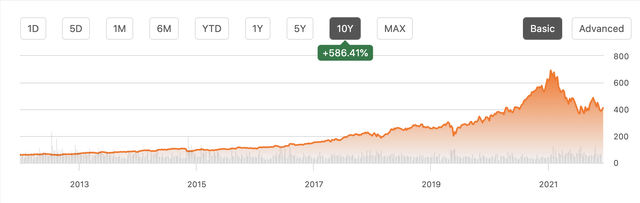

If you are an individual who files your own taxes, there is a good chance you use TurboTax. If you are a small business owner, you probably use Quicken. If you are looking at your credit score, you may use Credit Karma. Either way, you are using an Intuit (NASDAQ:INTU) product. These software solutions have become essential to everyday life. As a result, the stock has been an extraordinary long-term perform, but even with its premier franchises, it has not been immune to the tech wreck. After reaching a high of nearly $700 in 2021, shares have lost about 40% of their value. Even at this lower share price, I believe investors should avoid INTU. It simply is not the right type of stock for this market environment.

To be clear, my goal is not to be critical of Intuit the company-I think it is a fantastic company. My concern is with the valuation, share-based compensation, and the impact of higher interest rates. In fiscal 2022, the company generated $12.7 billion of revenue, up 24% pro-forma for M&A. Small business revenue was up an impressive 38%. Consumer revenue was up 10%; given TurboTax’s dominant position in the self-filing market, growth will be slower than in small business or Credit Karma. 10% is still pretty impressive, but likely as good as it will get. For the full year, non-GAAP earnings rose 22% but GAAP earnings fell by 4%.

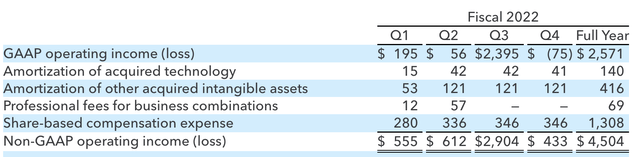

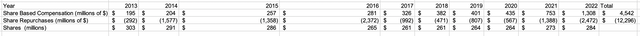

Now, many technology companies like to report non-GAAP results. One of the big items they exclude in non-GAAP is share based compensation, since this is a non-cash expense. However, it is still a cost, but rather than being a cash cost, it hits shareholders in the form of dilution by expanding the share count. Indeed as you can see below, that is the primary difference. Share-based compensation is $1.3 billion of the $1.8 billion difference. The remainder is amortization of intangibles, which I also view as a true expense. As we have seen in technology, unless you are constantly spending to enhance your product and intellectual property, new entrants can emerge and dethrone you. Current IP doesn’t retain its value forever; it does amortize its value over time.

The impact of this share-based compensation becomes apparent in this table I created from its financials. Over the past 10 years, the company has bought back over $12 billion in stock but given out $4 billion to employees. Share-based compensation is also recognized at the fair-value at the time of the grant, so if you grant a share at $100 and by the time it vests the stock is $300, if management wants to offset the dilution at vesting to repurchase the share the company has to spend $300. This is how share-based compensation gets expensive for shareholders.

As an investor, I don’t want to just see buybacks. I want to see share counts decline so that I own a bigger piece of the company. Now, Intuit has also done stock-based acquisitions, like of MailChimp, which added about 11 million shares to its count. But as you can see, its share count has not fallen by what one would expect given its large repurchases because a significant share of the buyback is really defraying a non-cash expense rather than truly returning capital to shareholders. This is why I believe investors should look at GAAP results first, unless there are truly extraordinary items.

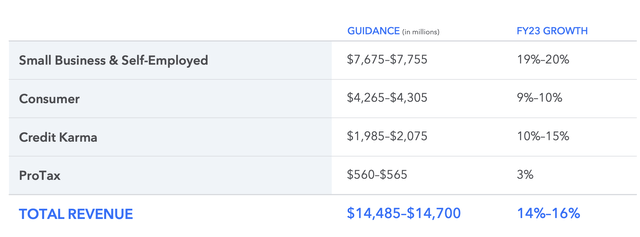

Now if we look at next year’s guidance, you may be inclined to say that the business is so strong that this accounting minutiae is losing the forest through the trees. After all, revenue growth is expected to be about 15%, driven again by small business with management expecting the TurboTax consumer unit to again be at about 10% revenue growth, a really impressive result given its existing market share.

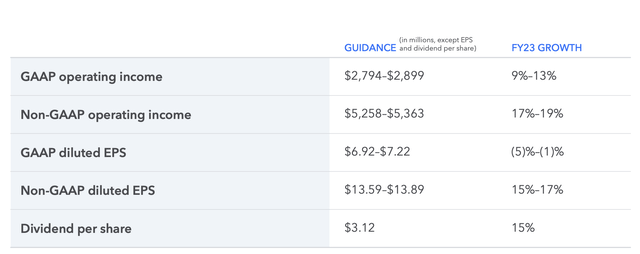

Interestingly, when we get to the profit guidance, that GAAP/non-GAAP wedge reappears. Non-GAAP operating income is going to rise 17-19%, a stellar forecast that is even faster than revenue growth. GAAP though is more muted at just 9-13%, lower than the revenue outlook. There is a $2.46 billion difference, and $1.8 billion of that comes from stock-based compensation; $660 million from amortization. That amortization figure is similar to last year, but that is a $500 million increase in share-based compensation, which from the table above has been rising substantially since 2019. As Intuit seemingly shifts more of its compensation to equity vs cash, that helps non-GAAP results, but it will just make share repurchase less effective in reducing the share count.

Indeed, it is noteworthy from the guidance that both GAAP and non-GAAP operating income growth are higher than their respective diluted EPS forecasts. This points to an implicit assumption of a higher share count. Intuit is growing strongly, but you may very well own a smaller piece of it in a year than you do today, so you will not realize that full growth of the business as an investor. With the stock trading at a 58x P/E off of GAAP numbers and a still hefty 30x non-GAAP multiple, these details matter.

This is particularly the case in a period of higher interest rates. Intuit shares enjoyed much of their bull-run during a period of low rates as investors chased growth, and as we have explained, Intuit is definitely a high-growth company. In that environment of very low-discount rates, growth may matter more than issues over accounting or share count. But with higher interest rates, valuation matters more, and while Intuit may be a great company, its stock is not built to perform in this environment.

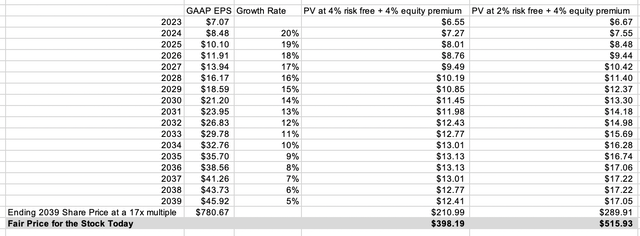

For making my valuation judgment, I am using GAAP EPS. Making long-term forecasts is always fraught with uncertainty, but I find them useful in framing out valuations. Being deferential to INTU’s strong results, I have assumed a 20% 2024 growth rate (higher than next year) slowing 1% per year to a terminal 5% by 2039. I then show the fair present value using a 4% risk free rate, given that is where the Fed expects to be before year-end, as well as 2% (more akin to the environment we were in last decade). I assumed investors would want a 4% risk premium over this risk-free rate. In the 2% interest rate world, Intuit is worth $515. But the same financial results in a 4% world make it worth less than $400.

Because high-growth companies earn so much of their profits out many years in the future, their valuations are highly sensitive to interest rate expectations. I also view these forecasts as optimistic. As the small business unit increasingly gains market share, its growth may slow like TurboTax. Assuming double digit EPS growth for a decade is being quite deferential to INTU’s growth potential, particularly if share-based compensation puts upward pressure on the share count.

Now, if you believe interest rates will start falling again, high-growth stocks may return into favor, and Intuit’s fair value would rise substantially, particularly as unlike many other high revenue growth stocks, Intuit is profitable with excellent products. I view this as the primary upside risk to the stock. However with inflation so high, the Fed determined to bring it down, and many other stocks trading at low valuations, the 2010s-like environment that allowed INTU to thrive appears unlikely. And with shares at nearly 60x earnings, the margin for error appears very low, making INTU’s risk reward profile unattractive.

Again, Intuit is a great company, but at the wrong valuation, great companies do not make great estimates. This was certainly the case when INTU was trading at $690. It remains the case with shares of above $410 in my view. With an optimistic fair value of $398, I am looking for shares to trade down to $360 (or a 10% discount to fair value) before I would consider buying. I actually hope INTU shares fall further as I would welcome an opportunity to buy a quality company like this at a discount, but at this price, investors should continue to be sellers of INTU. The multiple is too high in a higher interest rate world.

Be the first to comment