Viktoriya Kraynyuk/iStock via Getty Images

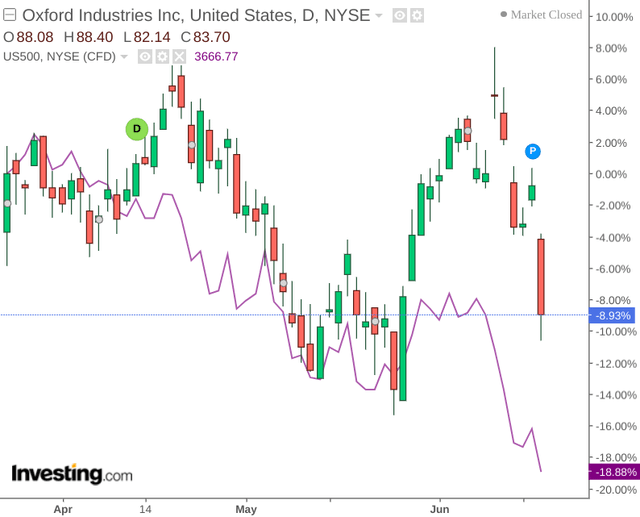

Investment Thesis: While Oxford Industries (NYSE:OXM) has seen a decline in stock price over the past two months, strong sales and earnings performance could mean that the stock is more attractively valued at this point.

Back in April, I made the argument that Oxford Industries could see some downward pressure as a result of supply chain concerns – in spite of encouraging growth in net sales.

Since then, the stock has declined – albeit by a lesser margin than the S&P 500:

My main reason for citing supply chain concerns at the time was the fact that a significant portion of the Tommy Bahama range is produced in China. With China just having emerged from broad COVID-19 lockdowns in large cities including Shanghai, this could have significantly affected the company’s ability to ship from China to the United States and meet consumer demand.

Given the recent release of Q1 2022 earnings performance, the purpose of this article is to assess whether we could see renewed scope for upside from here.

Performance

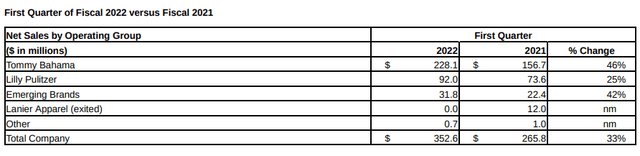

When looking at net sales, we can see that the company showed strong growth as compared to the same period last year – with Tommy Bahama showing the most growth on a percentage basis.

Oxford Industries Q1 2022 Earnings Release

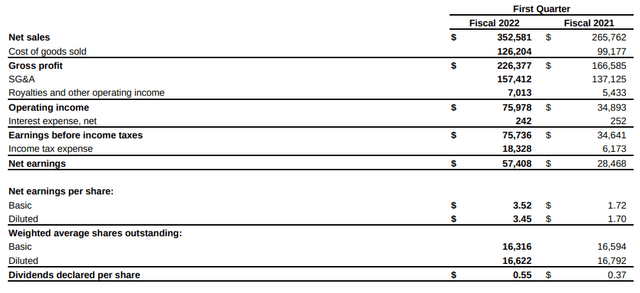

Earnings and dividends per share also showed strong growth:

Oxford Industries Q1 2022 Earnings Release

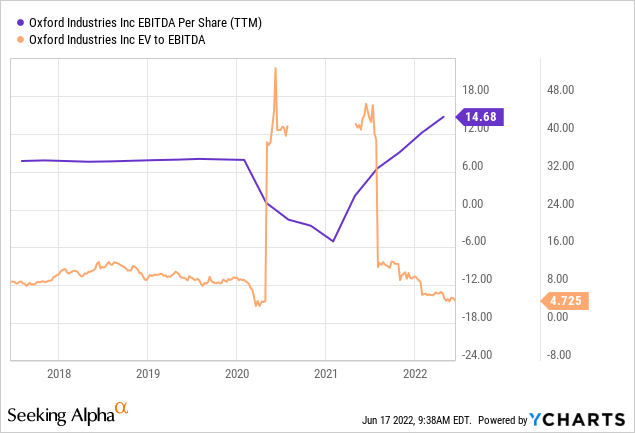

In this regard, we can see that EBITDA has continued to climb – while the EV/EBITDA ratio is trailing near a five-year low. This could be an indication that the selloff in the stock might be overdone and the stock is undervalued by the market:

ycharts.com

With that being said, it is probable that a degree of the growth in sales that we have been seeing are due to a revitalizing of demand for high-end clothing as the emergency phase of COVID abates.

Risks and Outlook

There is a significant possibility that sales growth could level off given inflationary pressures. In addition, the effects of COVID-19 lockdowns in China may only become apparent in the next quarter – namely the risk that Oxford Industries sees a significant decline in sales growth as a result of not being able to fulfill demand due to supply chain bottlenecks.

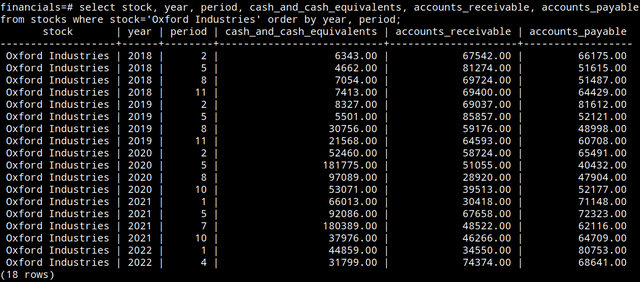

Should we see a drop in sales growth as a result – one aspect of the business that will likely prove important is the company’s ability to hold sufficient cash reserves. In this regard, I decided to collate quarterly data from 2018 to the present on cash and cash equivalents, and analyse the ratio of cash relative to accounts receivable (money which is due to Oxford Industries but has not yet been paid) and accounts payable (money which Oxford Industries owes to its own creditors). If Oxford Industries can maximize the cash it can hold onto relative to receivables and payables, then I take the view that the company will be better able to withstand a downturn in sales growth – as the company would be better able to buffer against payment delays while also holding adequate cash to pay its own suppliers.

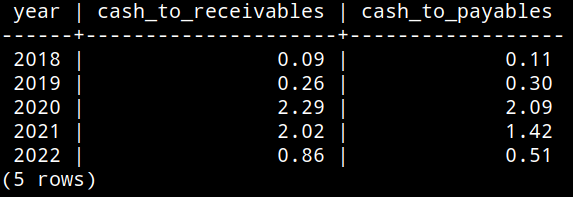

Quarterly data for cash and cash equivalents, accounts receivable, and accounts payable were collated into a SQL table. Data for the first two quarters of 2022 were also included.

Figures sourced from previous quarterly annual reports (2018 to present). SQL table created by author.

The cash to receivables and cash to payables ratios were calculated, with the results being averaged by year.

Financial ratios calculated using SQL.

We can see that while the ratio of cash to receivables and payables has fallen since 2020 (as the company was conserving large amounts of cash to make up for lower sales during the pandemic), we can still see that these ratios are still significantly higher than in 2018 and 2019.

For the remainder of the year, I take the view that investors will likely pay more attention to cash levels – particularly as inflationary pressures and supply chain concerns means a risk of sales growth leveling off. However, if Oxford Industries can continue to maintain strong supplies of cash and we do not see too big a drop in these ratios for the year as a whole – then I take the view that the stock could be in a good position to rebound once concerns regarding inflation become more stable.

Conclusion

To conclude, Oxford Industries has shown impressive growth in sales and earnings compared to the same quarter last year. While the stock has been down on broader market pressure – the stock looks like it could potentially be undervalued on an earnings standpoint. Should Oxford Industries be able to hold sufficient cash reserves to weather a potential slowdown in sales due to inflation, then the stock could see a rebound in upside once the broader macroeconomic situation improves.

Be the first to comment