xavierarnau/E+ via Getty Images

Aroundtown (OTCPK:AANNF) is a very interesting company within the European real estate sector with strong fundamentals, while it is currently offering a very high-dividend yield and a depressed valuation compared to its peers.

Company Overview

Aroundtown is a German real estate company, which was founded in 2004, and its core business is focused in the office market. Aroundtown has been listed since the end of 2015, and has nowadays a market value close to $5 billion, being by this measure a mid-sized company within the European real estate sector.

Investors should note that Aroundtown trades in the U.S. on the over-the-counter market, but liquidity is quite low and therefore it is a better option to trade its shares in its main listing on the German stock exchange.

Regarding its investment portfolio, Aroundtown’s strategy is to invest mainly in income generating properties, located on central locations in top tier European cities. Geographically, it invests in its domestic market, in the Netherlands and in London (U.K.).

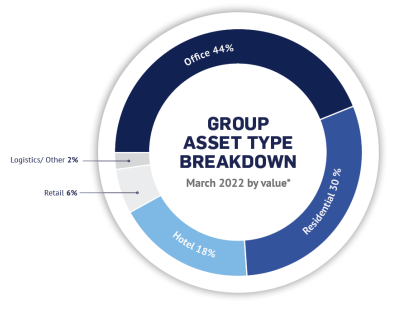

The vast majority of its investment portfolio is allocated to commercial real estate, while indirectly is also exposed to the German residential market through an equity stake on Grand City Properties (OTCPK:GRDDY) of 51%. At the end of last March, office represented the largest asset type with a weight of 44% of its portfolio value, residential accounted for 30% (including GCD at 100%), hotel accounted for 18%, while logistics and retail accounted for the remaining 8%.

Asset breakdown (Aroundtown)

Business Model and Portfolio

Aroundtown’s business model is relatively simple, aiming to buy and manage a portfolio of quality assets that generate recurring income. Beyond income, upside potential may come from higher rents or a lower vacancy rate, which should lead to higher property values over the medium to long term. Its tenant base is well diversified, with no dependency on single-tenants, and a large share of government tenants, which provides a highly safe and recurring cash flow profile. Indeed, its top ten tenants account for less than 20% of the company’s rental income, showing that tenant concentration is not an issue.

The company’s property portfolio was valued at some $25 billion at the end of March 2022, accounting Grand City Properties at relative consolidation, and had an annual rental yield of 4.3%. Its vacancy rate was 7.9%, an acceptable value for a company that is largely focused on commercial real estate. Note that Aroundtown’s growth strategy has been a mix of acquisitions and organic growth, with its portfolio growing quite rapidly in recent years considering that it was valued at just about $5 billion in 2016 when Aroundtown was listed.

From a geographic standpoint, its portfolio is well diversified across Germany, with the largest region (Berlin) having a weight of 25% in the portfolio, followed by North Rhine-Westphalia with a weight of 14%, while other regions have weights below 10%. In international markets, the company has some assets in the Netherlands and in London, but the combined weight in the portfolio is only about 12% of its total assets.

Aroundtown’s property portfolio has a rather defensive profile, given that the mix of a diverse tenant base, being approximately 3,500 commercial tenants, and its leases have a weighted-average term of about 7.7 years, providing a recurring profile of its revenues and cash flows over the medium term, and theoretically, should not be too exposed to economic cycles.

Going forward, Aroundtown should continue to pursue its growth strategy of acquisitions and active management of its portfolio, but the current challenging economic backdrop and the prospects of higher interest rates in Europe are two potential headwinds that should not be overlooked. Due to a high inflation rate, the European Central Bank has started to raise its key interest rates last month, which means that borrowing costs will be higher in the future when the company needs to issue new debt.

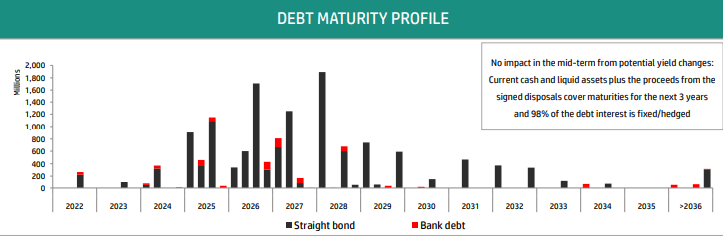

This will negatively impact its earnings and cash flows, while in the past few years it has benefited from the low interest rate environment to finance its portfolio growth. Nevertheless, Aroundtown’s current cost of debt is, on average, only 1.2% and its average debt maturity is close to six years, thus the effect of higher borrowing costs is expected to be gradual and should be relatively low in the couple of years, as the company doesn’t have significant debt maturities until 2025. Of its total debt of about $14.5 billion, less than $750 million mature during 2022-24, which means that Aroundtown’s average cost of debt is not expected to change that much in the short term.

Debt maturity (Aroundtown)

Another potential headwind is decreasing demand regarding the office segment, as the pandemic has changed how corporations organize their staff and work from home is now much more frequent than a couple of years ago. As Aroundtown is heavily exposed to office, it is necessarily affected by the trend, but its largest tenant segment is the public sector, accounting for about 30% of its tenant base in this segment, which for the most part should continue to require office space, while other segments, such as IT, are more likely to have lower interest in office space in the future. So far, the vacancy rate in this segment has increased only modestly, remaining near record low levels in Germany supported by still strong demand and some undersupply in major cities of office space in central locations.

Financial Overview

Regarding its financial performance, Aroundtown has a very good track record, due to its acquisition strategy that has led to very strong revenue, earnings, and cash flow growth over the past few years. While the company was affected by the pandemic in the hotel segments, and to some extent in the office as well, it was able to report strong financial figures over the past two years, showing that its business is highly recurring and sensitivity to economic cycles is lower than for other segments of the real estate market.

In 2021, Aroundtown’s net rental income amounted to $1.1 billion, an increase of 8% YoY, supported by a larger portfolio, while rents only increased by 0.3% YoY. Showing that its property valuations are conservative and the company can recycle capital and make profits, Aroundtown booked capital gains of around $800 million during 2021. This is quite positive given the headwinds created by the pandemic to the office and hotel segments, but also a strong indication that Aroundtown holds quality assets that are fairly valued on its balance sheet.

Its accounting profit was above $1 billion in 2021, but investors should not give much attention to this metric as it is inflated by capital gains, that aren’t recurring, and therefore funds from operations (FFO) is the best metric to look at regarding profitability. Due to inflationary pressures and uncollected rent, its funds from operations were $360 million, a small decrease from the previous year.

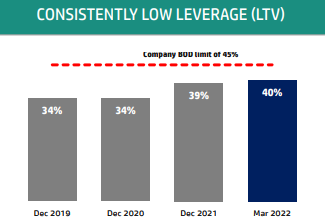

In the first quarter of 2022, Aroundtown remained quite active in its portfolio management, making several disposals above book value, further validating its portfolio valuations. Investors should note that Aroundtown started to consolidate GCP during 2021, thus its net rental income increased by 32% YoY to $310 million due to this factor, while rents have only increased by 0.9% YoY on a like-for-like basis. FFO was $90 million, an increase of 3% YoY, and the company maintained a strong balance sheet considering that, at the end of Q1, its loan-to-value (LTV) ratio, a key leverage indicator in the real estate industry, was 40%, which is a conservative level of leverage.

LTV (Aroundtown)

Supported by a recurring income profile and strong financial position, a key factor of Aroundtown’s investment case is its high dividend yield. While the company’s strategy is to have a sustainable dividend policy, aiming to deliver a growing dividend to shareholders, its current high dividend yield is mainly the results of a lower share price over recent months. Its dividend policy is to distribute some 65% of FFO to shareholders, which means that Aroundtown links its dividend distributions to cash flow rather accounting profits, a sensible option in my opinion.

Its last dividend was $0.24 per share related to 2021 earnings, an increase of 4.5% from the previous year. At its current share price, Aroundtown offers a dividend yield of about 7.4%, which is quite attractive from an absolute basis and also compared to other European real estate companies. However, investors should note that, like many European companies, Aroundtown only makes one distribution per year, thus the next payment will likely be made by mid-2023, reducing somewhat its income appeal.

Conclusion

Aroundtown is an interesting company within the European real estate sector, offering a high dividend yield that seems to be sustainable over the medium to long term. Moreover, Aroundtown is currently trading at a depressed valuation of only 0.27x NAV, a strong discount to the sector’s average of 0.58x NAV, reflecting its exposure to office and hotels that is currently out of favor.

This means that Aroundtown is currently a good income pick for long-term investors, offering a good combination of yield and potential upside when the economic cycle turns more favorable again for the real estate sector.

Be the first to comment