MesquitaFMS

Introduction

Burlington Stores (NYSE:BURL) prices are down 58% YTD; however, I believe the price decline will continue in 2022. Firstly, the company operates in the economy segment, where the consumer is most sensitive to rising inflation and a reduction in real incomes. Secondly, the company cannot pass on a 100% increase in input costs to the price, which puts pressure on the profitability of the business. In addition, elevated inventory levels in Q2 signal that the company will continue to sell aggressively and invest in marketing, which is also negative for margins. I did a valuation of the company using the DCF model, and as a result, I came to the conclusion that the company is still trading above its fair level.

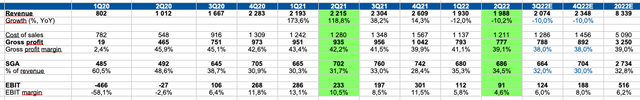

Survey of Q2 results:

On August 25, 2022, the company published financial results for the 2nd quarter of 2022, which turned out to be worse than investors’ expectations. Revenue decreased by 10% YoY due to a 19% decrease in LFL (guidance: -15%) due to: 1) the negative impact of high inflation on the cost of living in the US 2) high retailer inventory, which led to an increase in promotional activity.

Gross margin (as a percentage of total revenue): decreased from 42.2% to 39.1% due to higher freight costs and lower merchandise margins.

SGA: In addition, the operating margin was negatively impacted by an increase in SGA expenses (as a percentage of total revenue), which rose from 31.7% to 34.5% due to rising inflation in input costs, as well as an increase in purchase prices, which companies are not capable of being fully passed on to the end user.

The company’s operating margin continued to decline to 4.6% from 10.5% in 2Q21.

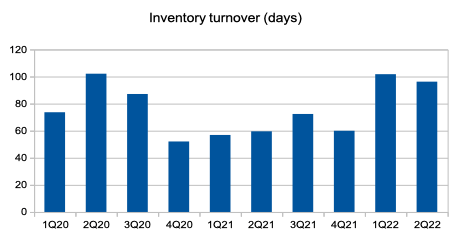

Also, I’d like to draw your attention to the elevated inventory levels that persisted in Q2, which in my personal opinion is a signal that we will see continued pressure on margins in Q3 as the company will be forced to reduce its gross margin to reduce inventory.

BURL official site (BURL official site)

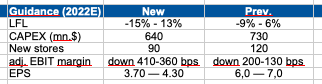

In addition, management lowered guidance for 2022, which caused a negative reaction from the investment community, which is clearly seen from the dynamics of quotations. I would emphasize that management has seriously cut its LFL forecast from -9%-6% to -15%-13% as the company’s target audience continues to experience pressure on real earnings as a result of rising inflation. In addition, the company has reduced its plan to open new stores from 120 to 90 stores. Also, management expects increased influence on adj. EBIT margin as a result of a reduction in gross margin and pressure from the SGA (% of revenue).

BURL official site

Valuation

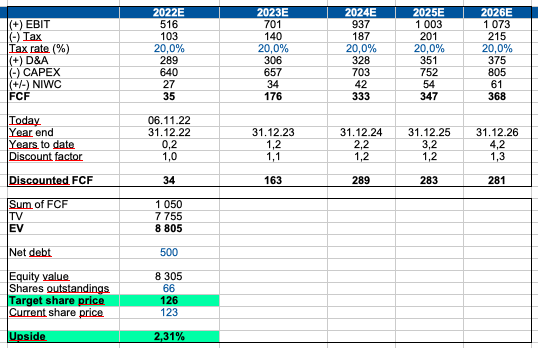

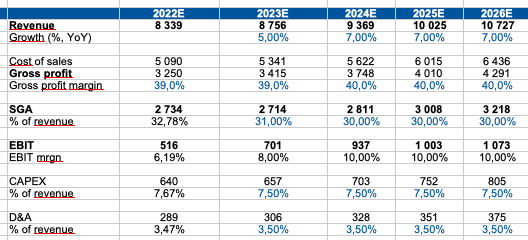

I believe that the DCF model can be used to estimate Burlington Stores because we can 1) predict the revenue growth rate based on management forecasts for LFL and new store opening rates 2) forecast gross margin and SGA (% of revenue) based on historical data and management forecasts for the coming years.

Main assumptions:

Gross margin: I am planning to reduce the gross margin in 2022 and 2023 to 39% in accordance with current trends and company management forecasts. Further, I allow an increase in gross margin up to 40% in subsequent periods.

SGA margin: in line with Q1 and Q2 22, we see that the company is facing an increase in SGA costs, in line with management comments, I predict a similar dynamic for 2022 and a gradual decrease in SGA (% of revenue) until 2026.

EBIT margin: I, therefore, expect significant pressure on margins in 2022 and a gradual recovery in margins through 2026 due to the company’s ability to raise product prices and improve cost control after the end of the interest rate hike cycle.

CAPEX: in 2022, I rely on the guidance of the company, then I lay down the historical level (capex % of sales).

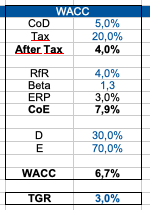

Terminal growth rate: 3.0%

WACC: 6.7%

Personal calculations (Personal calculations)

DCF model:

Personal calculations (Personal calculations)

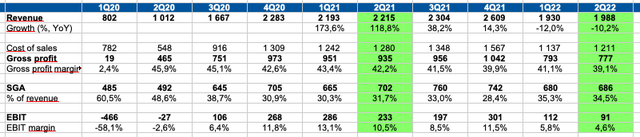

Quarterly projections:

Personal calculations (Personal calculations)

Yearly projections:

Personal calculations (Personal calculations)

Drivers

Macro improvement: a decrease in inflation will lead to an increase in real income, which is especially important for the company’s target audience. Growth in consumer confidence will lead to growth in revenue and LFL.

Increasing the prices of the company’s goods: an increase in the prices of products will help reduce the share of expenses (% of revenue) and restore the profitability of the business.

Cost reduction: SGA’s cost control and business process efficiencies can also drive margin growth and a reassessment of the company’s prospects.

Risks

Deteriorating macro and revenue growth rates: further increase in interest rates will continue to have a negative impact on the consumer, as a result, demand for the company’s products will continue to decline.

Gross margin reduction: High inventory levels, competition and increased marketing activity can lead to a decrease in business profitability if the company fails to successfully raise product prices.

Growth in the share of SGA (% of revenue): the growth of inflation entails an increase in incoming costs, which is difficult to pass on to the consumer in the mass market segment.

Conclusion

Despite the significant decline in the share price, I do not see the potential for growth according to my personal DCF model. I believe that the company will continue to face pressure on profitability in the following periods because: 1) the company operates in the mass market segment, where the consumer is highly sensitive to price increases 2) rising input costs put pressure on the operating margin of the business 3) high level of commodity stocks will continue to put pressure on the company’s gross margin.

Thus, given my assumptions in my model, I believe that the fair price of the stock is $126 (according to my DCF model), which means that there is no fundamental upside at the moment. In addition, I believe that in the coming quarters we will not see catalysts for growth and reassessment of the company’s prospects.

Be the first to comment