mikolajn

Introduction

I give Berkshire Hathaway (NYSE:BRK.B, NYSE:BRK.A) a buy rating. Berkshire is more than prepared to handle my estimated $3 billion loss from Hurricane Ian. Additionally, the company’s risk-off approach is excellent for economically uncertain times.

Berkshire Hathaway is a United States based conglomerate run by Warren Buffett and Charlie Munger. Per the company’s latest SEC filing, the company has $100 Billion in cash and short-term investments. Additionally, the company has grown 213% over the past ten years, or 21.3% per year.

Hurricane Katrina

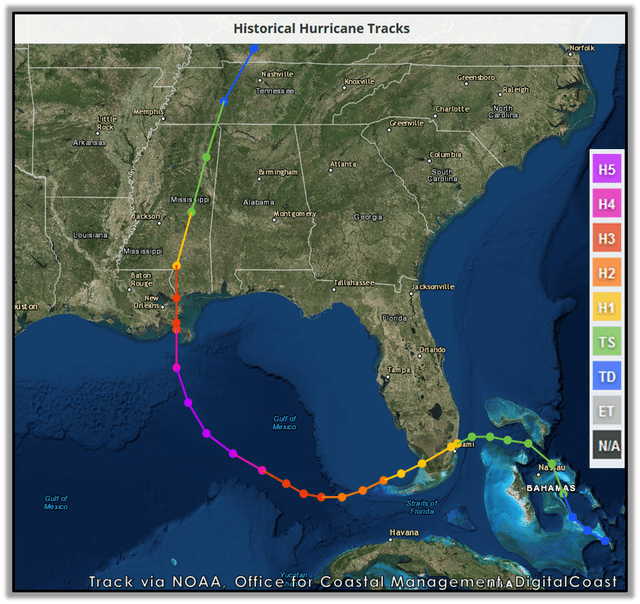

Hurricane Katrina’s path (National Weather Service)

The most expensive hurricane to date, as well as the most expensive natural disaster to date, was Hurricane Katrina, which struck the United States twice, causing an estimated $108 Billion in damages. Katrina’s second landfall was as a Category 5 storm, slightly more potent than Hurricane Ian.

Berkshire’s Loss

The effect on Berkshire Hathaway from Katrina can be seen in its 2006 annual letter, where Warren Buffett states:

In 2007, our results from the bread-and-butter lines of insurance will deteriorate, though I think they will remain satisfactory. The big unknown is super-cat insurance. Were the terrible hurricane seasons of 2004-05 aberrations? Or were they our planet’s first warning that the climate of the 21st Century will differ materially from what we’ve seen in the past? If the answer to the second question is yes, 2006 will soon be perceived as a misleading period of calm preceding a series of devastating storms. These could rock the insurance industry. It’s naïve to think of Katrina as anything close to a worst-case event

While Buffett never directly says the cost to the company from the storm, we can make an educated guess. As I will show later, Berkshire Hathaway is at risk for about 3% of any major catastrophe in the United States. If this holds for 2005, the company would have lost roughly $3 Billion from Hurricane Katrina.

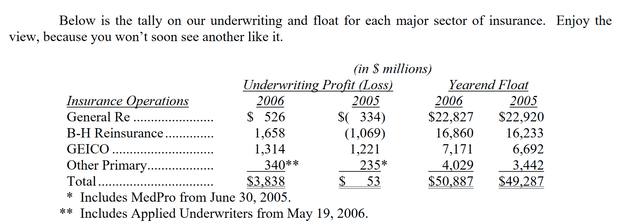

Looking at the chart below, we can deduce that the company had a $2.5 Billion difference in earnings from 2006 to 2005 in the company’s reinsurance business. And, since no other significant events happened during this period, we can conclude that the total damages from Katrina equaled this amount. Further backing up this number, Buffett stated in his 2005 annual letter, “We estimate our loss from Katrina at $2.5 billion – and her ugly sisters, Rita and Wilma, cost us an additional $.9 billion.”

Berkshire Hathaway 2006 Annual Letter

After Hurricane Katrina, the company looked at its mega cat insurance business, which likely helped it during Hurricane Ian. From the same 2005 annual letter:

It’s an open question whether atmospheric, oceanic or other causal factors have dramatically changed the frequency or intensity of hurricanes. Recent experience is worrisome. We know, for instance, that in the 100 years before 2004, about 59 hurricanes of Category 3 strength, or greater, hit the Southeastern and Gulf Coast states, and that only three of these were Category 5s. We further know that in 2004 there were three Category 3 storms that hammered those areas and that these were followed by four more in 2005, one of them, Katrina, the most destructive hurricane in industry history. Moreover, there were three Category 5s near the coast last year that fortunately weakened before landfall.

Was this onslaught of more frequent and more intense storms merely an anomaly? Or was it caused by changes in climate, water temperature or other variables we don’t fully understand? And could these factors be developing in a manner that will soon produce disasters dwarfing Katrina?

Joe, Ajit and I don’t know the answer to these all-important questions. What we do know is that our ignorance means we must follow the course prescribed by Pascal in his famous wager about the existence of God. As you may recall, he concluded that since he didn’t know the answer, his personal gain/loss ratio dictated an affirmative conclusion.

So guided, we’ve concluded that we should now write mega-cat policies only at prices far higher than prevailed last year – and then only with an aggregate exposure that would not cause us distress if shifts in some important variable produce far more costly storms in the near future. To a lesser degree, we felt this way after 2004 – and cut back our writings when prices didn’t move. Now our caution has intensified. If prices seem appropriate, however, we continue to have both the ability and the appetite to be the largest writer of mega-cat coverage in the world.

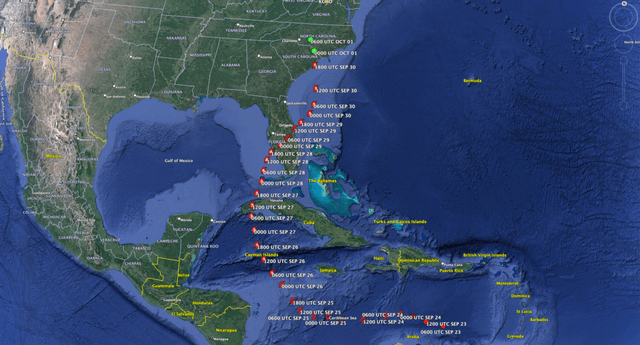

Hurricane Ian

Hurricane Ian made landfall twice. The first landfall occurred on September 28th near Cayo Costa in Southwest Florida. At landfall, the Category 4 Ian had a reported wind speed of 155 mph, just two mph short of being classified as a Category 5 Hurricane. It is likely that this wind speed will be revised in the coming months and could potentially even be revised to a Category 5. The hurricane rapidly cut across the Florida Peninsula and then worked its way up to Georgetown, South Carolina, where it made its second landfall as a Category 1 Hurricane.

Ian thrashed parts of Florida’s western coast, bringing intense winds, heavy rainfall, and catastrophic storm surges. A storm surge with inundation of an unprecedented 12 to 18 feet above ground level was reported along the southwestern Florida coast, and the city of Fort Myers itself was hit particularly hard with a 7.26 foot surge – a record high.

After the powerful coastal impact, Ian made its way across the state, and it managed to produce extreme rainfall, producing 1-in-1000-year amounts in some places. In addition to this excessive rainfall, the ground was already incredibly saturated in Central Florida, which led to devastating flooding.

Loss projections at this stage vary quite a bit. Still, a respectable loss modeler says he expects over $100 Billion in damages, making it the most costly Hurricane in Florida history.

Berkshire’s Loss

In 2005, we saw the company take on about 2.5% of the total damages of Katrina. In most Hurricanes, Buffett has stated that he expects to take about 3% of the damages, as seen in his 2017 annual letter:

I have warned you, however, that we have been fortunate in recent years and that the catastrophe-light period the industry was experiencing was not a new norm. Last September drove home that point, as three significant hurricanes hit Texas, Florida and Puerto Rico.

My guess at this time is that the insured losses arising from the hurricanes are $100 billion or so. That figure, however, could be far off the mark. The pattern with most mega-catastrophes has been that initial loss estimates ran low. As well-known analyst V.J. Dowling has pointed out, the loss reserves of an insurer are similar to a self-graded exam. Ignorance, wishful thinking or, occasionally, downright fraud can deliver inaccurate figures about an insurer’s financial condition for a very long time.

We currently estimate Berkshire’s losses from the three hurricanes to be $3 billion (or about $2 billion after tax). If both that estimate and my industry estimate of $100 billion are close to accurate, our share of the industry loss was about 3%. I believe that percentage is also what we may reasonably expect to be our share of losses in future American mega-cats.

Using the estimated $100 Billion in losses and Berkshire’s likely 3% cut, we can reasonably project that Berkshire Hathaway will face around $3 Billion in losses from Hurricane Ian, making it the most expensive hurricane in history for the company. The company is more than adequately prepared for a loss of this magnitude, and I believe that, in the end, the company will come out ahead because of this storm. Many competing reinsurance companies will not be able to sustain losses as well as Berkshire can, and this will likely put them in precarious places, allowing Berkshire to come in and scoop up even more business.

Risks and Conclusions

Berkshire Hathaway is about as safe an investment as you can make in a single company. They are incredibly diversified, have incredible management, and pride themselves on risk mitigation. However, due to these qualities and the company’s large size, it is challenging for the company to grow. As a result, the most considerable risk of investing in Berkshire Hathaway is underperforming the market.

Hurricane Ian will affect the company, but it is something they have prepared for and will most likely be able to capitalize on to expand their business. I think Berkshire is a very steady company and is a good investment for rocky economic times due to the company’s risk-off approach. For this reason, I give the company a buy rating.

Be the first to comment