Images By Tang Ming Tung

The Children’s Place (NASDAQ:PLCE) presents mouth-watering upside in 2023, with the share price potentially doubling or more if the business performs as expected.

Who They Are

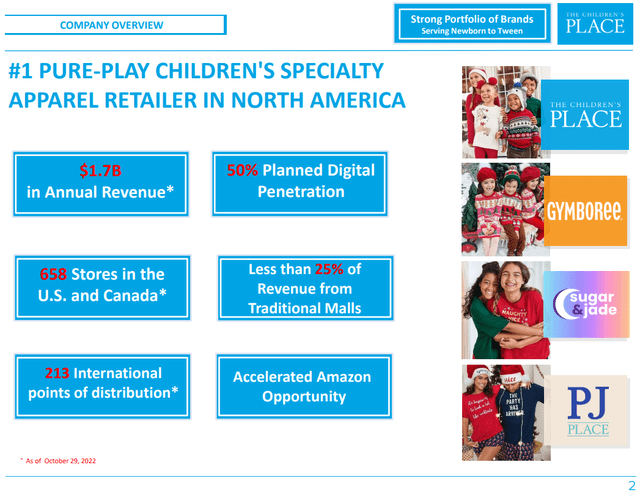

PLCE is a children’s specialty apparel retailer, primarily selling through its own E-Commerce efforts, Amazon (AMZN), and a fleet of 658 stores:

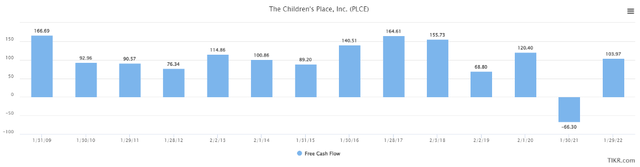

PLCE consistently generates free cash flow, an average of $101m per year since 2009…

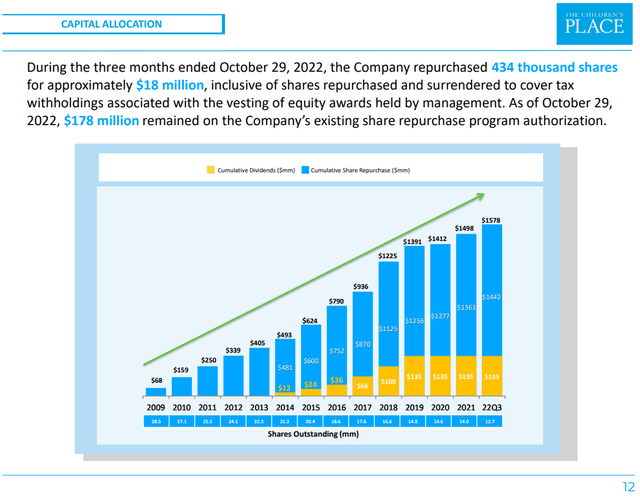

… and they consistently repurchased shares over the past decade+:

Almost dollar for dollar, every cent of free cash flow since 2009 was used for share repurchases. PLCE has reduced their share count by 15.8m shares since 2008 at an average cost of $91.27 per share (2.6x the current share price).

FY23 Story

PLCE has multiple tailwinds for 2023 that should serve as catalysts for the stock price to rerate.

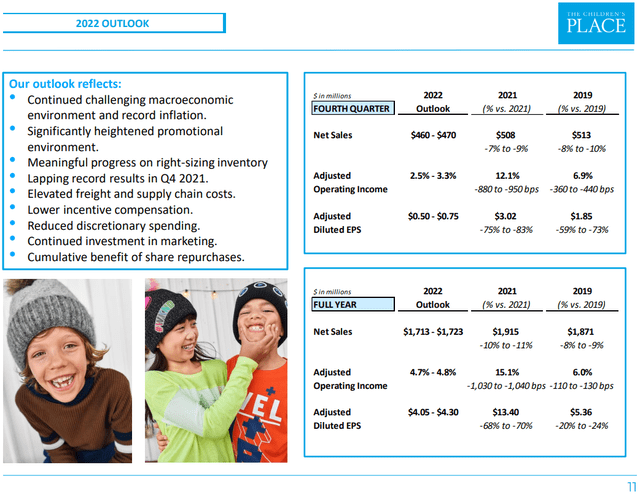

First, FY22 comps poorly to FY19 and even worse to a stimulus-fueled FY21, with declines in sales, operating income, and earnings per share:

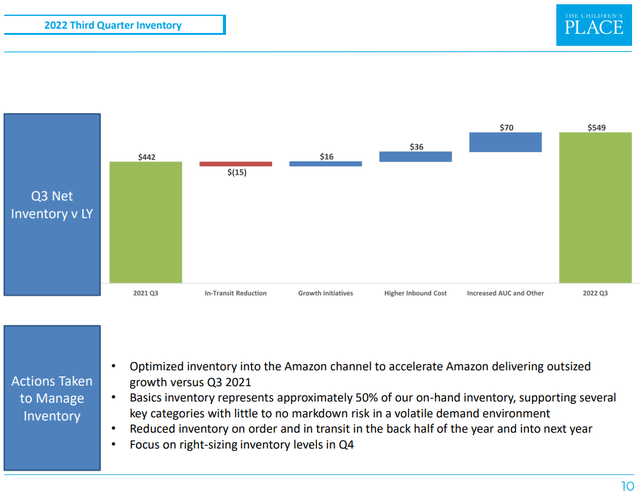

Net inventory increased 24% year over year, driven almost entirely by increased costs (i.e. freight and cotton pricing). This working capital increase depressed cash generation and helped reduced gross margins by 900 bps year over year:

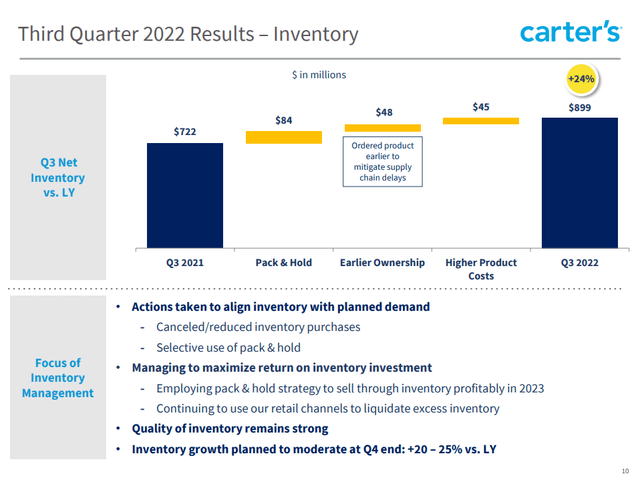

Carter’s (CRI) highlighted a similar year-over-year net inventory increase (24%), but the increase at Carter’s was a result of unit increases (18%) in addition to higher costs (6%):

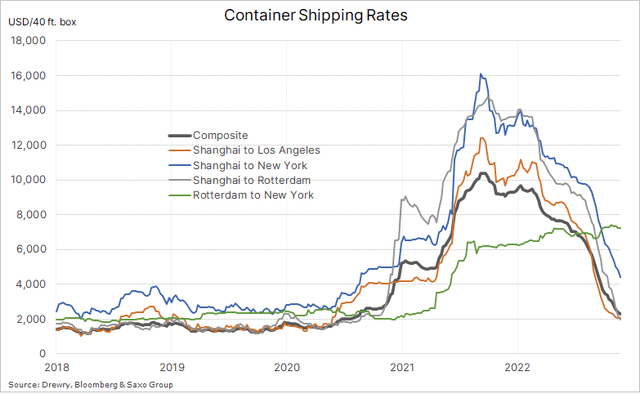

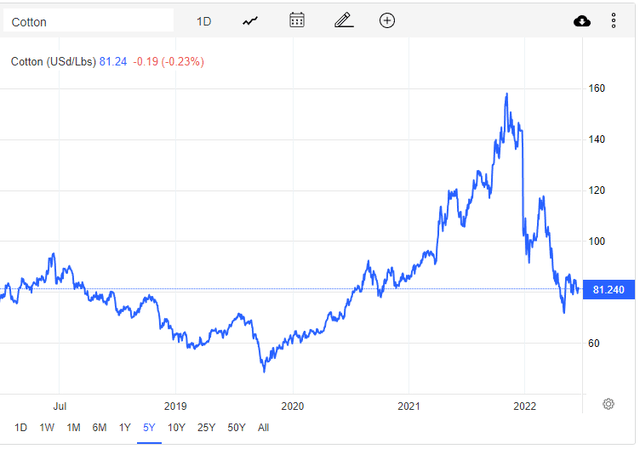

The distinction in inventory growth is important. PLCE was more susceptible to increased cost pressures, meaning they will have more torque as these pressures abate. Cotton prices and freight expenses have already moderated substantially (via TradingEconomics):

Drewry, Bloomberg & Saxo Group

These costs have pressured PLCE’s working capital and gross margins, both of which become tailwinds in FY23, particularly in the latter part of the year. PLCE noted on their last call that Average Unit Retail (AUR) is up 4% Y/Y, meaning they were able to raise prices but not enough to offset the margin pressures from cost increases.

FY23 Estimates

Back of the envelope, I expect the following for FY23 financials:

-

Revenue of $1.7B – down about 1% from FY22 to reflect promotional environment and tighter financial conditions, down 9% from FY19

-

Gross Profit of $595m – Gross Margin of 35% is flat vs FY19 to reflect cost pressures continuing in the first half of FY23 but significant moderation in second half

-

SG&A of $425m (25% of sales) – reflects current run rate

-

D&A of $50m, Interest of $10m, Taxes of $30m

-

$80m Net Income – assume 12m shares outstanding – $6.67 EPS

Note – you would need to bring gross margin to 30% before generating a GAAP loss in the above scenario.

Free Cash Flow

-

$130m Cash From Operations

-

Plus $25m Stock Compensation

-

Plus $100m Working Capital benefit

-

Less $50m CapEx

-

$205m Free Cash Flow (MC/FCF = 2x, EV/FCF = 3x)

If PLCE continues their share repurchase strategy of the past 15 years, our FY23 FCF projection suggests they could repurchase around half of the current outstanding shares. Even if the Company held back the working capital benefit to reduce leverage (leaving $105m for buybacks in FY23), they could still repurchase about a quarter of the current market capitalization.

If the company is able to repurchase 25-50% of the current market capitalization in FY23, and poised to earn meaningful free cash flow in future years, I expect strong upward pressure on the current $34 share price.

Expected Pushback & Risks

1. PLCE is a mall-based retailer with leverage – what are you thinking?

-

An understandable concern when first analyzing PLCE; however, ~50% of PLCE sales are e-commerce (Amazon or their own website), which Management has noted is the highest margin segment. One third of their stores closed since 2019 and 75% of their remaining leases expire in the next 24 months. PLCE is tracking towards ~$150m of lease expense in FY22 (vs $213m in FY19). PLCE has had success reducing expenses by eliminating under-performing stores and renegotiating more favorable terms for stores that remain open.

2. This management team is terrible at allocating capital, given the fact they spent $1.4B buying back stock and the Company now trades below a $500m market cap.

-

Maybe, or maybe an average buyback price near $90 represented a decent value before the Company was walloped by an unpredictable pandemic and subsequent supply chain crisis. PLCE made a strategic choice to compete with Gymboree on price prior to the pandemic, eventually buying their assets out of bankruptcy for $76m. Today Gymboree represents 15% of PLCE’s sales, over $250m. Reducing outstanding shares by over 50% and making one solid acquisition isn’t the worst capital allocation I’ve seen in retail, especially since they avoided a liquidity crisis during Covid.

3. E-commerce is low margin, the pandemic and stimulus pulled forward a ton of demand, and you are underestimating how bad things will be in a recession.

-

FY23 can absolutely end up worse than I’ve laid out above. That said, I’m comfortable with the margin assumptions, especially given the reduction of lease expense already saved more than 350 bps of gross margin versus 2019, and cotton and freight have normalized. E-com was 37% of 2019 sales and is now 50%, which improves margins for PLCE. In 2007-2009 PLCE (and Carter’s) grew revenues steadily through the recession, giving me confidence they can navigate a future consumer downturn.

4. Uh, oil is going over $200 and inflation and wages are higher for longer. You live in fantasy land if you think margin pressures resolve in FY23.

-

Anything is possible, we try to avoid putting too many eggs in a single macro basket. We also own some energy stocks and defensive businesses that we expect to do well in the above scenarios, but we think PLCE deserves consideration for a more balanced portfolio. PLCE serves a less-discretionary segment and has done well in most macro backdrops.

5. Debt has been growing, aren’t you worried about liquidity?

-

I’m always worried about liquidity. As of Oct-22, PLCE had $272.4m debt and $77.6m available under their ABL, with a strong history of cash generation. Paying down the debt is one alternative use of cash that may limit share buybacks in FY23.

-

PLCE owns a 700k square ft distribution center in Fort Payne, Alabama that I expect would fetch $50m or so in a sale leaseback, adding to their liquidity profile.

6. Management doesn’t seem to believe it’s time to buy.

-

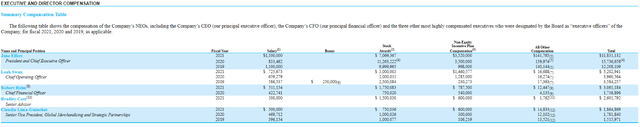

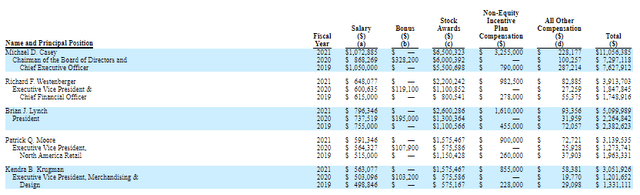

It’s a valid criticism – despite the share repurchases, only ~5% of outstanding shares rest with Management, the majority of which were acquired via grants. The executive team paid themselves nearly $30m for FY21 results, which one could certainly argue is a bit rich for the size of the business and when compared to the larger Carter’s business:

7. Speaking of Management, what’s with the revolving door at CFO?

-

The former PLCE CFO hit retirement in 2020 and Rob Helm was installed, being terminated after a year without cause. Helm quickly took over as CFO at $4B market cap Ollie’s (OLLI), suggesting he just wasn’t a good fit for PLCE.

8. You keep mentioning Carter’s, why not just buy them?

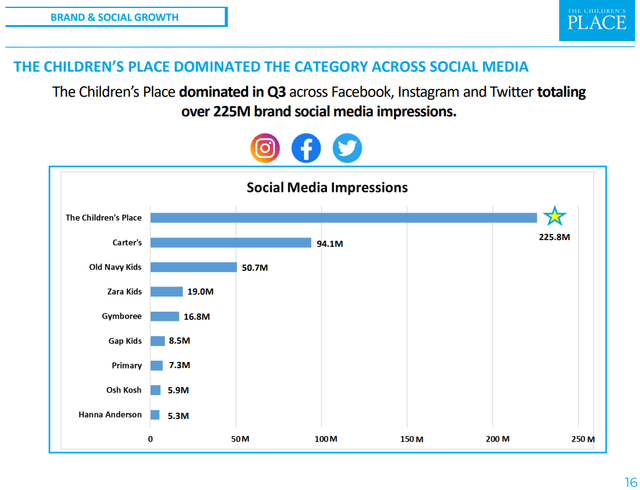

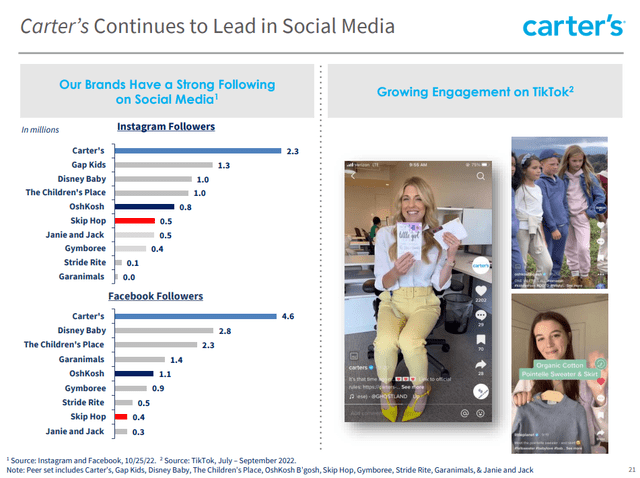

- Carter’s has less tailwinds from inventory issues and trades around four times the valuation (with 2x the sales), so I don’t see the same opportunity. Carter’s aims slightly higher in the market in terms of price and quality, which may make them more susceptible to demand declines in a downturn. Both companies boast about their social media reach, with PLCE focused on engagement versus total followers:

PLCE IR Presentation CRI IR Presentation

9. Almost 20% of shares outstanding are sold short, aren’t you on the wrong side of the smart money?

-

It’s always a risk, sure. The guide for Q4 was disappointing, and maybe investors expect further pain if FY23 guidance is underwhelming early next year. I think there are easier targets to bet against that generate much less cash. We will see – it’s what makes a market!

Kardashian Connection?!?

The level to which the Kardashian family has worked with PLCE in recent marketing campaigns is interesting, and Kim recently launched a private equity endeavor with a former Carlyle Group (CG) partner. Kim is looking for consumer and e-commerce investments and is apparently close with PLCE, so a future acquisition by her fund would not shock me. Longshot? Absolutely.

Conclusion

The Children’s Place is one of many retailers with deteriorating financial results, holding expensive inventory after a record-breaking FY21. However, its future working capital benefit, flexible lease base, ample liquidity, history of share repurchases, and inventory cost tailwinds set up PLCE for a spectacular reversion to the mean trade. Can PLCE generate over $200m of free cash in FY23 and plow it all into buybacks? It certainly seems possible, which would likely produce a three-figure share price within the next twelve months.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment