Drew Angerer

SQ Likely Bottomed In October 2022

Block, Inc. (NYSE:SQ) has outperformed the market since our previous update in late October, suggesting that the market has likely priced in significant pessimism.

We remain confident that SQ should continue consolidating constructively, with buyers confident in supporting its October lows, with its reward/risk more well-balanced after the recent recovery. Despite that, we remain confident that SQ’s potential is still skewed toward the upside from the current levels, even though we expect some near-term volatility.

The company’s underlying Square (merchant) and Cash App (consumer) ecosystems demonstrated their resilience, as Q3 metrics surprised to the upside, despite worsening macros. Therefore, the company’s strategy of developing an encompassing ecosystem away from Apple’s (AAPL) and PayPal’s (PYPL) is still on track, even though its profitability remains a work in progress.

Despite that, the company has shown that it has constructive OpEx levers to pull to reduce its investments and focus on lifting its operating leverage through the cycle.

Even though SQ’s YTD total return of -56% could suggest significant damage has been inflicted, its valuation is still configured with a premium against its peers.

As such, we believe the market needs Block to continue improving its profitability growth in 2023, corroborating its ability to gain share and grow adoption while improving its average revenue per user (ARPU).

The Fed’s Hawkish Stance Could Hamper Block’s Progress

However, it remains to be seen whether Block’s recent improvement in its underlying segments could be sustained moving ahead. Moreover, the Fed is committed to keeping its terminal rate at 5.1% (median) for 2023 before considering cuts in 2024. As such, investors need to assess the potential for a deeper downturn in its seller ecosystem, which could be disproportionately impacted.

Even though the company’s Bitcoin (BTC-USD) revenue growth has fallen significantly from its 2021’s highs, it still accounted for 39% of its FQ3 revenue base, while its gross profits accounted for 2.3% of its gross profits on a corporate level.

We assessed that the crypto winter has likely worsened the volatility seen in SQ over the past year. Therefore, investors need to be wary that the bad vibes in crypto could continue to be a drag against SQ’s recovery moving ahead, even though its direct contribution is immaterial to the company’s profitability.

Despite that, the company sees Bitcoin adoption as a critical lever in its bid to topple the traditional payments technology companies. However, as we also discussed in our PayPal and Visa (V) articles (here and here), these companies possess significant competitive moats. In addition, Visa has demonstrated that its global omnichannel approach continues to proffer solid profitability, benefiting its cross-border revenue recovery.

While Block has improved its ability to scale internationally, it faced macro and forex headwinds in 2022. But, its international revenue share of its total revenue of 7.1% in Q3 (up from Q2’s 5.8%) suggests that Block’s main growth driver remains in the US.

SQ: Expensive Compared To Peers

SQ’s valuation is not cheap. It last traded at an NTM EBITDA multiple of 37.4x. With a projected adjusted EBITDA margin of just 5.2% for FY22, investors could consider it as its glass half full or half empty. Compared to its peers’ median of 11.4x (according to S&P Cap IQ data), the market likely expects Block to continue lifting its operating leverage rapidly.

As such, we gleaned several questions in its Q3 earnings commentary by Street analysts who were justifiably concerned whether the company’s earnings growth trajectory could be impacted in FY23.

Management’s near-term outlook did not suggest that Block could face significant headwinds, but it was not yet ready to telegraph its FY23 guidance.

With the Fed’s monetary policy likely remaining firmly in the restrictive zone for FY23, we believe it could work against its Square ecosystem and less affluent Cash App customer base if a deeper recession were to occur. Coupled with its relatively expensive growth premium, we urge investors not to rule out ongoing volatility as the market assesses the impact of the Fed’s hawkish stance in 2023.

In the near term, we don’t expect the market to expect Block to deliver robust profitability metrics as seen in PayPal’s and Visa’s business models. But, of course, that depends on whether Block could continue to deliver significant operating leverage gains.

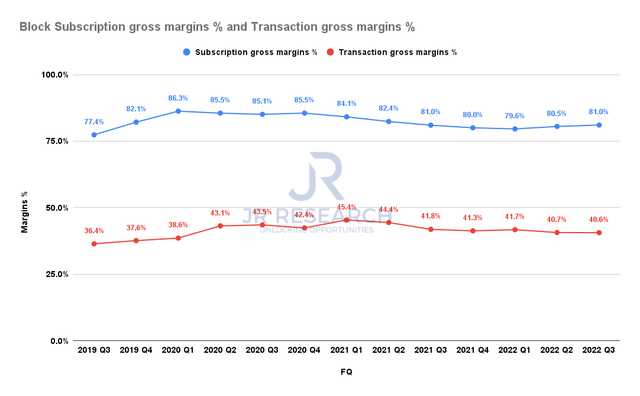

Block Gross margins by segment % (Company filings)

Hence, we urge investors to watch its segment gross margins closely, particularly in its higher-margin subscriptions & services segment. It’s imperative that its margins do not deteriorate further.

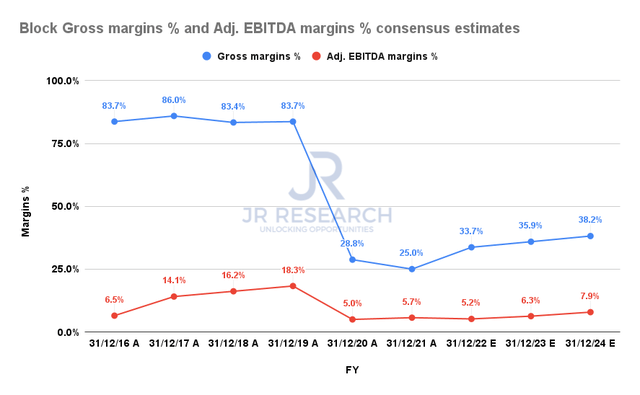

Block Gross margins % and Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The Street expects Block’s gross margins to continue its recovery through FY24. However, the Street has also gotten SQ’s ratings wrong over the past year, as it fell steeply from its 2021 highs. Therefore, it’s critical to apply a generous margin of safety on its estimates, given its embedded growth premium.

Takeaway

While we observed a strong recovery from its October lows, we urge investors to be cautious about expecting SQ to retake its August highs anytime soon.

Retaking its August highs would imply an NTM EBITDA target multiple of nearly 50x. We believe such an aggressive valuation approach is risky. Therefore, investors should consider adding more exposure closer to its October levels and wait patiently for pullbacks to improve their reward/risk.

Maintain Buy with a PT of $85, but we encourage investors to layer in over time.

Be the first to comment