Scott Olson

Investment Thesis

Wingstop (NASDAQ:WING) stock has soared since it went public in June 2015 at $19/share. Since the IPO, WING has trounced the S&P 500 returning 624% vs. 116% for the benchmark as the Company grew its system-wide store count from 845 stores at the end of 2015 to 1,898 stores as of the most recent quarter ended September 24, 2022. However, based on the stock’s current valuation of ~100x earnings, I believe investors are vastly overestimating the Company’s ability to create enough shareholder value to justify the current market price. As I will discuss below, I believe the Company’s historical growth rate will be difficult to maintain amidst a number of headwinds.

Context: Market Appears Bullish on WING

According to Seeking Alpha, only one Wall Street analyst has a sell rating on the stock as it stands at $154/share. After the most recent earnings report on October 26, the stock spiked in response to the Company beating revenue and earnings expectations. Management expressed a bullish tone on the call and did not seem concerned about a possible macroeconomic or company-specific slowdown ahead. However, as I will discuss, there are many harbingers of slower growth ahead and eventually a lower stock price.

Insider Selling

Perhaps the most salient bearish indicator is the absence of open market purchases by executives or directors since at least February 2021 according to Openinsider.com tracking. The Company’s executives are instead selling significant amounts of stock, especially for a mid-cap company. Since February 2021, board members and executives have sold a combined $24.4 million worth of stock while purchasing $0 worth at market prices with their own money. Most notably, CEO Michael Skipworth recently dumped $608,411 worth of stock just 5 days after the upbeat earnings report on October 26.

Executive Turnover

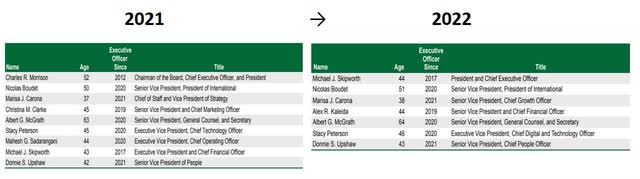

In my view, the stark difference between the executive officer list from the 2021 proxy statement to the 2022 proxy statement provides clear evidence of retention issues at the Company. Since the 2021 Proxy Statement was filed on April 16, 2021, the Company has seen the departure of its CEO and Chairman of the Board, Chief Operating Officer, Chief Technology Officer, Chief Marketing Officer, and President of International. The only executive with the same title as in 2021 is SVP, General Counsel and Secretary Albert McGrath. Each executive officer listed in the 2022 proxy statement either has a new title from last year or is no longer with Wingstop. Nicolas Boudet appears in both proxy statements; however, it was announced that he took a new role as Chief Operating Officer with Dairy Queen in September 2022.

Executive Turnover/Shuffling (WING Proxy Statements)

Most notably, former Chairman and CEO Charlie Morrison unexpectedly left the Company in March 2022 after 10 years to become the CEO of a much smaller chain of 60 salad drive-thrus called Salad and Go. Morrison was best known for leading the Company through its IPO and subsequent growth as a public company. To replace Morrison, Wingstop appointed its CFO Michael Skipworth as CEO and made Lead Independent Director Lynn Crump-Caine Chair.

Recently, Chief Digital and Technology officer Stacy Peterson left the Company on December 2 to become CEO of Jeni’s Splendid Ice Creams, a private equity backed firm. In my view, this departure is particularly important as Peterson worked for Wingstop since 2013 aside from a short unrelated stint at another company, making her one of the most experienced executives still left up until now. For a restaurant franchisor and operator which claims (see below) to be a “tech company”, I believe the recent loss of their top technology officer is important to highlight.

Technology Company (Wingstop Investor Presentation 5.17.22)

Balance Sheet and Cash Flows

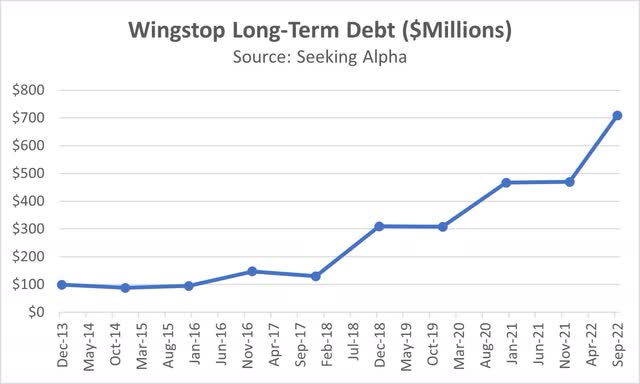

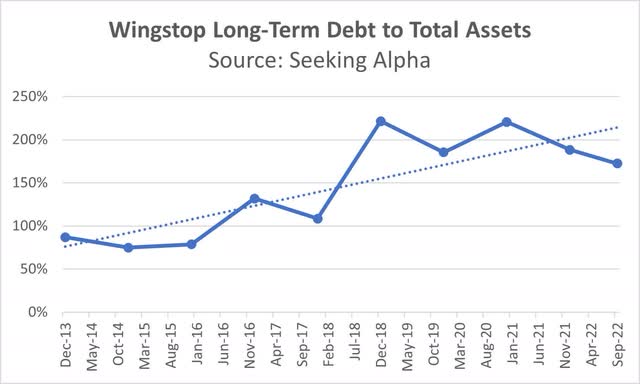

Wingstop has been one of the many beneficiaries of low interest rates as the Company has leveraged the balance sheet substantially over time to support growth and pay dividends as shown in the charts below.

Wingstop Increasing Leverage (Seeking Alpha)

Wingstop Increasing Leverage (Seeking Alpha)

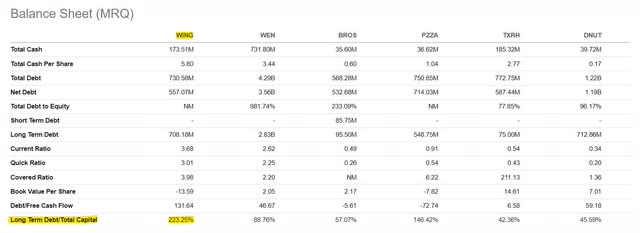

Wingstop has increased leverage significantly on an absolute and relative (to asset base) basis. As shown below, the Company is now meaningfully more leveraged compared to its public competitor set:

WING Leverage (Seeking Alpha)

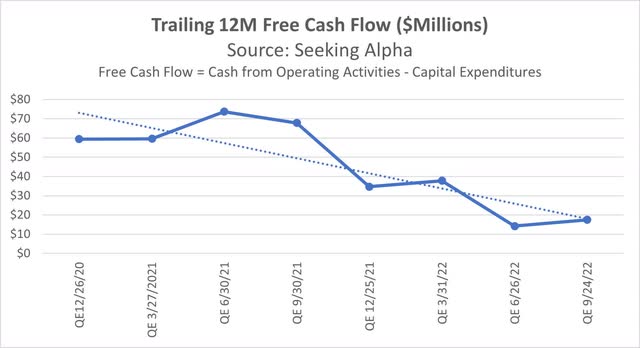

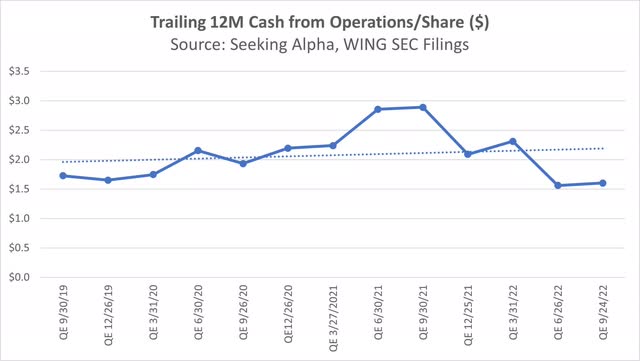

Wingstop is increasing leverage while its means of paying back the debt are declining. Although the stock price suggests otherwise, Wingstop is actually not generating any more cash for shareholders on a per share basis than it was two ago.

Wingstop Free Cash Flow (Seeking Alpha)

Wingstop Cash Generation (Seeking Alpha)

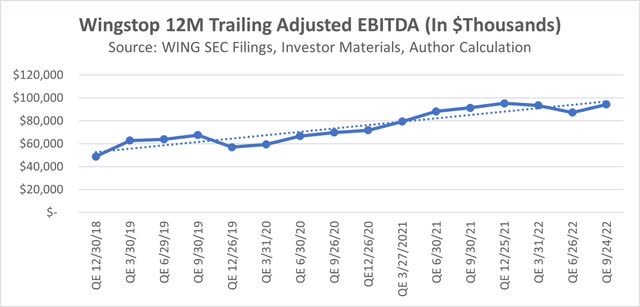

Notably, the Company’s reporting of adjusted EBITDA shown below indicates substantial profit growth while the cash flows shown above suggest otherwise.

WING Adjusted EBITDA (Seeking Alpha)

Income Statement

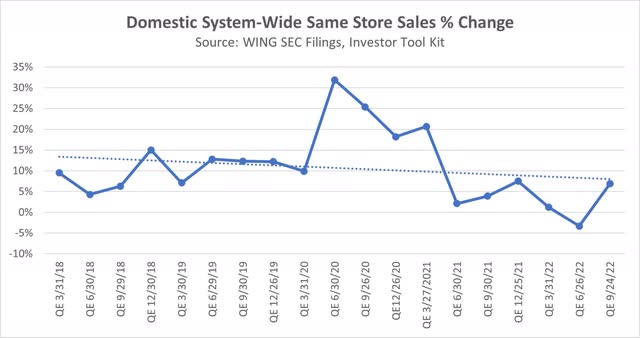

WING Same Store Sales (WING SEC Filings and Investor Materials)

Wingstop’s same store sales growth, while still decidedly positive, has slowed since its strong performance through the worst of the COVID-19 pandemic.

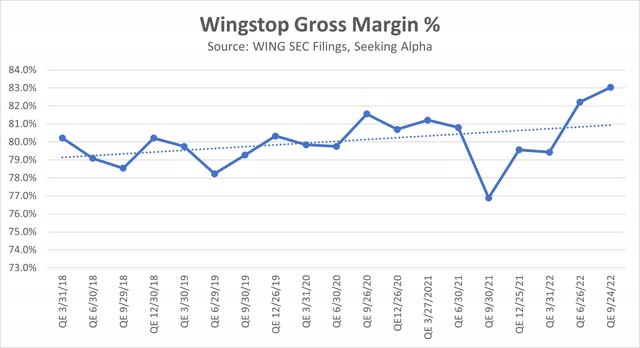

Separately, the Company is currently enjoying high gross margins as chicken wing prices are at multiyear lows after a rollercoaster period of price fluctuations since the start of the pandemic.

Author Calculated Using (Revenue – Cost of Sales)/Revenue (WING Financial Statements, Seeking Alpha)

Management appears to be optimistic about the commodity situation based on the Company’s most recent earnings call:

Based on everything we know today, we have a favorable commodity outlook, not only for bone-in wings, but also for breast meat, which we believe will continue into early 2023.

– Wingstop CFO Alex Kaleida

The Company’s repeated mentions of possibly investing more to take greater control of its wing supply chain would indicate higher wing prices could create issues for the Company. Currently, Wingstop is enjoying lower input prices for its wings and capturing the increased margin by not lowering prices while restaurant competitors are facing input cost inflation and a lack of pricing power. I believe this has provided Wingstop a temporary advantage. The Company’s CEO highlighted this phenomenon in the most recent earnings call:

As the industry is navigating 40-year high inflation forcing other brands to take price to manage margins, while consumer sentiment is shifting. Wingstop is different. We are in a position where we do not necessarily have to take price.

– Wingstop CEO Michael Skipworth

In my view, the market is underestimating the likelihood of future reversion to the mean in wing prices and gross margins. One of the analysts covering the Company astutely picked up on possible lower-than-expected earnings ahead:

And then Alex, just question on the 2022 guidance, you beat 3Q by more than you raised the full-year EPS. So, trying to better understand the implication for lower than expected 4Q.

– Andrew Charles, Cowen

I encourage readers to read management’s response in the earnings transcript and determine their own takeaways.

To summarize, Wingstop is enjoying an unusually favorable commodity market which I believe won’t last forever, as the Company’s implied lower 4th quarter guidance suggests.

Macroeconomic Positioning

In my view, the Company’s growth trajectory would suffer if higher interest rates were to persist. Higher interest rates could make it more difficult for franchisees to finance new stores, resulting in slower store count growth. Additionally, the Company would be impacted by a broader economic slowdown, but perhaps to a lesser extent than other companies with more discretionary, higher price point products and services. In my view, the Company benefited from a lack of dine-in options during the COVID-19 pandemic while its digital offerings and takeout/delivery emphasis were well-positioned to serve customers. In my view, the next recession may not be as friendly to Wingstop relative to its competition.

Valuation – Growth at an Unreasonable Price

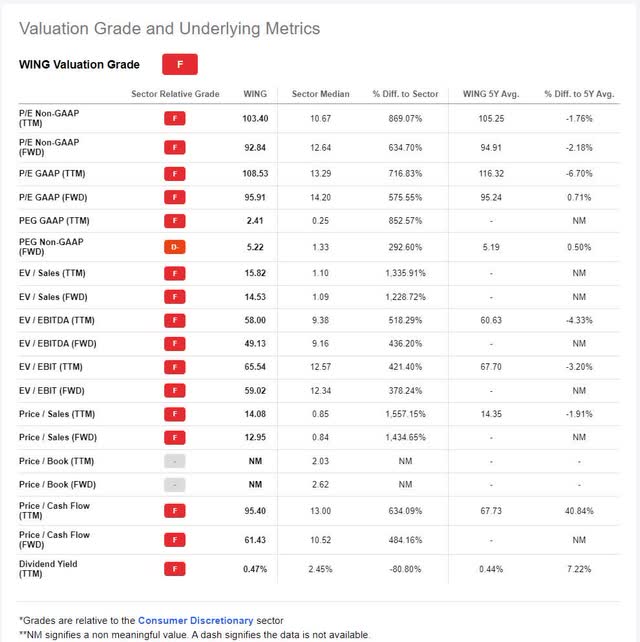

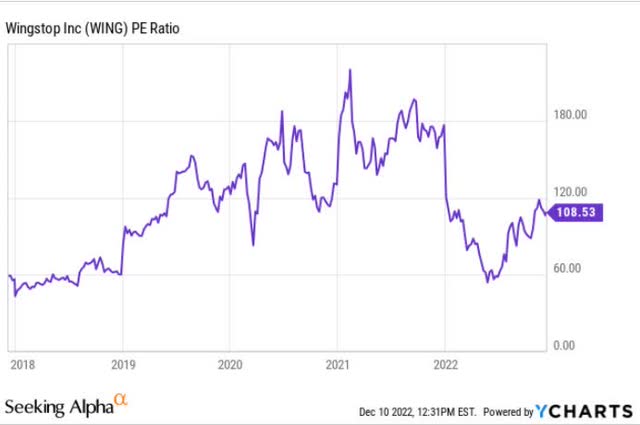

Despite the trends mentioned, the Company maintains an extreme valuation by virtually any measure as investors seem to be anchoring to historical top-line growth and the Company’s vision of becoming a top 10 global restaurant brand.

WING Valuation (Seeking Alpha)

WING 5-Year PE Ratio History (YCharts/Seeking Alpha)

Readers can determine their own precise valuation of the company, but with normalized annual free cash flow generation of ~$10-$30 million, high leverage, and an enterprise valuation of $5.1B, I believe the equity is worth much less than current market prices even when factoring in significant growth.

Risks

It’s important to note that overvalued stocks can remain so for an extended period of time before they eventually revert back closer to intrinsic value. However, I believe the stock has a clear near-term catalyst in the form of a return to historical margin levels as the Company is benefitting from what I believe to be a temporarily favorable environment with low bone-in wing prices.

Other risks to the bearish thesis include the Company possibly sustaining its rapid growth through continued store investment by current and prospective franchisees, introduction of new menu items, and price increases. Its international initiatives could prove successful as well. Finally, an economic reversal towards lower interest rates and reduced inflation would likely benefit the Company.

Final Thoughts

In my view, the stock’s next chapter faces substantial challenges in the form of macroeconomic headwinds, a potential reversal of what I believe to be unsustainable margins, significant management turnover, and an extreme valuation. These factors, when combined with an absence of insider buying, lead me to believe the stock is likely to struggle over the next several years relative to the overall market. Any hiccup in growth or piece of negative news could cause a severe drop in the stock with its currently stretched share price.

Be the first to comment