Mohamad Faizal Bin Ramli

Shares of Lincoln National (NYSE:LNC) have been hammered this year, losing nearly 40% of their value. For years, investors in life insurance companies were waiting for higher interest rates to come in order to boost earnings power. Unfortunately, higher rates brought with them a lower stock market, which has hit its capital position. This has left Lincoln unable to buy back much stock with shares in $40s after buying significant sums above $60 over the past 18 months. The stock is understandably in the “penalty box,” and it might be stuck there awhile.

Seeking Alpha

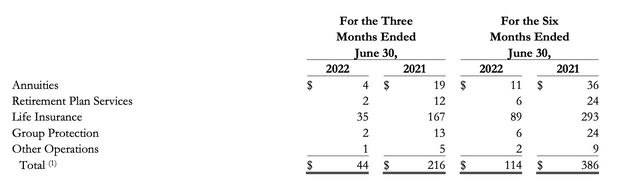

In the company’s second quarter, adjusted earnings were $2.23 from $3.17 last year. Overall, its hedging program was 98% effective, a fairly good results considering the market volatility. Unsurprisingly, alternatives investment returns were poor. Returns in private equity tend to be correlated with the stock market, so as equities fell in Q2, private equity holdings were marked down. As you can see below, earnings from alternatives were more than halved in Q2 from last year at just $44 million.

Lincoln National

When Q3 earnings are released on November 3rd, I would expect alternatives income to again be weak, and that will likely extend to Q4 given continued stock market volatility and the tendency for private assets to take a bit longer to catch up to the stock market. Now, just as 2021’s returns were too strong, eventually this bear market will end, and alternatives will contribute more earnings. Based on management’s discussion of results, that should be about $0.10-$0.20 above the Q2 run-rate. As I said though, I would not expect this rebound to occur until 2023.

On the bright side, revenues rose about 5% to $5.1 billion as Lincoln grows its product lines. Retirement plan net flows more than doubled to $913 million. Life insurance sales rose over 50% to $193 million, and group insurance rose 7% to $1.2 billion. Higher interest rates make life insurance policy pricing more attractive for consumers, so these sales gains should continue. Still, lower investment returns drove lower operating income across segments, except for group protection thanks to lower disability results.

The one jarring item is that book value fell from $115 to $53.97. That is because its investment book went from a $15.6 billion pre-tax unrealized gain last year to a $6.3 billion unrealized loss because of how much interest rates rose. In fact, the value of its fixed income securities fell from $122 billion to $103 billion. Fixed income accounts for 76% of its total assets with mortgages another 12%. Now, insurers typically are hold-to-maturity investors as they buy bonds with maturities that match the expected payments of life insurance and annuity payments.

As a consequence, it is best to look through these unrealized gains and losses as the theoretical value of the offsetting life insurance policy matches this, and as long as the issuer does not default, the bond will eventually mature at par, wiping out any unrealized gain or loss in the end. Because only 3.5% of its portfolio is below investment grade, the risk of defaults is low. Excluding accumulated other comprehensive income (AOCI), which is where these unrealized gains and losses flow, book value rose from $75.45 to $79.49.

The fact the stock is trading at such a large discount to book value might be surprising. After all, these results are not great, but they are not terrible. The company had an adjusted return on equity of 11.6% and is on track for over $8 of EPS. Further, Lincoln said that finally interest spreads are now a positive contributor to earnings, meaning that the company is able to invest cash at higher yields than its maturities, which should aid earnings power. Plus, its “Spark” initiative to cut expenses by $280 million is 40% realized.

The problem is that its risk-based capital [RBC] ratio fell by 15% to 400% coverage. It started the year at 427%. While saying that they were “comfortable” at the 400% level, management implied that buybacks were unlikely to accelerate until capital improves. As the equity market declines and volatility increases, the models assign greater potential losses, particularly in its annuity business, which has mechanistically drawn down its capital ratios.

Aside from these model-based challenges, COVID-19 caused a genuine hit to capital because of excess mortality. There were $642 million in pandemic claims last year and $250 million this year. Plus, the company bought back significant sums of stock last year and another $400 million in Q1 2022 when the stock market was more robust, further reducing its capital. The benefit of these buybacks is that shares outstanding are down since the end of 2019 by 13% to 171.1 million. On the downside, most of these shares were bought back at over $60. In hindsight, it would have been more powerful for LNC to have built cash and been able to deploy it with the stock substantially lower now.

Seeking Alpha

I think it also important to note that Ellen Cooper only became CEO in May, so she doesn’t “own” the decision to have bought back so much stock and if anything will be inclined to have a clean start and reset expectations. In fact, in Q2 as she took over, the company bought back just $100 million after repurchasing $400 million in Q1. During the Q2 earnings call, management guided “up to $100 million” in buybacks in Q3 and refused to give guidance for Q4.

As the company rebuilds capital in the operating incomes, it has dividend less to the parent holding company with dividends from the main Lincoln National Life subsidiary declining from $495 million to $305 million last year. Holding company cash is sufficient at $756 million to meet interest expenses, the $0.45 quarterly dividend, which costs $310 million a year, and some buybacks. Plus, these dividends will not go to zero but are likely to remain lower than in the past, especially as Q3 was likely a difficult quarter to build capital given continued market volatility.

To get back to the 427% RBC at the start of the year, that would require the company to build about $800 million in capital. At $2.35 in run rate earnings, the company has $400 million in earnings power. At a $100 million buyback and a $75 million dividend per quarter, that provides a net build of $225 million. That means it will take about one year of reduced buybacks to get LNC’s capital to a position more in-keeping with aggressive buybacks. This assumes no deterioration in markets and no growth in the business (as growth requires holding more capital against new policies).

When the company reports earnings in a few weeks, investors should expect management to continue to guide to slower buybacks. I see the risk being that RBC declines a bit further and that management reduces the buyback to closer to $50 million to build back capital more quickly. I do expect them to continue to buy back some stock, just at a slower pace. Using a $75 million pace, the company will return about $600 million to shareholders for a capital return yield of 7.7%. At $45, the stock is hardly expensive, but there is understandable frustration in the market that Lincoln repurchased over $1 billion in stock last year just to have to significantly slash buybacks when the share price fell.

Consequently, I believe management needs to regain the market’s confidence, and shares are likely to remain at a substantial discount to book value until capital has been rebuilt and buybacks can resume at full speed. I do believe for very long-term investors, LNC is attractive trading over $30 below book value as higher rates should gradually boost interest income and hedges are largely working. However, for the next 12-months, shares are likely to be stuck in the $40-55 zone, or a 7-9% capital return yield. At least, The dividend yield is 4%, so investors are being paid to wait. I purchased a small position earlier this year at $50 when I was less pessimistic on the share repurchase outlook, and I am remaining a holder given my ability to take a multiyear view and long-term potential from its discount to book value, but investors should feel no need to rush in as this will be a 12-month rebuild story.

Be the first to comment