zeynep boğoçlu/E+ via Getty Images

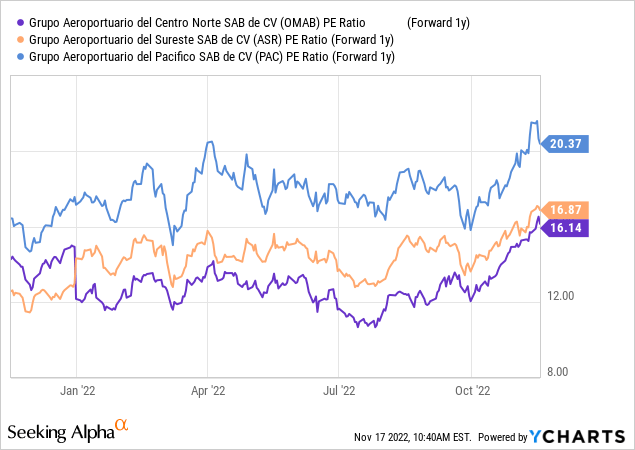

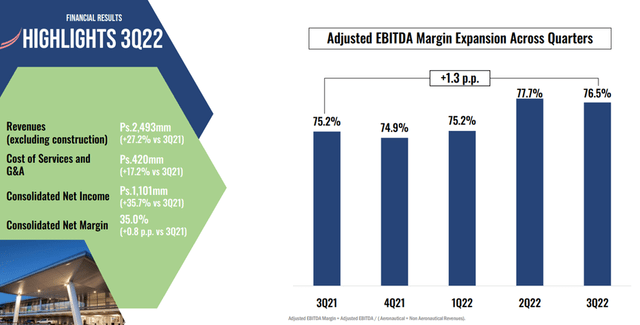

Mexican airport operator Grupo Aeroportuario del Centro Norte SAB (NASDAQ:OMAB) recently reported solid Q3 2022 numbers, with adj EBITDA margins expanding 1.3% pts YoY to 76.5% on a continued traffic recovery (now above pre-COVID levels). The improved profitability highlights the company’s ability to sustain profitability through the inflationary headwinds, and thus, I see good earnings momentum for OMAB heading into 2023. The stock has underperformed YTD (relative to peers Grupo Aeroportuario del Sureste (OTCPK:ASRMF) and Grupo Aeroportuario del Pacífico (PAC)), but with traffic turning around and likely to revert in the coming years alongside a post-COVID industrial business recovery in Mexico, there remains ample re-rating potential here.

Traffic Recovery Drives Revenue Outperformance

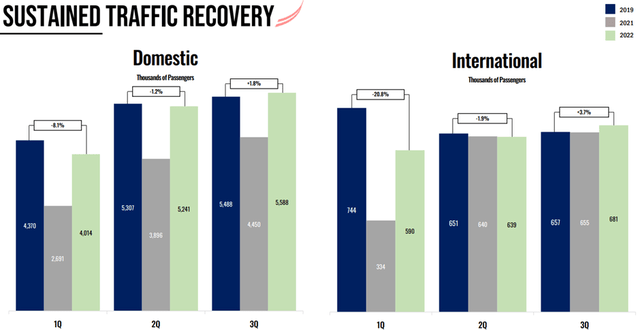

The +23% YoY traffic growth for the quarter (~2% above pre-COVID levels) set the tone for OMAB’s quarter. Domestic traffic led the way at +26% YoY, while international traffic was up a modest +4% YoY during the quarter. Of note, the company’s main Monterrey airport is showing signs of recovery, even with its outsized exposure to business travel, with total traffic levels now only ~1% below pre-COVID levels. Relative to Q3 2021, Monterrey (+26% YoY) only trailed Culiacán airport, the key growth driver at +31% YoY for the quarter.

Grupo Aeroportuario del Centro Norte SAB

The strong traffic performance led to revenues (ex-construction) of MX$2.5bn (+27% YoY), led by aeronautical revenues at +27% YoY (+23% from higher traffic levels and +4% from higher airport fees). Non-aeronautical revenues also increased at a +28% YoY pace on strength across diversification services (+35% YoY) and parking (+54% YoY). The commercial side was a source of strength as well, with the NH Collection Terminal 2 Hotel seeing a 79% occupancy rate (up from 70% in the prior year) and the Hilton Garden Inn reaching 77% occupancy (well above 51% last year). All in all, the operating momentum is promising, and with more routes starting operations in the coming quarters (eight previously untapped routes started operations in Q3), the OMAB traffic recovery has legs, in my view.

Strong Profits Highlight the Operating Leverage Story

OMAB’s profitability also outperformed, with adj EBITDA of MX$1.9bn coming in >30% above pre-COVID levels and EBITDA margins expanding +135bps YoY. Most of the margin delta was down to revenue gains, marking the continuation of the multi-year operating leverage story after a COVID-driven pause. Successful cost control measures also helped – despite traffic recovering to pre-COVID levels, the cost of service per WLU (’workload unit’ or one passenger/cargo unit) was only up a low-single-digits % in a highly inflationary environment. Still, the overall cost of service at +17% YoY bears watching, particularly with labor (+26% YoY) and hotel service costs (+30% YoY) on the rise. Given the incremental headwinds from FX swings and higher interest costs at the net income level, the MX$1.1bn (+36% YoY) bottom line result was impressive.

Grupo Aeroportuario del Centro Norte SAB

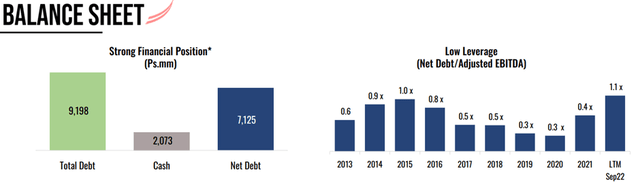

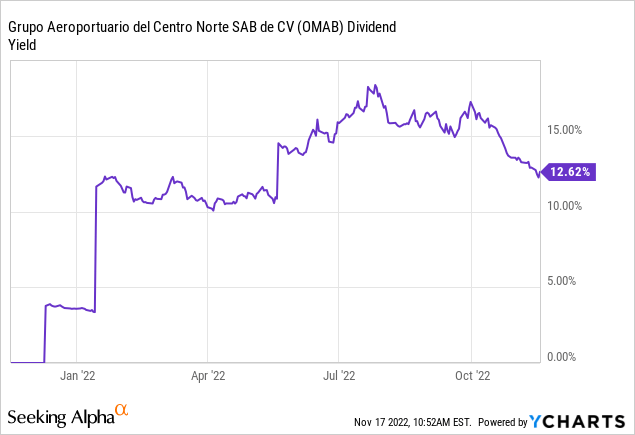

The strong traffic (and earnings) momentum leaves OMAB well-positioned heading into 2023. Beyond the traffic recovery, the lag in aeronautical revenue per WLU growth throughout this year (vs. inflation) could also mean the ~13% increase (in real terms) negotiated in the 2020 MDP has yet to kick in. The capex cycle is also winding down – most of OMAB’s expenditures are now focused on maintenance capex related to the MDP (mostly related to asset improvements and maintenance), with only ~MX$83m allocated to strategic investments. With leverage also at a healthy 1.1x net debt to EBITDA, the balance sheet capacity presents upside to the capital return (vs. the current ~13% yield).

Grupo Aeroportuario del Centro Norte SAB

Strategic Optionality from Vinci Airports

Prior to earnings, recall that a group of OMAB shareholders had reportedly entered into a share purchase agreement with a subsidiary of Vinci Airports for 29.9% of its capital stock. Per disclosures, the sale price will comprise $579m for the ~50m Series BB and ~8m Series B shares held by Servicios de Tecnologia Aeroportuaria (an implied >60% premium) and $237m for Aerodrome’s ~58m Series B shares (net of undisclosed debt).

I view this announcement as a strategic positive – having a major global operator on board should allow OMAB to take a major step forward in implementing best practices, particularly around commercial revenue maximization and cost efficiencies. Vinci’s Series BB shares also allow for governance improvements via special veto rights over corporate actions such as dividend payments and senior management hires. Clearing regulatory/antitrust approvals will be the key hurdle to closing the deal, although the limited competitive implications and the minority stake should help to accelerate the process.

Riding the Post-COVID Traffic Recovery

Following another strong quarter, which saw total traffic finally surpass pre-COVID levels, OMAB looks positioned for more earnings growth heading into 2023. Also impressive was the company’s continued ability to sustain margins (profitability is at a record-high) under significant inflationary pressure. While OMAB stock has underperformed its airport peers on below-par traffic, the recent traffic upturn in Q3, along with the prospect of an industrial business traffic recovery in Mexico, bode well for the re-rating potential. In the meantime, investors get paid to wait via the low-teens % dividend yield (mid-single-digit % on an fwd basis ).

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment