Noam Galai/Getty Images Entertainment

We’re bullish on Booking Holdings Inc. (NASDAQ:BKNG), as we expect 2023 to be a major growth year for the company. Booking is a one-stop destination for planning a holiday or any type of trip. The company provides a platform for customers interested in booking travel, hotel rooms, and rental cars. Our bullish sentiment on Booking is based on our belief that the company is making a comeback from its pandemic lows. Gross booking numbers were down in 2021 compared to a year earlier. Now we’re finally seeing gross bookings across Bookings’ travel, hotel, and car platforms rebound, beating 2019 levels with revenue surging 29% Y/Y in Q3 2022.

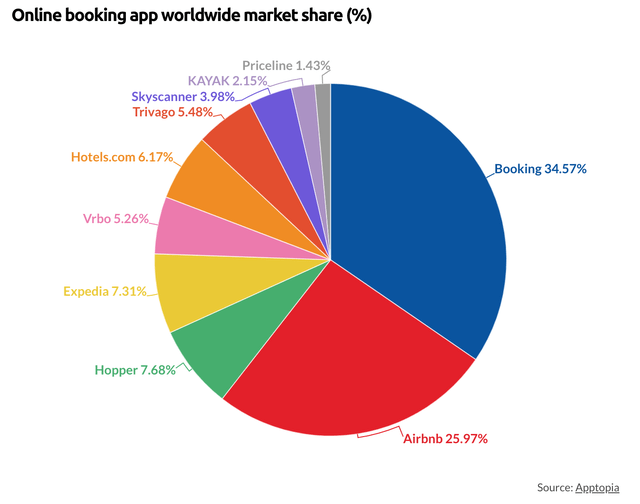

We like Booking’s position in the broader online travel booking industry, with a 38.2% market share in the U.S. online hotel booking industry, accounting for 91.6% of the company’s total revenue in Q3 2022. YTD, Booking is down nearly 15%. We believe the decline resulted from the pandemic environment, with online travel booking apps reporting 70% less traffic and bookings than in 2019 during the pandemic. We believe Booking is relatively cheap and provides an attractive entry point at current levels.

Travel demand recovering

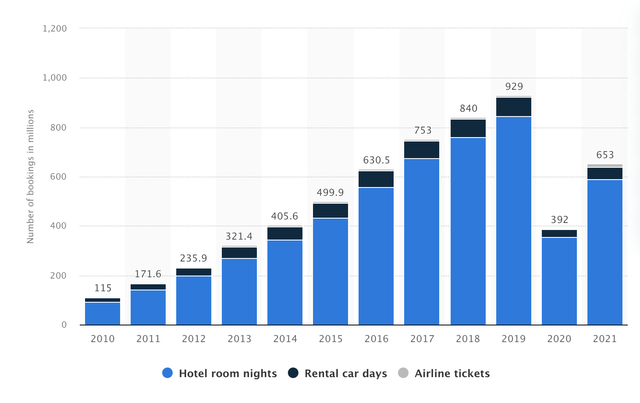

We believe the hotel bookings segment is Booking’s strong suit as we enter 2023, accounting for the majority of the company’s revenue. We expect the tourism industry is still recovering and has yet to reflect its true growth potential. Currently, Booking’s online hotel booking segment makes up 32.8% of the total U.S. industry revenue. We expect Booking’s online hotel bookings to boost revenue as pent-up demand for travel surges in the post-pandemic environment. Despite the economic slowdown, travel still appears to be a priority for customers. Booking’s third quarter of 2022 is its best quarter yet, highlighting that travel demand is gaining momentum.

Booking suffered a visible dip in revenues during the pandemic as lockdown restrictions limited and de-incentivized travel. We’re more constructive on the company now that we’re seeing demand pick up beyond 2019 levels for the first time since the pandemic began. Booking’s 3Q22 earnings report announced growth in Booking’s three segments; Room bookings increased by 31.5% Y/Y, Rental cars by 24.9%, and airline tickets by 45.1%. We expect demand for Booking’s services to continue to rebound as we slowly but surely exit the pandemic environment.

The following graph outlines Booking’s revenue by segment up to 2021.

We believe consumers have abandoned traditional travel agents and are increasingly shifting towards online booking, as everything can be done through a couple of clicks on the right platform. We believe Booking is expanding its market share and will benefit from being one of the all-in-one platforms that customers resort to when booking travel. Together, Booking and competitor Expedia (EXPE) make up around 60% of all travel bookings in the U.S. and Europe. We expect Booking is well-positioned to benefit from the upward trend in the online travel booking industry, forecasted to grow at a CAGR of 10.7% between 2022-2030.

Weeding out competition

We like Booking’s business model as we believe the company is working to maintain and expand its customer base. We believe Booking is doing this on two fronts: its app services and strategic acquisitions.

Booking App:

According to BusinessofApps’ research, Booking’s app has been the most downloaded online booking app for four years in a row. We believe Booking management’s focus on pushing customers to book via the app will help increase customer interaction by integrating relevant travel components in all three of the company’s booking segments. CEO of Booking, Glenn Fogel, emphasized the company’s increased focus on its app services on the 3Q22 earnings call.

Strategic Acquisitions:

Booking faces stiff competition in the online travel industry. We’re constructive on Booking expanding its market share by weeding out the competition through buying competition’s platforms or merging them into its service. The company owns competing booking platforms, including Agoda. Customers using Booking have access to relevant travel bookings in KAYAK and Priceline. We believe Booking is working to retain market share against Expedia and Airbnb (ABNB), as the two are best positioned to compete with Booking.

Stock performance

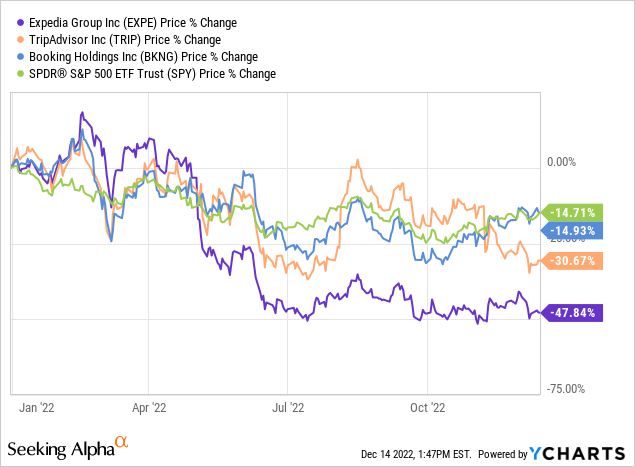

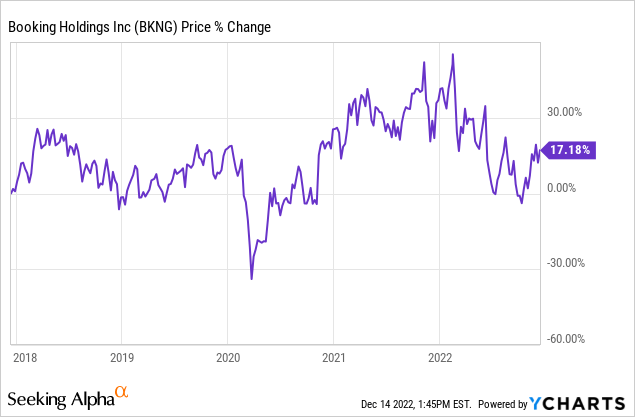

Booking stock grew nearly 17% over the past five years, facing a steep drop of 38% at the start of the pandemic in February 2020. YTD, the stock is down nearly 15%. Booking outperforms the competition on the YTD metric, with Expedia dropping about 48% YTD and TripAdvisor Inc (TRIP) down 31% during the same period. Booking performs in line with the S&P Index, which is down 15% YTD. We believe the online travel booking industry had a rough two years but expect travel demand to pick up in 2023. We recommend investing in the broader online travel booking industry through Booking.

The following graphs outline BKNG’s YTD against competition and five-year performance.

TechStockPros

TechStockPros

Valuation

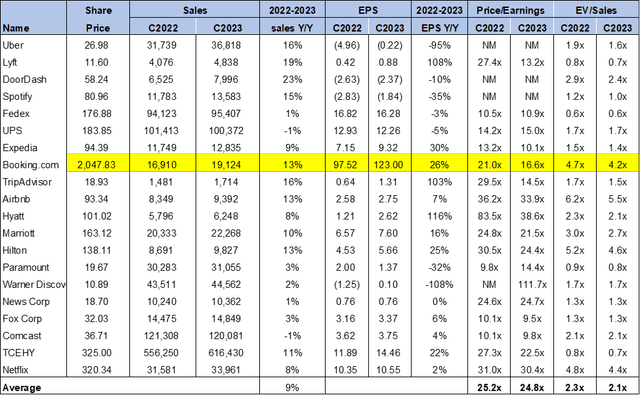

Booking is relatively cheap. The stock is trading at 4.7x C2023 on EPS of $123 on a P/E basis compared to the peer group average of 24.8x. On an EV/Sales metric, the stock is trading at 4.2x compared to the peer group average of 2.1x.

The following table outlines BKNG’s valuation compared to the peer group average.

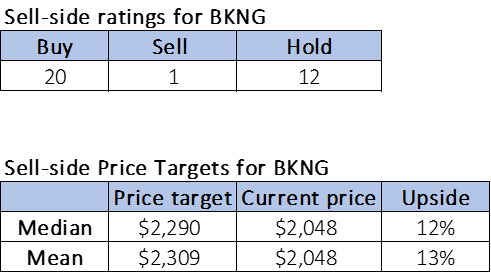

Word on Wall Street

Wall Street shares our bullish sentiment on the stock. Of the 33 analysts covering the stock, 20 are buy-rated, 12 are hold-rated, and the remaining are sell-rated. The stock is currently trading at $2,048. The median sell-side price target is $2,290, while the mean is $2,309, with a potential upside of 12-13%.

The following table outlines BKNG’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

We believe Booking provides a favorable entry point into the online travel booking industry. We’re optimistic about travel demand’s recovery toward 2H23. We believe Booking’s 3Q22 is already showing signs of demand tailwinds, reporting the highest gross bookings since 2019 levels. We like Booking’s position in the U.S. market share and recommend investors buy the stock before it rallies.

Be the first to comment