spooh

Co-produced with “Hidden Opportunities”

Warren Buffett has been loading up on Occidental Petroleum (OXY) for several years, with aggressive purchases in recent months. The Oracle of Omaha’s Berkshire Hathaway (BRK.A) (BRK.B) now owns ~27% of the exploration & production company and has the Federal Energy Regulatory Commission’s (FERC) approval to increase its stake up to 50%.

So why is Warren Buffett buying a dirty oil company when everyone talks about net zero emission targets and clean energy? Most importantly, why is Mr. Buffett buying a hydrocarbon company when oil seems to be off its peak prices?

The answer to both these questions is the moat. There is no new oil company coming to disrupt existing players. Mr. Buffett has been a seeker of businesses with a tangible competitive advantage and the ability to achieve profitability without spending too much to grow. The post-2015 oil and gas industry provides precisely what Warren Buffett seeks.

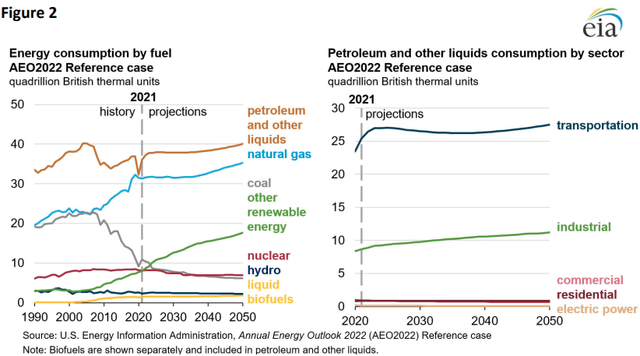

Perpetual demand: anyone who thinks oil is history is disconnected from reality. The Russo-Ukraine and global reaction has demonstrated the importance of energy independence. Since the beginning of the war, we see G7 leaders (the same ones who could only talk about clean energy and reducing carbon emissions a year ago) scramble for reliable hydrocarbon supply. Mr. Buffett understands that we will be more dependent on crude oil and natural gas in 2050 than we are today.

Moat: The barriers to entry in the oil and gas sector are solid. These include the need for costly assets, high startup costs, patents associated with proprietary technology, government and environmental regulations, and high operating costs. There are several big-name corporations in the upstream and midstream sectors, but no cool kid on the block is attempting to enter this space, thanks to the industry’s pariah status and these high barriers to entry.

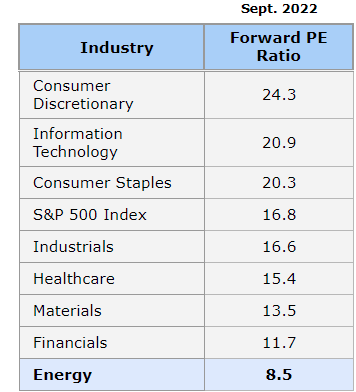

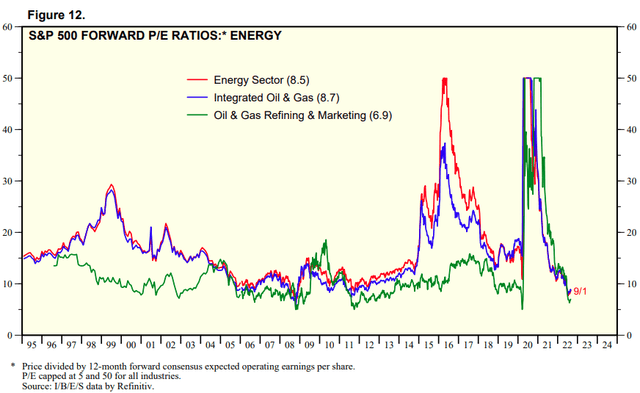

Cheap Valuation: When a tech company has no competition, it typically carries frothy valuations and is touted as a generational buying opportunity. But oil doesn’t enjoy those lofty multiples and is the cheapest industry sector today.

Yardeni Research

It is worth noting that despite record profitability, energy is trading below valuations seen during recent economic crises – in 2000, 2008, and 2020.

Mr. Market thinks oil is dead, but he is wrong. We will take advantage of this irrationality and load up on quality companies. We will now review two picks with up to a 9% yield to invest in energy and collect hard cash distributions, both without the K-1 tax form.

Pick #1: FEN, Yield 8%

Midstream is responsible for reliable and secure transportation, storage, and processing of raw energy commodities. Despite massive price volatility in recent years, midstream profitability has held up relatively well because of their long-term fee-based contracts that are immune to the underlying commodity prices. Thanks to lessons learned from the oil boom and bust in 2015, the industry has shifted to focus on cash-flow generation and a more-sustainable funding model. Altogether, midstream presents a lower risk for income investors, particularly retirees.

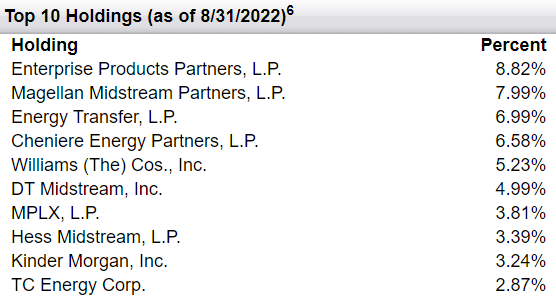

First Trust Energy Income & Growth (FEN) is a CEF (Closed-End Fund) that invests in cash-generating energy companies focusing on public MLPs. Most investors are hesitant to invest in public MLPs, typically due to the potential tax complication from Schedule K-1. FEN lets you side-step those complications by investing in MLPs, but issuing 1099 to shareholders. FEN’s top positions include some of the largest energy pipeline companies in the U.S.

First Trust Portfolios

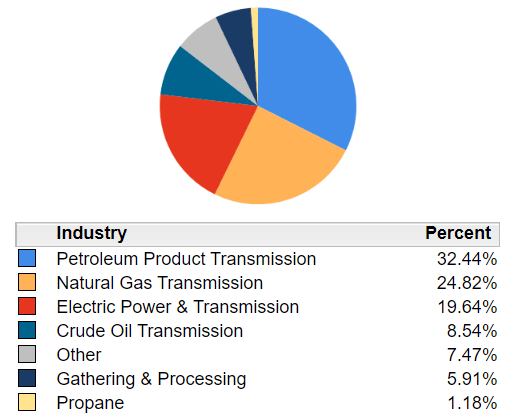

FEN is built with 56 securities, primarily within companies in the U.S. and Canada. The CEF is heavily focused on investing in companies that own assets with long-term monetization capability and are vital to energy transmission with no visible replacement on the horizon.

First Trust Portfolios

FEN trades at a 3% discount to NAV, and its $0.30/share quarterly distributions amount to a handsome 8% annualized yield. It is important to note that FEN reduced its dividend during the initial months of the COVID-19 pandemic due to the energy shock and its impact on the energy sector. While the dividend is yet to be restored to former levels, there is a strong likelihood of a distribution raise given declining CAPEX, increasing profitability, and reduction in debt of its holding companies.

It is not easy to build new energy pipelines anymore. It involves a lot of bad press and climate roadblocks, not to mention tedious regulatory approvals. This effectively keeps any new player from entering the space, making the existing infrastructure so much more valuable. FEN is an excellent investment in midstream for investors seeking diversified exposure to commodity transmission, high yields, and no schedule K-1.

Pick #2: AM, Yield 9%

We recognize that oil has a steady future with modest growth through 2050. But its relatively greener cousin, Natural Gas, has strong growth prospects due to its potential to reliably displace coal.

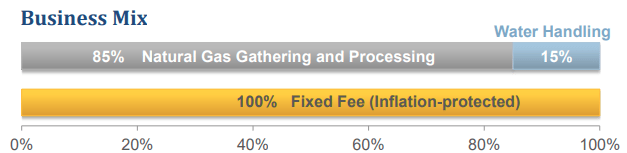

Antero Midstream Corporation (AM) owns and operates midstream energy assets servicing rich gas production in two of the lowest-cost natural gas and natural gas liquids (‘NGL’) basins in North America – the Marcellus Shale and Utica Shale. AM’s business is primarily focused on natural gas gathering and processing, and the company also has a modest operation in water handling. AM mainly provides its midstream services to Antero Resources (AR), which also owns 29% of the equity. (Source: AM August 2022 Presentation)

August 2022 Investor Presentation

AM pays a quarterly dividend of $0.225/share, a handsome 9% annualized yield. The company spent $217 million on dividends for six months of 2022, which was well covered by their $354 million cash flow from operations. 100% of AM’s contracts are fixed-fee with built-in CPI-based escalators, providing adequate protection against inflation pressures. This operating model ensures cash flow consistency and predictability, and immunity against commodity price volatility.

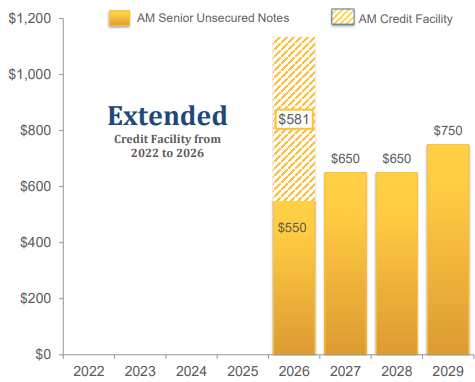

AM maintains an attractive debt profile with 3.7x leverage and no maturities until 2026. In 2023, the company expects EBITDA growth and declining CAPEX (music to my ears). As a result, the company projects an increase in free cash flow after dividends, giving adequate room for dividend increases, debt reduction, and share buybacks. It is noteworthy that AM targets a decrease in leverage towards 3x EBITDA by 2024.

August 2022 Investor Presentation

Since the beginning of the global pandemic, AM has seen three upgrades to its credit ratings, and we expect these to continue as debt paydown continues next year.

Natural Gas has strong growth potential. Liquified Natural Gas (‘LNG’), in particular, has strong export demand for use as a “transition fuel” due to its ability to burn cleaner than coal. Even before recent geopolitical challenges, rising energy prices had experts positioning LNG for a crucial role in the global energy transition. Morgan Stanley Research expects demand to increase by 50% over the next eight years. AM presents an excellent investment in this lucrative sector with high sustainable yields.

AM issues a 1099 tax form (no Schedule K-1).

Dreamstime

Conclusion

While renewables may be the fastest-growing energy source in the U.S. over the next three decades, petroleum and natural gas will remain the most-consumed energy sources in America through 2050. (source: EIA)

Warren Buffett buys highly profitable companies with high barriers to entry (strong competitive advantage). Most importantly, the Oracle makes sure he buys when they are on sale. Today, the hydrocarbon business is one with wide-moat, minimal CAPEX, and historically cheap valuation. He is backing the truck on OXY since it is a perfect addition to his portfolio of banks and railroads.

As income investors, we recognize the value proposition of the hydrocarbon industry but have different goals from our portfolio. Hence we will not buy precisely what Mr. Buffett is buying, but will look elsewhere in the same sector for our income needs. After all, the hydrocarbon business has transformed into a very shareholder-friendly industry since the 2015 boom and bust, and we intend to find income amidst quality companies. Energy is the lifeblood of modern society, and midstream companies are the lifelines. Energy independence will be an important objective of leading economies, and we present two picks with up to a 9% yield to prudently profit from an irrational market.

Be the first to comment