KenWiedemann

It pays to be choosy with shopping center REITs. While this segment has the potential for more rental increases and therefore higher dividend growth compared to net lease REITs, it also has more downside potential due to lower operating margins.

This brings me to Regency Centers (NASDAQ:REG), which is just one of a few REITs in its segment to not cut its dividend over the past 2 years. REG is a very high-quality REIT that has fallen down to an attractive level, and in this article, I highlight why it’s a durable buy for income growth investors, so let’s get started.

Why REG?

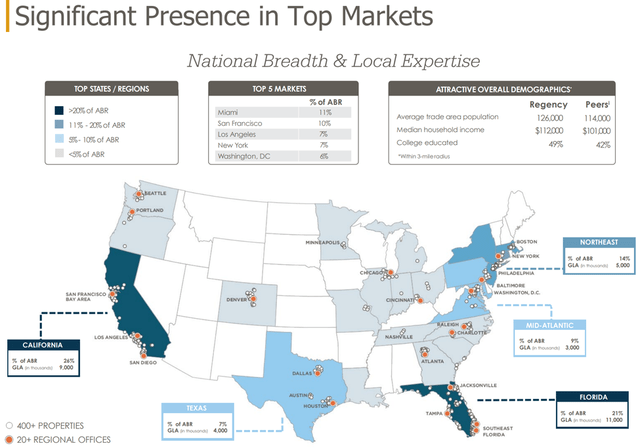

Regency Centers has a long operating history as it was founded back in 1963, and has one of the largest shopping center portfolios in the U.S. It’s also a member of the S&P 500 index, and at present, owns 400+ properties leased to more than 8,000 tenants. REG is well-diversified by geography with exposure to high population density markets along the East and West Coasts, Texas/Colorado, and the Midwest, as shown below.

REG Markets (Investor Presentation)

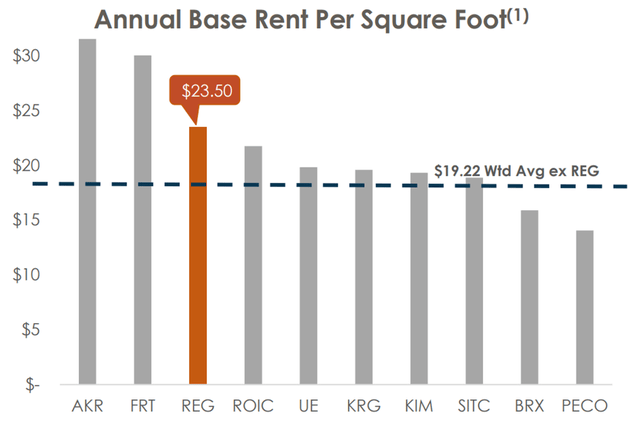

Like fellow REIT Phillips Edison (PECO), REG has very high exposure to grocery-anchored properties, which represent 80% of portfolio annual base rent. This makes REG’s properties essential community centers that are largely e-commerce resistant. This, combined with prime locations, has enabled REG to charge above average rents. As shown below, REG’s average rent per square foot ranks second highest in the shopping center category, sitting just behind Acadia Realty Trust (AKR) and Federal Realty Investment Trust (FRT).

REG Average Rent (Investor Presentation)

Meanwhile, REG maintains a well-regarded top tenant roster that is a who’s who of retailers, with Publix, Kroger (KR), Safeway/Albertsons (ACI), Whole Foods (AMZN), TJ Maxx (TJX), and CVS (CVS) as its top 6 tenants, representing 15% portfolio ABR. In addition, REG is demonstrating strong fundamentals with a 94.5% leased rate in the second quarter, which is 160 basis points higher than the prior-year period.

Moreover, REG has very strong small shop occupancy of 91.0%, sitting 220 basis points higher than last year. For reference, I generally regard small shop occupancy above 85% as being good. Importantly, REG is seeing strong demand for its properties, as it executed 1.3 million square feet of new and renewal leases in its latest reported quarter with a respectable blended cash rent spread of 8.8%.

Looking forward, REG is in good shape to not only weather the current economic downturn, but to thrive with the support of its well-located properties, strong balance sheet and development pipeline. These attributes were noted by management during the recent conference call:

In times when tenant bankruptcies may be elevated, our locations tend to be among the best performing limiting occupancy decline. Additionally, current positive momentum is a source of tailwinds into 2023 and beyond.

First and foremost is our strong pipeline of leases both execute and those in negotiation. Also next year we will see an even greater benefit from development and redevelopment NOI coming online. And finally, as we’ve been saying our dense suburban neighborhoods and communities continue to benefit from structural tailwinds stemming from post pandemic migration and hybrid work.

Where we have begun to see some impact from the current environment is in the capital markets, but again we are extremely well positioned. The strength of our balance sheet and our low leverage afford us the luxury of not needing to raise capital when it’s not advantageous to do so.

Factors that could drive REG’s share price down include the current rising interest rate environment. However, I do see a tipping point in which the Fed doesn’t want to completely upend the economy. Moreover, REG maintains a fortress BBB+ balance sheet that’s designed to whether adversity. This is reflected by REG’s debt to EBITDAre ratio of 5.0x, and full revolver availability of $1.2 billion. Notably, REG currently yields 4.5%, and the dividend is well-covered by a 63% payout ratio based on forward FFO/share of $3.95.

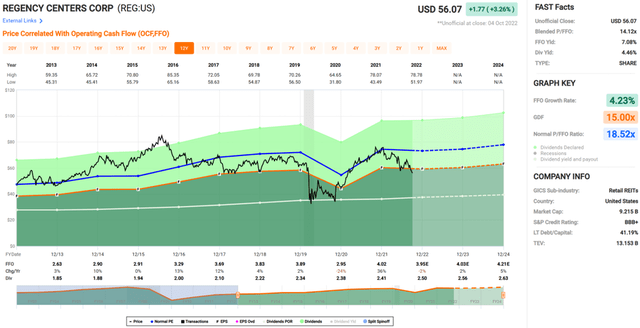

Lastly, I see the recent share price downturn as presenting a great opportunity to add to this holding. At the current price of $56.07, REG carries a forward P/FFO of just 14.2, sitting well below its normal P/FFO of 18.5 over the past decade. Sell side analysts have a consensus Buy rating on REG with an average price target of $70, equating to a potential one year 29% total return including dividends.

REG Valuation (FAST Graphs)

Investor Takeaway

Overall, I believe that Regency Centers is a top REIT that’s positioned to weather the current economic downturn and emerge stronger on the other side. The company has high-quality assets in prime locations, a strong balance sheet, and a solid development pipeline. I think the recent selloff presents a great opportunity to add to this stock.

Be the first to comment