dolgachov/iStock via Getty Images

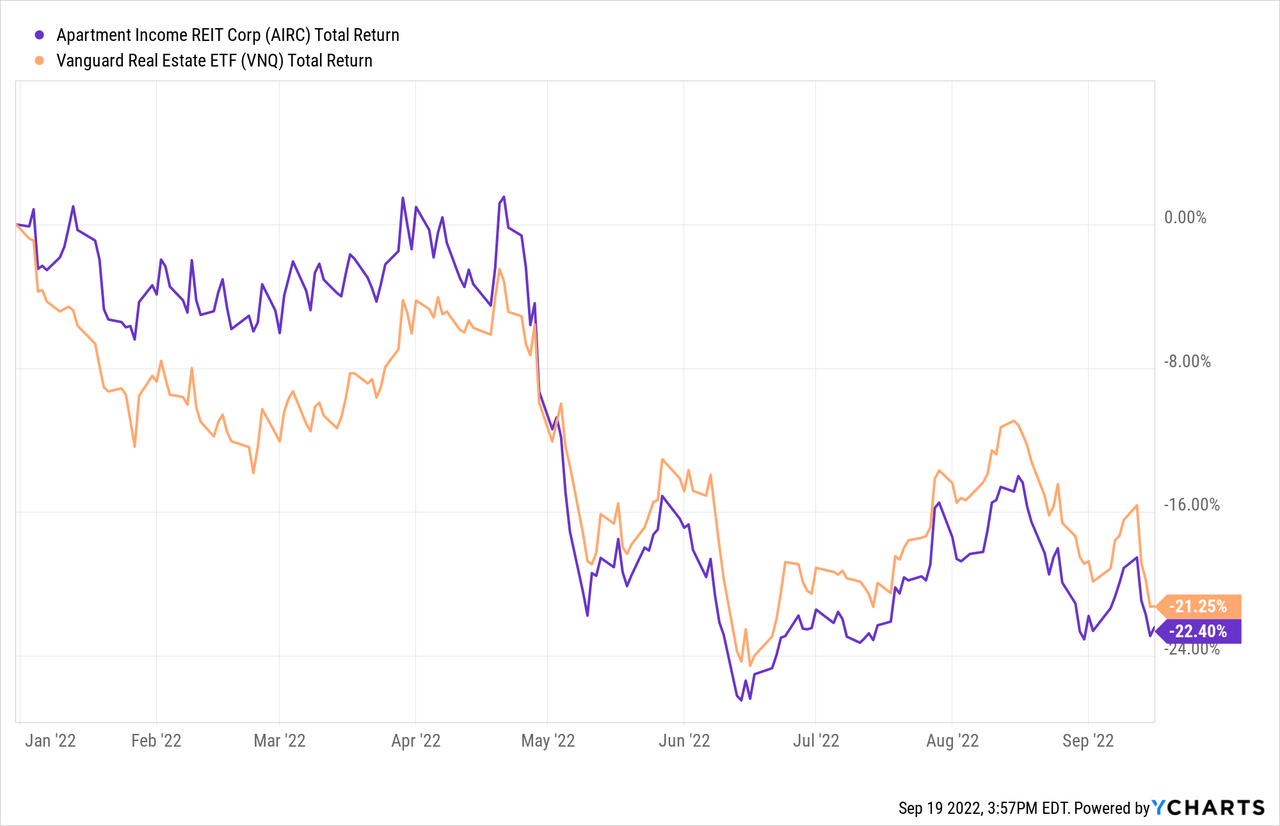

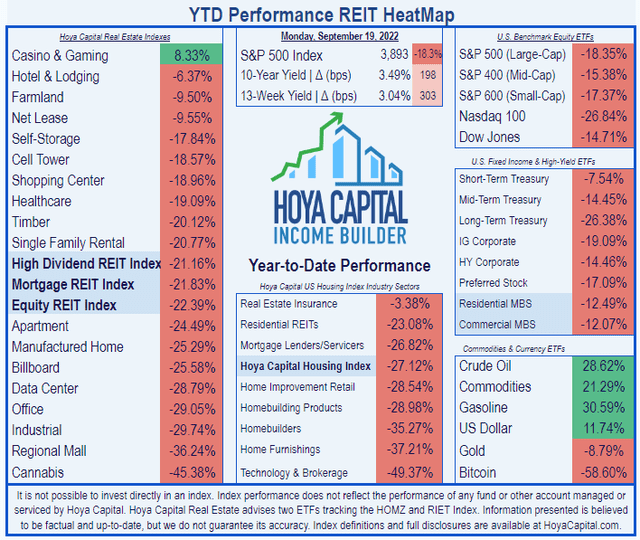

Contrary to expectations, the Apartment REIT sector has slightly underperformed the REIT average this year. The average total return for Apartment REITs thus far in 2022 is (-24.49)%, according to Hoya Capital Income Builder, compared to (-22.39)% for the Equity REIT index.

The (-22.40)% total return YTD for Apartment Income REIT (NYSE:AIRC) has been slightly better than the Apartment REIT sector, but still slightly lags the (-21.25)% posted by the Vanguard Real Estate ETF.

Despite outstanding earnings, and record-setting rent growth and occupancy rates amid the ongoing housing shortage, the Apartment sector is trading at historically cheap valuations.

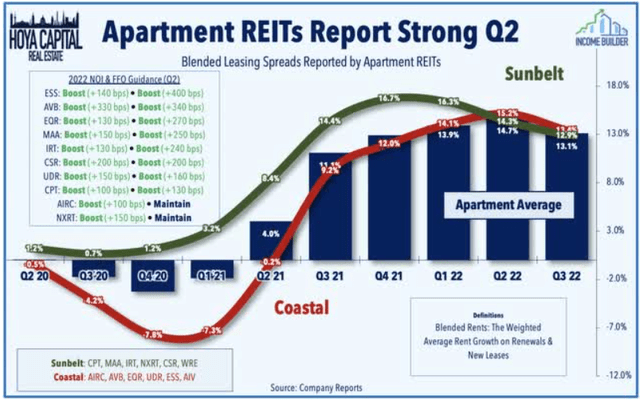

According to Hoya Capital’s latest sector report, blended leasing spreads remain in double digits nationwide, and the ten largest Apartment REITs by market cap all raised guidance following Q2 earnings. Apartment REITs reported new lease rate growth of 17.5% in Q2 while renewal rent growth averaged 12.4%.

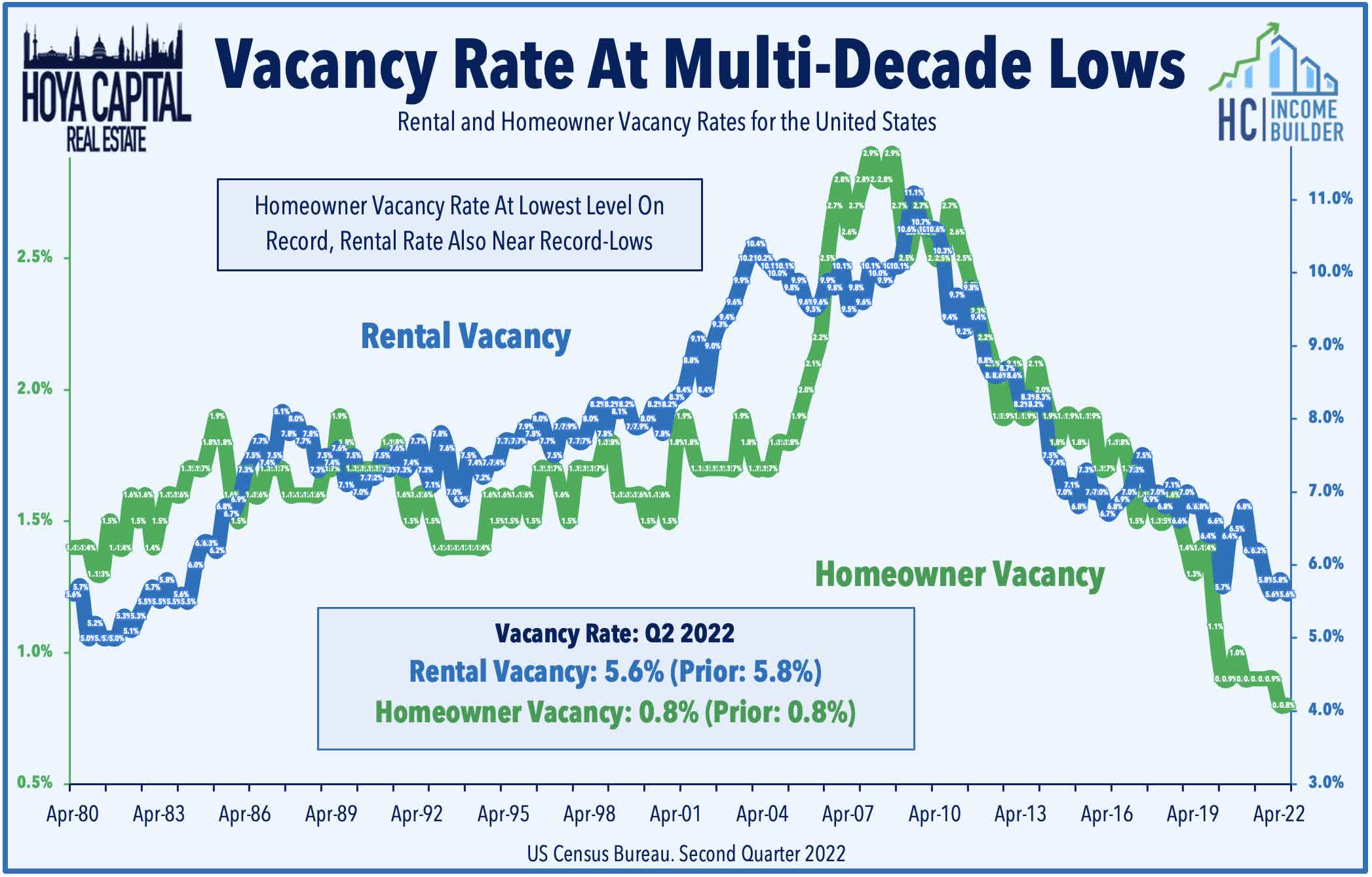

Occupancy rates increased to 96.6% for the Coastal REITs, up 30 basis points from last year. Meanwhile, average occupancy for Sunbelt REITs was 95.5%, 25 bps down from their record-high rates last year. Rental vacancy rates have fallen to their lowest level since the 1980’s.

Hoya Capital Income Builder

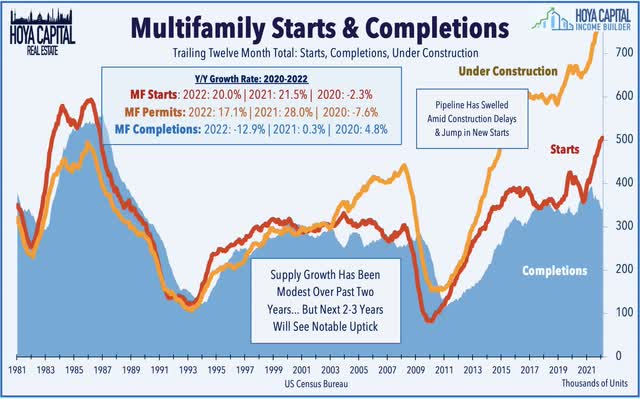

These metrics have led to a spike in multifamily housing starts. According to Hoya,

After several years of muted supply growth, multifamily starts and units-under-construction have climbed to multi-decade highs, but elongated construction timelines and lingering supply chain issues continue to limit completions. Given the hearty fundamentals of near-record-high occupancy rates and record-low turnover rates – combined with the discounted valuations – apartment REITs appear well-equipped to outperform through the inevitable normalization.

Hoya Capital also adds,

Importantly, residential real estate has also proven to be one of the best inflation hedging assets over the last century not only in the U.S. but also across different regions.

Meanwhile, according to Hoya, the average Price/FFO for Apartment REITs has fallen to 19.0x, just barely above the overall REIT average of 17.8, and the average Apartment REIT is selling for a 19.7% discount to NAV.

Meet the company

Headquartered in Denver and separated from parent company Aimco (AIV) in September of 2020, Apartment Income REIT owns 77 properties totaling over 25,000 units, across 8 major high-demand U.S. markets:

- San Francisco

- Los Angeles

- San Diego

- Denver

- Boston

- Philadelphia

- Washington, D.C.

- South Florida

Their largest concentration by NOI (net operating income) is in Los Angeles, with 20%, and the smallest concentration is in Denver, at 7.8%

The portfolio is split almost equally between Class A and Class B units, but the average rent is a lofty $2482 per month. Management believes this diversification of price points will create stable revenues over varying market conditions.

The company focuses on high-quality stabilized communities, and does not build its own, operating with low debt. The centerpiece of their strategy is something they call the AIR Edge.

- In addition to the buildings, AIRC focuses on the tenants, using data to select market segments with renters predisposed to longer than average tenure (“good neighbors”) in an effort to drive retention, which has registered 61.6% over the past 12 months. The same-property portfolio enjoys a 98.1% occupancy rate.

- It also includes a commitment to cost control, which management says saves 10 bps (basis points) per year.

- G&A expense is capped at 15 basis points of GAV (gross asset value)

- As a result, AIRC has earned a 64.7% rate of conversion from same store revenue to free cash flow, which management says is 9 – 10% better than its peers.

Company policy requires any new investment must promise a spread of 200 bps over the weighted average cost of capital. It all adds up to high stability in the revenue stream, with comparatively low risk.

Work orders are handled through a service technology platform for efficiency, as well as integration of robotics into the workflow. Smart home technology is installed in all units, to lower turn, utility, and insurance costs, and boost revenue.

Quarterly Results

Here are the highlights from the Q2 2022 earnings release and the company 10-Q. (Net income was negative a year ago, in Q2 2021, so percentage growth figures cannot be calculated.)

| Metric | Q2 2022 | YoY change | H1 2022 | YoY change |

| FFO per share | $0.64 | + 128.6% | $1.06 | + 41.3% |

| Same Store Revenue (millions) | $104.5 | + 16.4% | $205.1 | + 14.1% |

| Average Daily Occupancy | 96.8% | + 1.6% | 97.4% | + 2.1% |

| Revenue (millions) | $183.5 | + 2.3% | $365.0 | + 2.9% |

| Net Income (millions) | $211.7 | NA | $613.0 | +783.0% |

| Net Cash From Operations | — | — | $201.5 |

+114.8% |

| Net Income per share | $1.26 | NA | $3.66 |

+756.2% |

AIRC increased its share count by less than 1% YoY.

In Q2 2022, AIRC acquired 3 new properties, totaling 1001 units, at a total purchase price of $472.3 million. One is in Washington D.C., and the other two are in South Florida. Subsequent to quarter end, the company also acquired a third property in South Florida, comprised of 350 units, at a cost of $167.8 million. Management expects a first-year NOI yield of 4.0% for this portfolio, with the yield expected to grow to 5.0% by the third quarter of next year. The expected unlevered IRR is approximately 9%.

During Q2 2022, AIRC also sold four apartment communities (three located in California and one in Virginia) totaling 718 apartment homes, for gross proceeds of $203.1 million at a trailing twelve-month NOI cap rate of 4.7% (4.0% after taxes). Net sales proceeds were $186.6 million.

The company now anticipates an additional $550 million of dispositions this year, from Boston and New York City, at expected cap rates of approximately 4%.

During Q2 2022, AIRC repurchased 2.9 million shares for $125 million, averaging of $42.93 per share, and is authorized to repurchase an additional $375 million worth.

AIRC management estimates that the company’s “loss to lease” (the spread between in-place rents and market rents) was above 10% in the second quarter, which bodes well for revenue growth going forward.

Growth metrics

Here are the 3-year growth figures for FFO (funds from operations), TCFO (total cash from operations), and market cap.

| Metric | 2020 | 2021 | 2022* | 2-year CAGR |

| FFO (millions) | $193 | $171 | $332 | — |

| FFO Growth % | — | (-11.4) | 94.2 | 31.16% |

| FFO per share | $1.73 | $2.14 | $2.37 | — |

| FFO per share growth % | — | 23.4 | 10.7 | 17.4% |

| TCFO (millions) | $283 | $333 | $402 | — |

| TCFO Growth % | — | 17.7 | 20.7 | 19.2% |

*Projected, based on H1 2022 results

Source: TD Ameritrade, CompaniesMarketCap.com, and author calculations

For its first two years in operation, at least, AIRC is growing at double-digit rates in the key revenue and cash flow metrics. AIRC’s market cap of $6.1 billion sits right in the $4-$10 billion sweet spot.

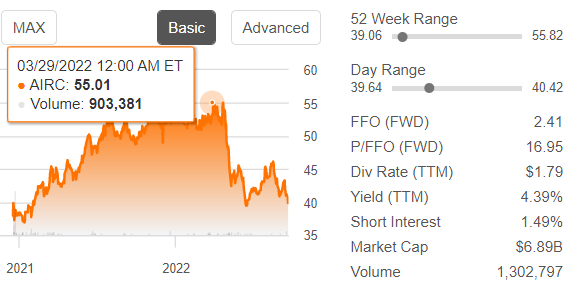

On its first day of trading (Dec. 15, 2020), AIRC share price closed at $38.41. It climbed as high as $55.82, but then sold back over the past 5 months, returning almost exactly to its starting point. The September 20 closing price was $39.85. So the share price gain for investors has been just 2.13% per year, and most of the total return has been the dividend Yield.

Seeking Alpha Premium

Meanwhile, the Vanguard Real Estate ETF has done a little worse, closing at $85.74 on December 15, 2020, and $87.97 September 20 of this year, for an annual Gain of about 1.5%.

Balance sheet metrics

AIRC’s bond-rated balance sheet is basically solid. The Liquidity Ratio is a little lower and the Debt Ratio a little higher than both the Apartment and Overall REIT averages, but only by a little, and the Debt/EBITDA is lower.

| Company | Liquidity Ratio | Debt Ratio | Debt/EBITDA | Bond Rating |

| AIRC | 1.58 | 30% | 5.3 | BBB |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

The company reports total liquidity of $925 million, against $3.368 billion in debt. The weighted average interest rate is 3.8%, with a weighted average maturity of 6.9 years.

Dividend metrics

This is where AIRC excels. Its current Yield of 4.52% and Dividend Score of 5.00 handily outpace the REIT average, and even more so the comparatively low-yielding Apartment REIT sector. In fact, it is the highest-yielding company among Apartment REITs with market caps of at least $1 billion.

| Company | Div. Yield | 3-yr Div. Growth | Div. Score | Payout | Div. Safety |

| AIRC | 4.52% | 3.4% | 5.00 | 80% | D |

Source: Hoya Capital Income Builder, TD Ameritrade, Seeking Alpha Premium

Dividend Score projects the Yield three years from now, on shares bought today, assuming the Dividend Growth rate remains unchanged.

Dividend Safety is paramount, because any cut to the dividend will be swiftly followed by a plunge in the share price. The Dividend Safety grade of D, assigned by Seeking Alpha Premium, would appear to be a bit shaky. Investors must decide for themselves if this is safe enough. The company’s focus on turning revenue into free cash flow weighs in its favor here.

Valuation metrics

From a value investing perspective, AIRC is attractively priced at just 16.8x 2022 FFO, and a 23.4% discount to NAV.

| Company | Div. Score | Price/FFO ’22 | Premium to NAV |

| AIRC | 5.00 | 16.8 | (-23.4)% |

Source: Hoya Capital Income Builder, TD Ameritrade, and author calculations

From a growth investor’s perspective, this is not a great proposition. The below-average Price/FFO actually bodes ill for total return. As Hoya Capital has found, cheap REITs tend to stay cheap.

What could go wrong?

AIRC provides a very lengthy and thorough look at the company’s risk in its annual 10-K. Here are some of the key points:

- Health experts are predicting a resurgence of COVID this fall, and that proved difficult for Apartment REITs in 2020.

- Since AIRC operates in only 8 markets, adverse economic changes in any of those locales could have an outsized effect on revenues.

- Continued high inflation rates would raise operating costs.

- Apartment REITs compete with each other for both properties and tenants, and compete with other housing options, such as condos, single-family homes, and home ownership. Changes in the favorability of those options would change the competitive footing of AIRC.

- Even though it is two years in the past, AIRC faces an ongoing risk of disputes with Aimco over the terms of their separation, which could result in increased operating costs.

Investor’s bottom line

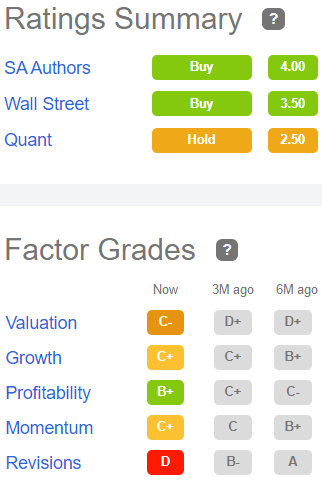

The average price target of the 12 Wall Street analysts covering AIRC is $47.55, implying 19% upside. Four call it a Strong Buy, six call it a Hold, and two recommend selling.

Seeking Alpha Premium

Among those sellers, BMO Capital Markets analyst John P. Kim sees the revenue set-up for 2023 as favorable,

but with increased uncertainty, and dwindling new jobs-to-supply. By improving its balance sheet and simplifying its structure, AIRC has lower 2023 FFO growth than peers – we are estimating 0.8% FFO growth in 2023, and limited upside potential from developments.

On the other hand, according to Hoya Capital, which maintains a Buy,

our [price] target for Apartment Income is based on a warranted 20x P/FFO multiple . . . which we view as quite conservative given the strong medium-term growth trajectory.

The Seeking Alpha Quant ratings show AIRC as a Hold, as do Zacks and Ford Equity Research, while The Street says Sell and TipRanks says Buy.

As I see it, AIRC is a healthy company, and there is no compelling reason to sell. If you are a short-term investor, nothing is really safe until the market sorts itself out. This company is not a compelling proposition for a growth investor, but if you are a value investor, and your horizon is at least 2 years, and you want a high yield with low risk in an Apartment REIT, AIRC is a good choice.

In the last analysis, it’s your opinion that counts most.

Be the first to comment