Matthew Lloyd

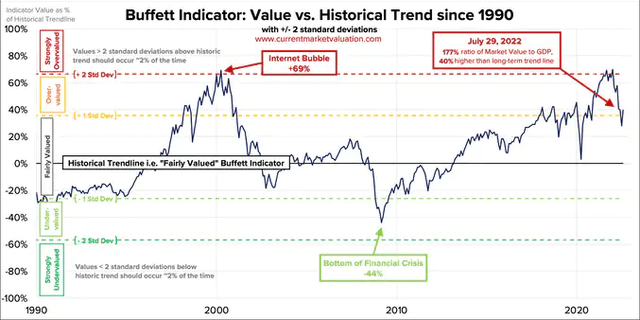

S&P 500 (NYSEARCA:VOO)(SPY) valuations remain elevated despite numerous recession warnings and indicators. For example, the Buffett Indicator – the ratio of the total U.S. stock market capitalization to U.S. GDP – indicates that the stock market is about 40% overvalued at the moment:

Buffett Indicator (currentmarketvaluation.com)

Another indicator known as the P/E ratio model also indicates that the stock market is severely (52%) overvalued:

P/E Ratio Model (currentmarketvaluation.com)

In addition to these indicators that the stock market is overvalued, the economy is besieged by numerous headwinds, including four-decade high inflation rates, interest rates that remain near the low end of the historical spectrum and appear set to rise in response to stubbornly high inflation, lingering supply chain issues, war in Eastern Europe which is disrupting the global food and energy supply chains, and soaring geopolitical tensions between the world’s two largest economies and most powerful militaries (the U.S. and Communist China) over the political status of the Republic of China/Taiwan.

To make matters worse, according to the traditional definition of a recession (two consecutive quarters of declining GDP), the United States is already in a recession and – given the aforementioned headwinds – it seems very likely that we are only in its early stages.

Three Year Bear Market Warning

When you put these factors together, it is hard to get too bullish about the near-term outlook for the stock market. In fact, highly respected bubble expert and GMO cofounder and chief strategist Jeremy Grantham recently warned that corporate profits are poised to decline as a result of the recession in the United States, which would then send stocks into crash mode. In fact, he suggested the very real and even likely scenario that the S&P 500 could plunge by another 25% below its recent 2022 lows, saying:

Of course earnings will now come down. The big second shoe falls [for the stock market] where earnings decline… It’s likely that there will be considerably more pain before this is finished

His one year price target for the S&P 500 is 3,000, which is 27% below current levels and that the market downturn could continue for up to three years. He also noted that bubbles like the massive one he believes is currently deflating (he referred to it as a “super bubble” and “one of the great speculative periods”) could lead to investors not making any money relative to previous highs for ten years.

The Bull Case For The S&P 500

While the bear case is certainly compelling – if not frightening – all hope is not lost. There still remain a few strong cases for being bullish on the market here.

Perhaps the biggest reason to be bullish is that there are numerous green shoots that imply inflation may have peaked. Gas prices have retreated quite a bit from their peak levels and many natural resources and industrial materials have seen price corrections. Even Elon Musk, CEO of Tesla (TSLA), tweeted:

Inflation might be trending down. More Tesla commodity prices are trending down than up fwiw.

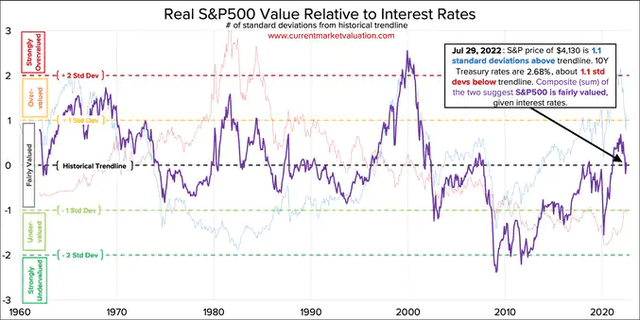

Why is this so important for the S&P 500’s outlook? Well, apart from the relief this will provide to company profit margins and consumer purchasing power, it also means that the Federal Reserve may not have to hike interest rates much more if at all to rein in inflation. If that is the case, it bodes quite well for the S&P 500’s near-term outlook as according to the Interest Rate Valuation Model, the S&P 500 is fairly valued relative to current interest rates:

Interest Rate Valuation Model (currentmarketvaluation.com)

As a result, if interest rates have truly reached the “neutral level” like Fed Chairman Jerome Powell indicated at a recent press conference, then the stock market is actually at a pretty reasonable level to buy.

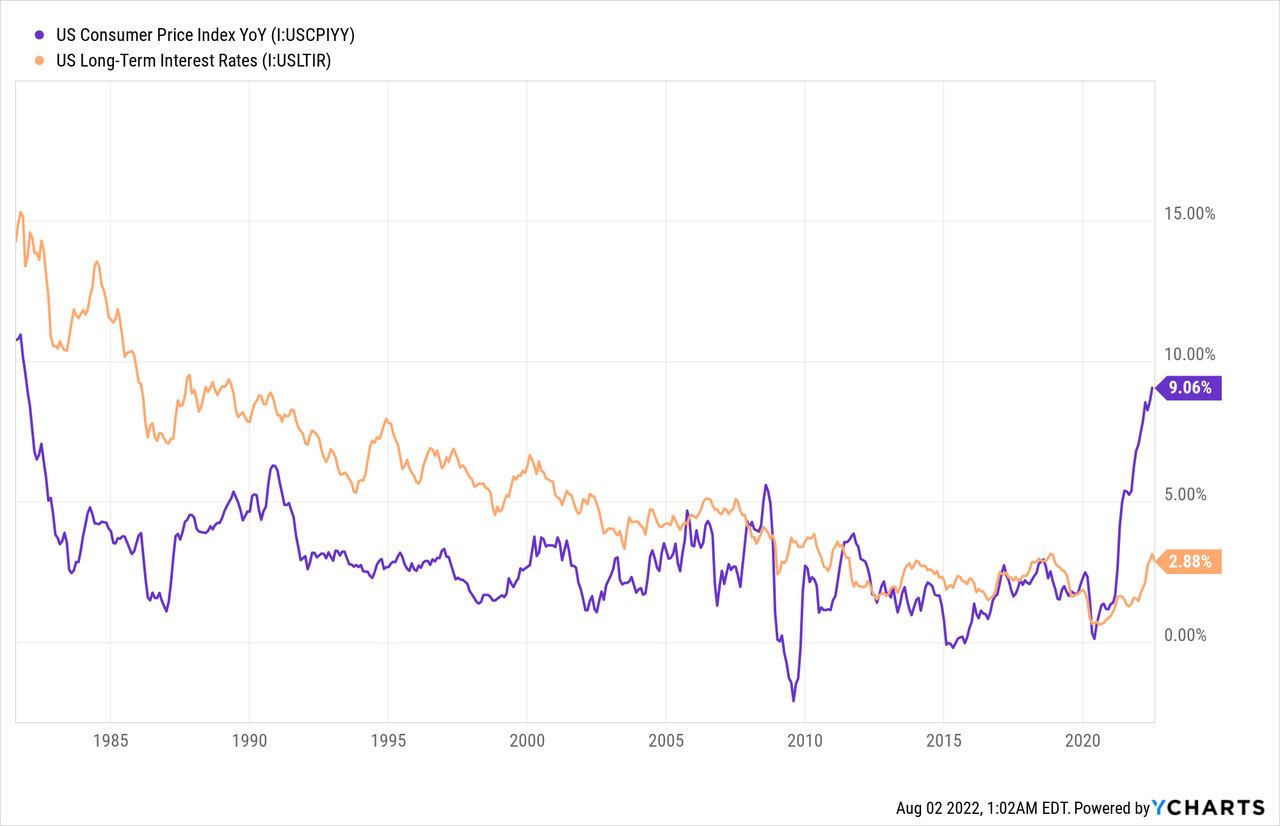

Of course, that then begs the question of whether or not interest rates are high enough. Looking at a historical chart of inflation and interest rates, it is hard to make that case, as interest rates remain near historic lows and inflation is raging at four-decade highs:

However, the counterpoint is that underneath the headline numbers are two very clear factors at play: inflation is largely being caused by government responses to a once-in-a-century global health event and is being further aggravated by war. Once these catalysts subside, inflation should return to normal levels. Additionally, there is a massive wave of technological innovation going on right now that in the coming years and decades will have a massive deflationary effect. As a result, there is a fair case to be made that interest rates are not too low at present.

Finally, if the Federal Reserve is indeed done with hiking interest rates and inflation has truly peaked, then there is still hope that the U.S. economy can quickly reverse course and skirt any sort of prolonged or deep recession, thereby saving corporate earnings from a meaningful decline.

Investor Takeaway

As always, it is extremely difficult and often a fool’s errand to try to make investment decisions based on short-term macroeconomic calls. While we generally avoid engaging in macroeconomic-driven investing decisions, it is tempting to be bearish here given the headline numbers being presented in the financial media. At the same time, there are encouraging signs that inflation may have peaked and the accelerating wave of deflationary technological innovation is also truly exciting and encouraging.

As always, time will tell if Jeremy Grantham’s prediction of doom and gloom will become reality or if the worst is in the past for the stock market and we can get through the current economic headwinds with just a short and mild recession.

Regardless, our approach at High Yield Investor is to continue buying undervalued, well-capitalized, high-quality dividend stocks with an overweight focus on more defensive sectors like midstream energy giant Enterprise Products Partners (EPD), high yield and growth utilities like Algonquin Power & Utilities (AQN), and undervalued high yield triple net lease REITs like STORE Capital (STOR). We believe this provides us a better risk-adjusted return profile than buying S&P 500 index funds like VOO at the moment. That said, we are not necessarily big bears on VOO either at the present time as we see a compelling case for both the bears and the bulls.

Be the first to comment