Quick Take

Wipro Digital (WIT) has announced the acquisition of Rational Interaction for an undisclosed amount.

Rational has developed technologies to assist enterprises in mapping and orchestrating customer journeys online.

With the deal, WIT adds an important customer experience piece to its digital consulting offering and I like the strategic reasons for the acquisition.

However, WIT’s consistent underperformance compared to competitor InfoSys (INFY) leads me to be cautious on the stock, so my bias is NEUTRAL.

Target Company

Seattle, Washington-based Rational was founded to provide a full service digital agency with integrated consulting services for brands seeking increased return for their online marketing efforts

Management is headed by Chief Executive Officer Ms. Kahly Berg, who has been with the firm since 2017 and previously held several positions in marketing at Microsoft

Below is an overview video of Rational:

Source: Rational Interaction

Rational’s primary offerings include:

Company partners or major customers include:

-

Acer

-

Microsoft

-

Amazon

-

PWC

-

Zillow

-

Accolade

Market & Competition

According to a 2018 market research report by Grand View Research, the market for customer experience management is expected to exceed $32 billion by 2025.

This represents a forecast CAGR (Compound Annual Growth Rate) of 22.9% from 2017 to 2025.

The main drivers for this expected growth an increase in demand from retail sector companies seeking to compete with online e-commerce sites; call center operations are also expected to account for demand growth.By region, the Asia Pacific region is expected to produce the fastest growth during the period, growing at a forecast rate of 24.7%.

Major vendors that provide customer experience software include:

Source: Research Report

Acquisition Terms & Financials

Wipro Digital didn’t disclose the acquisition price or terms and didn’t file a form 8-K, so the deal was likely for a financially non-material amount.

Management didn’t provide a change in financial guidance as a result of the transaction.

A review of the firm’s most recent published financial results indicate that as of December 31, 2019 Wipro had $4.9 billion in cash and short term investments and $3.8 billion in total liabilities of which $313.1 million was long-term debt.

Free cash flow for the twelve months ended December 31, 2019 was $997.2 million.

In the past 12 months, Wipro Digital’s stock price has fallen 14.4% vs. the U.S. IT industry’s rise of 29.5% and the U.S. overall market index’ growth of 14.0%, as the WIT chart indicates below:

Source: Simply Wall St.

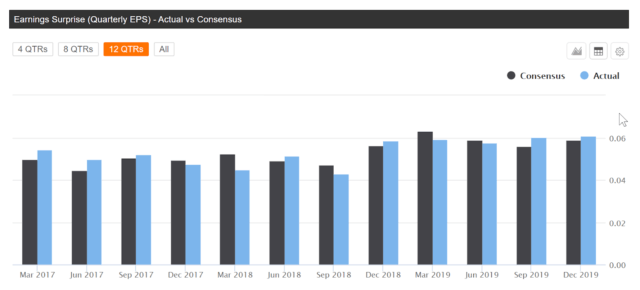

Earnings surprises versus analyst consensus estimates in seven of the last twelve quarters, as the chart shows here:

Source: Seeking Alpha

Valuation Metrics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$19,440,000,000 |

|

Enterprise Value |

$16,120,000,000 |

|

Price / Sales |

0.44 |

|

Enterprise Value / Sales |

1.90 |

|

Enterprise Value / EBITDA |

9.28 |

|

Free Cash Flow [TTM] |

$920,560,000 |

|

Revenue Growth Rate |

5.18% |

|

Earnings Per Share |

$0.25 |

Source: Company Financials

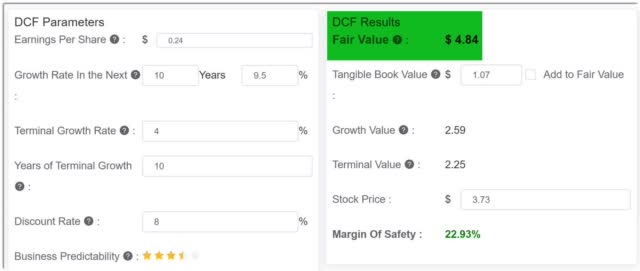

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Assuming the above generous DCF parameters, the firm’s shares would be valued at approximately $4.84 versus the current price of $3.73, indicating they are potentially currently undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary

WIT acquired Rational to bolster its customer experience offerings within its Wipro Digital unit.

As Rajan Kohli, President of Wipro Digital stated in the deal announcement,

This acquisition comes at a time when companies increasingly compete solely on CX, and the market for CX spending is growing exponentially. Discovering, refining and optimizing the customer experience from first impression through repeat sale requires best-in-class talent, unique marketing technologies and methodologies, and the ability to scale and demonstrate payback quickly.

Customer experience [CX] is a hot space in online marketing, as it covers the entire customer journey from first awareness to loyal customer.

While we don’t know how much Wipro paid for Rational, the deal makes strategic sense, as it will combine Rational’s ‘ability to map and orchestrate the customer journey with Wipro Digital’s ability to design and build experiences at global scale.’

The deal won’t move the needle for the parent group’s stock, but it provides investors with a view into management’s thinking and resource allocation for areas that the firm intends to broaden and deepen its offerings, which are typically in higher-growth areas such as customer experience.

As for WIT’s current valuation, my DCF assumptions indicate the stock may be undervalued. India’s economy has been hard hit in recent periods. Although Wipro is a global firm, it has no doubt been negatively affected.

Given WIT’s consistent underperformance in comparison to INFY, my current bias on the stock is NEUTRAL.

I research IPOs and technology M&A deals.

Members of my proprietary research service IPO Edge get the latest IPO research, news, market trends, and industry analysis for all U.S. IPOs. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment