Consumer Confidence- Talking Points

- US Dollar Drops as consumer confidence misses estimates

- Coronavirus fears go unmentioned in report

- Business conditions outlook ticks higher

The US Dollar dropped lower after this morning’s consumer confidence figure from the conference board crossed the wires at 130.7, missing expectations of 132.2. The US Dollar Index (DXY) was trading at the 99.29 mark before moving lower as the figure from the Conference Board crossed the wires. The USD index is now trading near overnight lows of 99.13.

US Dollar Index – DXY (1-Min Chart)

Chart created by @FxWestwater with TradingView

Recommended by Thomas Westwater

Get Your Free USD Forecast

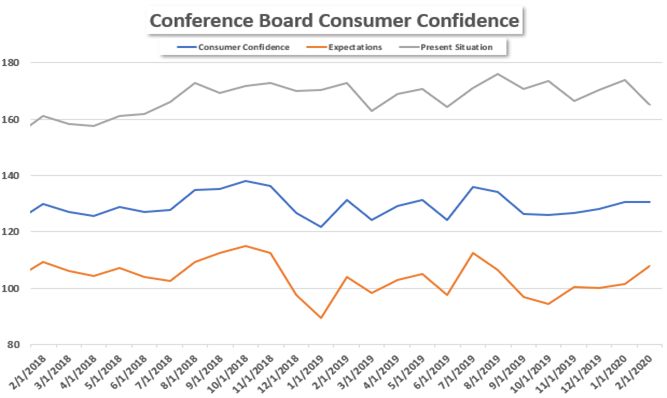

The present situation index declined to165.1 from 173.9. However, the expectations index, which is based on the short-term outlook for income and labor market conditions increased from 101.4 in January to 107.8 for this February. The coronavirus went unmentioned in this month’s report. The virus reignited recession fears in the global economy recently and pushed stock indices sharply lower Monday morning.

Source: Bloomberg

A bright spot in the report reflected growing optimism in business conditions over the next six months, with the percentage of consumers expecting an improvement increased to 20.4 percent from 18.4 percent. Moreover, income prospects also ticked up, with 22.0 percent expecting an increase, up from 21.6 percent.

–Written by Thomas Westwater, Intern Analyst for DailyFX.com

Contact and follow Thomas on Twitter @FxWestwater

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Be the first to comment