Christoph Burgstedt/iStock via Getty Images

Investment Thesis

It’s been almost a year since a meme stock bonanza pulled out Bionano Genomics (NASDAQ:BNGO) from the verge of bankruptcy. Like other companies in the same category, the stock price rally preceded (and caused) fundamental improvements on the balance sheet and, to a lesser extent, the income statement.

The company continues its efforts to spread awareness of its product, engaging with the academic sector to build the literature needed to steer the biotech industry towards adopting its Structural Genome Variation “SV” solution. The progress remains painfully slow, and many investors capitulated on the stock, contributing to the stock’s catastrophic performance.

Optical Genome Mapping “OGM” advantage over traditional cytogenetic tests is not absolute, and the 1990s tech carries a set of advantages and disadvantages over other methods. In my view, the base-case scenario is that OGM will gain enough adoption to be included in the genome testing tool kit but not enough to replace traditional methods. For now, BNGO remains a speculative thematic trade in the genomics industry.

Revenue Trends

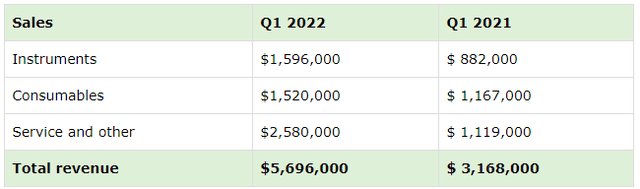

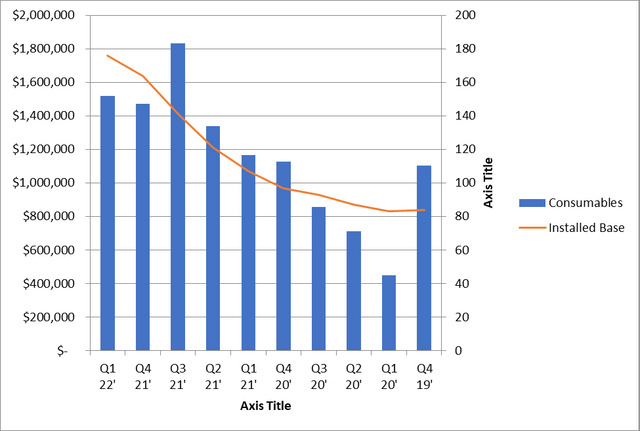

Bionano Genomics. Table created by the author

BNGO drew a vivid illustration of its sales potential on investment prospectuses using Illumina (ILMN) sequencers as an indicator of its market size, citing the complementary nature of Saphyr to genome sequencing. In a neat 2018 presentation before going public, management told investors that each of ILMN’s 6,000 sequencers on the market at the time would ideally be accompanied by one of its own Saphyr devices, complementing single-nucleotide sequencing with a wide-angle image of the genome. Since then, ILMN has sold 14,000 additional sequencers, compared to BNGO selling 176 OGM devices. Using ILMN’s installed base as a proxy for market growth, it is likely that BNGO lost market share despite revenue.

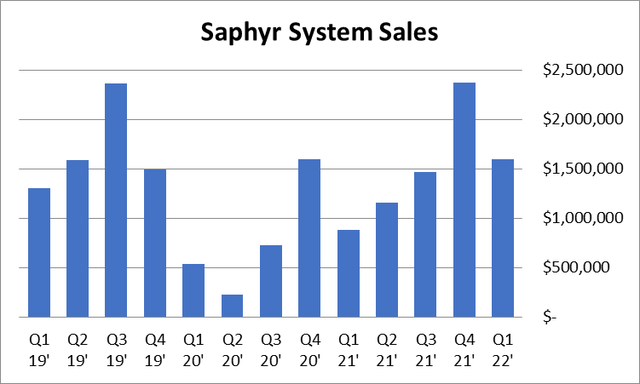

Moreover, one can’t help but notice that Saphyr’s revenue remains in line with historical averages, contradicting management’s claim of momentum, a profound assertion implying market acceptance, which isn’t exactly evident in the numbers. This is a critical distinction given BNGO’s market position as a market disruptor trying to introduce new technology to the market, an effort it had endeavored since at least 2011 when it introduced BioNanomatrix’s nanoAnalyzer 1000 system.

Bionano Genomics. Table created by the author

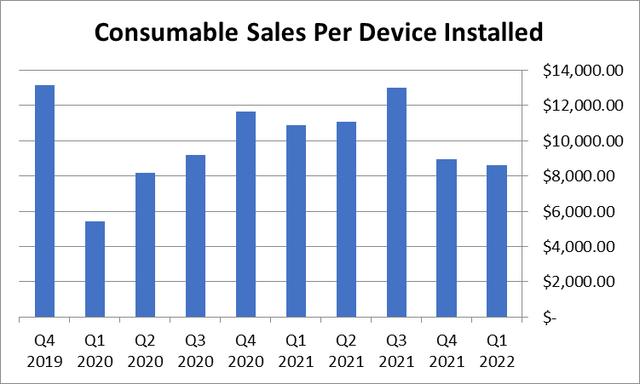

There is also no evidence of increased utilization of Saphyr in the labs, at least by an amount that constitutes a “momentum,” as shown in the Average Consumable Sales per Device graph below. If there were a hype around Saphyr as management claims, one would expect to see increased system usage, translating to a higher demand for consumables per device installed.

Bionano Genomics. Table created by the author Bionano Genomics. Table created by the author

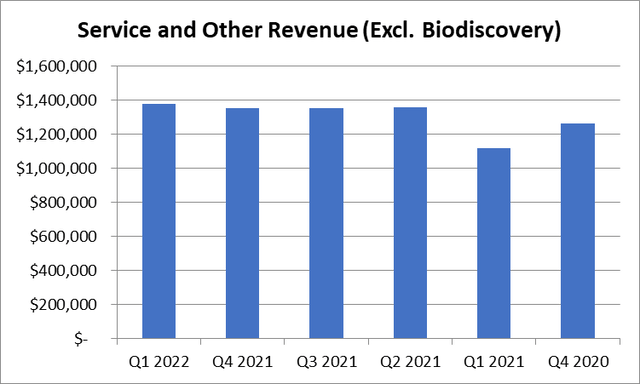

BNGO resorted to vertical and horizontal expansion to increase awareness of OGM, acquiring Lineagen and Biodiscovery in August 2020 and October 2021, respectively, whose revenue is now part of the Services segment, along with Saphyr warranty proceeds and in-house OGM testing service.

To examine management’s claim of revenue momentum in core operations, one should exclude revenue contribution from Biodiscovery, shedding more light on the organic performance (including Lineagen, since it was acquired more than a year ago). The graph below shows flat revenue in the Services division, giving more evidence that although BNGO’s revenue was solid during the quarter, claiming momentum is an overstatement.

Bionano Genomics. Table created by the author

Earnings Trends

Biodiscovery and Lineagen might have transformed BNGO into a genomics data solution provider instead of a life science equipment vendor. Still, Saphyr remains its highest growth potential and the basis of its investment hypothesis.

The product segment, which includes sales from Saphyr and accompanying consumables, contributed just over half of Q1 sales. The division resembles the print and cartilage business model, which is structurally profitable. However, multiple factors cloud its earnings picture, including supply chain disruptions, reagent rental programs, clinical trial expenses, and non-cash items related to the Biodiscovery acquisition.

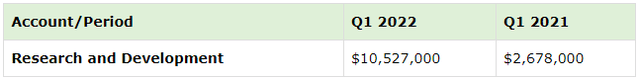

Research and Development

R&D expenses nearly quadrupled in Q1 compared to the same period of last year, fueled by increased hiring for the clinical trial project and headcount increase after the Biodiscovery acquisition, in addition to related non-payroll expenses.

Bionano Genomics. Table created by the author

About a third ($3,328,000) of Q1 2022 R&D expenses are non-cash stock-based compensation for R&D engineers working on its development projects across its three segments; Saphyr, Biodiscovery, and Lineagen. A significant portion of the stock-based balance relates to Biodiscovery’s NxClincial V7 software development. NxClincial V7 will be the first version supporting OGM, a welcomed upgrade, giving OGM the same footing as its competitors, namely whole-genome sequencing, which is already supported by previous versions.

At this point, Saphyr faces competition from alternative technologies instead of peers with similar products. This has implications on the R&D budget allocated to Saphyr, which, from my understanding, is smaller than what management is assigning to NxClincial, aside from the clinical trial expenses, whose function is to develop pathways for reimbursement and spread awareness of the system rather than a product upgrade.

On the clinical trials national registry website, BNGO states that the primary end date of its clinical trial is March 2024. From my experience, clinical trials reported on the registry often end before the stated primary end date. Management guided for higher R&D expenses for the rest of the year, albeit at a slower pace than 2021. Management perceives these expenses as strategic and necessary for the long-term adoption of OGM, preceding profitability on the leadership’s priority list.

Unit Cost and Supply Chain Disruptions

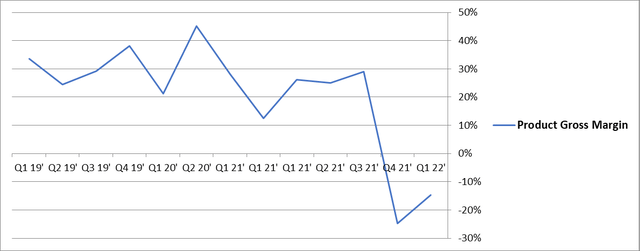

Between Q1 2019 and Q3 2021, gross product margin (instrument and consumables sales) hovered between 13% and 45% (28% average). Discrepancies relate to the fluctuation of the Direct and Reagent Rental sales mix. The latter consists of a rental agreement where a client obtains the instrument for free in exchange for a long-term consumable purchase contract.

Gross Product Margin (Instrument and consumable sales) (Bionano Genomics)

More recently, gross margin dipped to negative territory. Like many companies, BNGO and its third-party manufacturers decided to alter some components of Saphyr and consumables in response to supply chain disruptions and material shortages. Some flowcell products failed on customer sites despite passing contractual quality control specifications. BNGO stopped shipping these components and wrote off the faulty inventory, recording the loss in COGS, leading to the negative gross margins shown in the graph above.

Since BNGO doesn’t own a manufacturing facility and relies on third-party suppliers, it still needs to abide by purchase agreements, given that contractually, the products match quality control specifications, regardless of whether they work or not. This is why the issue, which surfaced in Q4 2021, extended into Q1 2022 and is expected to put pressure on gross margins for the coming few quarters.

Summary

Beyond BNGO’s 80% revenue growth lays cracks in management’s claim of momentum, an assertion implying an embrace from the clinical and biotech research industry. Although revenue reached record levels, this is mainly attributed to the Biodiscovery and Lineagen acquisition and, to a lesser extent, a wider Saphyr installed base, enhancing total consumable sales. On the other hand, Saphyr, Consumable sales per device, and Services revenue remain close to the historical average, contrary to management’s momentum claim. All-in-all, the genomics market grew faster than Saphyr, a sign that the company lost market share, despite YoY revenue growth.

BNGO is applying for the CPT Category 1 code, the first step to streamlining reimbursement, a critical factor affecting sales to the clinical lab industry. The management approach to navigating the regulatory environment is a bit unsystematic. The product remains a Research Only Device, and obtaining a Pre-market Authorization “PMA” (medical device certificate) will significantly facilitate reimbursement pathways for its clinical lab clients. However, despite the robustness of its clinical trials, they are not designed as part of a PMA or 510K application, instead, to build literature that is enough to enhance smaller wins, including obtaining a CPT code from the American Medical Association “AMA”.

Supply chain disruptions pushed gross margins to negative territory, and management expects this issue to put pressure on margins for the next few quarters. Operating expenses will remain elevated as the company continues to execute its ELEVATE program, manifested in its four pillars; Reimbursement, Expanding Awareness, Product Development, and Clinical Studies.

Be the first to comment