Parradee Kietsirikul/iStock via Getty Images

Thesis

John Hancock Financial Opportunities Fund (NYSE:BTO) is a closed-end fund focused on financial services companies’ equities. The CEF utilizes leverage and has recently moved to a discount to net asset value from a pricing perspective. Significant discounts to NAV are not desirable because they dilute the brand value of the asset manager, and speak poorly to the ability to pick good components for the fund’s portfolio. BTO is a well-run CEF with robust long-term results and a good management team. The fund is actively trying to prevent significant moves in its discount to NAV via share repurchases:

BOSTON, Dec. 15, 2022 /PRNewswire/ – John Hancock Financial Opportunities Fund BTO announced today that the Board of Trustees has renewed the Funds’ share repurchase plans.

The Board of Trustees approved the renewal of the share repurchase plans as part of its ongoing evaluation of options to enhance shareholder value and potentially decrease the discount between the market price and the net asset value per share (“NAV”) of the Funds’ common shares. Under the share repurchase plans, each Fund may purchase, in the open market, between January 1, 2023 and December 31, 2023, up to an additional 10% of its outstanding common shares (based on common shares outstanding as of December 31, 2022). The Board of Trustees will review the plan periodically and may authorize adjustment of its terms and size.

The share repurchase plans allow the repurchase of common shares in the open market at a discount to NAV. The plans could allow the Funds to realize incremental accretion to their NAV to the benefit of existing shareholders. They could also have the benefit of providing additional liquidity in the trading of common shares.

Usually, we see only 5% buy-backs, and moreover, we see minimums in terms of discounts to NAV (i.e., if the fund is trading below 98% or 95% of its net asset value), not here. The fund has voted to be able to buy back almost 10% of its shares next year.

We like this proactive approach to discount to NAV management, especially in a tough market like the 2022/2023 one. In many instances of risk-off environments, CEFs lose value from a widening of the discount to NAV rather than from their primary risk factors. This contributes to creating worse analytics for the names – higher standard deviations, lower Sharpe ratios, and worse off risk/reward metrics. A large share repurchase program that can be activated on liquidity-impaired days can act as a great dampener and liquidity mop when needed.

We like this corporate action, and it speaks volumes towards John Hancock as a well-run platform. Ultimately, many managers fail because they just end up clipping fees and not really engaging in much of anything else (we have seen for example the Macquarie/Delaware fund family closing shop on the back of persistent wide discounts to NAV).

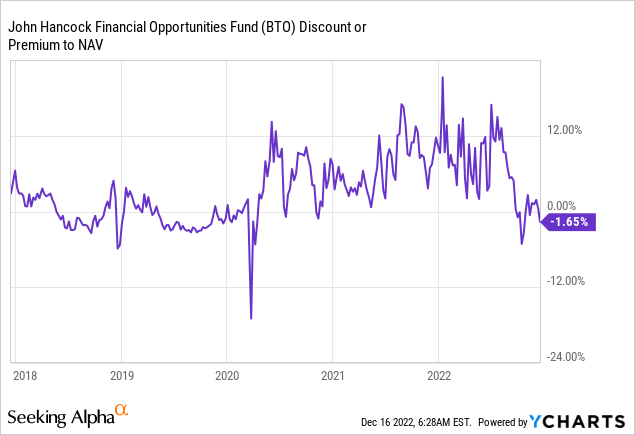

BTO Premium/Discount to NAV

The fund usually trades at a premium to NAV:

As financial conditions have deteriorated and the stock market has entered a risk-off period, BTO moved to a discount. We can see from the above graph that the only other historic period when the fund consistently traded at a discount was the 2020 Covid crisis.

Putting a soft bottom to its discount to NAV via share repurchases is a good idea, and it will ensure that during violent market sell-offs, the fund has the liquidity and ability to minimize further market price losses from NAV discount widening.

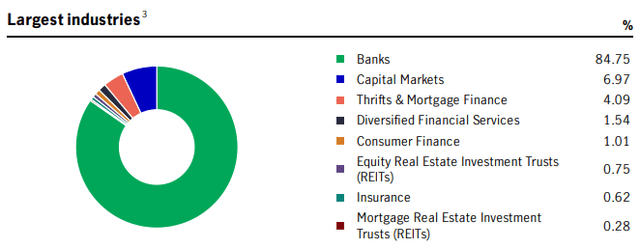

BTO Holdings

The fund holds mostly financial equities:

Largest Industries (Fact Sheet)

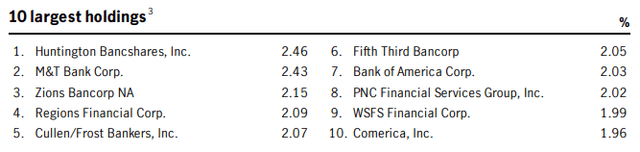

To that end, the largest holdings in the fund are reflective of the industry build:

Largest Holdings (Fund Fact Sheet)

We can see that the largest holdings are regional banks, all of which are below a 5% threshold for single names. For equity funds, we usually consider any structure with multiple names above a 5% threshold as being concentrated.

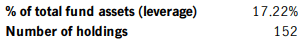

The fund holds a fairly large pool of individual names, exceeding 150:

Holdings (Fund Fact Sheet)

We can see that the CEF has layered leverage on top of the equity structure, leverage which has a modest figure of only 17.22%.

Conclusion

BTO is an equity CEF focused on financials. The fund does not usually trade at a discount to NAV but has recently moved to one. The fund management just voted on a large share repurchase program for 2023, that can see up to 10% of outstanding shares being bought back. This corporate action should put a soft bottom in place for the fund’s discount to net asset value as well as improve the CEF’s volatility and risk/reward metrics. The corporate action speaks volumes towards the asset manager’s ability to proactively address a market which will likely exhibit bouts of illiquidity and gap-down events in 2023. This corporate action is a positive for existing BTO shareholders, and moreover, speaks well towards a very proactive asset manager in John Hancock.

Be the first to comment