grandriver

Investment Thesis

Ring Energy (NYSE:REI) is a small Permian Basin exploration and development company. The Permian Basin remains a pillar of the domestic US oil and gas industry, being one of the lowest-cost production areas in the United States.

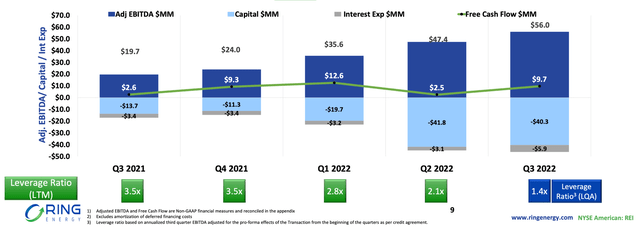

The closure of the Stronghold acquisition in September 2022 will add approximately 10,000 boe/d to REI’s asset base. This adds significant natural gas and natural gas liquids production to REI and drives the oil/total mix from 85% to 70%. The acquisition boosted cash flow in the short term by 10% quarter over quarter and year over year revenue growth of 82%. Debt is being paid down quickly and now sits at 1.4x of debt over EBTIDA. Additionally, the reserve-based lending facility has decreased to 73% drawn post the Stronghold acquisition.

REI is expanding margins and an increasing bottom line, reaffirming its commitment to a strong balance sheet in FY23. Among peers, it is already a star for valuation, and with outlook for oil markets improving into FY23, we think that REI is a high risk buy for 2023.

Estimated Fair Value = EFV

EFV = E23 EPS times P/E

EFV = $1.00 X 5.0 = $5.00 per share

Our P/E calculation is erring on the lower end of the typical 5.0x – 10.0x range that exploration and production companies typically sell at depending on investor sentiment.

Benchmarking Performance

Capital expenditures in 4Q22 are expected to be $44 million. Cash Operating Costs year-to-date (YTD) of $10.55/boe.

Break-even oil price is estimated at $25-30/bbl for drilling and completion operations and about $45-50/bbl fully loaded with all company expenses.

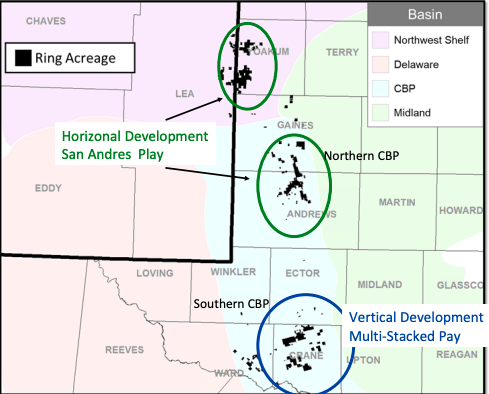

REI Operating Areas (REI 3Q22)

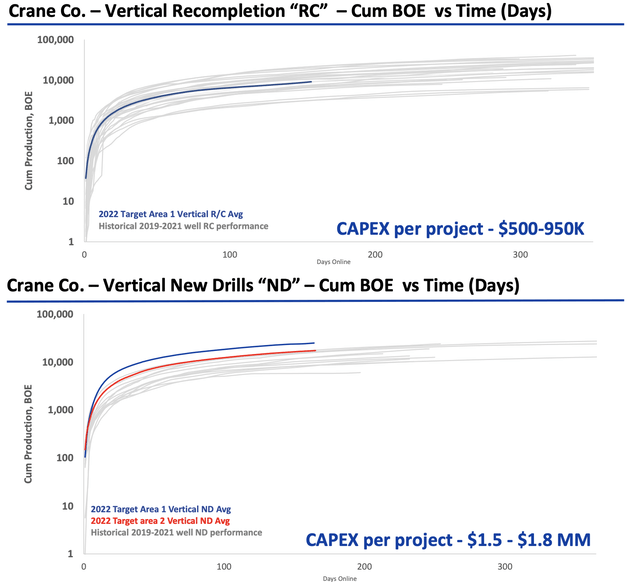

The primary vertical development area is within the CBP (Central Basin Platform) in the Permian Basin. Similar deep vertical fracking operations are coming in at $1.2-2 million for a fully complete well. REI reports vertical fresh drills coming in at $1.5-1.8 million, and completion of old drill bores at $500-950k. These are in line with the sector. REI expects 3 additional vertical wells to come online by the end of the year. While vertical drilling is an old-fashioned legacy method, concentrated deposits lead to high returns and low-cost drilling opportunities. Cumulative well performance is much higher with modern multi-stage wells, with new REI vertical drilling operations hitting 10,000 boe in cumulative production in around 100 days.

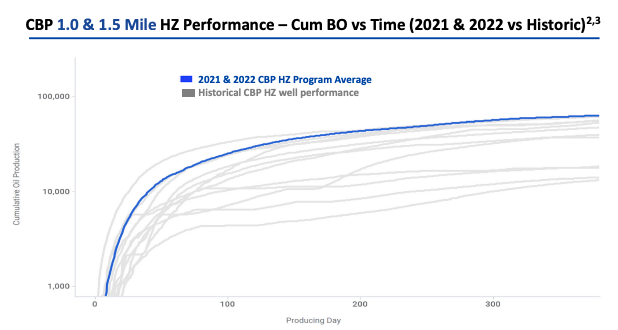

Secondary REI plays are the Northwest Shelf and the San Andres where horizontal drilling will be widely implemented. Horizontal drilling is more technically complicated and costly, with well costs and development time varies wildly depending on the depth and length of the formation. The average horizontal well in the Permian Basin costs around $2.6 million, from first drill to production. REI has ranged between $1.3-3.4 million according to management, depending on the area, with cheaper wells concentrated in the North. Average horizontal well performance has consistently increased over time, with 50,000 boe in cumulative production being hit in around 60 days. REI expects to have 7 additional complete and online horizontal wells by the end of this year.

Performance within the CBP over time. (REI 3Q22)

Production is expected to average 19,000 boe/d in 1Q23 a 53% increase over 1Q22.

Production Environment

REI has embarked on an efficiency program to convert the older electrical submersible pumps (ESPs) to rod pumps. This rod pump program requires a small capital expenditure to significantly reduce the lease plus operating costs (LOE) of a well and future pulling costs by 75%. The primary reason for this saving is that rod pumps are more reliable and energy efficient. Rod pumps will also help reduce bottlenecks in some production areas.

REI acquired space in the Northwest Shelf (NWS) in 2019 and is targeting a shallow oil reservoir at 5,000ft. There are 79 proven horizontal drilling areas and 11 vertical drilling areas with additional potential drilling areas possible. In the NWS, REI owns much of its own infrastructure which ultimately has led to an average individual well return average of 98% even at prices as low as $40/bbl in net realized price.

REI acquired much of its CBP from the acquisition of Stronghold. CBP target is the oily San Andres formation at 5,000ft. There are 2 identified vertical drilling locations and 38 identified horizontal drilling areas within the original area. Following the acquisition REI now owns 200 additional drilling locations that fit a low-cost operating profile. There are an additional 100 drilling areas that could provide low-cost output but would require exploratory drilling outside of known reserve areas.

Balance Sheet and Valuation

REI’s stated strategy is to focus on building FCF (Free Cash Flow) and leverage reductions. In 3Q22, FCF rose 273% year over year, and debt fell to a low of 1.4x EBITDA

Even with the acquisition of Stronghold debt repayments hit an all-time high at $17 million in 3Q22, allowing liquidity to spike and giving REI much-needed breathing room.

REI owns non-core asset space in the Delaware Basin which it is seeking to offload. REI states that the sale of these assets could be used for debt reduction or provide additional funds for further accretive acquisitions. While the assets within the Delaware Basin fit the profile appropriate for a low-cost high rate of return development, REI states that the opportunities in their current NWS and CBP play are more attractive.

Capex expectations have been reduced for the remainder of the year by approximately 15% to $44 million. In the post-acquisition environment, REI will be focusing on merger synergies and rod pump conversion operations. Free cash flow and earnings per share should increase in our opinion as the production grows and cost-efficiency projects like the rod pump conversion are completed.

For FY23, the strategic plan is to pay off existing debt with modest organic production growth. Excess cashflow will fund opportunistic acquisitions that bring strong economies of scale or low breakeven costs. The increase in cash flow may be returned to shareholders if there is not a solid acquisition. A hypothetical dividend for FY23 at only a 10% payout ratio would still put the yield of REI at 3.3% at its current price of approximately $2.35.

On a valuation basis, REI has a low valuation with a price to earnings and price to book sitting at 2.5x and 0.6x respectively. REI is in our opinion undervalued at its current price especially given the strength of FY23 fundamental guidance.

Market Dynamics

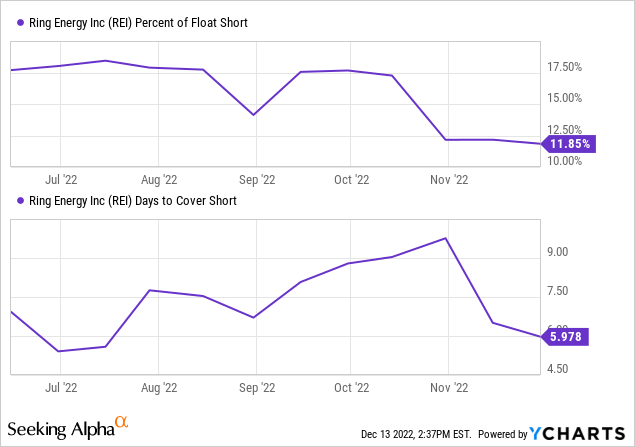

At the time of writing this article, short interest as a float for REI is at 12%, and the average day to cover is a little under a week. This is an extremely large short position for a company with increasing revenues and positive strategic outlook. A potential short squeeze looks highly likely.

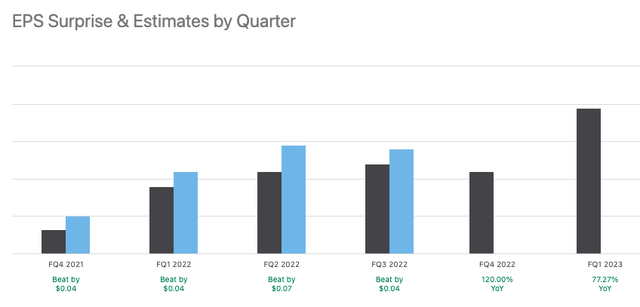

On Wall Street, the sentiment according to Seeking Alpha seems to be positive, with an average price target of $5.50. in 3Q22, REI breached GAAP EPS targets by almost $0.25, raising guidance to by 156% higher year over year at $0.80 for the year.

Normalized EPS estimates by quarter (SeekingAlpha)

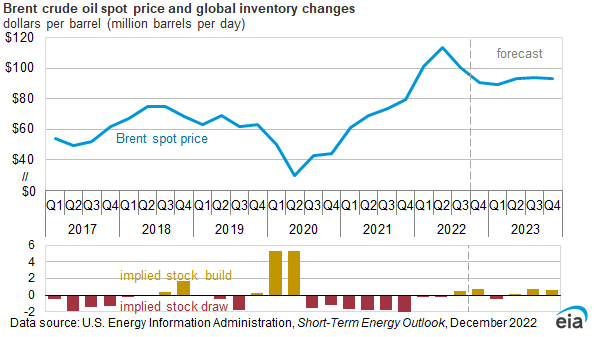

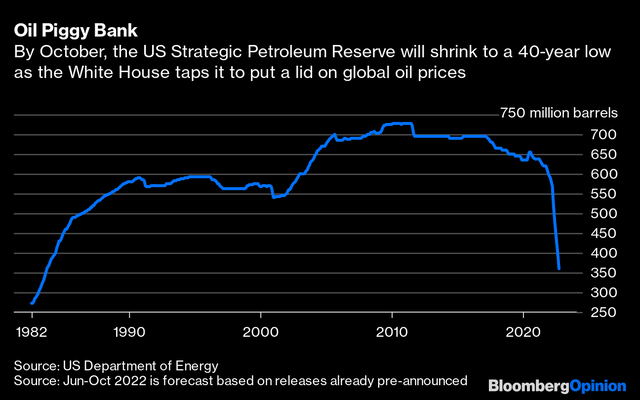

There has been some softening in the price of oil and gas versus their Russian invasion of Ukraine spikes. We expect Brent and WTI (West Texas Intermediate) crude to move back above $100 in 2023. We expect the median price to be above the $92.36 expected by the EIA. The EU’s $60/bbl price cap on Russian oil and the prohibition of nearly all Russian seaborne oil exports means that there is still some uncertainty going into FY23. These sanctions will create inefficiencies and increase the price in Europe and the US. OPEC has reduced production by almost 1 million bbl/d so far, agreeing in early October to reduce production by 2 million bbl/d by the end of the year. In addition, the Strategic Petroleum Reserve (SPR) depletion is ending, and Chinese demand is coming back online as strict COVID shutdown policies are eased.

Risk

An important financial risk for oil and gas exploration is failed exploration. Step-out wells are typically drilled to test the potential for new oil or gas reserves and to assess the feasibility of developing those reserves. Step-out locations can be risky, as there is no guarantee that the well will be successful in finding new reserves. However, if a step-out well does discover new reserves, it can be a significant source of additional production and revenue for a company. Thus far REI has primarily expanded through accretive acquisition but does have 100 potential exploration locations in the Central Basin Platform that could fit REI’s criteria.

In new drilling areas, there are certain bottlenecks that must be overcome. There are areas of development that are within the profile of low-cost but are bottlenecked by disposal for saltwater or electricity capacity. These bottlenecks must be rectified to expand production and require additional capital required which reduces the rate of return of the well. REI expects these bottlenecks to go away by 2H23, which will increase production for the San Andres Play.

Despite our $100 price expectations for crude oil, a recession has historically dampened oil prices and softened global demand. The risk of severe recession crushing demand and the price of oil is real but not likely in our opinion. However, REI’s all-in-total breakeven costs of $50/bbl provide a sufficient margin of safety.

Editor’s Note: This article was submitted as part of Seeking Alpha’s 2023 Market Prediction contest. Do you have a conviction view for the S&P 500 next year? If so, click here to find out more and submit your article today!

Be the first to comment