FreshSplash/E+ via Getty Images

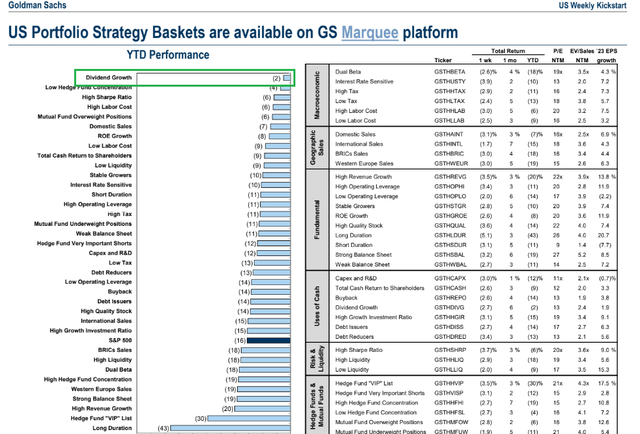

What’s the best performing factor so far this year according to Goldman Sachs Investment Research? Dividend growth stocks. Also, equities with exposure to commodities have generally beaten the S&P 500. One mid-cap packaging firm in the Materials sector has enjoyed big relative strength against the broad market. But is the stock still a good value? And can dividend investors see reason to own Sonoco? Let’s unpack the trade.

Dividend Growth Top of the Stack in 2022

According to Bank of America Global Research, with revenues of $5.6bn in 2021, Sonoco (NYSE:SON) is a leading global manufacturer of industrial and consumer packaging products, as well as protective packaging. SON also provides packaging services. SON’s Tubes and Cores/Paper products include paperboard tubes, cores, papers used for converted paper products, beverage insulators, and displays. SON’s Consumer Packaging products include composite paperboard cans (i.e., Pringles) and pails, plastic bottles, ends, and closures, and printed flexible packaging.

The South Carolina-based $5.8 billion market cap Containers & Packaging industry company within the Material sector trades at a low 13.5 trailing 12-month GAAP price-to-earnings ratio and pays a high 3.3% dividend yield, according to the Wall Street Journal.

The firm recently opened a new plant in Turkey as demand for its products grows. Sonoco also invested in RTS Packaging from WestRock – another optimistic capital outlay decision by the management team. Before that, the firm beat on the bottom line in its Q3 report, but modestly missed on revenues.

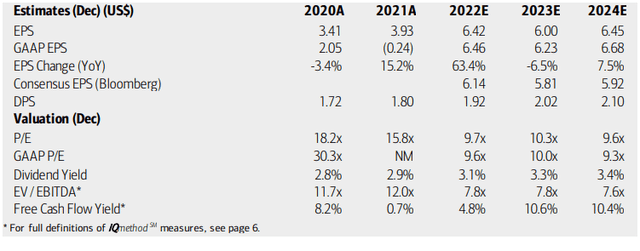

On valuation, analysts at BofA see earnings having risen sharply this year, but then dipping slightly in 2023. Per-share profits are then expected to rebound to a normalized growth rate above inflation. The Bloomberg consensus forecast is less sanguine than what BofA sees, however.

Still, the forecast operating and GAAP P/Es are at attractive levels. Moreover, the EV/EBITDA multiple looks good while free cash flow rises big next year despite the EPS fall. Overall, I like the valuation and you get a decent yield along the way.

Sonoco: Earnings, Valuation, Dividend Forecasts

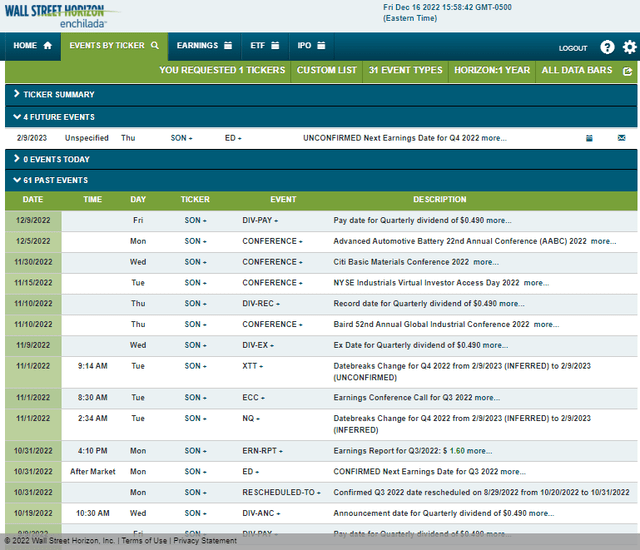

Looking ahead, corporate event data from Wall Street Horizon show a quiet volatility calendar until SON’s Q4 2022 earnings date unconfirmed to take place on Thursday, February 9.

Corporate Event Calendar

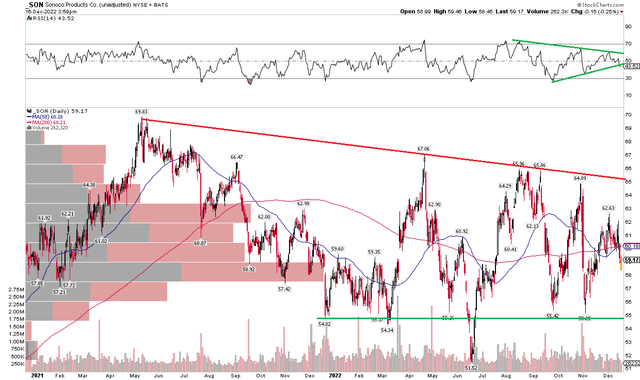

The Technical Take

SON has massive bullish relative strength so far this year. Shares are up more than 5% in 2022 versus an 18% drop, including dividends, for the S&P 500. While it’s outperforming, SON’s chart is simply in a prolonged sideways trade. Notice in the chart below how the stock is making lower highs while there could be some support in the $54 to $55 area.

I like how SON put in a bullish false breakdown in June, then held that level on a pair of recent attempts by the bears to take the stock lower. I would like to see SON rise above the mid-$60 level. The all-time high is just under $70, so it won’t take much of a rally to get the stock through resistance. Overall, it is a wait-and-see, but I err on the side of the bulls.

SON: Sideways Action, But Relative Strength

The Bottom Line

Despite macro risks and a few possible recent investments, I like the valuation on Sonoco, and the stock has held up well amid broad market volatility. With improving free cash flow and a solid dividend, I think the stock is a buy here.

Be the first to comment