blackdovfx

6th Quarter of Double-digit EBITDA Growth

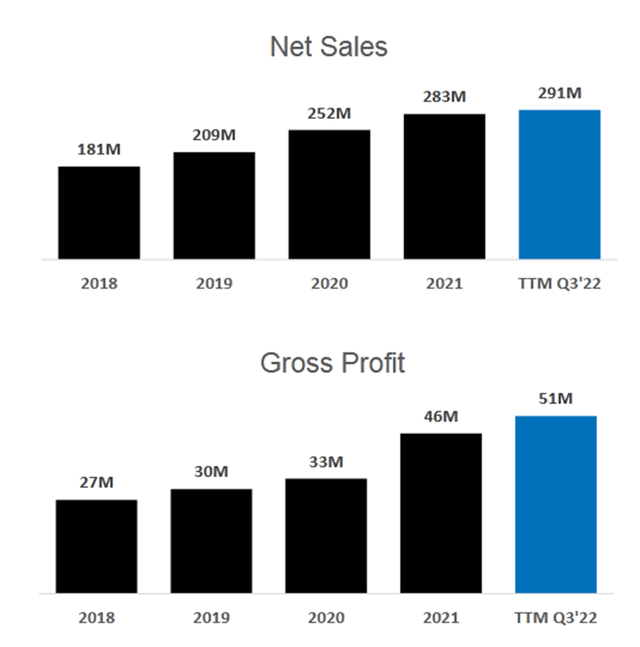

Climb Global Technologies (NASDAQ:CLMB), previously called Wayside Technology Group [old ticker WSTG] reported yet another quarter of excellent financial performance across metrics. Revenue grew double digits at +11% [excluding FX it was +12%], while adjusted gross billings increased +17%. All of the revenue growth was organic in nature, and driven mainly by the top 20 accounts. EPS of $0.50 was down versus $0.55 a year ago, but adjusted for the negative impact of FX, EPS would have increased 6% YoY. Also, acquisition-related one-time costs also reduced EPS by 10 cents. Adjusted EBITDA jumped +17% YoY.

Gross margin grew 19% YoY for Q3. SG&A expenses versus sales were 12.9% compared to 11.8%, but as a percentage of adjusted gross billings, were flat at 3.7% versus 3.6%. Effective margin, defined as adjusted EBITDA as a percentage of gross profit, was 36.6% in Q3, down slightly from 37.4% YoY. All of these margin metrics were negatively impacted by $0.5 million in FX transaction losses. If not for FX, adjusted EBITDA margin would have been 40.3%.

Looking at the most recent results, we are enthused by CLMB’s ability to generate consistent top-line growth and sustain margins despite a difficult macro environment globally, and FX headwinds. This has been the sixth consecutive quarter of double-digit profitability growth for CLMB, even in an environment that had been marred by issues related to conflict in Europe and COVID-19 in the USA.

Net cash at quarter-end was $22.2 million [$5.10 per share], or 15% of market cap.

7.7x P/E, 11% FCF yield, $55 price target

Over the last many quarters, CLMB has continued to demonstrate strong, yet consistent, growth in financials coupled with strong free cash flow generation, a net cash balance sheet and steady dividend payouts. Successful execution of the management’s strategic vision – to focus on marketing, customer management and introducing upcoming vendors – has led to stellar performance. Also, CLMB is early in its life cycle, and in a position to continue to grow from a relatively small base. This goes for the stock price as well, with only a $145 million market cap.

Eventually, CLMB may be bought out and merged with another tech services or distribution company, in our opinion. Even though the stock is up 45% since we recommended it in June 2020, we think there is still significant room for re-rating given the multiples that other tech stocks trade at. We have a target price of $55 for the company which is based on a 14x ex-cash P/E multiple applied to our 2023 estimates. We have further added back net cash per share of $5.10 to this to arrive at the $55 price target. Our target price represents 70% upside potential.

Despite the stock having done well in the last 2 years, the valuations still look compelling and relatively inexpensive. This to us implies that the stock still has a long way to go. On our forward 2023 estimates of $3.50 [which is bang in-line with just 1 published Wall Street estimate], CLMB trades at a P/E of 9.3x. On an ex-cash basis this looks even cheaper at 7.7x P/E based on 2023 estimates. Investors should also note that the company is forecasted to generate a FCF yield of 11% on 2023. This, along with 15% net cash to market cap bolsters our confidence that the stock has an attractive risk/reward profile. CLMB also offers investors a dividend yield of 2.1%.

Conclusion

CLMB’s stock has done well since our initial recommendation, being up 45%, and has been in a “holding pattern” in the low to mid $30s for well over a year. This is not bad, given the carnage of tech stocks and the NASDAQ. Meanwhile, the company continues to deliver solid results.

Given its consistently strong financial performance, ability to generate profitable growth and cheap valuations, we believe the stock price still has a considerable runway to appreciate. The stock continues to trade at clear deep value levels of 7.7x P/E and an 11% FCF yield all based on our 2023 estimates. We value CLMB at a $55 target price, implying a return potential of 76%.

Be the first to comment