Brian Koellish/iStock via Getty Images

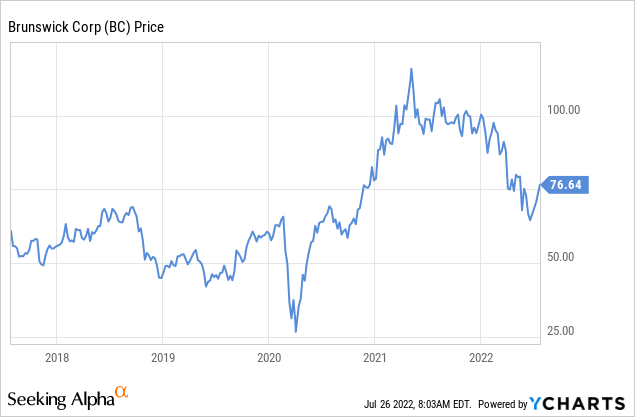

As a leisure and consumer discretionary company, Brunswick Corporation (NYSE:BC) can be expected to be more volatile than your average stock. Its shareholders have been on a roller coaster these last few years. Shares collapsed to very low prices at the start of the Covid pandemic but recovered very quickly as people started spending more time in the outdoors, and recreational vehicle sales took off.

More recently, as inflation has been taking consumers’ discretionary spending power away, and recessionary warning signs start appearing, shares have given up much of the gains they made in the post-pandemic period. So, is this a good time to buy the shares? While shares can certainly go much lower, especially if the economy enters a deep recession, we believe the valuation is currently attractive and that the company has taken a lot of steps to transform itself into a company with more reliable growth and resilient earnings power. It is also innovating, and we are particularly attracted by the optionality that comes from electrifying boats, where Brunswick Corporation is putting itself in a leadership position to drive this change.

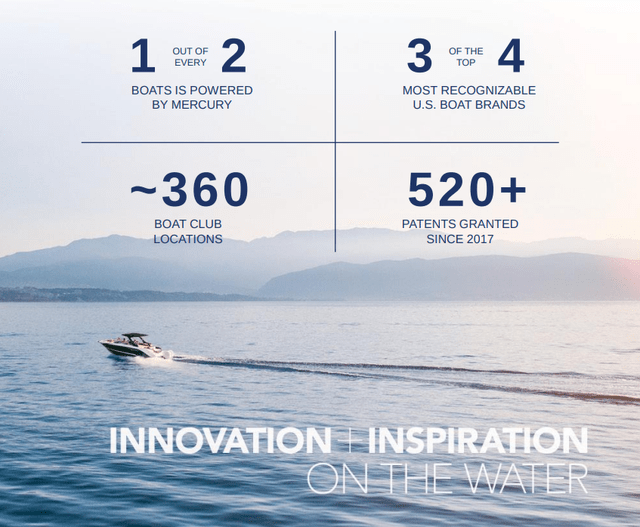

To understand the company, it is important to remember that Brunswick Corporation is more than just a “boats” company. A lot of its business actually comes from selling the propulsion systems, mostly using the ‘Mercury’ brand, to other manufacturers, and it also makes a lot of money from parts & accessories. It also operates one of the largest boat clubs, which has approximately 360 locations.

Brunswick Corporation Investor Presentation

Financials

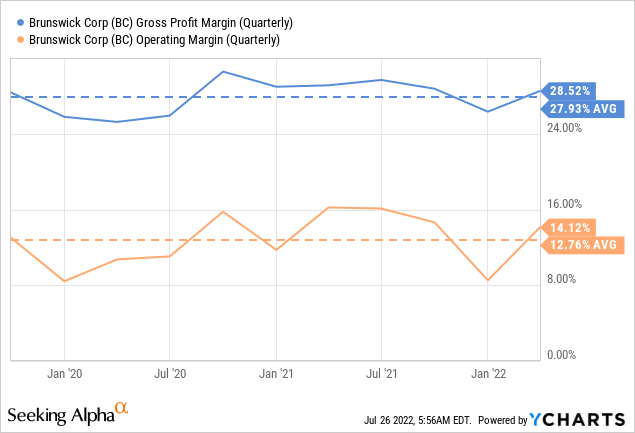

Brunswick has decent profit margins, with some cyclicality as can be expected from a consumer discretionary business, especially one focused on leisure activities. Still, 12% average operating margins are nothing to sneeze at, especially when the company is guiding for margins to improve significantly going forward.

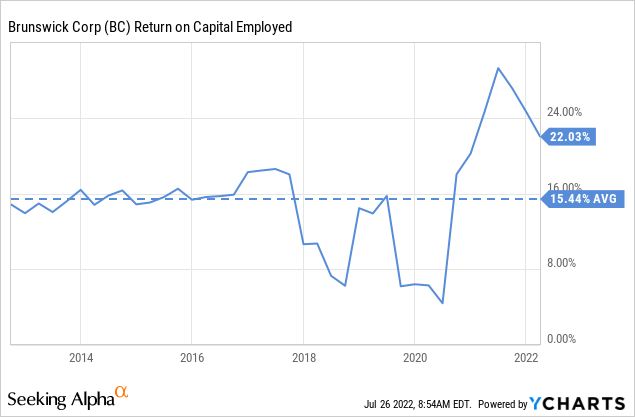

The return on capital employed is attractive, albeit somewhat cyclical, with a ten-year average of ~15%. It is important to mention that it is only since July 2019 when the company became a marine-only business, as it used to have other business which have since been separated or sold.

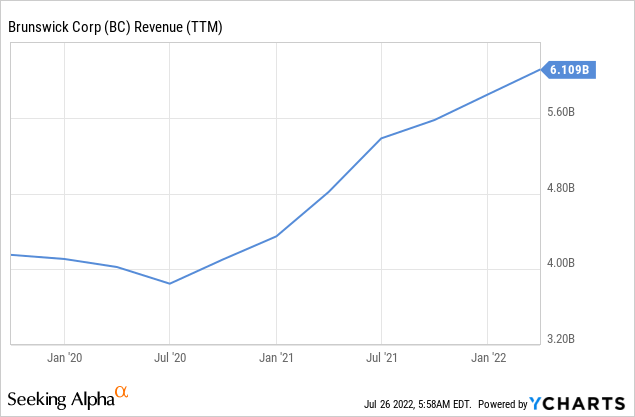

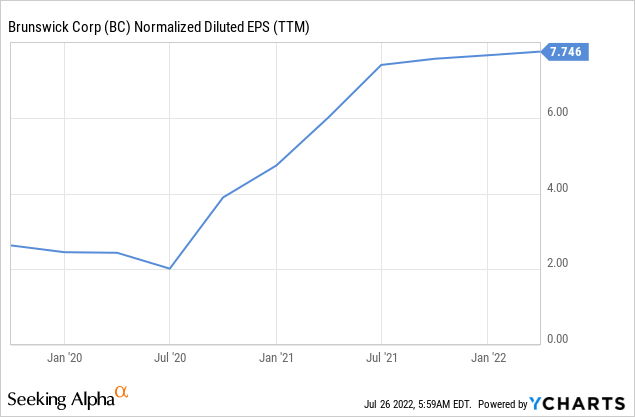

Growth

Thanks to the post-Covid boom in outdoor activities, as well as some small acquisitions the company made, revenue has significantly grown from ~$4 billion to more than $6 billion in less than 3 years. According to the company’s 2025 plan, it expects an average of at least 15% revenue growth each year throughout the plan, with a 4-year EPS CAGR of approximately 20%.

Acquisitions made in 2021 added more than $500 million in anticipated 2022 revenue, and very importantly, added precious technology skills and capabilities. For example, the company acquired Navico, with its industry-leading radar, sonar and display systems that will be critical enablers for their autonomy and Advanced Driver Assistance systems going forward. In the first year of Brunswick ownership, Navico delivered outstanding financial results, revenues were up 35% to prior year and bottom-line earnings more than doubled.

The company also acquired RELiON Battery, a leading Li-ion battery provider with strong foothold in both marine and non-marine industry verticals.

The combination of these new acquisitions, with strong organic revenue growth, propelled earnings per share much higher. From about $2 per share to more than $7 per share for the trailing twelve months.

Innovation

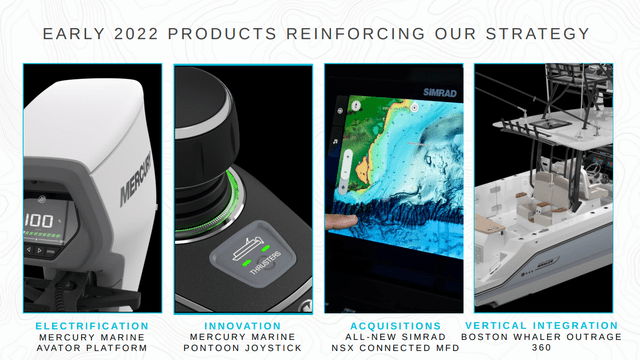

What we find most exciting about the company is their ‘ACES’ innovation strategy. This includes innovation in Autonomy/ADAS, Connectivity, Electrification, and Shared-access. An Autonomy/ADAS example is their recently launched Dock Sense Alert docking assist system. As you can see, it is not only cars that are in the process of becoming autonomous, companies like Brunswick are working hard to bring autonomy and advanced driver assistance systems to boats as well.

Brunswick Corporation Investor Presentation

Then there is of course electrification, which will be increasingly important. Brunswick is positioning itself nicely to be a leader in the electric boats industry. In addition to the acquisition of RELiON in 2021, its Mastervolt business initiated development of marinized lithium-ion batteries to support Mercury’s launch of low horsepower electric motors later this year. They also recently began formation of a world-class high-voltage battery tech center that will help support migration to higher horsepower applications.

Mercury Marine is launching its first electric propulsion products using the Mercury Avator platform this year. Five new electric outboard products are expected to be in the market by the end of 2023 – and three additional electric outboards by the end of 2025. By 2023, they will have launched four boat applications with electric propulsion systems.

Brunswick Corporation Investor Presentation

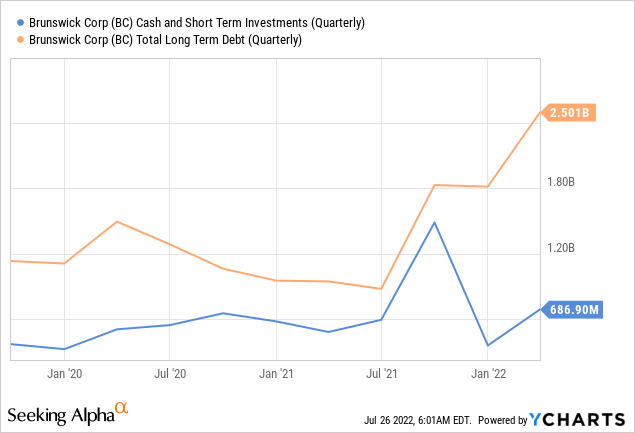

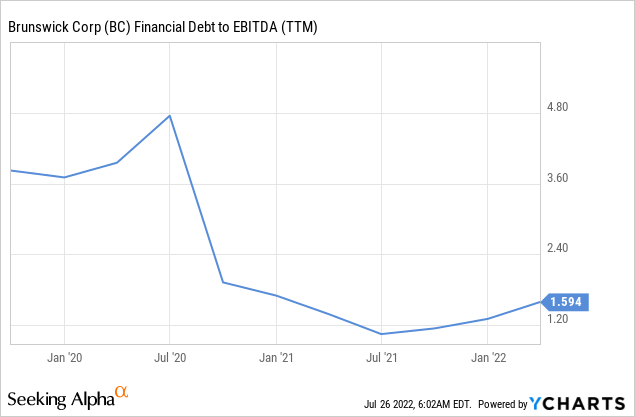

Balance Sheet

Brunswick Corporation has a very manageable debt load, even after the increase caused by the Navico financing. The company is guiding to deleveraging starting in 2H’22, with systematic debt repayment through 2025.

The debt to EBITDA ratio is relatively low at ~1.59x, but this being a consumer discretionary company, we would not want to see anything much higher than that.

Valuation

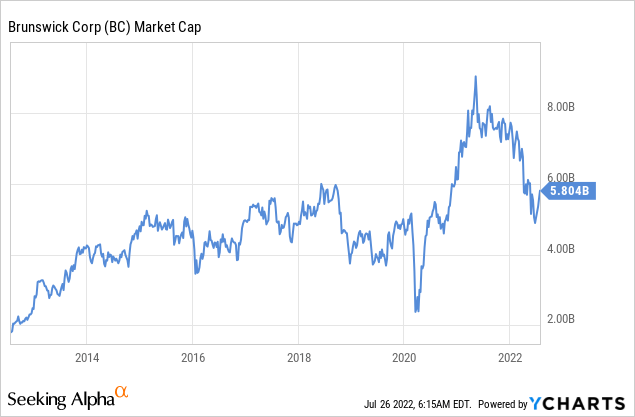

As we previously saw, the company has trailing twelve months revenue of ~$6.1 billion, yet their market cap is only ~$5.8 billion. The company is therefore trading with a P/S ratio of less than one.

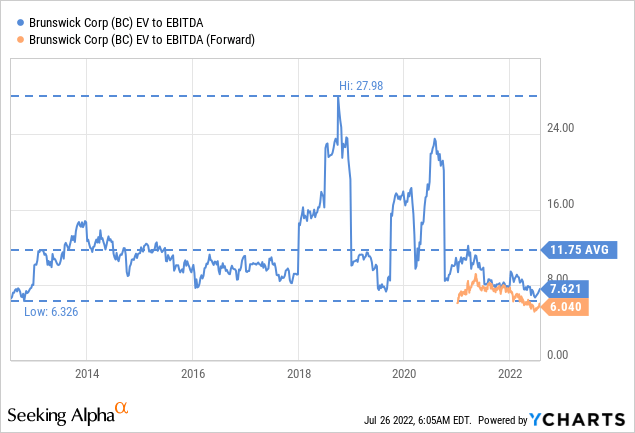

The ten-year average EV/EBITDA for the company is ~11.75x, but it is currently trading at a much cheaper multiple of ~7.6x. The forward EV/EBITDA is even lower at ~6x. The forward price/earnings ratio is only ~7.5x. We believe these valuation multiples are too low for an industry leader, even if it operates in a consumer discretionary sector.

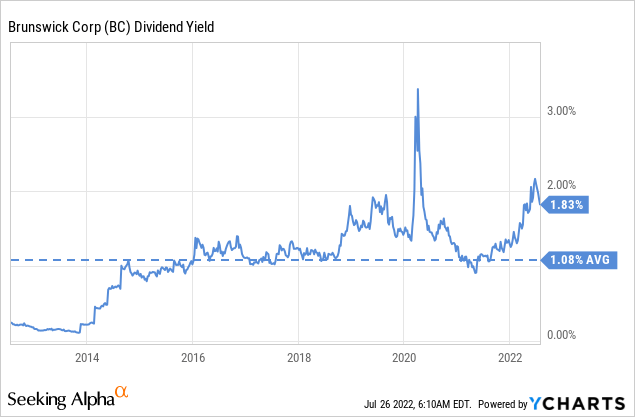

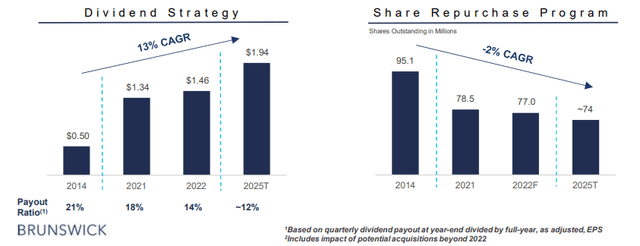

The company also pays a dividend, and the yield is currently much higher than the ten-year average. While it might still seem low at ~1.8%, it is important to remember that the 2022 dividend of $1.46 per share is approximately a 14% payout.

The company is guiding to dividend increases too, as well as meaningful stock repurchases. The dividend is expected to reach $1.94 by 2025, a ~13% CAGR.

Brunswick Corporation Investor Presentation

Earnings Resiliency

The company sounded very confident about their earnings resiliency during their 2022 Investor Day, where they shared that they found it difficult finding a reasonable scenario where their earnings drops back to $6.00 a share, which would still be ahead of their 2020 performance.

Following the 2008 financial crisis, the company substantially lowered its fixed cost base, and also elevated variable margins through a series of new product investments and operational excellence initiatives. Its cost structure positions the company with a run-rate break-even point at approximately $3.5 – $3.7 billion of sales, or approximately a 50% decline from anticipated 2022 levels.

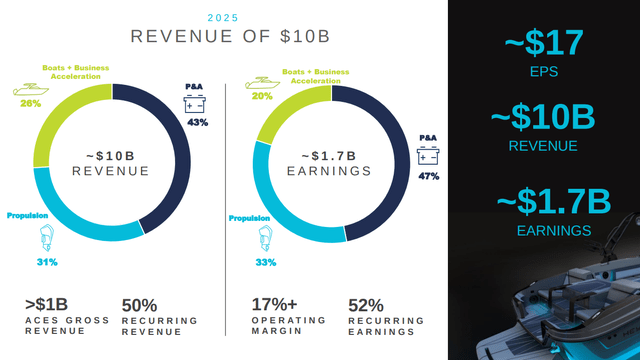

The company’s earnings are also becoming more resilient thanks to the growth in recurring revenue and earnings. For 2022 the company estimated that approximately 38% of its revenue and 42% of its earnings to be from recurring sources. It is also guiding to a ~$10 EPS and ~$7 billion in total revenue. For 2025 the company estimates that half of its revenue will be recurring, and 52% of its earnings, and guides for a 2025 EPS of ~$17, with total revenue of ~$10 billion. To put the ~$17 EPS in perspective, at current prices around $74, the estimated 2025 earnings P/E ratio is only ~4.3x. We believe this represents an extraordinary opportunity for investors if the company can deliver the expected results.

Brunswick Corporation Investor Presentation

Risks

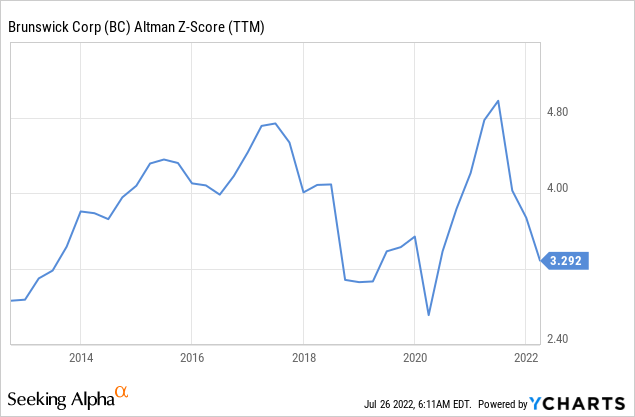

We view Brunswick Corporation as an above-average risk investment, given that it operates in the highly discretionary leisure industry, and that the company carries a significant amount of debt. The Altman Z-score is also barely above the 3.0 threshold. On the positive side, the company has said that it plans to start deleveraging soon.

Conclusion

Brunswick Corporation is probably one of the most attractive investment options currently offered by the market, even if it is one that carries above-average risk. The estimated 2025 earnings P/E ratio based on company guidance is only ~4.3x, which we believe is extremely attractive. Its ‘ACES’ innovation strategy is also very promising, as the electrification of boating should provide some added optionality, as some customers will be looking to replace their ICE boats for EV boats.

Be the first to comment