happyphoton/iStock via Getty Images

Thesis

After writing about Unilever (UL, UNLYF) and Nestle (NSRGY, NSRGF) (see: here and here), arguing that these stocks provide some protection to investors in a challenging macro-economic environment, I also wanted to expand coverage to Mondelez International, Inc. (NASDAQ:MDLZ). I see Mondelez as an equally defensive play, giving investors exposure to steady revenue growth and value accumulation.

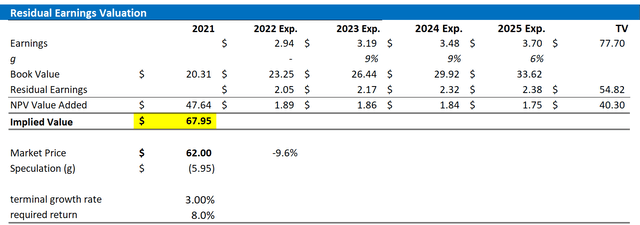

I assign a Hold recommendation based on a $67.95/share target price. My recommendation is mostly driven by financial analysis, as I anchor on a residual earnings framework based on analyst consensus EPS estimates.

About Mondelez

Mondelez Inc. is US-based food and beverage company with global presence. Mondelez was created through a spin-off from Kraft Foods in 2012 and is focused on developing, manufacturing and marketing of packaged food products such as biscuits, chocolates, other packaged snacks and beverages. Notably, the company owns a portfolio of many billion-dollar brands such as Oreo, Cadbury, Toblerone, Milka, BelVita, Trident gum.

For reference, investors could consider Mondelez’ portfolio based on five key categories: biscuits (1) and chocolates (2), which approximately account for 80% of total sales, gum & candy (3), which accounts for about 10%, cheese & grocery (4) with about 5%, and beverages (5) with another 5%. From a geographical perspective, Mondelez’ exposure is quite diversified with Europe accounting for 40% of sales, North America with 30%, AMEA (Asia, Middle East, and Africa) with approximately 20% and Latin America with about 10%. Moreover, there is no significant single-customer exposure as the top five customers account for less than 15% of the company’s revenues and the top ten largest customers account for about 25% of revenues.

The opportunity

Investing in Mondelez is a defensive play, as the company has a history of steady revenue growth and value accumulation. That said, from 2018 to 2021 Mondelez revenues grew at a CAGR approximately in line with nominal GDP growth—from $25.9 billion in 2018 to $28.72 billion in 2021. Respectively, net-income jumped from $3.55 billion (13.7% margin) to $4.21 billion (14.4% margin). Cash from operations is in line with net income: $4.36 billion in 2021.

As of Q1 2022, Mondelez recorded cash and cash equivalents equal to $1.95 billion and total debt of $20.21 billion. However, if we compare the company’s debt position in relation to the company’s $84.68 billion equity valuation and $3.18 billion of FCF, the company does not appear over-levered.

How Analysts See It

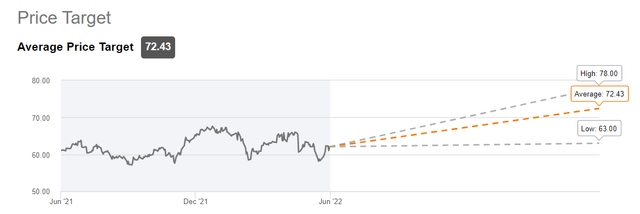

Analysts see Mondelez positively. Based on 24 analysts who cover the stock, there are 11 strong buy ratings, 8 buy ratings and no sell or strong sell rating. The average target is $69.86/share and the highest target stands at $118/share. Most notably, the average target would imply more than 100% upside, while the strong sell rating of $30/share only has approximately 10% downside.

Investors may appreciate that there is not much volatility in Mondelez’ revenue or earnings. In fact, steady revenue growth and value accumulation is expected to continue. According to the Bloomberg Terminal, as of June 2022, analysts indicate revenues for 2022, 2023 and 2024 of $29.82 billion, $31.05 billion, $32.08 billion, representing a 3-year CAGR approximately in line with nominal GDP growth. Respectively, EPS is estimated at $2.94, $3.19 and $3.48.

How to value MDLZ

If analyst consensus is right, what would be a fair valuation for Mondelez? To value the company, I have constructed a Residual Earnings framework. I anchor on the following assumptions:

- To forecast revenues and EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal.

- The estimate of the cost of capital, I use the WACC framework. I model a three-year regression against the S&P to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of June 24, 2022. My calculation indicates a fair WACC of approximately 8%.

- For the terminal growth rate, I apply expected nominal GDP growth, which I estimate at 3%.

- I do not model any share buyback – further supporting a conservative valuation.

Based on the above assumptions, my calculation returns a base-case target price for MDLZ of $67.95/share, implying material upside of about 40%.

Analyst Consensus Estimates; Author’s Calculation

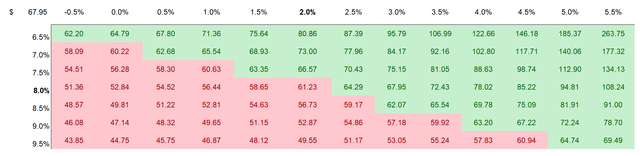

I understand that investors might have different assumptions with regards to MDLZ’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red cells imply an overvaluation as compared to the current market price, and green cells imply an undervaluation. The risk/reward looks highly favorable to me.

Analyst Consensus Estimates; Author’s Calculation

Risks

Arguably, buying MDLZ stock is relatively low risk, given the company’s history of steady value accumulation. Moreover, the company has proven earnings resiliency even in challenging macro-environments and the stock outperformed during past recessions. That said, I argue that the company’s global presence, scale and consumer-facing brand portfolio provides a defensive business profile. Short term downside risks could be currency exposure and compressing profit margins due to inflation and higher tax payments. As potentially long-term risks I have identified non-strategic/non-economic M&A activity and structurally changing market trends–such as changing demographics and consumer preferences.

Conclusion

At a x20.65 price-to-earnings ratio Mondelez stock is not necessarily trading cheap. However, as compared to long-duration assets and companies with strong cyclical exposure, Mondelez doesn’t expose investors to a lot of downside. Based on a residual earnings framework–anchored on analyst EPS consensus–I calculate a fair implied share price of $67.95/share. Although my analysis indicates approximately 10% upside, this is not enough to justify a Buy recommendation. Hold

Be the first to comment