South_agency/E+ via Getty Images

Investment Thesis

After the first six months of 2022, Bristol Myers Squibb (NYSE:BMY), the US Pharma giant, has been able to report some good progress, which has resulted in a share price that has risen from a December 2021 low of $54 – its lowest ebb since Fall 2019, if we discount the March 2020 pandemic selloff, from which it quickly recovered – to current price of $75, which represents a 39% gain.

Bristol Myers pays a dividend of $0.54 per quarter, which works out at $2.16 per annum and yields ~3%, so we can conclude that the company has been delivering for investors across the past 12 months, although it should be added that the company’s stock price was stagnant for the five years before the start of 2022.

CEO Giovanni Caforio has been at the helm since 2015, and was also appointed Chairman of the Board in 2017. It may have taken some time, but Caforio seems to have engineered a transformation at the company.

Firstly, the CEO was able to negotiate the $74bn acquisition of Celgene – one of the largest ever Pharma M&As – in 2019, which drove top line revenues from $26.15bn in 2020, to $42.52bn in 2021. Operating income has also risen from $6bn in 2019, to $9.8bn in 2021.

Secondly, and just as importantly, Caforio and his Senior Management team have laid out plans that, if executed, will see the Pharma shrug off the patent expiries – expected in 2023 – of two of its best-selling drugs, >$9bn per annum selling Revlimid, and >$3bn per annum selling Pomalyst, both assets acquired from Celgene.

The boost to top line revenues BMY gained via the Celgene deal wasn’t the only positive – the Pharma also gained access to an exciting late-stage drug development pipeline, which I discussed in a previous note on BMY as follows:

Blood cancer therapy Reblozyl (peak sales estimate >$2bn), CAR-T cell therapy Abecma (p/s estimate >$1bn), Leukemia therapy Onureg (p/s >$1.5bn), auto-immune treatment Zeposia (p/s >$5bn), and lymphoma cell-therapy Breyanzi (p/s >$1bn).

These assets have all been guided through the US drug approval process by BMY and are now commercialised, and with $10bn peak sales on the table, ought to more than make up for the loss of exclusivity (“LOE”) of Revlimid and Pomalyst, whose revenues will likely decline at a rate of ~20% per annum after 2023.

Major Pharmaceuticals are constantly fighting against LOEs, and the entry of generic drugs into markets once dominated by their patent protected drugs. Generic drug makers do not have to fund any R&D so they can afford to price their products more cheaply, meaning they not only take market share away from the original drug, but force Pharma’s to slash its price in order to stay competitive.

Around 2027, BMY’s biggest seller, the blood thinner Eliquis, which generated $10.7bn of revenue in 2021, will lose patent protection, whilst Yervoy, which generated >$2bn in 2021, and is indicated for treatment of melanoma, will likely lose protection in 2025. Apart from these two, and chemotherapy Abraxane – $1.1bn sales in 2021, patent expiry due in 2023 – the product portfolio appears well protected until the end of the decade at least.

To counteract falling sales of Eliquis / Yervoy after generic market entry, BMY has made further acquisitions – Myokardia was bought out for ~$13bn, and its lead asset, Camzyos – indicated obstructive hypertrophic cardiomyopathy – is also now approved, with peak sales expectations of $4bn per annum.

More recently, BMY paid $4.1bn to acquire Turning Point Therapeutics (TPTX), gaining access to the company’s lead asset Repotrectinib, a next-generation tyrosine kinase inhibitor that targets the ROS1 and NTRK gene mutations and is expected to gain approval in NSCLC, given it is the same class of drug as Roche’s (OTCQX:RHHBY) Rozlytrek, with mid-stage trials suggesting it may have a longer duration of response. The peak sales expectation is estimated by analysts to be ~$1.5bn.

Within BMY’s in-house pipeline, there are also exciting prospects such as selective allosteric TYK-2 inhibitor Deucravacitinib, expected to gain approval in September in Psoriasis, Iberdomide, a potential replacement for Revlimid in Multiple Myeloma, and Milvexian in secondary stroke prevention.

Management’s stated ambition is to offset an anticipated $12-$14bn erosion of revenues due to patent expiries with an $8-$10bn increase in sales of existing products such as Eliquis and Opdivo, and a $10-$13bn contribution from new product sales i.e. the cell therapies Abecma and Breyanzi, Zeposia, Deucravicitinib, Camzyos, Reblozyl etc.

This ought to translate into top line revenue growth in the low to mid-single digits, management believes, and with gross margins expected to hold at low to mid 40 percentage points, an increase in net income and cash flow – the goal is to generate $45-$50bn in free cash flow between 2022 and 2024.

If this can be achieved, then my calculations suggest that investors buying BMY stock at the current price of $75 are getting a very good deal. My target price for BMY stock would be $93-$100, based on management achieving its goals and driving low to mid single digit top line growth, whilst narrowing operating margins ever so slightly.

Q222 Earnings & Guidance – Good But Not Great

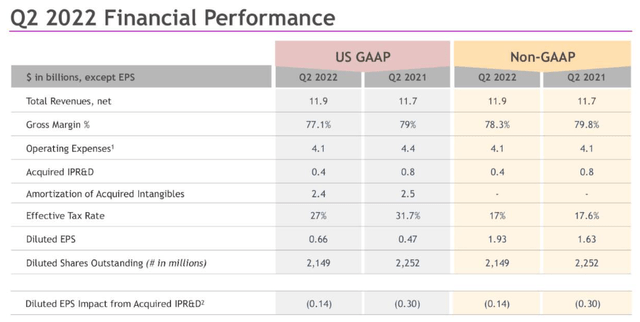

BMY headline Q222 earnings. (earnings presentation)

I would describe BMY’s Q222, and its H122 performance as good without being great. Revenues increased year-on-year, although not by much – just 1.7%. The company was profitable, and gross margins decreased, which is encouraging, and the forward price to earnings ratio based on non-GAAP reporting is ~11x, and based on GAAP reporting ~22x. The sector average for US Big Pharma is ~23x, so I would not have many concerns on that score, and based on this performance alone, would be hopeful of the share price climbing.

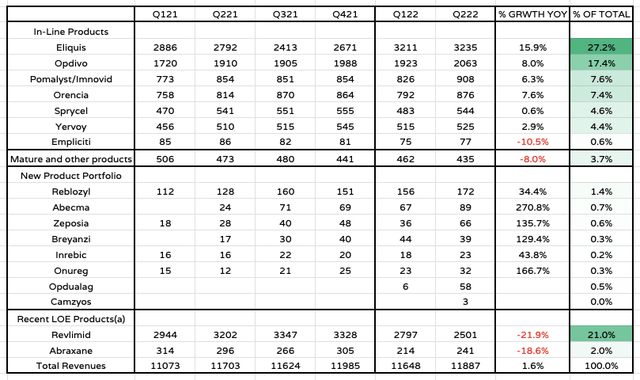

BMY quarterly sales performance by product since Q121. (my table using BMY reporting)

BMY has now broken its commercial product into four distinct categories. In-line products accounts for 69% of total revenues at the present time, and is likely to be the main revenue driver until the end of the decade when Eliquis, Opdivo, and most notably Pomalyst will face generic competition and therefore declining revenues. Performance in this division was fairly strong across the board with total revenues increasing by 10%, an encouraging sign for the short-to-medium term.

The “mature and other products division revenues” will predictably decline over time and revenues fell 8% year-on-year – not a major concern given the division accounts for less than 4% of total revenues.

Growth across the new product portfolio is also predictably strong, although products are climbing from a very low base and such growth ought to be expected. Nevertheless, it is encouraging to see Reblozyl sales surge past $150m and Abecma revenues climb towards triple digit millions per quarter.

Onureg and Inrebic revenues may be a slight concern given the demanding peak sales targets management seems to have in mind based on growth projections, whilst it is too early to judge Opdualog and Camzyos. Still, the very fact all of these drugs have made it through the FDA/EMA authorisation process is encouraging and evidence of management’s good stewardship and ability to identify promising assets.

The fall in Revlimid revenues within the new “Recent LOE Products” division is fairly sharp, proving the point that generics rapidly erode revenue generation. Sequentially also revenues fell by 10%, or by nearly $300mn, which is three fifths of the entire new product division revenues. That helps to illustrate that the challenge of replacing a mega-blockbuster like Revlimid is never easy.

BMY is also a heavily indebted company – the price to pay for an acquisition as bold as the Celgene deal – and management reported it had made $2.9bn in debt repayments in Q222, whilst there are a further $10bn in debt maturities by 2024.

Total debt of $42bn dwarfs current cash position of $13.2bn. Cash flow from operations fell to $2.3bn in Q222, versus $3.1bn in Q221, and $5.3bn in Q321, although this may reflect the Turning Point acquisition. BMY’s debt is rated highly by all credit agencies, and management is also permitted to make up to $10.2bn of share repurchases, having just completed $5bn ASR in Q122.

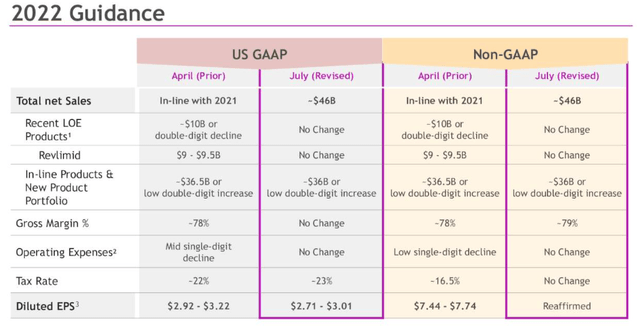

BMY 2022 Guidance. (earnings presentation)

As we can see above, BMY did amend its FY22 GAAP guidance EPS down from $2.92-$3.22, to $2.71-$3.01, having downgraded revenue expectations for the In Line and New Products division from $36.5bn, to $36bn. Gross margin on the non-GAAP side decreases slightly, and the forward PEs are 26x on the GAAP side, and 10x on the non-GAAP side, which remains encouraging.

The market never likes to see forecasts missed or downgraded, and BMY stock has suffered a little bit in the aftermath of announcing Q222 earnings and FY22 guidance on July 27th, although shares are already back on an uptrend, since the long term goals remain eminently achievable.

My Price Target Estimates & Calculations

In order to calculate a fair price target for BMY stock I have looked at BMY’s product portfolio, and management’s guidance, and tried to look ahead and forecast each products’ likely sales in each year to FY28. I am using peak sales estimated by analysts, which can turn out to be well wide of the mark, but I am also paying attention to management’s pledge to achieve low to mid single digit organic top line growth, drive $45-$50bn of cashflow in 2022-2024, and keep chipping away at margins.

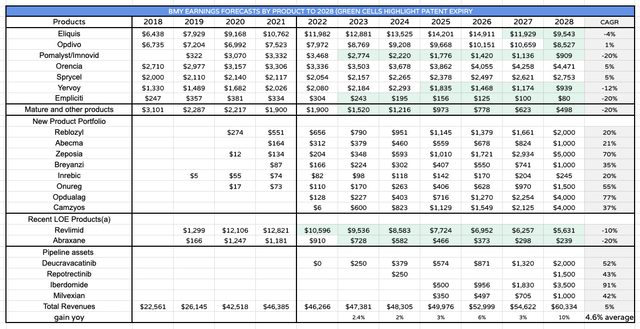

BMY product sales forecasts to 2028. (my table and estimates)

To summarise, I increase product sales at a 5% CAGR for products where there is no specific guidance. After an LOE occurs (highlighted green in the table), I reduce product sales by 20% per annum. For new products, I use a peak sales figure in 2028, then estimate year of approval and first year sales, calculate the CAGR from first year to peak sales, and increase product sales accordingly in the intervening years.

Revenue growth is perhaps weighted a little too much to 2028 owing to the use of CAGR calculations, with 10% year-on-year growth in revenues between 2027 and 2028, but the average CAGR of 4.6% is in line with management’s expectations, perhaps a little on the high side. I’ll be the first to admit these are optimistic sales projections, but then again there may be other assets commercialised and acquisitions made which could make them look under-ambitious.

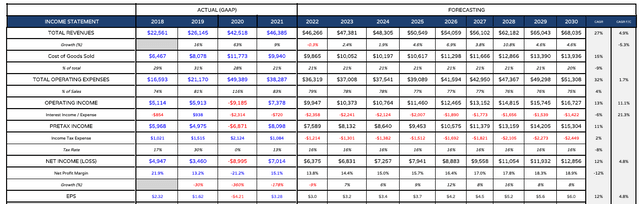

BMY Income statement forecasts. (my table and estimates)

Next I create an income statement and use a mixture of historical data and management forecasts to make my predictions. We can see operating expenses as a percentage of total revenues decreases slightly as Celgene and other M&A synergies kick in, and EPS grows at a similar rate to top line revenues, with a forward PE in 2028 of 14.6x in 2028. I use the CAGR of 4.5% calculated in the product sales forecasts to extend out to 2030.

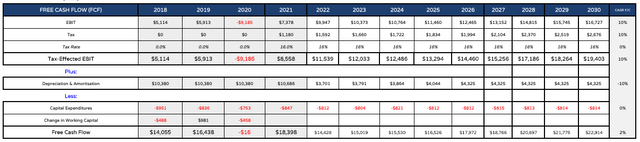

BMY Free cash flow calculations: (my table and estimates)

Next the free cash flow, and as we can see, the estimated total for 2022-2024 is for $45bn, at the lower end of management’s forecasts. I use a depreciation figure of 8% per annum, which is lower than the historical average, although my tax rate is also low, at 16%, and I do not include any working capital figures at the present time.

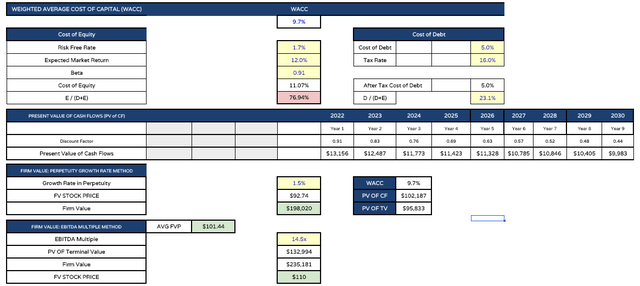

BMY WACC and DCF calculations. (my table and estimates)

Finally, the weighted average cost of capital calculations – I calculate a figure close to 10%, which is very similar to the rate I use to evaluate other US Big Pharma companies, and after applying discount factors, I calculate a target price of $93 using DCF, and $110 using EBITDA multiple analysis.

Conclusion

These tables of estimates are not intended to be ironclad – they reflect one of a number of scenarios that could play out for BMY over the next seven years. I hope they prove useful for readers who will undoubtedly have their own opinions as to whether the guidance is accurate.

Personally, I think it is reasonable to believe that BMY shares are as much as 20% undervalued at the present time, because I believe management has done an excellent job of mapping out how it will overcome the problem of the Revlimid and Pomalyst LOEs, and even the LOE of Eliquis in 2027/2028.

Amongst big Pharmas, only AbbVie (ABBV), in my view, delivers as much clarity for its investors, and I admire BMY’s long-sightedness. Most of the predictions the company made about the value of the Celgene deal being in its pipeline as well as its big selling assets have come true. BMY itself has developed several potential blockbuster assets in-house, and its other M&A has generally been astute in my view.

As such I have little hesitation in picking out BMY as one of the “Big 8” US Pharmas to buy and hold. Investing is about placing faith in management to deliver on its goals, and at the very least, it helps if these goals are explicit and measurable, as in BMY’s case, I believe they are.

I believe BMY stock could reach a value of >$90 in 12-18 months, and even if management fails to hit every target – it could struggle to drive growth between 2023-2026 – the long term view is a pleasant one for shareholders, with debt decreasing, and dividends and share buybacks offering short term rewards.

Be the first to comment