onurdongel

On Thursday, August 4, 2022, Canadian midstream giant Pembina Pipeline Corporation (NYSE:PBA) announced its second quarter 2022 earnings results. One of the common trends that we have been seeing among midstream companies lately is that revenues and cash flows have delivered year-over-year growth. Pembina Pipeline has certainly been no exception to this, as not only did the company’s revenue increase by 14.09% year-over-year, but the company also posted record adjusted EBITDA during the quarter.

There were many other things to like here as well, as the company made some significant progress on several of the growth projects that it has had in development for quite some time now, which positions Pembina Pipeline well to continue to produce growth over the next few years. Pembina Pipeline also could be a promising investment for anyone that is concerned about a potential upcoming recession due to its stable cash flows and monthly dividend payout that gives the stock an attractive 5.27% yield at the current price.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Pembina Pipeline’s second-quarter 2022 earnings results:

- Pembina Pipeline reported net revenue of C$1.020 billion in the second quarter of 2022. This represents a 14.09% increase over the C$894 million that the company reported in the prior-year quarter.

- The company reported an adjusted EBITDA of C$849 million in the most recent quarter. This represents a 9.13% increase over the C$778 million that the firm reported in the year-ago quarter and also represents a record level for the company.

- Pembina Pipeline handled an average of 3.344 million barrels of oil equivalents during the period. This compares somewhat unfavorably to the 3.500 million barrels of oil equivalents that the company handled during the equivalent period of last year.

- The company executed a long-term agreement with a leading company in the Montney region, which should generate significant resource volumes for the company going forward.

- Pembina Pipeline reported a net income of C$418 million in the second quarter of 2022. This represents a substantial 64.57% increase over the C$254 million that the company reported in the second quarter of 2021.

The interesting thing that we see in these highlights comes in the fact that Pembina Pipeline saw greatly improved results across the board despite the fact that its average handled volumes were lower than a year ago. As we have discussed many previous times before, Pembina Pipeline primarily makes its money from charging a fee for each unit of resources that moves through its infrastructure. Thus, we would expect that these fees would be lower than in the year-ago quarter due to the volumes being lower on average. However, that does not tell the entire story since another critical factor is the price that the company charges its customers for each unit of resources that is handled. These fees were substantially higher than a year ago, which Pembina Pipeline credits to inflation. This higher price more than offset the average decline in volumes.

The other thing that we notice here is that Pembina Pipeline’s financial performance improved by much less than other energy companies and by much less than we would expect considering the year-over-year increase in energy prices. Despite the recent decline, Brent crude is still up 41.02% and natural gas at Henry Hub is up 118.47% over the past year. This is unfortunately a side effect of the same volume-based business model that protects the company against declines in energy prices.

That does not mean that Pembina Pipeline does not benefit at all from high energy prices, however. One benefit is that the high prices provide Pembina Pipeline with growth opportunities. As you may recall if you have followed the energy industry for a few years, back in 2020 many midstream companies, including Pembina Pipeline, canceled or deferred many of the infrastructure projects that they had under construction. This was mostly because the uncertainty that was plaguing the upstream oil and gas producers led midstream firms to question if that new infrastructure would actually be needed. Indeed, the production of natural gas and liquids declined substantially at that time so Pembina Pipeline was uncertain if it could justify the investment into new capacity.

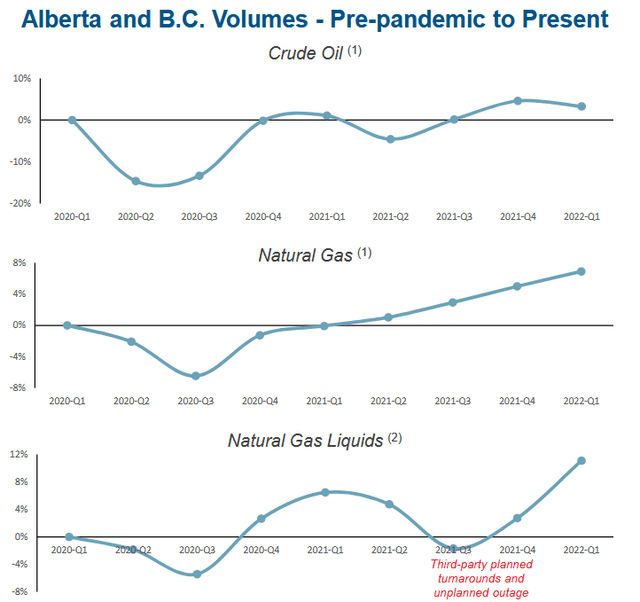

However, the high energy price environment that we are now seeing has caused the production of these resources to rebound in a big way. As we can see here, the production of both natural gas and liquids in Alberta and British Columbia is now substantially higher than back at the start of 2020:

This has prompted Pembina Pipeline to resume work on some of its growth projects. One of the most significant of these in the near term is the Empress Cogeneration facility. This is a 45-megawatt natural gas-driven power plant that is being constructed at the Empress Natural Gas Liquids Extraction plant in southern Alberta. The fact that it is a cogeneration plant means that it is independent of the municipal power supply and can often generate both heat and electricity somewhat more efficiently than the municipal power plant, reducing overall fuel consumption and by extension greenhouse gas emissions. Admittedly, this strikes me as more of a “feel-good” project to help Pembina Pipeline bolster its environmental credentials as opposed to a growth project since Pembina Pipeline will not actually be selling any of the power that is produced by this facility. However, the company does expect that it will reduce the operating costs of the Empress Extraction plant, which should allow more of the facility’s revenue to make its way down to its cash flow, which could provide some additional support for the dividend. This facility is expected to come into service within the next month or so; thus, we should begin to see its impact over the remainder of the year.

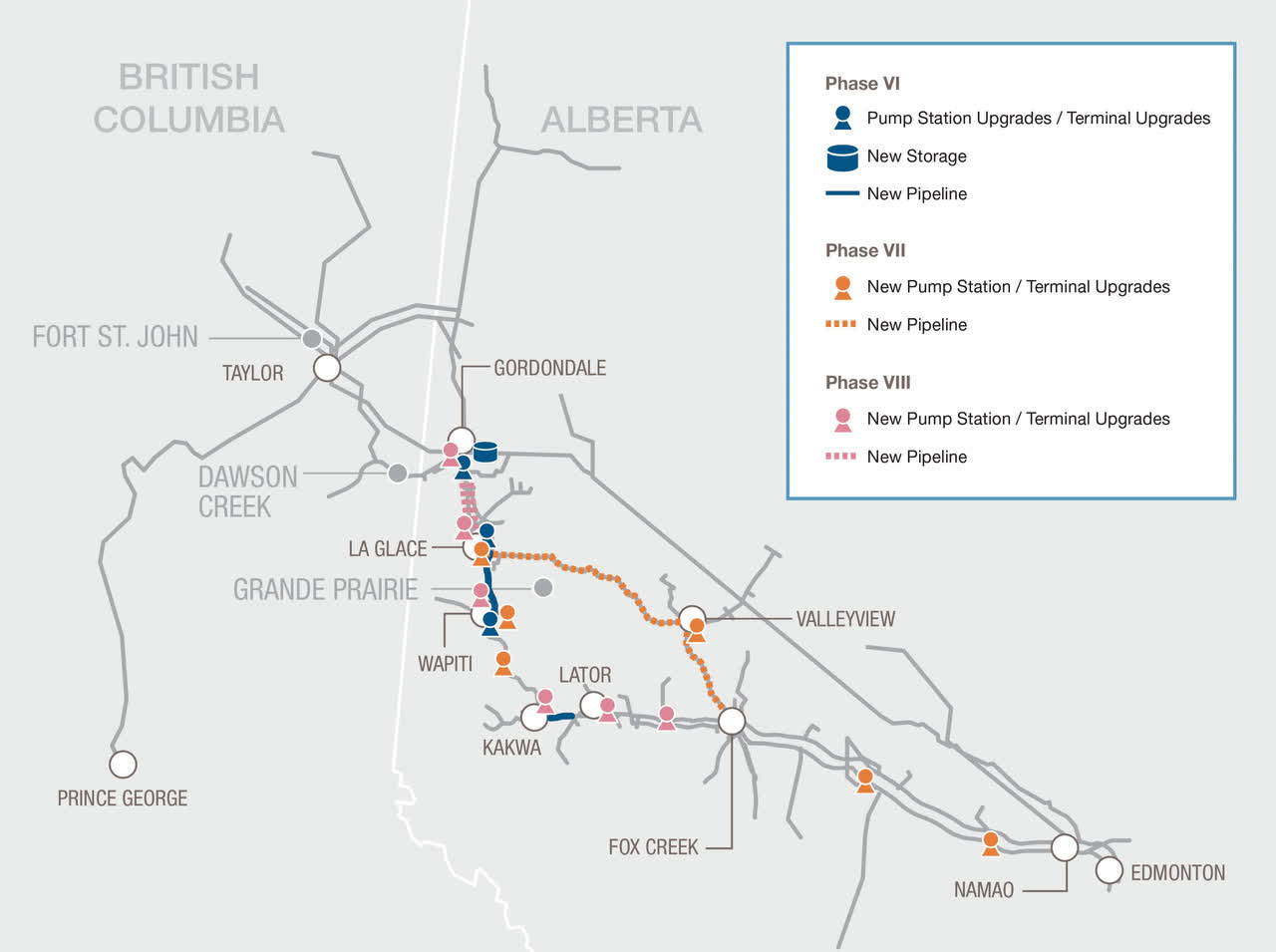

Another major project that will have an impact on Pembina Pipeline’s performance as we enter the new year is Phase IX of the long-running Peace Pipeline expansion program. The Peace Pipeline is Pembina Pipeline’s primary asset, spreading across much of the oil-producing region of Alberta and British Columbia:

MyGrandePrairieNow.com

For many years now, Pembina Pipeline has been working to expand the capacity of this system in response to the production growth that has been occurring in the Western Canadian Sedimentary Basin. I have discussed several of the earlier phases of this expansion program in previous articles about Pembina Pipeline that I have posted to Seeking Alpha over the past decade. Phase IX of this program includes the installation of new six- and sixteen-inch pipelines that are intended to remove the bottlenecks currently plaguing the area north of Gordondale, Alberta, by greatly increasing the takeaway capacity from the region. The nice thing about this new capacity is that Pembina Pipeline has already secured contracts from customers for its use. Thus, we know that the pipeline will begin generating cash flow when it begins operating around the end of the year.

As stated in the highlights, Pembina Pipeline executed a long-term agreement with Tourmaline Oil Corporation in the Montney Shale of northeast British Columbia. That company, as part of this agreement, has committed to utilizing a significant amount of the new capacity that is being added along with Phase IX of the Peace Pipeline Expansion Project. Pembina Pipeline, unfortunately, has provided no further than this, such as estimated volumes or projected incremental cash flows from this agreement but we can expect both figures to be sharply positive. Overall, this should further increase our confidence that this project will result in growth.

One of the biggest reasons that investors purchase shares of midstream companies like Pembina Pipeline is that they tend to have higher yields than many other things in the market. Indeed, Pembina Pipeline’s current 5.27% yield is significantly higher than the 1.43% yield of the S&P 500 index (SPY). Pembina Pipeline is perhaps more attractive than its peers in some ways because it pays its dividend monthly as opposed to quarterly. This is nice for people that want a monthly income in order to pay their bills, as may be the case for retirees. It is also nice for those that reinvest the dividends as it allows for more rapid compounding. Finally, Pembina Pipeline has a history of steadily growing its dividend over time, and unlike many of its peers, it did not have to cut it back in 2020:

There may be some readers that point out that the dividend fluctuates significantly from month to month in the chart above. This is simply because the company pays its dividends in Canadian currency, but the company’s stock that trades on the New York Stock Exchange pays its dividends in U.S. dollars. As that is likely the stock that most readers are going to be purchasing, we will have to accept that the dividend will fluctuate a little bit from month to month, although it does generally increase over time.

It is always important to determine how well a company can afford its dividend. After all, we do not want to find ourselves suddenly being the victim of a dividend cut since that would reduce our income and probably cause the stock price to decline so it would both reduce our incomes and our savings. The usual way that we judge a company’s ability to afford its dividend is by looking at its free cash flow, which is the amount of cash that was generated by the firm’s ordinary operations that is left over after it pays its bills and makes all capital expenditures. This is therefore the cash that is available to reduce debt, buy back stock, or pay a dividend. Free cash flow is typically calculated as operating cash flow minus capital expenditures. During the second quarter of 2022, Pembina Pipeline reported an operating cash flow of C$604 million and had total capital expenditures of C$152 million. That gives it a free cash flow of C$452 million but it only declared a total of C$349 million in dividends.

Thus, it does appear that the company is generating more than enough cash to pay its dividend with a decent amount of money left over for other tasks. Overall, the dividend is likely secure and investors should not have to worry too much about a cut.

In conclusion, Pembina Pipeline has quite a bit to like about it. The company posted some relatively modest year-over-year growth in the most recent quarter, however, the best appears to be yet to come due mostly to Phase IX of the Peace Pipeline Expansion Project coming online later this year along with the contract that the company secured with Tourmaline Oil Company. This should position it well to continue the historical dividend growth that we have come to expect from this company. Overall, this 5.27%-yielding firm may be worth considering for anyone’s portfolio.

Be the first to comment