akinbostanci/iStock via Getty Images

Investment Thesis

At the beginning of December 2021, Bristol Myers Squibb (NYSE:BMY) stock traded at a value of $53 – its lowest price since the stock market crashed in March 2020 in response to the global pandemic. Today it trades at a price of $79 per share, representing a 49% increase, and I believe that this current price remains ~30% discounted to its actual present day value, based on projections and discounted cash flow analysis, meaning BMY continues to be an excellent stock to hold, or buy.

Whilst 2022 has been a strong year for BMY and its share price, the December 2021 stock price of $53 reflected a ~20% decline in value over a 5-year period, and was equivalent to the price BMY stock was trading at all the way back in 2013.

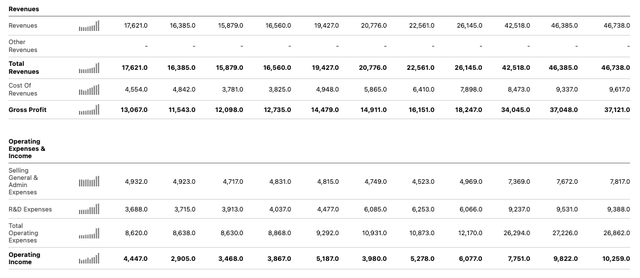

In fairness to BMY, the company grew revenues from $17.6bn in 2012 to $22.6bn in 2019 and grew its operating income in almost every year, as we can see below.

Bristol Myers Squibb annual income statement (Seeking Alpha)

Despite this solid performance, it was clear that BMY needed to take some drastic action to revive its share price, and under its long-term CEO Giovanni Caforio, who has been at BMY since 2000, and has been CEO since 2015, and Chairman of the Board of Directors since 2017, the company did just that, paying ~$74bn to acquire the global pharmaceutical Celgene.

Although the deal completed in March 2019, it remains central to any discussion of BMY, its commercial drug portfolio, pipeline assets and future value.

Why Celgene Deal Was So Important For BMY

Prior to Celgene BMY was heavily reliant on 6 drugs – its cancer therapy Opdivo and blood thinner Eliquis, which earned close to $5bn of revenues each in 2018, autoimmune disease therapy Orencia, which earned ~$2.5bn of revenues in that year, leukemia therapy Sprycel, ~$2bn revenues, melanoma therapy Yervoy, ~$1.2bn revenues, and Hepatitis B therapy Baraclude – ~$1bn of revenues.

After the Celgene deal completed, BMY could claim ownership of blood cancer drugs Revlimid and Pomalyst, and chemotherapy Abraxane, which helped BMY drive top line revenues from $26bn in 2019, to $42.5bn in 2020. The three drugs earned revenues of $12.1bn, $3bn and $1.25bn for the company in 2021 as BMY reported record revenues of $46.4bn, and operating income of $9.8bn.

Even this stellar top and bottom line growth failed to move the share price however, for 2 main reasons. Firstly, investors were fearful of the amount of debt the company took on to complete the Celgene deal. Between 2018 and 2019 current liabilities rose from $10.7bn, to $18.3bn, whilst long-term debt rose from $5.7bn, to $43.4bn, and total liabilities from $20.9bn, to $78.2bn.

Secondly, both Revlimid and Pomalyst are set to lose their patent exclusivity during and slightly after 2022, meaning they will face competition from generic drugs manufactured by the likes of Teva Pharmaceutical (TEVA), Dr. Reddy’s (RDY), Cipla and Viatris (VTRS), negatively impacting both its future sales volumes and list price, likely by about -20% per annum

These are certainly major issues for management to tackle but shareholders will be happy about the way it has handled them thus far.

Firstly, ahead of the Celgene acquisition management were well aware that Revlimid and Pomalyst would soon go off patent – the reason they paid such a high price for the company was in fact more to do with Celgene’s pipeline than its commercial products, despite their being worth >$16bn per annum in 2019, 2020 and 2021 and likely $15bn in 2022.

BMY has successfully won approval for Blood cancer therapy Reblozyl, CAR-T cell therapy Abecma, Leukemia therapy Onureg, auto-immune treatment Zeposia, and lymphoma cell-therapy Breyanzi (p/s >$1bn). If these 5 drugs reach their projected (either by management or analysts) peak sales targets, they ought to be worth >$11bn per annum to BMY by 2028.

Secondly, BMY’s cash flow generation is already tremendous – across the first three quarters of 2022 it is ~$9.8bn – and management has promised to drive $45 – $50bn in free cash flow between 2022 and 2024, which is helping to alleviate the debt pile.

In Q322, $2.8bn was used for debt repayments, with management adding that it could repay an additional $6.8bn by 2024. The debt has an investment grade rating, and as of Q322 it stands at ~$37bn, with $18.9bn of current liabilities. That may still be a very high figure, but it is far from the worst in the US “Big Pharma” sector. Current debt to equity ratio of 1.23x is lower than Eli Lilly (LLY) – 1.56x, for example, and significantly lower than AbbVie (ABBV) – 4.34x, and Amgen (AMGN) – 10.6x.

BMY’s Risk-Taking Approach Is Paying Off

BMY’s management has not been afraid to make further acquisitions, such as paying $13.1bn to acquire MyoKardia and its lead asset Mavacamten, a cardiovascular therapy now approved for obstructive hypertrophic cardiomyopathy (“HCM”) and expected to generate peak sales of ~$4bn.

In essence, BMY seems to be a company that does not shy away from risk but instead is prepared to walk towards it believing that it offers more of an opportunity than a threat. But, the risks that management have been taking are calculated ones. As I explained in my last note on the Pharma:

Management’s stated ambition is to offset an anticipated $12-$14bn erosion of revenues due to patent expiries with an $8-$10bn increase in sales of existing products such as Eliquis and Opdivo, and a $10-$13bn contribution from new product sales i.e. the cell therapies Abecma and Breyanzi, Zeposia, Deucravacitinib, Camzyos, Reblozyl etc.

This ought to translate into top line revenue growth in the low to mid-single digits, management believes, and with gross margins expected to hold at low to mid 40 percentage points, an increase in net income and cash flow – the goal is to generate $45-$50bn in free cash flow between 2022 and 2024.

That is great news for shareholders and prospective investors because, as well as paying a reasonably generous quarterly dividend of $0.54 per quarter, which yields 2.7% on an annual basis, mitigating the risk of share price losses somewhat, it is easy for investors to tell if management are meeting their stated goals.

So long as they are, the outlook for the share price is very positive based on my forward revenue and profit projections, and discounted cash flow analysis.

Q322 Earnings & FY22 Guidance In Review

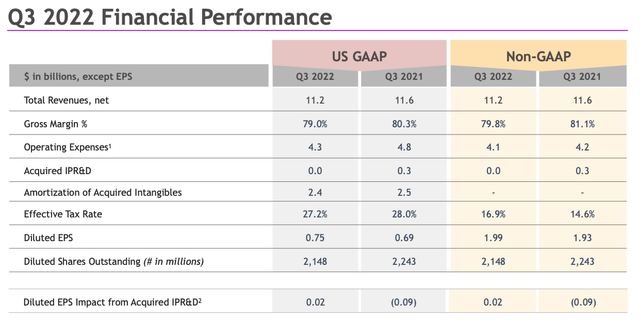

BMY Q322 financial performance (BMY earnings presentation)

As we can see above, BMY’s revenues actually fell marginally year-on-year in Q322, to $11.2bn, although both GAAP and non-GAAP EPS rose, to $0.75 and $1.99 respectively, and cash flow from operations rose to $3.7bn, versus $2.3bn in Q222 – although it had been as high as $5.3bn in Q321.

I would put this down to final settlement of a $5bn share repurchase program last quarter, $2.8bn of debt repayment, and another acquisition – of Turning Point Therapeutics, and its late stage cancer therapy Repotrectinib – apparently a blockbuster (>$1bn sales per annum) product in waiting. The rising EPS I would put down to the operational efficiencies realised as a result of the Celgene merger beginning to kick in.

The reasons for the fall in revenues is clear – in an otherwise thriving hematology division, where revenues from newly launched products such as Abecma, Breyanzi, and Onureg climbed by respectively 51%, 47%, and 52% year-on-year, sales of Revlimid fell by 28% year-on-year, as a result of generic competition.

Management has forecast for $9 – $9.5bn of revenues for Revlimid in FY22 – down by $3bn year-on-year – which was expected given its loss of exclusivity (“LOE”) in its market. As well as the new drugs are performing, they are not quite ready to offset the lost Revlimid revenues, which means that BMY’s annual revenues in FY22 – forecast to be $46bn by management – will be down slightly year-on-year.

BMY has also revised its FY22 GAAP EPS down slightly, to $2.54 – $2.84, compared to the $3.1 achieved in FY21, whilst non-GAAP EPS is expected to be $7.44 – $7.74, matching or likely outperforming the non-GAAP EPS of $7.51 achieved last year. The forward PE is therefore either 29x on a GAAP basis – an ok score, or ~10x on a non-GAAP basis – a very good score for any company in any industry sector.

Performance across BMY’s other divisions was also encouraging – in Solid Tumor Products, Opdivo sales rose by 7%, to >$2bn, driven by demand in first line lung, renal, gastric, bladder and other cancers, underlining its importance and putting it behind only Merck’s (MRK) Keytruda in terms of solid tumor cancer drug sales. Yervoy sales also rose by 2% whilst sales of newly approved Opdualag of $84m compensated for falling sales of Abraxane, another product nearing the end of its shelf life.

In Cardiovascular, Eliquis sales continued to grow – by 10% year-on-year, to $2.7bn, whilst newly launched Camzyos earned its first revenues. The caveat here is that Eliquis will likely lose patent protection after 2026, but by that time, Camzyos and the other recently approved products ought to keep company revenues on an upward trajectory.

Within the Immunology Division, sales of Orencia were up by 1%, whilst newly approved assets Zeposia and Sotyktu contributed $69m and $1m of sales – again, these figures ought to grow exponentially over the coming years as these are both drugs with potential best-in-class efficacy and safety profiles, proven in clinical trials.

Pipeline Progress & Forward Revenues Outlook

As mentioned, it isn’t just the Celgene pipeline assets that are beginning to pay out for BMY. Management is promising 4 new approvals by 2023 – label expansions for cell therapy Abecma in multiple myeloma, a Camzyos approval in Europe, Sotyktu approval in plaque psoriasis in Europe, and a first approval for Turning Point’s Repotrectinib, in ROS1+ lung cancer.

7 key data readouts are promised also, involving cell therapy Breyanzi, in follicular and marginal zone lymphoma, Opdivo in first line prostate, Reblozyl in myelodysplastic syndrome (“MDS”), and Sotyktu in Crohn’s Disease and Ulcerative Colitis.

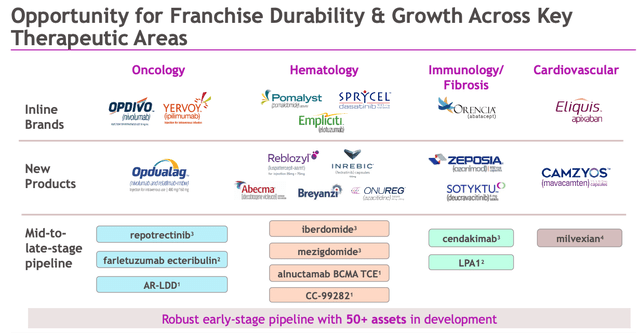

BMY Franchise Growth Opportunities (earnings presentation)

As we can see above, BMY is again open and clear about how it hopes to grow its 4 franchises – oncology, hematology, immunology and cardiovascular – by adding new products, and it is also encouraging to note that the drug development funnel gets wider at the early stage end, with more than 50 assets in development overall.

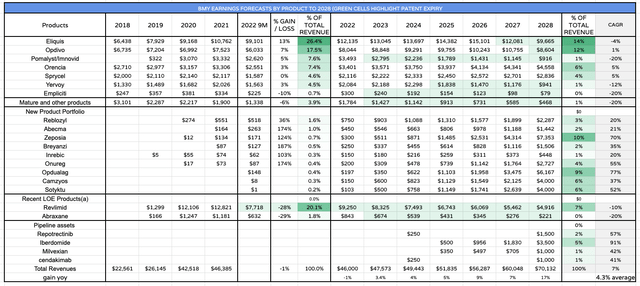

Revenue projections for BMY product portfolio and pipeline (my table and estimates based on management’s guidance / analysts peak sales expectations)

As I did in a note on BMY I wrote for Seeking Alpha in August, I am sharing some rough forward sales projections for BMY’s current and future approved drug products.

I have made a few adjustments since my last note however. First I have reduced sales estimates for Revlimid in 2022 as per management’s guidance, although I continue to expect that revenues will decline at a rate of 10% per annum after 2022 (cells are highlighted green where a patent expiration has occurred).

To get to FY22 projections I have taken revenues across the 9m to September 30th, and used the average quarterly earnings as my 4th quarter revenue expectation. Since this left me well short of management’s guidance for FY22 of $46bn, and because sales of BMY’s new products are climbing so fast, I have increased these by $50 – $150m over Q4, to make up the deficit. For example, Abecma sales to the end of Q3 were $263m, but for FY22 my revenue projection is for $450m.

I have moved Camzyos and Sotyktu from the “pipeline assets” to the “new product portfolio” section, since both are now approved. For the pipeline section, I have taken only one asset from the mid-to-late stage pipeline for each division and mapped out forward sales, assuming they will be approved.

All of this leaves me with a FY28 revenue projection of $68bn for BMY by 2028, or a compound annual growth rate of ~7%. It can certainly be argued I have used some optimistic forecasting, and it should not be forgotten that in 2028, BMY will be facing the twin threat of Eliquis and Opdivo patent expiries, but equally, I have only included revenues from a handful of BMY’s pipeline products – it’s possible significantly more may end up being approved.

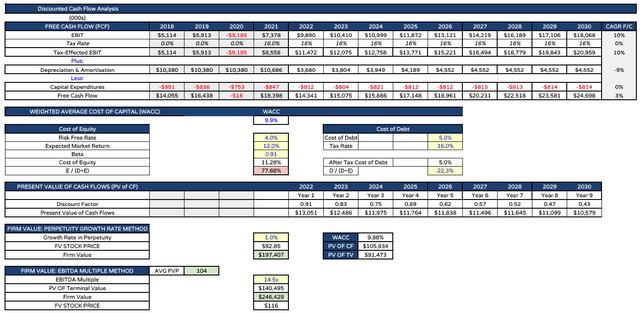

Below, I share my discounted cash flow analysis (assuming BMY’s margins remain consistent and potentially increase slightly over the next 5 years) which shows how I get to my target share price of $104 – the average of the share price calculation using both EBITDA and DCF methods, and a >30% premium to current share price.

BMY updated DCF analysis (my table and estimates)

Conclusion

BMY may not grow its revenues year-on-year in 2022, but that should not deter investors from considering BMY as a strong investment opportunity in my opinion.

The share price has had its best year for more than a decade in 2022, as management has finally been able to get it moving again. It may have taken a $74bn acquisition – the largest in Pharma history – to do so, but at its core the BMY of today is a relatively straightforward company to understand, marketing and selling just 18 products, of which 8 make blockbuster sales, whilst 9 more have been launched within the past 18 months.

If management continues to execute on its strategy to offset lost Revlimid revenues with new product sales, whilst bringing through more strong candidates with best-in-class potential, its share price ought to keep growing to match the company’s intrinsic value, and once share buybacks have been completed, a dividend hike could be next.

Large pharmaceutical companies tend to be profitable, with good net profit margins, investment grade debt, and plenty of protection in their markets. Drug development is not straightforward but it is lucrative and if BMY can keep executing as well as it has done in 2022, top and bottom line, and share price growth, looks assured.

Be the first to comment