Dragan Mihajlovic

EnLink Midstream, LLC (NYSE:ENLC) is a little-known diversified midstream company operating in a number of basins throughout the United States. As is the case with many of its peers, the company has certainly given its investors a wild ride in recent years as it crashed with energy prices in 2020 but has since rebounded in a very big way. Indeed, EnLink’s units are up 75.22% over the past year in sharp contrast to many of its peers that have seen their prices decline over the same period. Despite the very strong price appreciation that has benefited the company, EnLink Midstream still boasts a 4.23% yield, which is overall very attractive given today’s broader economic conditions. There are some reasons to believe that the best may be yet to come though as the company is very well positioned for cash flow and distribution growth over the coming years. Let us investigate and see if EnLink Midstream could be deserving of a place in your portfolio.

About EnLink Midstream

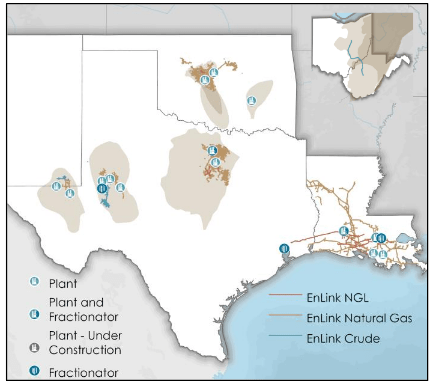

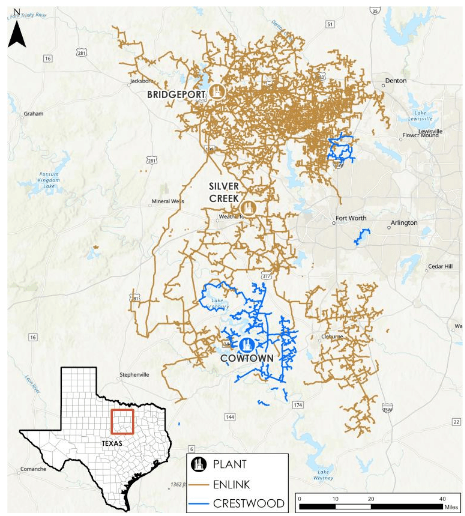

As stated in the introduction, EnLink Midstream is a mid-sized but little-known midstream company operating in various hydrocarbon-producing basins in Appalachia, New Mexico, Oklahoma, and along the Gulf Coast:

EnLink Midstream

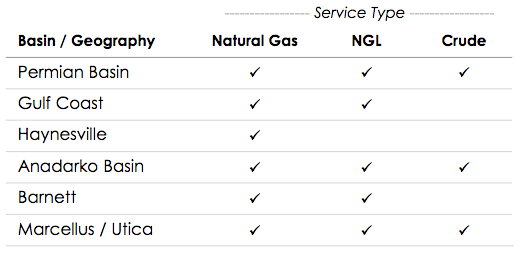

The basins that the company operates in are the Permian, the Haynesville Shale, the Anadarko Basin, the Barnett Shale, and the Marcellus Shale. The company also has a variety of midstream facilities located around the Gulf Coast in Texas and Louisiana. In total, EnLink Midstream has approximately 12,100 miles of pipelines, 5.5 billion cubic feet per day of natural gas processing capacity, and 320,000 barrels of natural gas liquids per day fractionation capacity. This is actually a fairly large reach considering that EnLink Midstream is not as well-known as many of its peers. The fact that the company operates in many different basins is something that is quite nice to see. This is because each of these different basins has somewhat different characteristics. For example, the Permian Basin is often targeted by those looking to produce crude oil but the Marcellus Shale is generally considered to be a natural gas play. As such, we might expect EnLink Midstream to handle a variety of different products. This is the case, although EnLink Midstream does not specifically state what proportion of its cash flow comes from any given product. However, natural gas is the only resource that the company handles in every different region:

EnLink Midstream

This product diversity is also quite nice to see because all three of these hydrocarbons have different fundamentals, although they are all reasonably strong. It is also nice to see that EnLink Midstream handles natural gas in all of the regions in which it operates since the fundamentals for natural gas are perhaps the strongest of any fossil fuel. This is somewhat reflected in the market prices of the various compounds. Over the past twelve months, the price of natural gas has increased by 80.29% but the price of West Texas Intermediate crude oil has only increased a much more moderate 35.74%. EnLink Midstream, however, is not particularly affected by changes in natural gas resource prices because of the business model that it uses. In short, EnLink Midstream enters into contracts to transport and process the customer’s resources and the customer compensates EnLink Midstream based on the volume of resources handled and not on their value. Admittedly, the business model is somewhat more complicated than this but the point remains that EnLink Midstream’s cash flows correlate with resource volumes, not resource values.

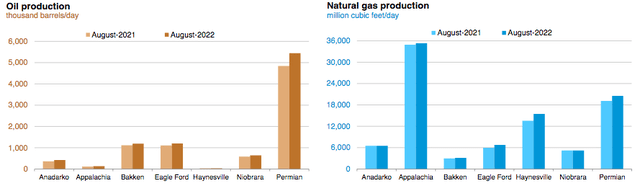

Fortunately for EnLink Midstream, production volumes are up in a few of the basins that it operates in, notably the Permian Basin, Appalachia, and the Haynesville Shale. However, production in totally flat year-over-year in the Anadarko Shale:

U.S. Energy Information Administration

We can expect this increased production to result in volume growth for EnLink Midstream. This is because someone has to take the incremental resources to the market where they can be sold. That is exactly the business that EnLink Midstream is in. This expectation did prove to be correct as well since the company’s Permian Basin infrastructure reported a 12% year-over-year volume increase in the first quarter, which helped EnLink Midstream to announce its highest adjusted EBITDA in history. There are some reasons to believe that this will not be a one-off event.

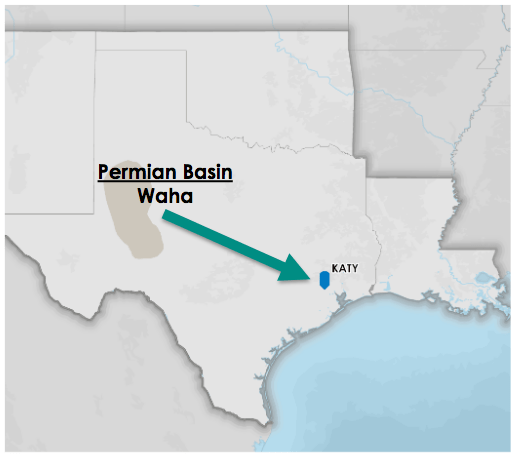

One of the ways that the company will drive forward growth is by adding new infrastructure. This actually makes sense since midstream infrastructure is only capable of handling a finite quantity of resources by its very nature so the only way that the company can increase its volumes beyond these inherent limits is by constructing new infrastructure. One of the company’s major growth projects is the Matterhorn Express Pipeline, which will run from the Permian Basin to Katy, Texas:

EnLink Midstream

When the pipeline is complete, the 490-mile pipeline will be capable of carrying approximately 2.5 billion cubic feet of natural gas per day. As such, this pipeline will address one of the biggest problems that is holding back the development of the Permian Basin. This problem is a lack of sufficient midstream takeaway capacity and it has been plaguing the region for years. This is one reason why so many midstream companies were involved in growth projects in Texas prior to the COVID-19 lockdown-driven crash in energy prices. One of the nice things here is that EnLink Midstream has already secured contracts for the use of this pipeline from its customers. This is nice for two reasons. The first of these is that we can be certain that EnLink Midstream is not spending a great deal of money to construct infrastructure that nobody wants to use. The second way that this situation is nice is that EnLink Midstream knows in advance exactly how profitable the pipeline will be so it knows that it will earn a sufficient return to justify the investment. Unfortunately, EnLink Midstream has not divulged any numbers about the project’s profitability but usually projects like this pay for themselves in about four to six years so that is probably a reasonable estimate here. As is often the case, EnLink Midstream is constructing this pipeline as part of a joint venture in order to limit its own financial risk but this also means that it will have to share the cash flows with other companies. EnLink Midstream owns 15% of the Matterhorn Express Pipeline so its allocation of the pipeline’s cash flows should be commensurate to this. The pipeline is scheduled to begin operation in the third quarter of 2024 so we should begin to see an impact on EnLink Midstream’s cash flows around that time.

Another growth opportunity for EnLink Midstream was consummated back in May and so should begin imparting a positive effect on the company’s second quarter 2022 earnings results. This opportunity was of course the acquisition of Crestwood Equity Partners’ (CEQP) North Texas gathering and processing assets:

EnLink Midstream

This acquisition substantially increased EnLink Midstream’s position in Texas and is immediately cash flow-generative for EnLink Midstream. The purchased assets include a total of 500 miles of natural gas gathering pipelines and three natural gas processing plants that are capable of processing a total of 425 million cubic feet of natural gas per day. EnLink Midstream paid $275 million for these assets and by all accounts got a very good price for them. Based on the cash flows that they are currently generating, these acquired assets will repay their purchase price in about four years and anything beyond that is simply pure profit. As the acquisition was completed back in May, we will begin to see the impact of these assets in EnLink’s second quarter results but there will be a much larger impact in the third quarter as they will be generating cash flow for EnLink for the entire quarter as opposed to just one month.

Fundamentals Of Midstream

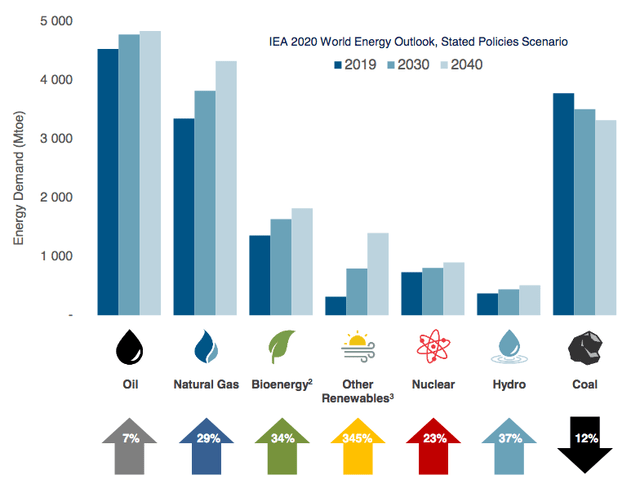

As already discussed, EnLink Midstream makes its money by transporting natural gas, crude oil, and other hydrocarbons. Therefore, it would make a certain amount of sense to have a look at the fundamentals of these resources as part of our analysis of the company. Fortunately, these fundamentals are quite positive as the demand for them is likely to increase over the coming years. This is something that may be surprising considering that politicians and others in the various developed nations have been very aggressively trying to reduce the consumption of fossil fuels within their borders. However, the International Energy Agency states that the global demand for crude oil will increase by 7% and the global demand for natural gas will increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

Perhaps surprisingly, the natural gas demand growth is being driven by concerns about climate change. As everyone reading this is likely well aware, these concerns have prompted governments all over the world to impose a variety of incentives and mandates that are intended to reduce the carbon emissions of their respective nations. One of the most popular of these strategies is to encourage utilities to retire their old coal-fired power plants and replace them with renewables. However, renewables are not reliable enough to support the needs of a modern electric grid. After all, wind power cannot generate electricity when the air is still and solar power does not work when the sun is not shining. The usual solution to the problem is to supplement the renewable power plants with natural gas turbines because natural gas does enjoy the reliability that is expected by people in modern society as well as burning far more cleanly than any other fossil fuel. This is why natural gas is often referred to as a “transitional fuel” since it will provide for society’s energy needs until renewables are sufficiently advanced to accomplish this task on their own.

The argument for crude oil growth is much harder to understand given the demands by politicians and activists to get their nations off of crude oil. However, it is a very different story in the various emerging nations around the world. These nations are all expected to enjoy substantial economic growth over the projection period, which will have the effect of lifting those nations out of poverty and putting them securely into the middle class. These newly middle-class people will naturally begin to desire a lifestyle that is much closer to what their counterparts in the Western nations enjoy than what they have now. This will require increased energy consumption, including energy derived from crude oil. As the populations of these nations are substantially larger than the populations of the various developed nations, the rising demand from these parts of the world will more than offset the stagnant-to-declining demand for crude oil in the world’s developed nations.

The United States is one of the few nations in the world that has the ability to significantly increase its production of hydrocarbons in order to satisfy this demand growth due to the incredible mineral wealth of areas like the Permian Basin. As we have already seen, production in various basins has already begun to increase. While it is doubtful that the energy industry in aggregate will actually increase its production sufficiently to fully satisfy this demand growth, that is irrelevant to our discussion here since it does look like production will grow at least somewhat. These incremental resources will need to be taken to the market in order to be sold, which is exactly the business that EnLink Midstream is in. This should therefore result in growing volumes and by extension cash flows for the company over the coming years.

Financial Considerations

It is always important to look at a company’s financial structure before making an investment in it. This is because debt is a riskier way to finance a business than equity because debt must be repaid at maturity. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, a decline in cash flow could push the company into insolvency if it has too much debt. Although midstream firms tend to have remarkably stable cash flows over time, bankruptcies are certainly not unheard of in the sector.

The usual way that we analyze a midstream company’s ability to carry its debt is by looking at the leverage ratio, which is also known as the net debt-to-adjusted EBITDA ratio. This ratio tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of March 31, 2022, EnLink Midstream has a leverage ratio of 3.8x based on its trailing twelve-month adjusted EBITDA. This is a very reasonable ratio that is quite a bit below the 5.0x that analysts usually consider to be acceptable. As I have pointed out in various previous articles, many midstream companies have been trying to get this ratio below 4.0x ever since the pandemic broke out in order to reduce the risks of their financial structure. I also prefer to see this ratio below 4.0x for the same reason. We can clearly see that EnLink Midstream beats even this more conservative requirement. Thus, it appears that there is nothing to particularly worry about with regard to the company’s debt as it should be able to carry it going forward.

Distribution Analysis

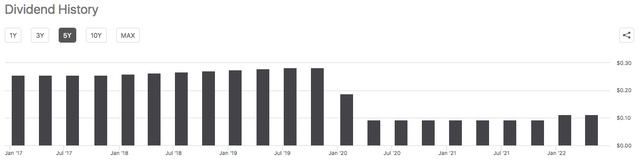

One of the biggest reasons that investors purchase companies like EnLink Midstream is because of the fairly high yields that they tend to possess. As of the time of writing, EnLink Midstream yields 4.23%, which is much more attractive than the 1.54% yield of the S&P 500 index (SPY). Unfortunately, EnLink Midstream’s distribution history leaves something to be desired:

As we can see, the company had a reasonably good track record prior to the pandemic but then it was forced to cut its distribution twice in response to the events of 2020. Although it has slowly started to increase the distribution, it still remains well below pre-pandemic levels. This will almost certainly be disheartening to any investor that desires a source of stable and secure income with which to pay their bills. However, anyone purchasing the partnership units today will receive the current distribution at the current yield and does not have to be particularly concerned about the company’s past troubles. The important thing for someone buying today is whether the company can afford to maintain its distribution at the current level. After all, we do not want to risk another cut that reduces our income and likely causes the units to decline.

The usual way that we analyze a company’s ability to carry its distribution is by looking at the company’s free cash flow. Free cash flow is the amount of money that was generated by the company’s ordinary operations and left over after it pays all its bills and makes all necessary capital expenses. This is therefore the money that is available to do things like reduce debt, buy back stock, or issue a distribution. In the first quarter of 2022, EnLink Midstream reported a levered free cash flow of $216.0 million but only paid out $56.4 million in distributions. Obviously, the company is easily able to carry its distribution with a great deal of money left over for other purposes. There appears to be minimal risk of a distribution cut here.

Conclusion

In conclusion, EnLink Midstream is not the most well-known name in the midstream business but it certainly has a great deal of potential. The company is witnessing growing volumes in several of the areas in which it operates, which is resulting in growing cash flow. This cash flow growth should continue over the next few years as some of the firm’s growth projects come online and begin contributing to the company’s finances. When we combine that with a solid balance sheet and a sustainable 4.23% yield, we see that this company may be worth considering for your portfolio.

Be the first to comment