Bryan Bedder

I’ve been fairly vocal on this platform (and with subscribers) in the past several weeks that I think the bottom is in, and as a result, I’m very bullish on US equities. However, that bullishness doesn’t extend to just anything, as there are sectors (and companies) that are clearly weaker than others. That’s why I preach relative strength and watching the charts, because it can help avoid losers.

One such loser is coatings behemoth Sherwin-Williams (NYSE:SHW), which reported earnings yesterday, and was clobbered for slashing guidance. We’ve seen other companies provide guidance that was better than feared, but that clearly wasn’t the case with SHW, which fell 9% on a day when the S&P 500 was up 2.6%. That’s telling, but so is a lot of other evidence when it comes to SHW.

In this article, we’ll take a look at what we can learn from the chart, as well as the fundamental situation. The TL;DR is that both are less-than-bullish at the moment, and I do not think you should be buying the dip here.

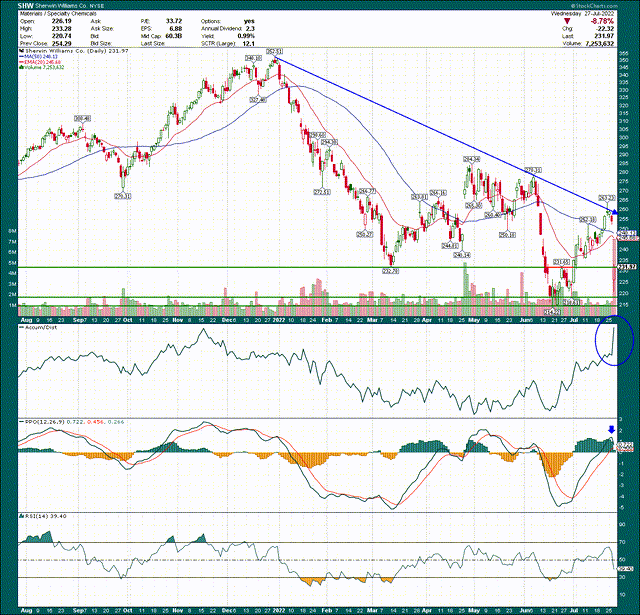

Charting the course

We can see very clearly on the price chart that the dominant downtrend that SHW has been in since the December peak came into play again yesterday. The stock rallied hard into the report, and then was rudely rejected right where you’d expect it to be. Until that downtrend is broken, SHW is not a stock you should want to own.

On the plus side, the accumulation/distribution line is outstanding, and given the stock rallied throughout the day yesterday, it’s actually at its high. That’s unusual for a stock that is getting dumped on a weak earnings report, because it means Wall Street is still buying the dip. Does that mean the stock will recover quickly? Perhaps, but rather than supporting the bull case, I’m seeing the A/D line as a bullish outlier. Keep in mind also that you should never buy or sell a stock based purely on A/D; it is simply an indicator.

The PPO rallied nicely along with price into the earnings report but it certainly looks like it’s rolling over again. I doubt we get back to -4 on the PPO, but I do expect to see a trip to -2 or so as this selloff works itself out. That’s supportive of not buying the dip because I think you’ll get a lower price, and potentially much lower.

Finally, there are a lot of resistance levels overhead, with the first being the prior relative low at $232. That’s exactly where the stock closed yesterday, so we’ll know quickly if that’s going to be a problem. But even if it isn’t, the 20-day EMA and 50-day SMA are both pointed sharply lower, and there’s the downtrend line to contend with. In other words, I have little faith in near-term upside here because there are simply too many barriers.

Let’s quickly take a look at relative strength to hammer this home.

The top panel is SWH against its peers, and the bottom panel is the group against the S&P 500. SHW has been very weak against its peers (no surprise) and the group has been weak against the market. We’ve seen a slight uptick in relative strength for the group in the past couple of weeks, but I’m not seeing anything here that makes me want to own this stock, either.

Let’s now turn our attention to the fundamental case for avoiding SHW.

Margins and debt

The coatings business is great when times are good. Everyone needs coatings, whether it’s stain, paint, or whatever else you can think of, buildings, houses, cars, boats, airplanes, and a variety of countless other products need coatings. That means the overall market tends to grow nicely over time, and booms when the economy is good. In addition, margins are generally pretty strong, leaving plenty of room for SHW and its competitors to make a lot of money. However, when the margin story breaks down from higher input costs, so does the case for owning the stock.

But before we get to that, let’s have a quick look at demand for SHW’s products.

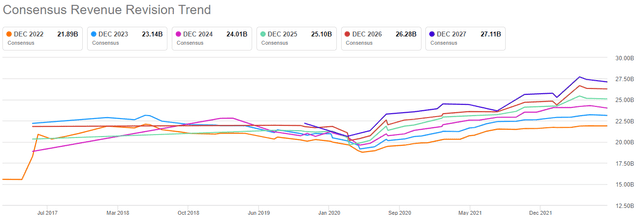

Seeking Alpha, revenue revisions

Revisions have been steadily higher since COVID hit more than two years ago, although the magnitudes aren’t that great. Still, the company has seen analysts continue to raise revenue estimates, and that’s a good sign. As I mentioned, demand is almost always pretty good for coatings, and it’s part of the reason why SHW has grown the way it has over the decades. In short, I don’t see SHW as having a demand/revenue problem.

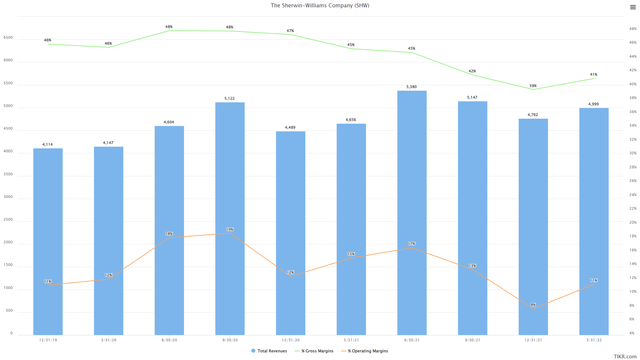

What it does have is a margin problem. Below we have quarterly revenue, gross margins, and operating margins for the past few years to get a sense of what SHW is dealing with.

We’ve seen gross margins steadily decline on rising input costs for some time, and as revenue rises and falls, operating margins follow suit. That’s normal for most businesses, but look at the damage it can cause for SHW’s earnings. We saw 19% operating margins in the September 2020 quarter, but less than half of that in the December 2021 quarter. Revenue was lower, so fixed costs were leveraged up, but gross margins are killing its profitability. Gross margins were under 42% again in the June 2022 quarter.

At some point input costs will moderate, but even so, SHW’s margins are not the mark of a healthy company. Pricing actions will help, but that also has the potential to drive price-sensitive customers to competitors, of which there are many.

Indeed, I’ve bought paint a bunch of times in my life, and I honestly couldn’t tell you the difference between SHW’s products and other brands I’ve used. I suspect most DIY customers are that way, so if you’re price-sensitive, and you don’t see the difference between SHW and others, price increases are probably enough to drive you to try another brand.

While I think SHW will continue to see strong demand over time, I’m really concerned about its ability to generate margin from that demand. As such, I think the stock starts the fundamental conversation on the back foot.

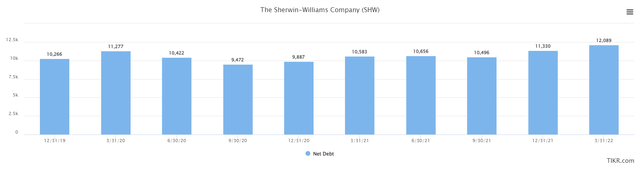

Now, let’s take a look at SHW’s leverage, because it is sizable. This is outstanding net debt in millions of dollars for the past few years to get an idea of how much the company has borrowed.

Leverage is being added regularly, and net debt is now greater than $12 billion. That’s a lot of money where I come from, and the company is paying ~$90 million per quarter just to service it. For a company with margin issues, that’s less than ideal.

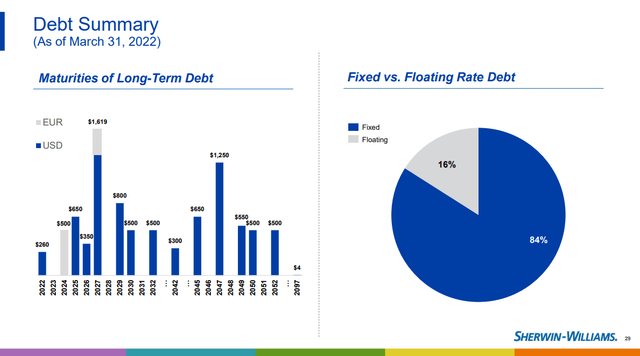

Investor presentation, debt summary

Here’s a look at the maturity schedule, and we can see it has only a very small fraction of it due in 2022, with nothing due in 2023. Things get dicey after that but I have zero fear that SHW won’t be able to refinance. What I do fear is that the company’s cash flow situation has deteriorated to the point where it has no ability to actually reduce this debt at some point. This is particularly true given its history of returning capital to shareholders, which appears to me to have gone too far. Permit me to explain.

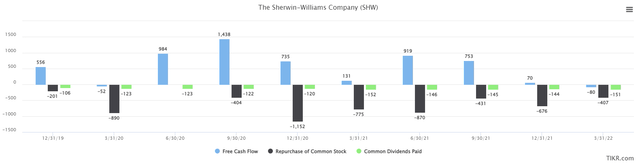

Below we have free cash flow in blue, share repurchases in black, and dividends paid in green. These are quarterly numbers and in millions of dollars.

TIKR, cash production and usage

FCF has dwindled over time, peaking at $1.4 billion in September 2020 to a deficit of $80 million in the March quarter. The most recent quarter saw $640 million in operating cash flow, and capex of $130 million, so SHW was back to producing positive FCF again on a quarterly basis. But my point is that if we look at the spending on buybacks and dividends, the company is vastly outstripping cash supply with cash demand.

That gives me pause on its ability to continue to buy back stock over time, given the dividend is sacred and almost certainly isn’t going anywhere. But with $12+ billion in net debt already, and spending more cash than it produces, I wonder how long this can last. If buybacks do slow or stop at some point, that has implications for EPS growth, which impacts the multiple investors are willing to pay, which impacts the share price.

Looking ahead

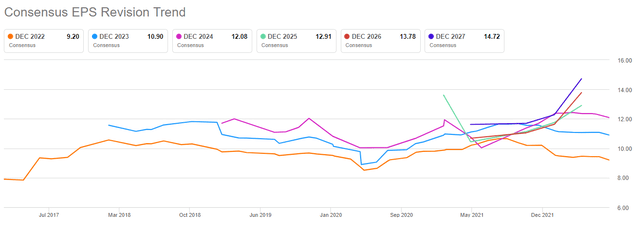

What’s interesting when we look at EPS revisions is that it’s pretty clear analysts think the margin issues the company is facing will be transitory. There’s still ample space between years, indicating high levels of year-over-year growth, but the lines have been trending lower since last year. That’s a lot different from revenue, and it’s not exactly bullish.

This reflects the company’s margin challenges, and I generally don’t want to buy a stock that has steadily declining EPS estimates, simply because if you do, you’re relying upon valuation alone to drive your returns. As we’ll see below, I don’t think that will work, either.

Here’s a look at the stock’s five-year history of forward P/E ratios for some perspective.

Pre-COVID, the stock traded in a pretty narrow range of 20X to 24X forward earnings. Post-COVID, we saw a run to 37X times forward earnings, right at the height of the froth of this market. That was obviously unsustainable, and the decline was swift. We’re at 22X today, so I don’t even see the stock as cheap. Keep in mind also that since the earnings report was yesterday, the “E” portion of the P/E ratio is almost certain to see some downgrades in the coming weeks, which means the stock is likely even more expensive than it appears today. Like just about everything else we’ve look at, I don’t see any reason to want to buy this stock.

Final thoughts

I like the coatings business for the long-term, and if your holding period is a decade or two, you can buy SHW today and be fine. But I’m interested in stocks that are about to make a run near-term, and I have zero evidence SHW is such a stock. The price chart has warning signs all over it, relative strength is pretty ugly at this point, the company has margin issues, and its FCF/debt situation is worsening.

Given all of this, and the fact that the stock isn’t even attractively priced, I think you should sell SHW and look in any number of other places in this market that I think has already bottomed.

Be the first to comment