Mauricio Graiki/iStock via Getty Images

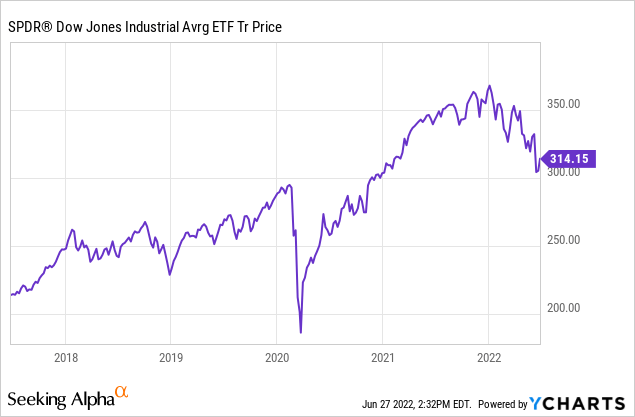

Will the Dow Jones Industrial Average (NYSEARCA:DIA) continue to slide, or has the market fully priced in the changing economic outlook? We’re about to get a lot more information about the likely path of markets with the quarter ending this week and earnings season around the corner. As of my writing this, the broad S&P 500 Index (SPY) is down a little less than 19% for the year while the Dow is doing better, down a bit less than 14%.

When the general public looks at what the market is doing for the day, they generally refer to the Dow as the benchmark, while market professionals tend to look more at the change in the broader S&P 500 index, especially when comparing performance.

Part of this is due to index construction – the Dow is a bit of a goofy index with only 30 components and ~54% of the index in just 10 holdings. But the Dow does have clout, and the index providers have mostly done a good job of sampling the broad market and diversifying the companies throughout different sectors. The other virtues of the Dow are that the dividend yield is much better than the S&P 500 and that it’s a less tech-heavy index.

The Outlook For Stocks For The Rest Of 2022

The Dow made headlines this month when it briefly traded below 30,000 in response to some bad economic data and the Fed being forced to hike rates by more than expected. But the future direction of the market will hinge more than anything on the earnings of the businesses that underlay the stock market. The Fed is important, but it isn’t the final arbiter of stock prices. After all, stocks were very cheap compared with earnings in 2008-2012 when cash interest rates were at zero, and very expensive in 2000 when rates were at 6%-plus.

Earnings were at their highest ever in 2021 on the heels of historically unprecedented fiscal stimulus. But whether they can continue at the 2021 pace or will recede closer to the pre-pandemic pace they were at in 2019 is an open question. In other words, was the crazy boom in stocks, housing, crypto, and junk bonds in 2021 secular or cyclical? Since shortly before the pandemic, earnings have grown much faster than nominal GDP (and inflation by extension). But the market is starting to believe that the boom was cyclical, and stocks are likely to retreat to pre-COVID highs if this belief continues to be adopted.

I’ve called for the S&P 500 to trade back to a fair value of 3300, roughly its pre-pandemic high. The Dow is a little more path-dependent since it’s so concentrated in a few names, but sub-30,000 seems inevitable and I wouldn’t be at all surprised if the index went as low as 25,000.

What I mean about index concentration – UnitedHealth (UNH) is the Dow’s largest holding at nearly 10% of the index. It’s been a juggernaut over the last 10 years. The next largest holdings are Goldman Sachs (GS) and Home Depot (HD), at roughly 6% of the index each, two stocks that are universally considered to be pretty sensitive to the economy. These three stocks alone make up nearly as much of the index as the top 10 holdings of the S&P 500. Small and mid-cap indices generally have less than 10% of their assets in their top 10 holdings.

Anyway, like much of Wall Street, Goldman grew its headcount rapidly over the past couple of years, and now that the capital markets business (investment banking, IPOs, etc) has slowed significantly, analysts have warned that some heavy rounds of layoffs will soon need to happen. Goldman will almost certainly be fine in the long run, but this is yet another indication of a possible earnings slowdown. The story isn’t much different at Home Depot (HD), which is facing a probable slowdown in home building/home renovation sales as consumers are squeezed by mortgage rates going from 3% to 6% with large increases in property taxes, utility bills, and HOA dues. And UnitedHealth has done great for shareholders, but is the path of their earnings growth sustainable if Congress could change it with the stroke of a pen?

To paraphrase Morgan Stanley (MS) chief strategist Mike Wilson, Corporate America will be coming into the confessional booth to confess its sins over the next six weeks, and what leading economic indicators are saying is that earnings may not top 2021’s breakneck pace for at least a couple of years.

For the broader market, Apple (AAPL), Tesla (TSLA) Amazon (AMZN), Target (TGT), and Walmart (WMT) will be the earnings reports that affect stocks the most, due to the large market caps of the companies and their broad interaction with American consumers. If leading economic indicators are to be believed, these stocks could fall sharply if earnings and profit margins come in lighter than expected.

Some leading economic indicators that make it hard to completely dismiss the idea of Dow 25,000:

- Consumer confidence is at crisis levels, not seen since 2008 or the late 1970s/early 1980s.

- Econometric models by the Fed show that real GDP is not growing. GDP is likely to change by +/- 0% annually in Q2 after shrinking in Q1.

- Inflation-adjusted earnings have trailed inflation by nearly 4% over the last 12 months, leading to a serious drop in the standard of living in America not seen since 2008. Many other Western countries are in worse shape, squeezed by skyrocketing costs for food and energy. Consumers have dealt with this so far by spending down pandemic-era savings, but that’s not a permanent fix.

- Jobs are a lagging indicator, NOT a leading indicator, but news stories of layoffs seem to be starting to pile up, with a concentration in the tech, finance, and real estate industries.

- Informally polling owners/managers of restaurants that I know personally, they’re increasingly saying business is hit or miss or slowing. I’ve noticed this since April.

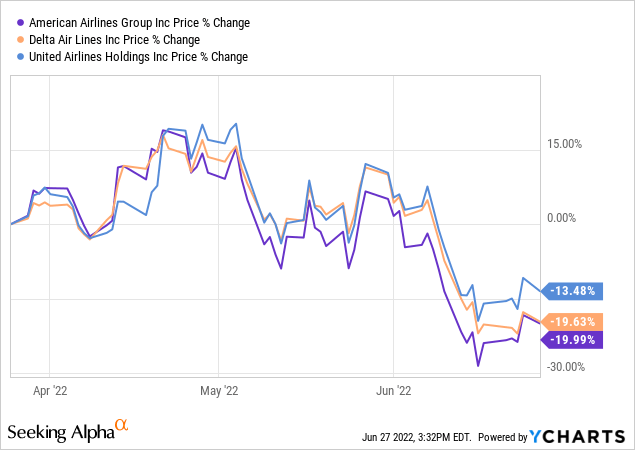

The news isn’t all bad, but you wonder if the economy is about to take a dive. For example, travel demand is off the charts right now. But is the supply there to serve all these travelers looking for vacations after two years of decreased demand? Not quite. And is it even sustainable to do this for airlines with a possible recession looming and the threat of winter lockdowns in areas that are politically inclined to do so? The market is souring on travel stocks over the last three months even as business booms –another ominous sign for stocks.

It’s not impossible that the bottom is in for stocks, but for this to happen, a new group of stocks is likely going to have to take leadership. The next bull market could very well be led by tech again, but valuations are still on the high side after heavy declines. Stocks are currently being led by energy stocks in a stagflation-type trade, which isn’t very helpful for the broad market. Exxon (XOM) got kicked out of the Dow in 2020 and replaced by Salesforce (CRM), so you’re not getting that anymore in the index! I could be wrong, but I just don’t see any other sectors stepping up with the earnings picture likely to be softer than analysts previously forecasted.

Bottom Line

It’s tough to tell where the Dow will go from here because it’s so concentrated in a few names, but the upcoming season of earnings reports is likely to be the No. 1 factor in determining the direction of the markets going forward. I’d be very cautious about buying anything before earnings season starts to wind down in August unless you have a high degree of confidence that the trend of declining earnings and profit margins is likely to reverse course in the near term. The market is likely to go lower here. I’d be patient and not commit too much capital before we get some clarity over the next six weeks, likely forcing the market to price in some more of the reality on Main Street.

Be the first to comment