winhorse

Introduction

As a dividend growth investor, I constantly seek opportunities to increase my investment income. I look for income-producing assets that can add to my dividend growth portfolio. Sometimes I add to existing positions, and on other occasions, I start new positions to diversify my holdings further to lower my portfolio’s volatility. The current volatile market may be an opportunity to buy assets for cheap.

Following my article on Schwab U.S. Dividend Equity ETF (SCHD), I started looking at more income-producing ETFs. I found JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) an exciting possibility. It uses options and stock strategies to create a higher income from primarily dividend-paying stocks. If the income grows sustainably, it may appeal to many investors.

I will analyze the ETF differently than how I analyze dividend growth stocks. I will first focus on the fundamentals and understand which index is the benchmark for the ETF. Then I will examine the pros and cons of investing in that ETF and draw my conclusions regarding the attractiveness of the ETF from income and dividend growth investors’ perspective.

Seeking Alpha’s company overview shows that:

JPMorgan Equity Premium Income ETF is launched and managed by J.P. Morgan Asset Management. The fund invests in public equity markets. The fund invests directly and through derivatives in stocks of companies operating across diversified sectors. It uses derivatives such as options to create its portfolio. It invests in growth and value stocks of companies across diversified market capitalization. The investment seeks current income while maintaining prospects for capital appreciation. The fund seeks to achieve this objective by (1) creating an actively managed portfolio of equity securities comprised significantly of those included in the fund’s primary benchmark, the Standard & Poor’s 500 Total Return Index (S&P 500 Index) and (2) through equity-linked notes (ELNs), selling call options with exposure to the S&P 500 Index. Benchmark: S&P 500 TR USD

Fundamentals

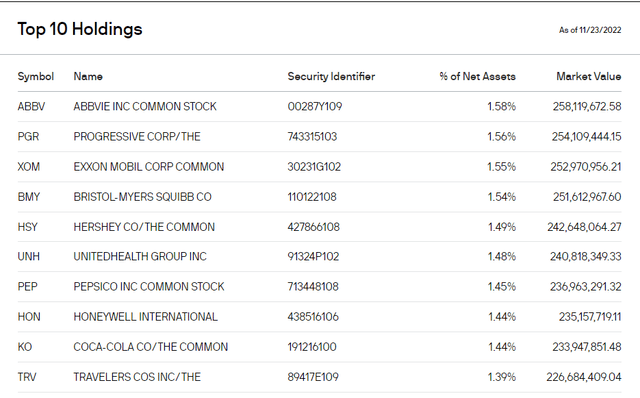

The JPMorgan Equity Premium Income ETF invests primarily in large-cap companies that pay dividends. The ETF holds companies like AbbVie (ABBV) and PepsiCo (PEP). The ETF sells covered calls to supplement the income from these dividend-paying stocks to get the premium. The premium and the dividend are the ETF distribution. Covered calls are less risky as there is limited exposure as the ETF owns the base asset.

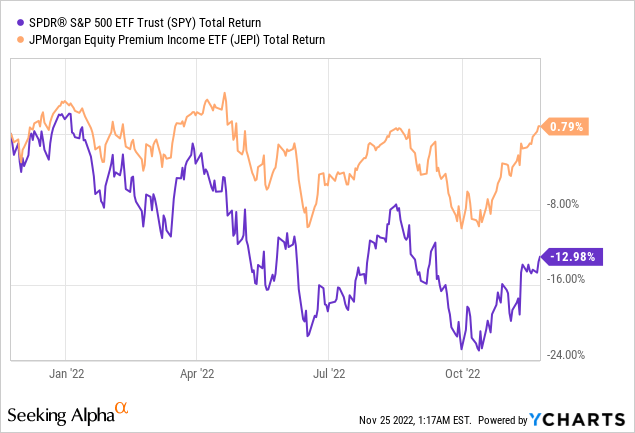

The ETF has a short track record, as it only started trading in 2020. Unlike other ETFs, it is hard to measure it against its benchmark. According to JPMorgan (JPM), the benchmark for this investment should be the S&P 500 (SPY) total return. Many dividend growth investors may find the short track record a disqualifier since a long track record of dividend increases is usually a prerequisite.

The ETF is part of a new wave that has become very popular of actively managed ETFs. The most famous nowadays is the ARK ETFs. As investors prefer simple investment vehicles with limited expenses, mutual funds are not as popular as they used to be. A managed ETF charges higher fees than a passive fund or ETF but aims to bring alpha to investors.

Moreover, in the last year, the ETF by JPMorgan managed to beat inflation with its income. The latest payment in November was 65% higher than the one paid in November 2021. However, higher volatility in the stock market allows the fund managers to achieve higher premiums, and distribution growth is not guaranteed or even assumable like in dividend growth stocks.

Pros

Performance has been excellent for the ETF. Since its inception, the ETF has performed similarly to the S&P 500 when considering the distribution. When we look at the performance year to date, it is even more promising. The ETF has outperformed the S&P 500. The market volatility allows the fund managers to earn more money from writing covered calls and supports the performance during times of uncertainty. Yet, as mentioned before, the track record is short, making it hard to conclude.

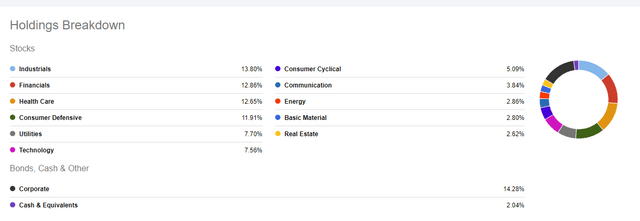

The holdings are another advantage for dividend and income investors. The fund is diversified and holds stocks across sectors, with industrials and financials leading the way. Moreover, the companies it owns are blue chips that will make most dividend growth investors comfortable. The options strategy is just the icing on the cake, as the holdings are incredibly high-quality dividend growth companies.

Experience is another crucial advantage for the JEPI ETF. It is an actively managed fund and doesn’t follow the index. Thus, the experience of the fund managers is essential. Both managers have over 30 years of experience in the industry. They have been with J.P. Morgan for over a decade and have managed the fund since its inception. Investors should feel comfortable knowing that a capable and experienced team runs the fund.

Cons

The income is less reliable compared to SCHD or other dividend-focused funds. A company has a lot of impact on its dividend. On the other hand, when income relies on options, there is a significant reliance on the market. Market conditions will decide how much risk one has to take if one wants to gain the same premiums. During high volatility, premiums are higher, but it becomes harder to earn similar income when the volatility declines.

Another disadvantage is that you rely on others by investing in JEPI. It is not a passive fund, so investors should monitor what the fund holds every once in a while. Moreover, they should also see if there are significant changes in the fund management as it may also affect the performance. Unlike a passive fund, this fund may be significantly affected by how capable its managers are.

Expenses are another disadvantage. The ETF doesn’t outperform the benchmark. Since its inception, the total return of the ETF has been similar to the total return of the S&P 500. The ETF did manage to produce much higher income, but it did so with less capital appreciation. So similar performance requires investors to pay 0.35% in fees annually. In my opinion, it is not too high, but it may deter some investors who prefer to invest in the S&P 500 and sell a portion of their investment every month.

Conclusions

An investment in JEPI is not suitable for most dividend growth investors. The income is erratic, and growth is uncertain. It also lacks the needed track record to be considered a reliable income-producing vehicle. Dividend growth investors tend to be more conservative, so they prefer SCHD for their goals. JEPI can be a small portion of a diversified dividend growth portfolio only if the investor knows what to expect.

JEPI can still be a valuable investment in many portfolios. The ability to gain additional income will be most welcome by most income-seeking investors. Combining a high yield with high-quality assets while still performing well compared to the index makes JEPI an exciting prospect. I still think that lacking a track record is a significant challenge, and investors should still consider this ETF, especially during volatile times.

Be the first to comment