hapabapa

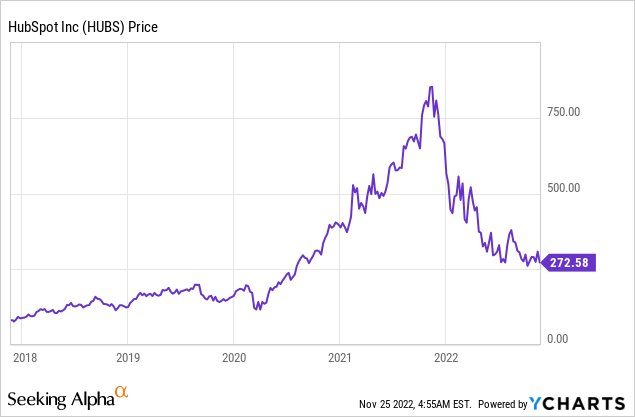

HubSpot (NYSE:HUBS) is a marketing automation software platform that you can think of as Salesforce for small-medium-sized businesses. The company became a thought leader in content marketing and even popularized the term “inbound marketing”. In the third quarter of 2022, HubSpot continued to execute well beating both top and bottom-line analyst estimates for growth. In this post I’m going to break down the company’s financial results before revealing its valuation, let’s dive in.

Solid Third Quarter Results

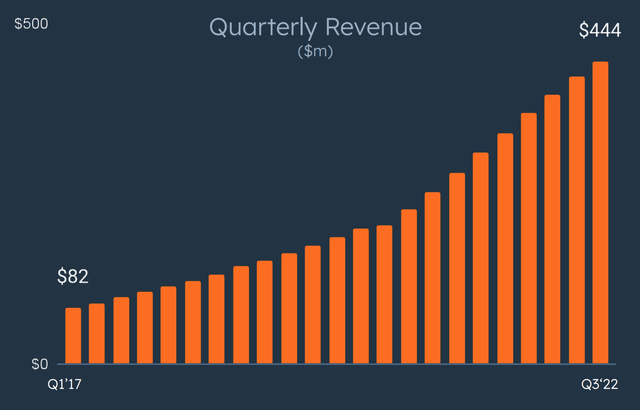

HubSpot reported solid financial results for the third quarter of 2022. Revenue was $443 million, which grew by 38% year over year (constant currency basis) and beat analyst expectations by $17.89 million. This solid revenue can be broken down into subscription revenue which increased by 32% year over year. While its “services and other” revenue segment did offset this with a decline by 13%. Overall, I don’t deem this to be a major issue, as I would prefer to see growth in HubSpot’s higher-margin business than its lower-margin services business.

Breaking down revenue by region, Domestic revenue increased by 33% year over year. In addition, International revenue increased by 29% or 44% on a constant currency basis. HubSpot is now well diversified with International revenue making up 46% of total revenue as of the third quarter of 2022. HubSpot’s top line is driven by two major metrics; customer growth and revenue per customer.

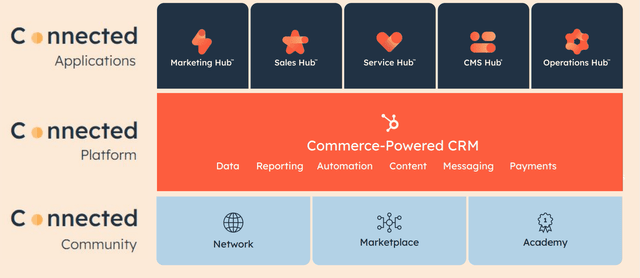

In Q3,22 HubSpot added over 8,000 new customers and reported 160,000 in total up a rapid 24% year over year. HubSpot primarily focuses on the SMB (Small medium size business market). In my personal experience, I have found the platform to be popular with venture-backed startups as its pricing scales with the growth of the company. Most enterprises tend to use a solution such as Salesforce (CRM) or Adobe (ADBE), with its Marketo and analytics products. However, HubSpot is gradually moving upmarket with its system, which should result in even greater retention. For now, HubSpot can position itself as the low-cost solution and the recent growth has been driven by HubSpot’s free starter CRM (Customer Relationship Management) suite which is a frictionless way to entice users into using the platform. This is a brilliant strategy as once a customer uploads all their customer data, they will then want to market to those customers, sell to them, etc. Therefore they will end up purchasing more applications or “hubs” from HubSpot such as the Marketing Hub and Sales Hub. Then of course, many of these customers may require support so the Service Hub will be naturally adopted. This is a classic “land and expand” or upsell/cross-sell model.

HubSpot has highlighted its customer pain point of using many single-point solutions and not having all its customer data in one place. Its multi-hub platform solution solves this. Therefore it is no surprise that Average Subscription Revenue per customer increased by 7% year over year or 12% on a constant currency basis.

The company reported solid Net Revenue Retention of 109% in the third quarter of 2022. This was down slightly due to customers delaying upgrades, due to fears about the macroeconomic environment. However, this is still a solid retention rate overall.

Profitability and Expenses

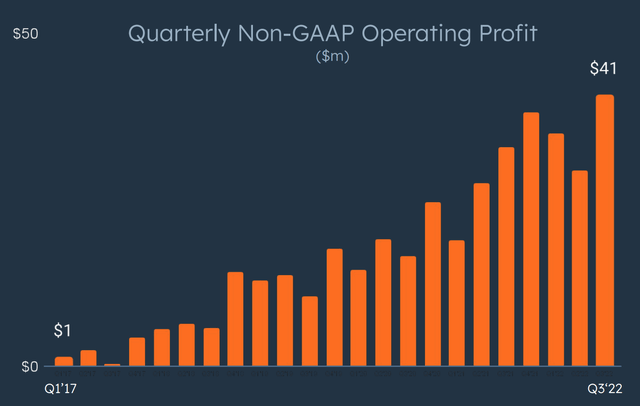

HubSpot reported a super high gross margin of 82% which increased by 2% year over year. As mentioned prior its services business is a real laggard with a negative 49% gross margin, therefore I would like to see this side of the business continue to make up less of the total revenue. The company reported Earnings Per Share [EPS] on a GAAP basis of negative $0.65 which beat analyst expectations by $0.20. On a Non-GAAP basis, the company reported a quarterly operating profit of $41 million, which beat analyst expectations.

Operating Profit (Q3,22 report)

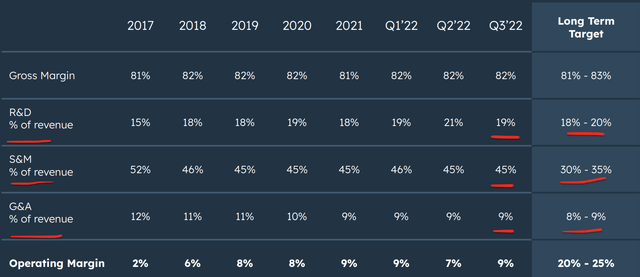

HubSpot’s management reported its long-term financial targets, as you can see on the image below. Currently, the business is investing ~19% of total revenue into Research and Development as it improves the product and continues to innovate. This is expected to stay at a similar percentage between 18% and 20% longer term. Overall, I don’t deem this to be a bad sign as companies that tend to invest more into R&D tend to produce greater shareholder value long term, think Google, Amazon etc. Sales and Marketing expenses made up an eye-watering 45% of revenue in the third quarter of 2022. Long term this expense is expected to drop to between 30% and 35%. If any company can make accurate Sales & Marketing forecasts it is HubSpot, as the business is a thought leader in this space and also can learn from the data of all its customers to optimize their own marketing spend. G&A expenses are forecasted to stay at between 8% and 9% long term. The overall Operating Margin is expected to jump to between 20% and 25% which looks to be mostly driven by improved S&M expenses and top-line growth.

Long Term Financial Targets (Q3,22)

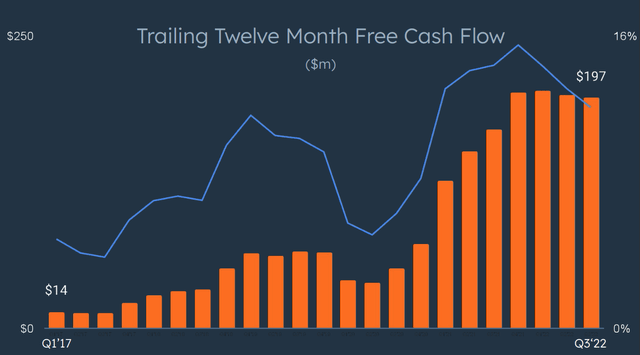

HubSpot reported $197 million in free cash flow over the trailing 12 months which has increased substantially over the past couple of years.

Hubspot Free Cash Flow (Q3,22 report)

HubSpot has a solid balance sheet with cash and marketable securities totaling $1.4 billion. In addition, the company has ~$454 million in debt which consists of mostly convertible senior notes.

Advanced Valuation

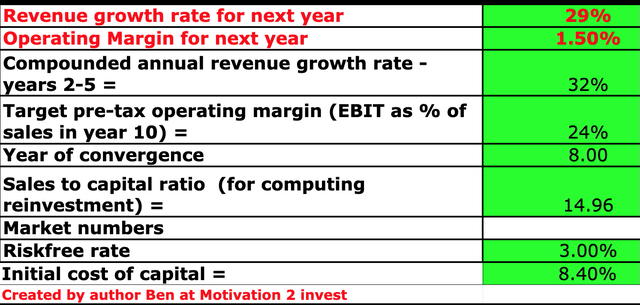

In order to value HubSpot, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted a 29% revenue growth rate for next year and a 32% revenue growth rate over the next 2 to 5 years. I believe the company may experience slightly lower growth next year due to the recessionary environment. However, in years 2 to 5 I forecast revenue to grow at a faster, albeit still modest rate.

Hubspot stock valuation 1 (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized the company’s R&D expenses which has lifted operating income to 1.5%. Over the next 8 years I am forecasting a 24% operating margin, which is aligned with the long term financial target HubSpot’s management has reported.

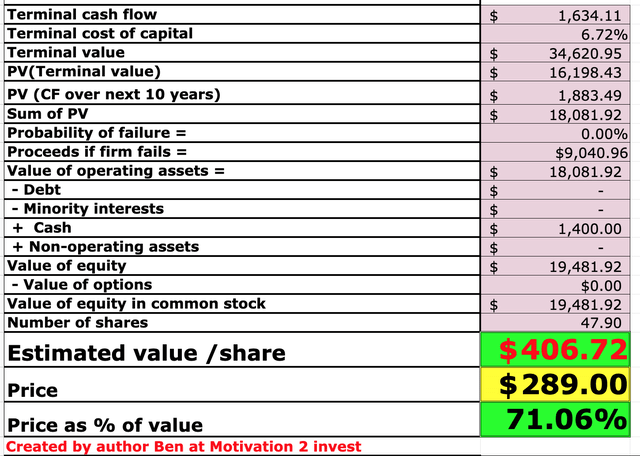

Hubspot stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $406 per share, the stock is trading at $289 per share at the time of writing and is thus ~29% undervalued.

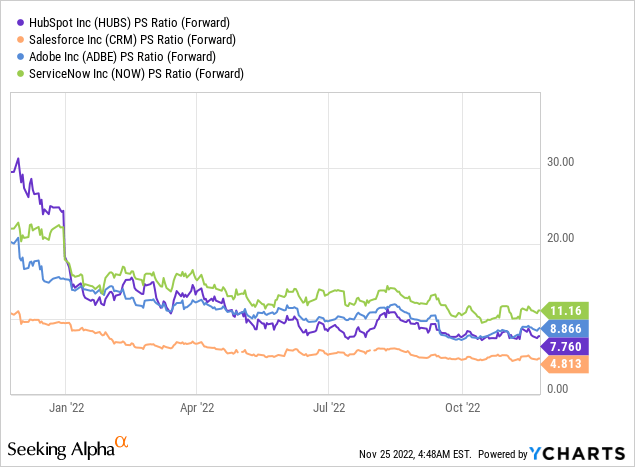

As an extra datapoint, HubSpot trades at a price-to-sales ratio = 8, which is 44% cheaper than its 5 year average. HubSpot trades at a mid-range valuation relative to industry peers such as Salesforce, Adobe and ServiceNow (NOW).

Risks

Recession/Longer Sales Cycles

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. Therefore I expect lower paid product adoption and longer sales cycles at least for the next year.

Final Thoughts

Hubs is a tremendous company that truly listens to its customers and provides an immense amount of free value upfront. This is a risky strategy in the short term, but long term this has paid off well for the company so far. Although I am predicting slightly slower revenue growth rates this year, new customers should still be enticed by the free part of the platform. Therefore when the economic situation improves HubSpot will be in prime position to capture economic value from its growing customer base.

Be the first to comment