Pgiam/iStock via Getty Images

About TPG RE Finance Trust Inc.

TPG RE Finance Trust Inc. (NYSE:TRTX) is a commercial real estate finance company. It originates, acquires and manages commercial mortgage loans and other commercial real estate-related debt instruments. The company focuses primarily on floating rate first mortgage loans that are secured by high quality commercial real estate properties. The company:

… invests in commercial mortgage loans; subordinate mortgage interests, mezzanine loans, secured real estate securities, note financing, preferred equity, and miscellaneous debt instruments; and commercial real estate collateralized loan obligations and commercial mortgage-backed securities secured by properties primarily in the office, multifamily, life science, mixed-use, hospitality, industrial, and retail real estate sectors.

Capital Structure

TPG RE Finance Trust is a small-cap REIT with a market capitalization of $721 million, which earns its revenue through interest on mortgage loans. However, the net worth (book value of equity investments) of this REIT is $1.5 billion, more than double its market value. This means that the stock is trading at Price/Book ratio (P/B) of less than 0.5.

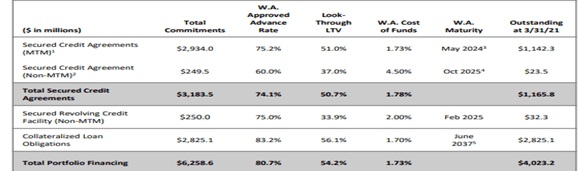

TPG RE Finance Trust has a total debt of around $4 billion, thus it has a debt to equity (D/E) ratio of 2.7. The company has a capacity of enhancing its debt, and in turn enhancing its lending portfolio by another 20 percent. TRTX also has a relatively low cost of debt with a weighted average interest rate floor of 1.05 percent. The company has a diverse capital base, and only 27.5 percent of its funds is under mark-to-market financing.

Dividend and Price Performance

This New York based finance trust was incorporated in 2014, and has been paying steady quarterly dividends since 2017. The dividend yield is quite high. Its current yield is almost 10 percent, and the REIT generated a four-year average yield of almost 12 percent over the past four years. However, the yield is high only because the price fell. Else the current dollar value of quarterly dividend is just 55 percent of pre-pandemic value of quarterly dividends.

It may seem that the company is not doing well, and that’s why its dividend and price fell so low. However, being a mortgage financing REIT, the return will always be determined by the level of interest it pays on its debt and the coupon it earns on its mortgage lending portfolio. It earns a weighted average coupon of almost 4.6 percent, whereas the weighted average credit spread is 3.44 percent. As the market value of debt is almost 5.6 times that of market value of equity, this credit spread becomes large enough for this REIT to consistently offer a high yield to its shareholders.

TPG RE Finance Trust stock traded around $20 since it was listed in July 2017 till the pandemic hit the US stock market in March 2020. At the end of March 2020, the stock reached a bottom of $2.5, and then slowly recovered to reach a price of $13.5 by November 2021. However, during the past 6 months, the stock has again taken a downward trend and is trading around $9 at present. This is a fall of almost 33 percent from the November 2021 high.

Loan Portfolio

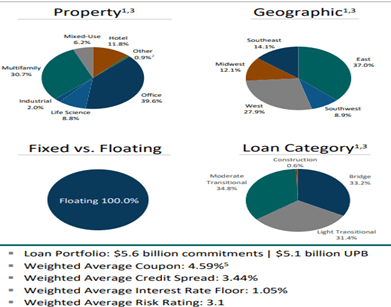

A good thing about TPG RE Finance Trust is that geographically its loan portfolio is well diversified among all the major markets located in different parts of the United States. Top 25 markets account for almost 80% of total loan commitments. The company also has “long standing relationships with repeat borrowers, developers, investors, national brokerage firms, and financial institutions”.

TPG RE Finance Trust is also reducing its exposure in the office segment in every aspect, starting from originations, repayments to proactive portfolio management. The company’s asset allocation in the office segment has come down below 40 percent of its entire portfolio from a level of 52.3 percent a year earlier. The company has also concentrated more on multifamily residential communities. The share of multifamily communities have gone up to 31 percent from that of 17 percent a year earlier.

TRTX loan types (Company website)

The company has another 12 percent exposure in hotels, and 9 percent exposure in the life sciences sector. TPG RE Finance Trust has a loan portfolio of $5.6 billion, lent mostly bridge loans and moderate transitional loans. Out of this $5.6 billion, $5.1 billion is Unpaid Principal Balance (UPB), thus having a very small proportion of interest outstanding, meaning a better recovery rate.

The entire loan portfolio consists of floating rate loans, which has the advantage of being unaffected by the series of interest rate hikes. However, as the interest rate goes up, it may probably impact the demand for new mortgage loans and restructured loans. Fortunately, over 38% of the total loan portfolio originated post-COVID, and the entire portfolio of loans has a weighted average maturity somewhere during 2031.

TRTX Loan portfolio (Company website)

Investment Thesis

TPG RE Finance Trust Inc. can be considered as an investment option purely on the basis of a consistent high dividend yield. Hopefully, the company will be able to sustain this high yield as it has a good credit spread, high D/E ratio, and the entire loan portfolio is at a floating rate of interest. However, there is an extremely high risk of price loss. Due to these, existing shareholders must hedge their investments.

Four and seven months forward put options of TPG RE Finance Trust are available for an exercise date of October 21, 2022 and January 20, 2023, respectively. The lowest available strike price is $7.5, which is 16 to 18 percent lower than the current price. The $7.5 put option of both those dates are available at a very low premium ranging between $0.05 to $0.65. Existing investors may want to buy these put options at the lowest possible premium, say within $0.25 so as to protect their investments and enjoy a double-digit yield.

Be the first to comment